Currency markets are holding steady after an extremely busy session that saw odds on a December rate cut plunge, helping the dollar post its best daily performance in almost two months. Benchmark ten-year Treasury yields are holding near 4.14 percent—up almost three basis points from yesterday—equity futures are setting up for gains at the open, and the euro, yen, and Canadian dollar are all trading defensively against the greenback ahead of the delayed September jobs report in half an hour.

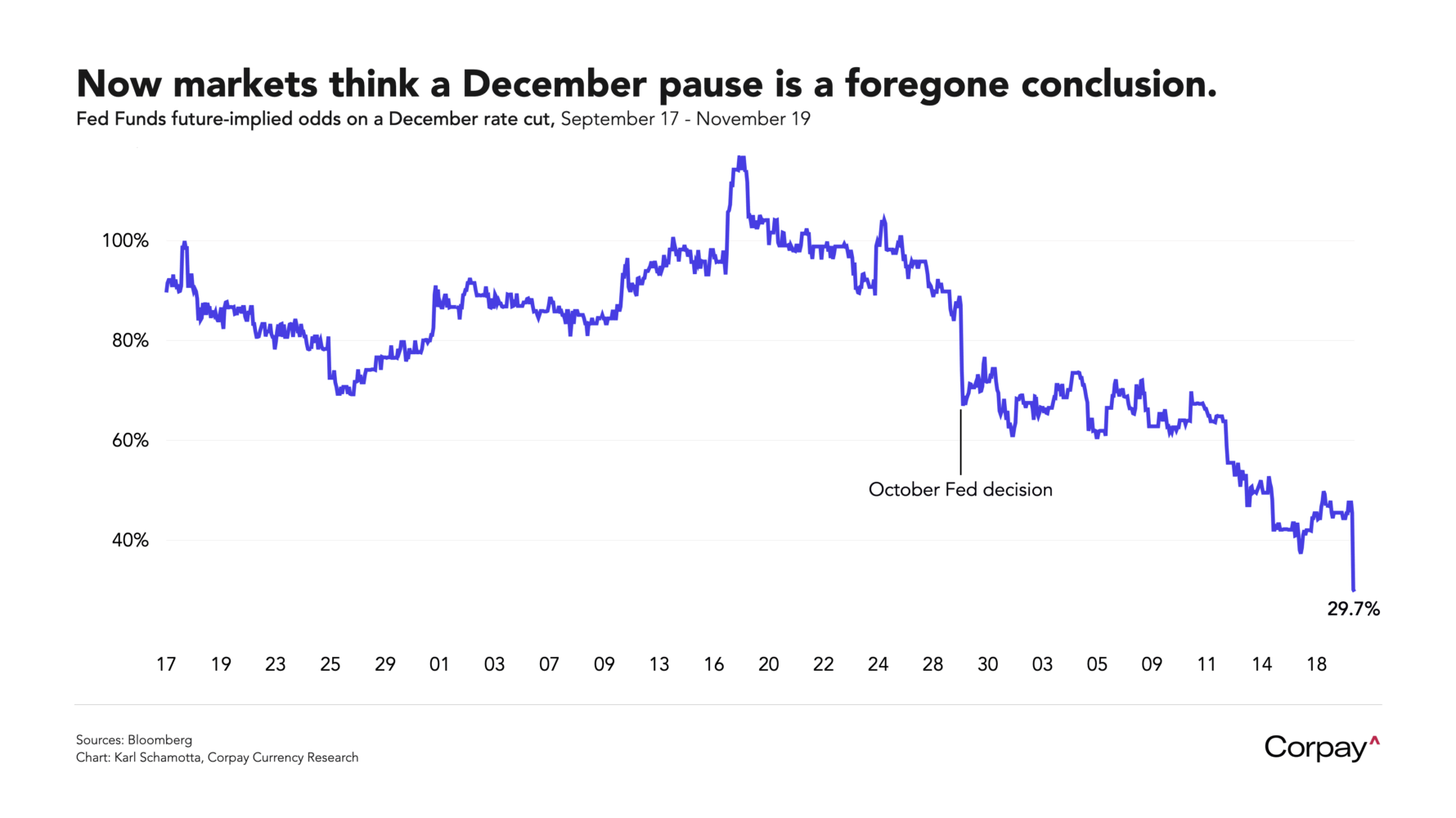

Minutes taken during the Federal Reserve’s late-October get-together showed policymakers turning more hawkish than markets had anticipated, further lowering the likelihood of more easing at next month’s meeting. According to the record, “many” officials were opposed to a December move, while “several” (generally interpreted to mean fewer than four) favoured a third sequential cut. Investors now see a pause as a “foregone conclusion”—to use Jerome Powell’s language—but there are uncertainties ahead. Measures of core and headline price pressures are running almost a full percentage point above the central bank’s target (and showing signs of accelerating), but shelter inflation is easing and more unofficial evidence of labour market softening could still tilt the balance toward a December cut. Sentiment could reverse direction several times over the coming weeks.

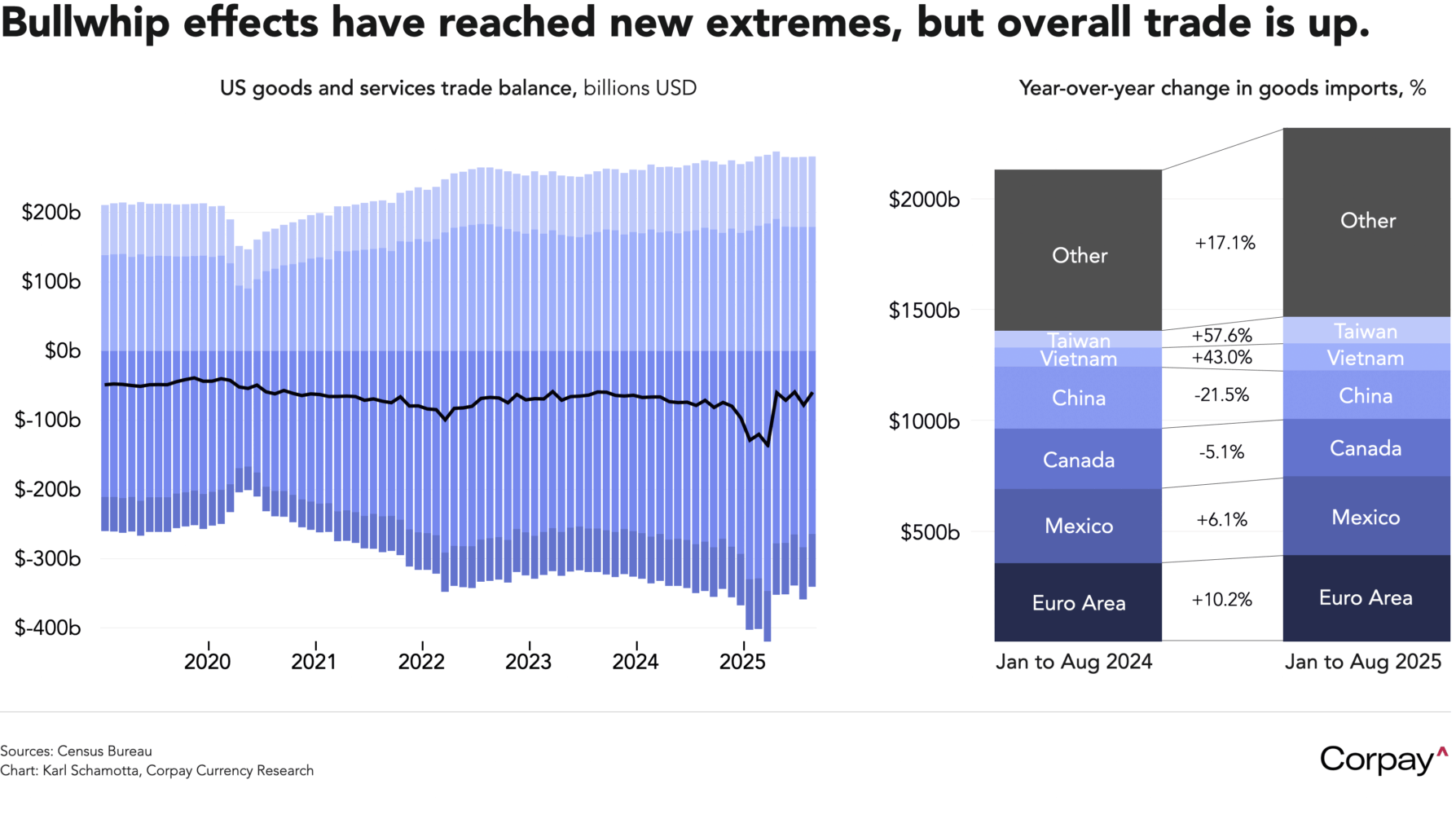

The US trade deficit narrowed sharply in August as imports fell broadly across industrial supplies, consumer goods, and capital equipment. According to delayed data published by the Census Bureau, goods imports plunged 6.6 percent from July, led by a steep drop in non-monetary gold, while goods exports were essentially flat and services trade was almost unchanged, shrinking the trade imbalance by 23.8 percent in month-over-month terms. This is likely to translate into a significant bump in third-quarter gross domestic product calculations.

But “bullwhip effects” are obscuring the fundamentals. Goods imports between January and August are still up almost 9 percent over the same period last year, partly reflecting a pull-forward of purchases by businesses and consumers ahead of threatened tariff increases, as well as continued resilience in underlying American demand for foreign products. Volumes have shifted across trading partners in accordance with tariff policies and export categories—suggesting that extensive transshipment is occurring—but when calculated on a year-to-date basis, the overall deficit is up 25 percent from 2024. We don’t expect to get a clear picture of how the global trade landscape has been reordered for many months yet.

Markets dodged an Nvidia-shaped bullet once again last night when the world’s most valuable company reported another quarter of blockbuster earnings. Equity indices and pro-cyclical currencies climbed after the chipmaker said its revenue had climbed 62 percent on a year-over-year basis to $57 billion in its fiscal third quarter, and that it expected to generate another $65 billion in the current quarter—numbers that came in well above Wall Street estimates and averted continued selling in American technology firms.

More good news landed this morning when Walmart said its US comparable store sales climbed 4.4 percent in the third quarter relative to the same period last year, suggesting that plunging consumer confidence levels aren’t translating into spending patterns.

Economists think this morning’s non-farm payrolls report will show the US economy adding roughly 50,000 jobs in September, keeping the unemployment stable at 4.3 percent. Markets will undoubtedly deliver a kneejerk response to any major headline surprise, but we think hedgers should look more closely at the three-month average rate of job creation, which may skew in a more positive direction if the July and August estimates are revised upward.