The dollar is trading near a two-week high this morning as traders pull back on overly-optimistic monetary easing expectations and adjust positions amid heavy quarter-end rebalancing. The Canadian dollar, British pound, euro, and Japanese yen are all holding near the lower ends of their technical trading ranges, Treasuries are holding steady, and equity markets are licking their wounds after a modest pullback from record heights late last week.

Swaps traders have 40 basis points in easing priced in for the final two Federal Reserve meetings this year, down from almost 50 after a series of cautious statements from policymakers, and a raft of remarkably-positive data releases. San Francisco Fed president Mary Daly yesterday added her voice to the chorus, saying “It is likely that further policy adjustments will be needed,” but that some economic “bridling” was still necessary to bring inflation down to target. Numbers published this morning showed initial jobless claims slipping to 218,000 in the week ended September 20, ex-transportation durable goods orders climbing 0.4 percent in August—beating expectations for a flat print—and the economy growing at a revised 3.8-percent annual rate in the second quarter, snapping back from the -0.6-percent contraction recorded in the first three months of the year, and coming in well above the original advance estimate for a 3-percent expansion.

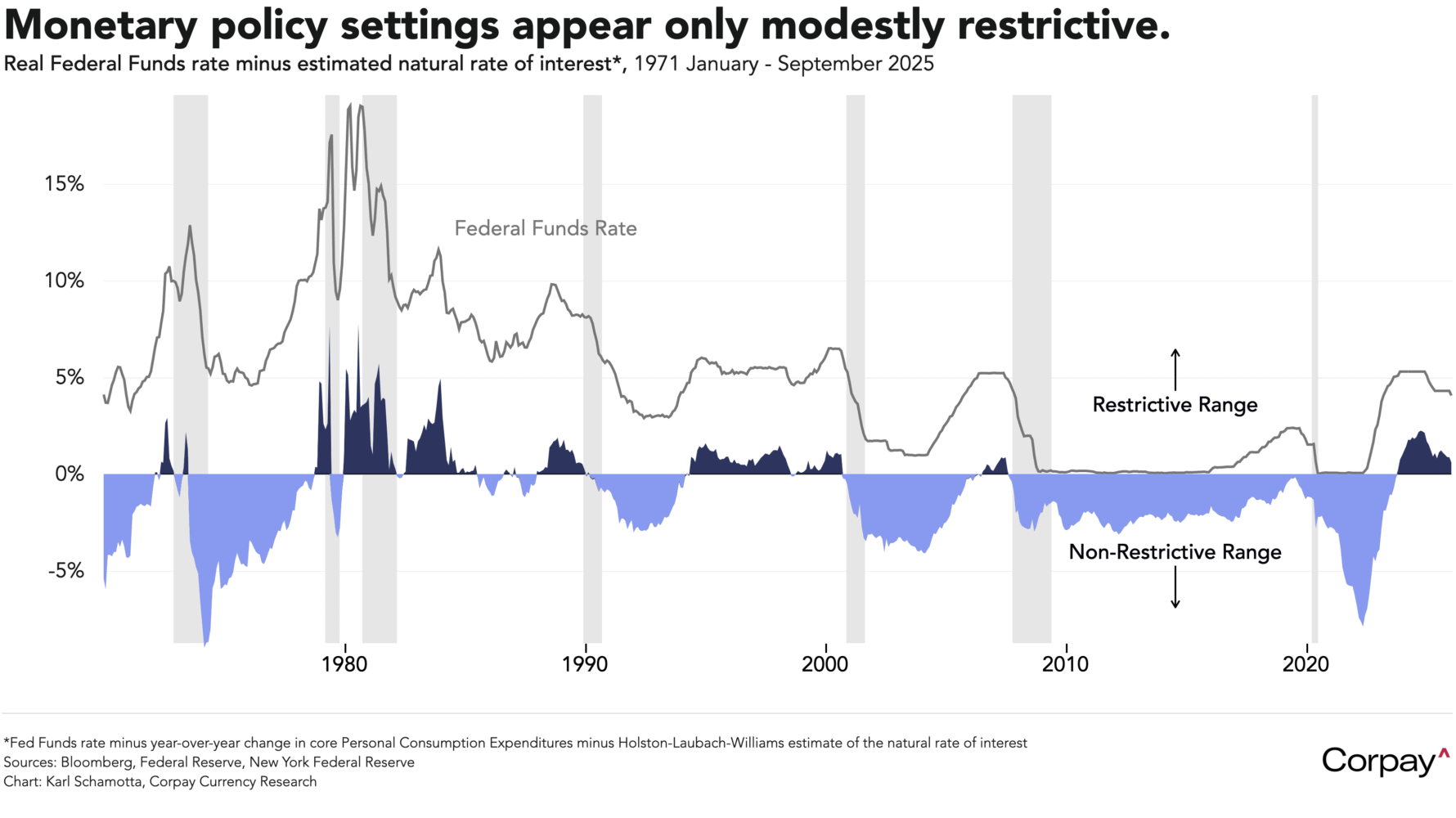

By our count, another six Fed officials are scheduled to make appearances today, with New York’s John Williams standing out as one to watch. Williams is considered one of the intellectual heavyweights on the Federal Open Market Committee, and is known for arguing that global trends in demographics and productivity growth haven’t reversed, meaning that the ‘neutral’ rate of interest—the theoretical borrowing rate that neither slows nor stimulates the economy—hasn’t budged materially from pre-pandemic lows. He nonetheless has supported keeping the Fed’s policy rate in “modestly restrictive” territory, given that he expects tariffs to raise consumer prices more sharply in the months ahead.

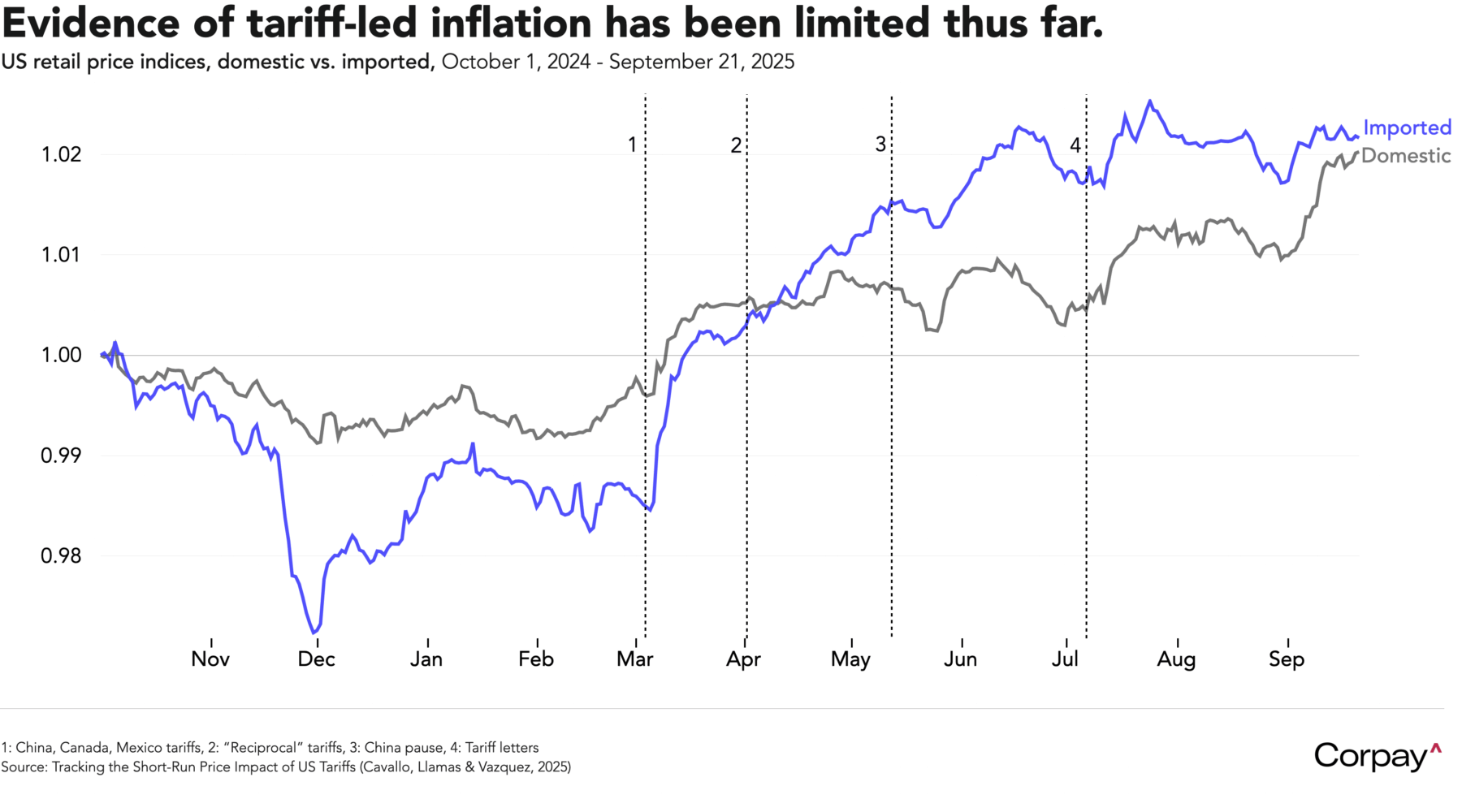

Data thus far has not established a clear link between the administration’s trade policies and underlying inflation. Although retail prices have climbed after tariff announcements and some tangible goods categories have seen increases, the extent of the change hasn’t matched the scale of the levies imposed, and the gap between imported and domestic price indices has narrowed slightly in recent months, suggesting that businesses are absorbing higher taxes by winding down existing inventories or sacrificing profit margins. It’s unclear how long this will last.

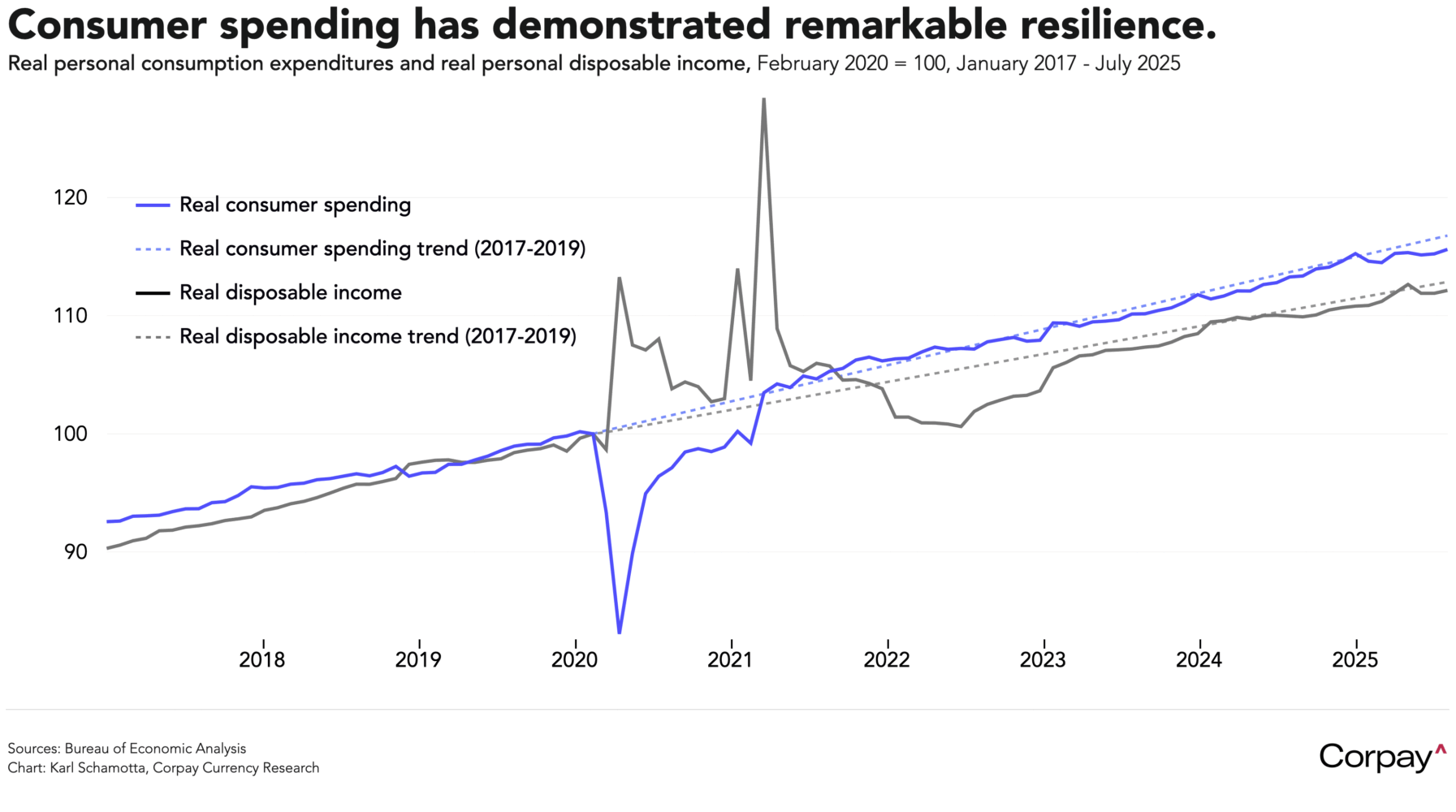

Tomorrow’s data could provide important clues, with personal income and spending numbers helping illuminate both the willingness and the capacity of consumers to absorb future price increases. Since deviating from historical patterns in the wake of 2020’s shutdowns, household outlays have remained on a steady upward path, seemingly ignoring a succession of economic shocks. Explanations vary: some attribute the resilience to precautionary savings built up during the pandemic, others to shifting consumption habits among baby boomers, and still others to the outsized role of affluent households whose paper wealth has surged. The jury is still out, but as long as this dynamic endures, it is hard to justify betting against the American economy—or expecting the Fed to embrace an emergency-style course of monetary easing.