• Hold the line. US equities at record highs, while shifting spreads are supporting the USD. EUR at multi-month low. AUD drifting back.

• AUD divergence. AUD losing ground to the stronger USD. But it is holding up on the crosses. We expect these trends to continue.

• Data flow. AU business conditions out today, as is the UK jobs report. Several US Fed members speaking over the next few sessions.

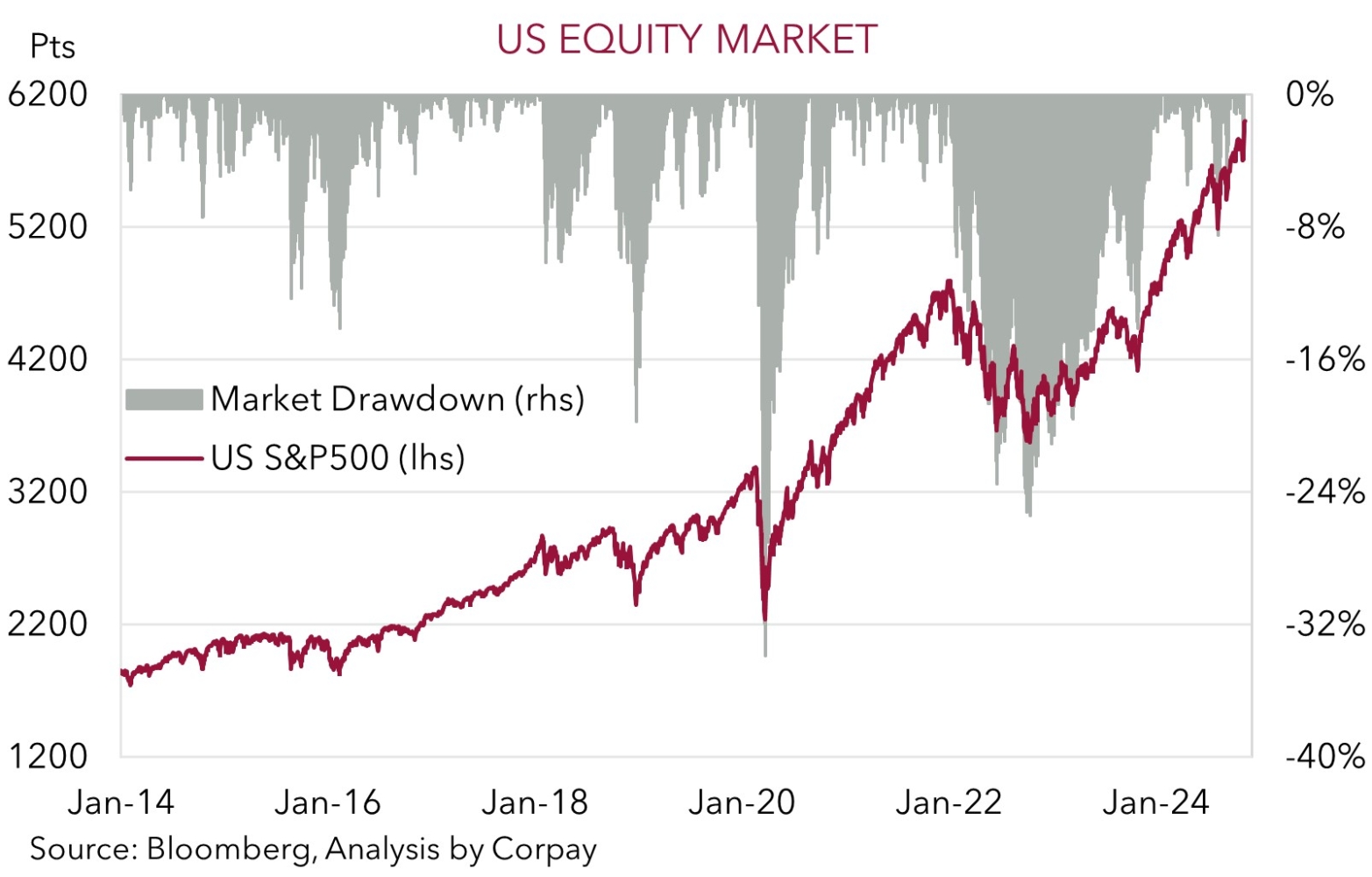

It has been a quiet start to the week. Unsurprising given the US bond market was closed for Veteran’s Day and the lack of data releases/new information to move the dial. In terms of the numbers US equities remain supported with the S&P500 consolidating near record highs. That said, under the hood there has been a rotation across sectors with big tech losing out to small caps and Banks which are being underpinned by expectations of sturdier economic growth and/or deregulation under a Trump Administration. European equities also rose (EuroStoxx50 +1.1%), and the China onshore market ended the session higher (CSI300 +0.7%) after opening in the red in response to the perceived lackluster stimulus package unveiled at the end of last week and softer credit data (especially the subdued private sector borrowing).

Negative sentiment towards China’s growth momentum has also kept commodity prices under pressure. WTI crude oil is ~3% lower to be at ~US$68.20/brl, towards the bottom end of its 1-year range. Copper (-1.5%) declined while iron ore is hovering around ~US$101/tonne. In FX, the USD upswing continued with the USD Index within 1% of its 2024 peak. EUR (-0.5%) has fallen to its lowest level since mid-April (now ~$1.0655) as widening yield spreads support the USD. GBP (now ~$1.2863) slipped back. USD/JPY (now ~153.70) edged up, as has USD/SGD (now ~1.3340). By contrast, NZD (now ~$0.5960) and AUD (now ~$0.6569) remain on the backfoot.

As mentioned yesterday there are a few important data releases this week, including the UK jobs report (6pm AEDT), US CPI inflation (Weds night AEDT), China activity data (Fri AEDT), and US retail sales (Fri night AEDT). BoE Governor Bailey and Fed Chair Powell are also speaking (both Fri morning AEDT). In our judgement, signs US retail spending/consumption is holding up, a lack of improvement in US inflation, and/or comments by Chair Powell that the Fed isn’t on autopilot and future policy changes will be data-driven may keep yield differentials in favour of a stronger USD. Moreover, as outlined in our recent research, we believe the Trump policy agenda, which is focused on trade-tariffs, greater fiscal spending, and curbing US immigration, could generate a renewed inflation impulse that constrains the Fed’s ability to lower interest rates as far as it might have. We think the pricing in of this risk, combined with possible downward revisions to global growth, and a Trump unpredictability factor can keep the USD stronger for longer (see Market Musings: Trump 2.0 & the AUD).

AUD Corner

The AUD has drifted a bit lower over the past 24hrs. The firmer USD and weaker commodity prices have exerted downward pressure with the AUD tracking near ~$0.6570, less than 1% from last week’s post-US election lows. That said, it hasn’t been a one-way street with the AUD clawing back ground on most of the major crosses. The AUD has ticked up by ~0.2-0.5% versus the EUR, GBP, JPY, and CNH with the moves partially unwinding Friday’s dip. At ~0.6165 AUD/EUR is ~1.3% from its 2024 highs. AUD/JPY (now ~101) is towards the top of its ~3-month range, and AUD/CNH (now ~4.7493) is nearing its 200-day moving average.

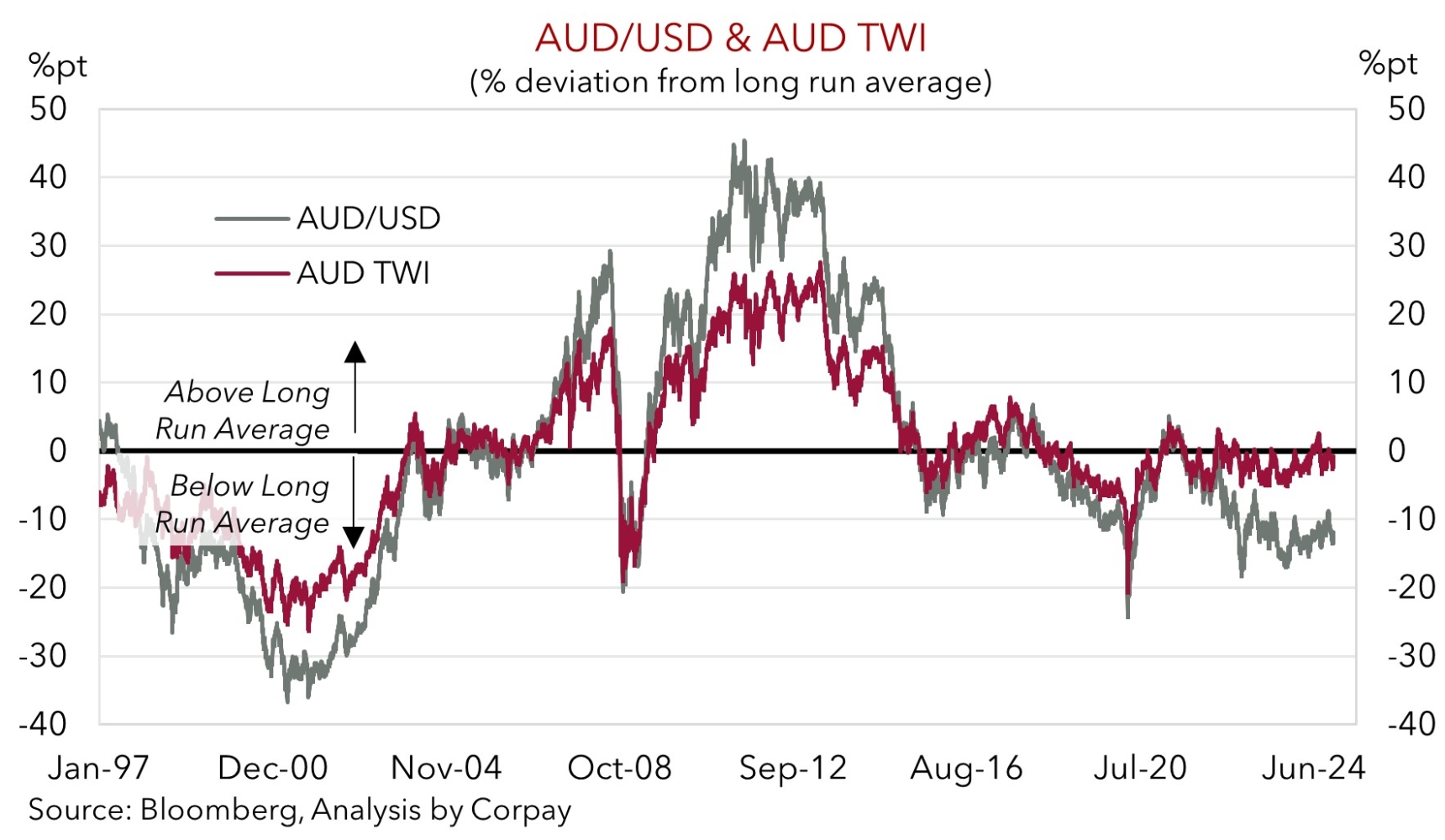

The AUD strength on the crosses is inline with its recent trend. As our chart shows, in contrast to AUD/USD (which is now more than ~10% below its long-run average) the AUD trade-weighted index is close to average. The relative strength in the AUD isn’t a surprise to us, and we expect this to continue over the period ahead. As discussed over the past few days and in more detail in our recent research note although we feel the Trump policies could be USD supportive over the medium-term, and this constrains the AUD’s upside potential (i.e. the AUD lingers in the mid-$0.60s over the next few quarters rather than kicking up towards ~$0.70), various fundamentals are still in the AUD’s favour. See Market Musings: Trump 2.0 & the AUD.

Locally, the resilient labour market and stickiness in core inflation due to the still high level of demand (especially across the labor-intensive services providing sectors) due to strong population growth supports our long-held view that the RBA will lag its peers in terms of when it starts and how far it goes during the easing cycle. We continue to believe that the start of a gradual/modest RBA rate cutting phase is a story for H1 2025. We think the diverging policy trends between the RBA and other central banks, and widening yield differentials, should be AUD supportive versus EUR, CAD, GBP, and NZD. This may be on show once again over the next few days given forecasters are looking for the UK labour market to soften (today 6pm AEDT) and for the Australian jobs report (Thurs AEDT) to show positive employment and low unemployment. Added to that, while Trump trade and fiscal policies can create growth headwinds and/or inflation risks, nations in the firing line such as China are unlikely to stand still, especially as China’s economy is already stumbling along. In our judgement, China may try to offset any US tariff-induced export pain via moves to prop up commodity-intensive and internally focused infrastructure investment. This is the area Australia’s key exports are plugged into. This, and Australia’s rather tariff-insulated export basket due to minimal domestic manufacturing could prove to be relative AUD supports.