The US dollar is gaining as investors turn more cautious ahead of a raft of important economic data releases and central bank decisions through the remainder of the week. In a pattern familiar to aficionados of the ‘dollar smile’ theory, the greenback is climbing on continued outperformance in the US economy, a firming in rate expectations for the Federal Reserve, and a dimming growth outlook in other major economies. The Japanese yen and British pound are treading water against a resurgent Swiss franc, and the Canadian dollar is coming under sustained selling pressure ahead of tomorrow’s Bank of Canada decision, which is expected to leave policy forecasts in neutral.

The euro remains on the defensive after the weekend’s EU-US trade deal left investors unimpressed. The existence of the agreement should reduce uncertainty, and the embedded 15-percent tariff rate is less painful than the 30-percent levy that had been threatened, but the terms are seen as asymmetrically favouring the US, imposing a more meaningful economic toll on the 27-member bloc. The common currency posted its second-largest drop this year during yesterday’s trading session, and is down another quarter percent today. We think this is mostly down to positioning—speculators were crowded into untenable long positions ahead of the news—but bullish technical momentum has clearly evaporated.

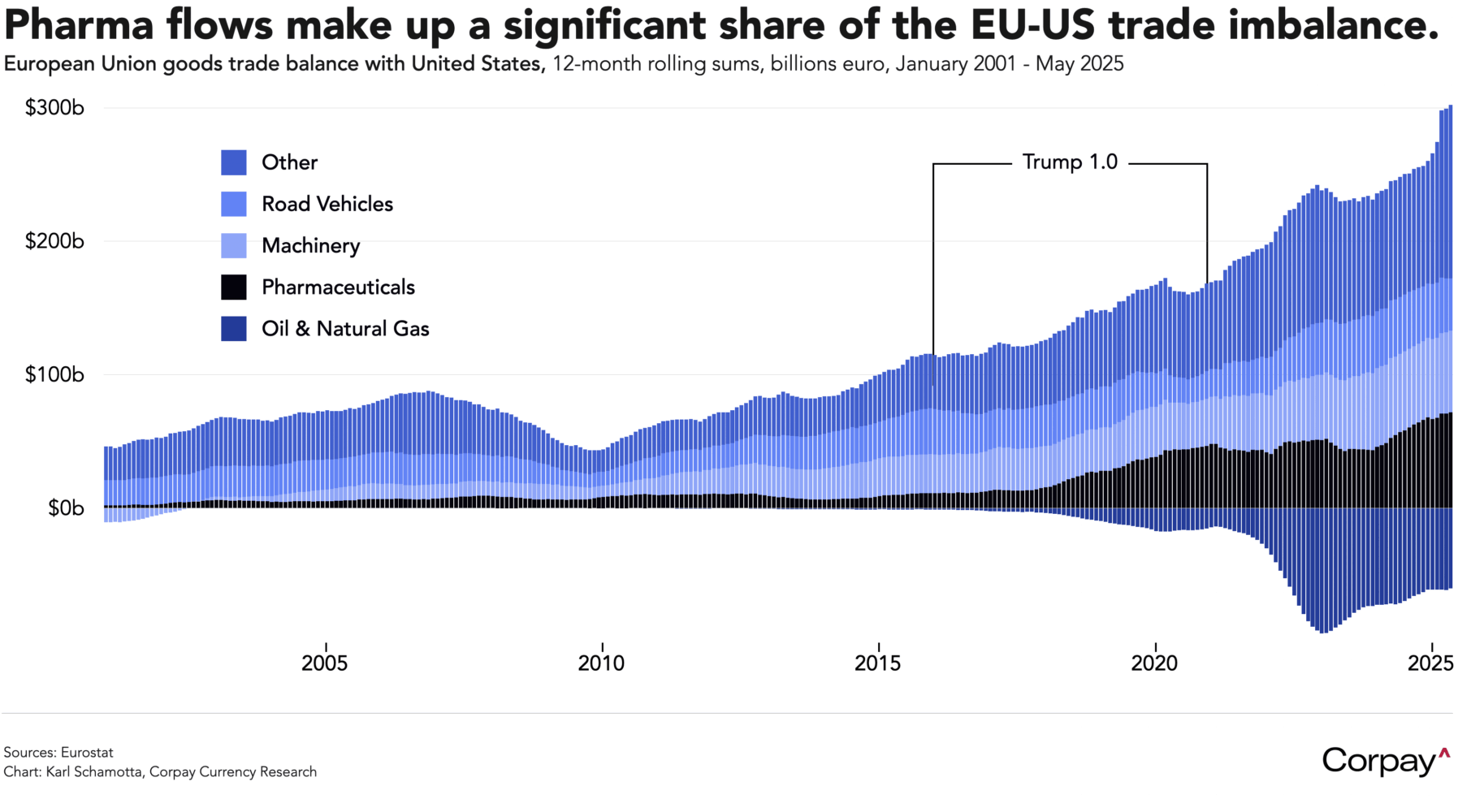

It’s possible that markets take a more favourable view once the fundamental wheat is separated from the rhetorical chaff. According to both the White House and European Commission President Ursula von der Leyen, the EU agreed to purchase an additional $750 billion in energy products from the US over the next three years, a figure that would amount to a tripling in the bloc’s energy imports from the US, and require private sector firms to overlook underlying price economics. Brussels lacks the legal and financial capacity needed to compel private investors to up their allocation to US assets by the mooted $600 billion. Similarly, the Commission does not oversee arms procurement, so the EU is unlikely to find itself buying “vast amounts” of US weaponry. It’s too early to say how the EU plans to reduce tariffs on agricultural goods, but history would suggest that domestic opposition will prevent wholesale changes from occurring. And the two parties appear conflicted on the treatment of pharmaceutical flows, which—through transfer pricing and tax avoidance activities—have driven the lion’s share of the expansion in the EU’s bilateral surplus with the US since Trump’s first term*. Von der Leyen suggested that pharma was included in the agreement, and Trump initially seemed to confirm this, telling reporters that the 15-percent tariff was “straight across” on “automobiles and everything else,” but then later said that pharmaceutical products were “unrelated to this deal,” appearing to suggest that this would hinge on the outcome of a trade investigation that is due for release later this week.

Turbulence might hit the dollar over the coming days.

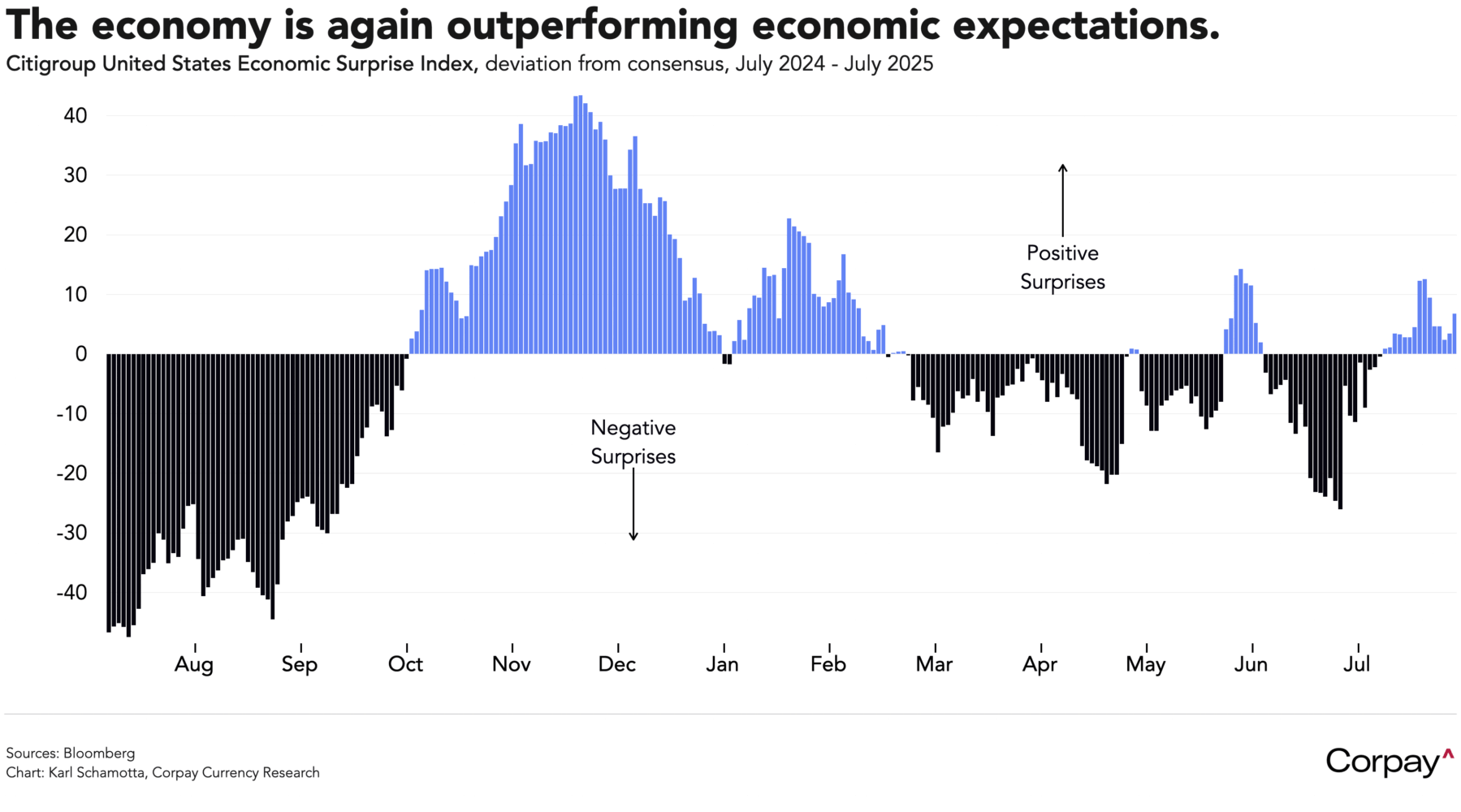

A slew of data releases could put upside pressure on interest rates. If the economy demonstrates continued resilience through today’s Job Openings and Labor Turnover and Conference Board consumer confidence surveys, tomorrow’s second-quarter gross domestic product print, Thursday’s personal spending and income update, and Friday’s nonfarm payrolls report, traders will brace for a more gradual easing campaign from the Federal Reserve ahead. Odds on a September move are vulnerable to further downward adjustment, and might help preserve the dollar’s favourable rate advantage over other major currencies.

However, signals embedded in the communications surrounding tomorrow’s Fed decision could be interpreted to mean that policymakers are moving closer to a rate cut, perhaps in December. A double dissent—by Governors Bowman and Waller—is widely anticipated in markets and is likely priced in, but a deviation by Chair Powell away from the relatively-hawkish stance exhibited in recent appearances is not. If Powell gives voice to Waller’s well-founded fears around the slowdown in private-sector jobs creation, and suggests—in a carefully-hedged way—that tariff increases are unlikely to lift inflation on a sustained basis, investors could more firmly anticipate a big move by year end. At the moment, one 25 basis-point cut is priced into Fed Funds futures markets, and traders are assigning 80-percent odds to a second move. This could change, dependent on Powell’s words.

Trade-related issues could also generate havoc. Headline risks will emerge when the US Court of Appeals for the Federal Circuit hears oral arguments on President Trump’s use of the International Emergency Economic Powers Act on Thursday—a case that most legal scholars expect the president will ultimately lose—forcing him to impose tariffs using other, slower and more complex measures. And the deadline for “reciprocal” tariff hikes lands on Friday, exposing many emerging market currencies to considerable uncertainty.

Broadly speaking, we think the recent jump in risk assets and decline in measures of implied currency market volatility should be regarded with suspicion. Major uncertainties about the path of US trade policy, worldwide economic growth, and the evolution in central bank reaction functions remain unresolved, and won’t be answered for several months yet. Corporates would be wise to consider upping hedge ratios amid these conditions. As a certain poverty-stricken individual named Warren Buffett once put it, it is wise to “be fearful when others are greedy and greedy when others are fearful”.

*Please check out the brilliant Brad Setser’s work on this at the Council on Foreign Relations.