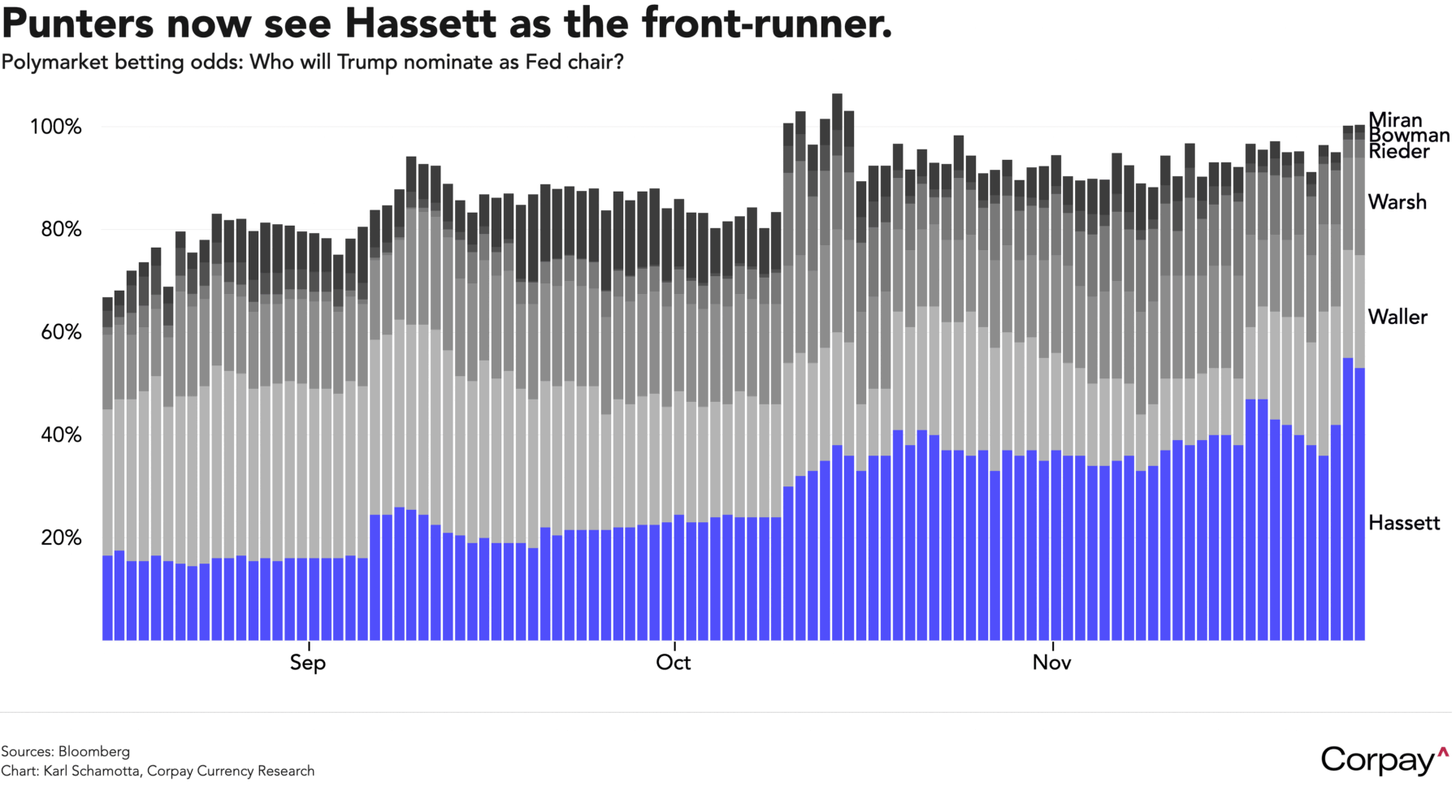

Currencies are trading on a mixed footing this morning as investors pivot from expecting some Federal Reserve easing to anticipating too much. The dollar slumped, equity markets rallied, and yield curves shifted in yesterday’s session when Bloomberg reported that Kevin Hassett had become the front-runner in the race to replace Jerome Powell at the head of the world’s most powerful central bank. Hassett—now heading the National Economic Council and once a senior Fed official—is regarded as a capable economist, but also as someone more inclined to heed the president’s call for lower rates, even at the risk of stoking longer-term inflation; markets have duly ramped up bets on aggressive easing next year, steepening the curve on expectations that price pressures will be allowed to run hotter. Treasury Secretary Scott Bessent says Donald Trump will make his final choice by Christmas.

But installing a new chair will not guarantee easier policy. Although the chair plays an important role in building consensus and communicating the Fed’s policies to the public, interest-rate decisions require a majority on the 12-member Federal Open Market Committee—composed of seven presidentially-appointed governors, the New York Fed head and a rotating group of regional bank presidents—who are selected by local businesses and nonprofit executives, and often have no partisan background. Expectations for the Fed’s policy trajectory beyond the end of Chair Powell’s term in May are vulnerable to change, and it would be reasonable to expect several sharp reversals in the coming months.

Data published yesterday showed US consumers turning more cautious through the autumn months, with retail sales disappointing, inflation firming and confidence turning sharply lower. A long-delayed Census Bureau update showed headline retail sales rising just 0.2 percent in September, while the core “control group”—which strips out vehicles, fuel, dining, and building materials—slipped -0.1 percent. A separate report from the Bureau of Labor Statistics indicated wholesale prices climbed 0.3 percent in September after declining in the previous month. And the Conference Board’s confidence index tumbled to 88.7 in November from 95.5 in October, badly missing forecasts and marking its weakest reading since the administration unveiled its “Liberation Day” tariffs earlier this year.

We remain unconvinced that consumer spending is rolling over. Higher-frequency indicators such as the Johnson Redbook same-store sales index continue to suggest underlying resilience, and most major retailers are still issuing upbeat guidance. A pullback may yet emerge—especially if labour-market conditions deteriorate more materially—but it is far from clear that household behaviour has decisively shifted. Much as we value hard data, this afternoon’s purely-anecdotal Beige Book survey may offer a more reliable snapshot of the US economy than yesterday’s stale and deeply flawed releases.

Across the pond, the British pound is trading modestly lower amid chaotic price action after the Office for Budget Responsibility accidentally published its long-awaited Autumn Budget forecasts early, sparking confusion across financial markets. According to the release, Chancellor Rachel Reeves will lift her fiscal headroom to £22 billion—£12 billion more than projected in March—as roughly £11.3 billion in additional spending is offset by £26 billion in new tax measures, including a freeze on income tax thresholds until 2030-31, a new council tax surcharge on properties valued at more than £2 million, an unexpected two-point rise in tax on savings and property income, and tighter rules on pension contributions. The British economy is projected to grow 1.5 percent this year, up from the 1 percent previously estimated, but is seen decelerating in 2026 to 1.4 percent, down from 1.9 percent previously.

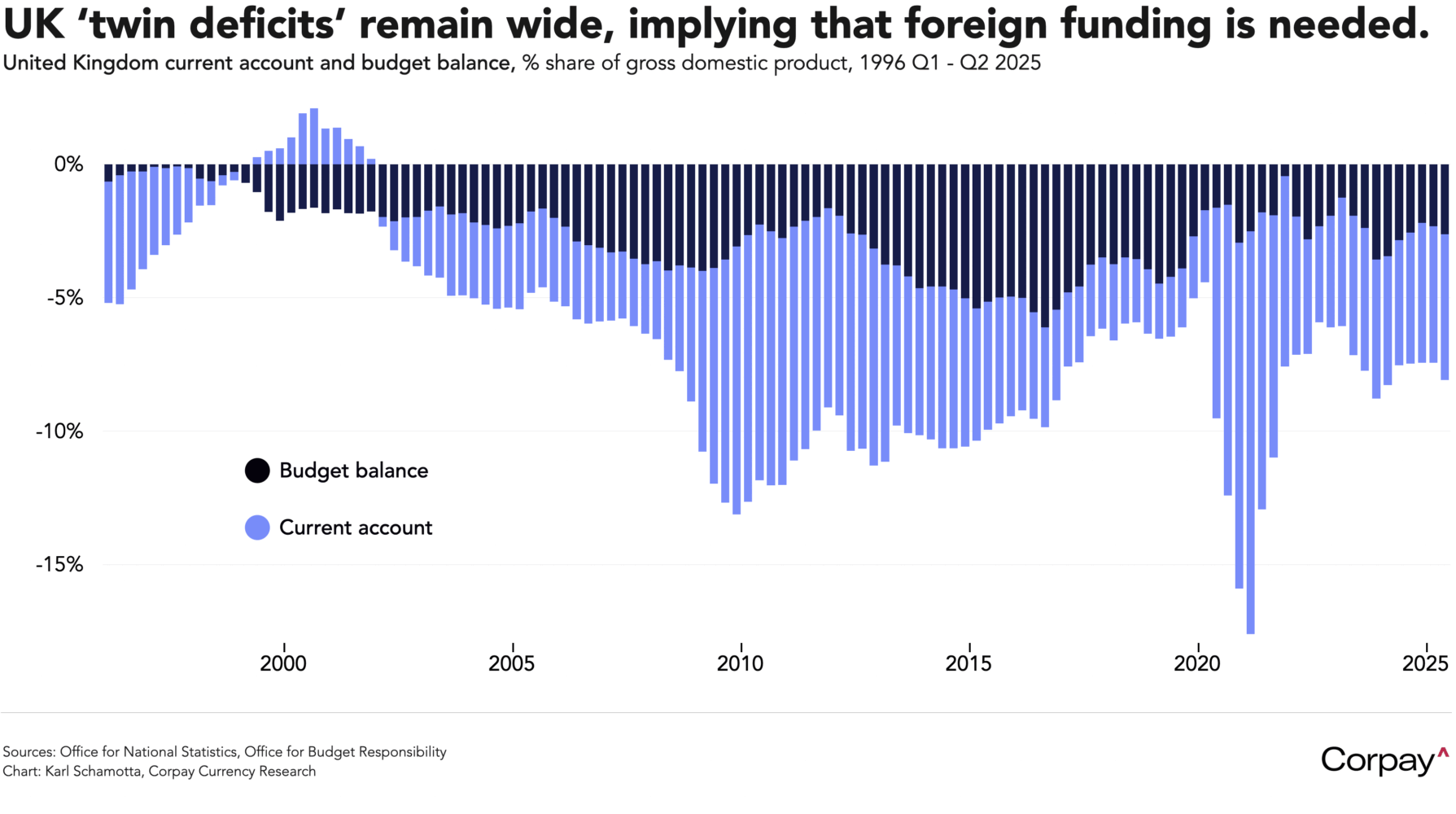

Hedgers should expect continued turbulence in the pound over the coming weeks. Markets typically take time to digest shifts in the UK’s fiscal stance, and forthcoming guidance from the Debt Management Office could add another layer of uncertainty. While growth trends and monetary-policy expectations are likely to dominate near-term currency moves, the underlying reality is unchanged: Britain must attract sustained flows of foreign capital to fund its twin current-account and fiscal deficits. That dependence will leave sterling prone to periodic bouts of volatility for years to come.