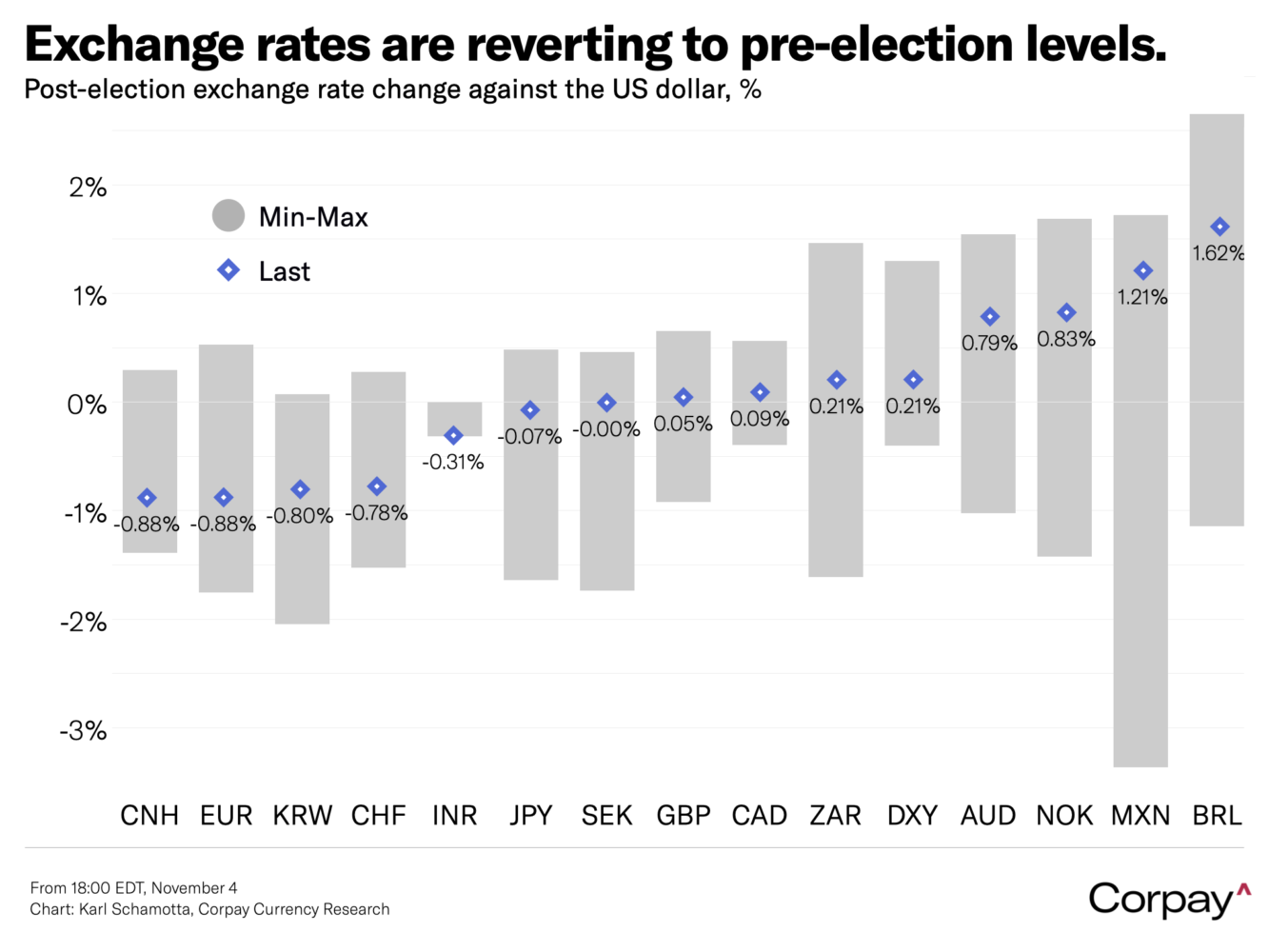

The “Trump trade” that animated currency markets after Tuesday’s presidential election continues to dissipate this morning. The dollar’s post-election rally is now almost fully unwound, the Mexican peso and its emerging market brethren are broadly higher, and most major currencies – including the euro, British pound, and Japanese yen – are either above, or just a few basis points below key psychological levels that could support further upside.

Treasury yields are slightly lower after the Federal Reserve kept its options open in yesterday’s decision. Officials cut rates by a quarter percentage point and made semantic modifications to the accompanying statement that could be interpreted to mean that a slower pace of easing might be ahead – but Jerome Powell appeared to suggest otherwise in the post-decision press conference, characterising the changes as implying that the central bank remains confident in the gradual return of inflation to target, and broadly content that labour markets are in a “good place”.

The chair faced repeated questions on the extent to which the Fed would adapt its policy settings under the new administration, but he refused to be drawn. “We don’t guess, we don’t speculate, we don’t assume” he said, “in the near term, the election will have no effect on our policy decisions”. Markets generally expect next month’s Summary of Economic Projections – the vaunted “dot plot” – to say otherwise, with policymakers revising growth, inflation, and rate expectations higher across the forecast horizon, implying a more cautious pace of easing.

And no one can doubt the chair’s commitment to maintaining full employment. When a reporter asked if he would resign upon the president’s request, Powell responded with a flat “No”. And when another questioned whether the president had the power to fire or demote him, he said “Not permitted under the law”.

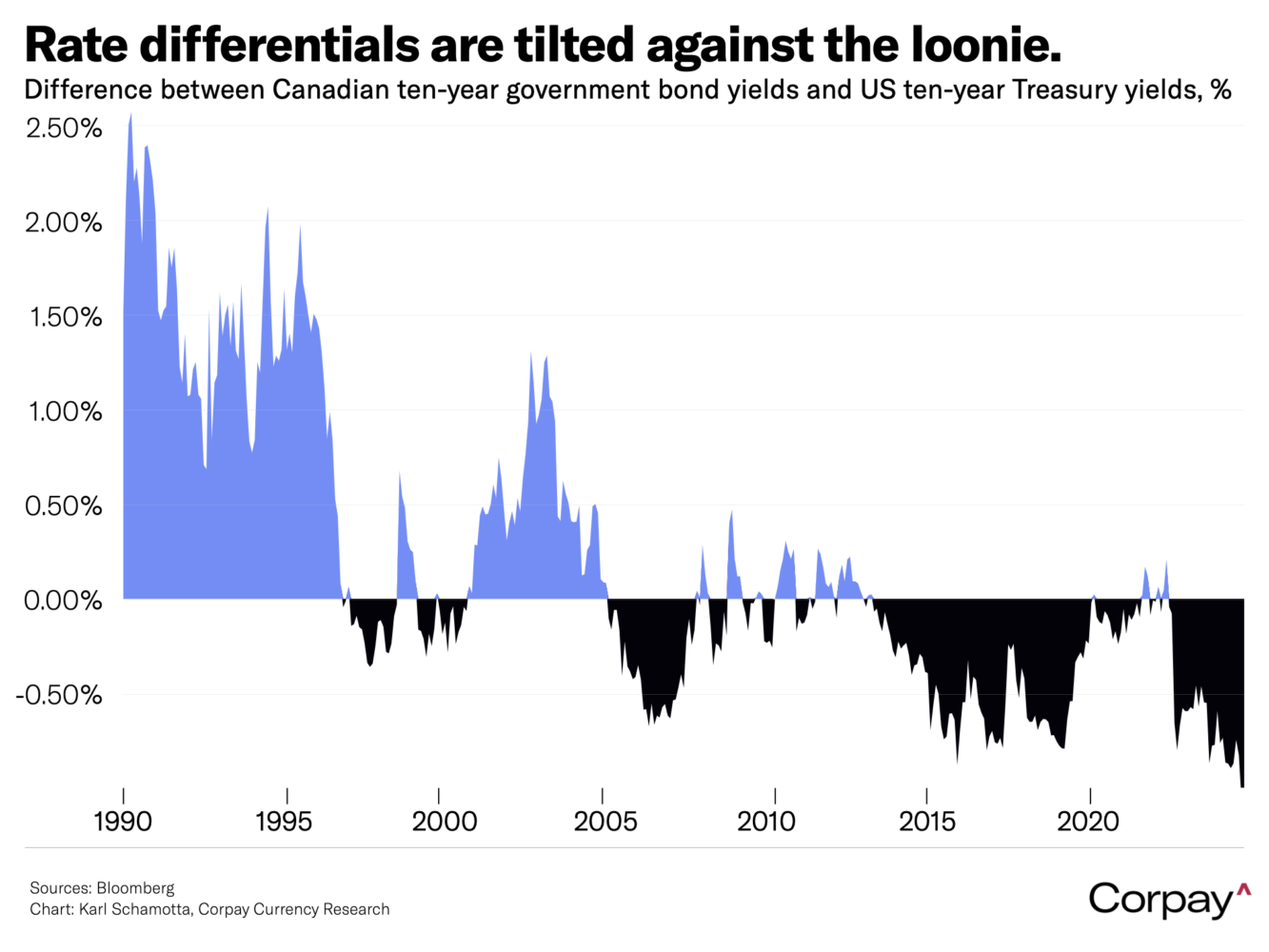

The Canadian dollar is slightly softer after the economy added just 14,500 jobs in October, helping modestly bolster odds on another jumbo-sized cut at the Bank of Canada’s next meeting. According to Statistics Canada, the country added the smallest number of new jobs in seven months, but the unemployment rate held steady at 6.5 percent and wage growth accelerated, rising to 4.9 percent on a year-over-year basis from 4.5 percent in the prior month – suggesting that underlying consumption drivers are relatively stable*. Odds on a 50-basis point rate cut at the Bank’s December meeting are holding just above coin-toss levels, and the rate differential between US and Canadian ten-year bond yields remains extremely wide relative to history, helping put sustained pressure on the loonie.

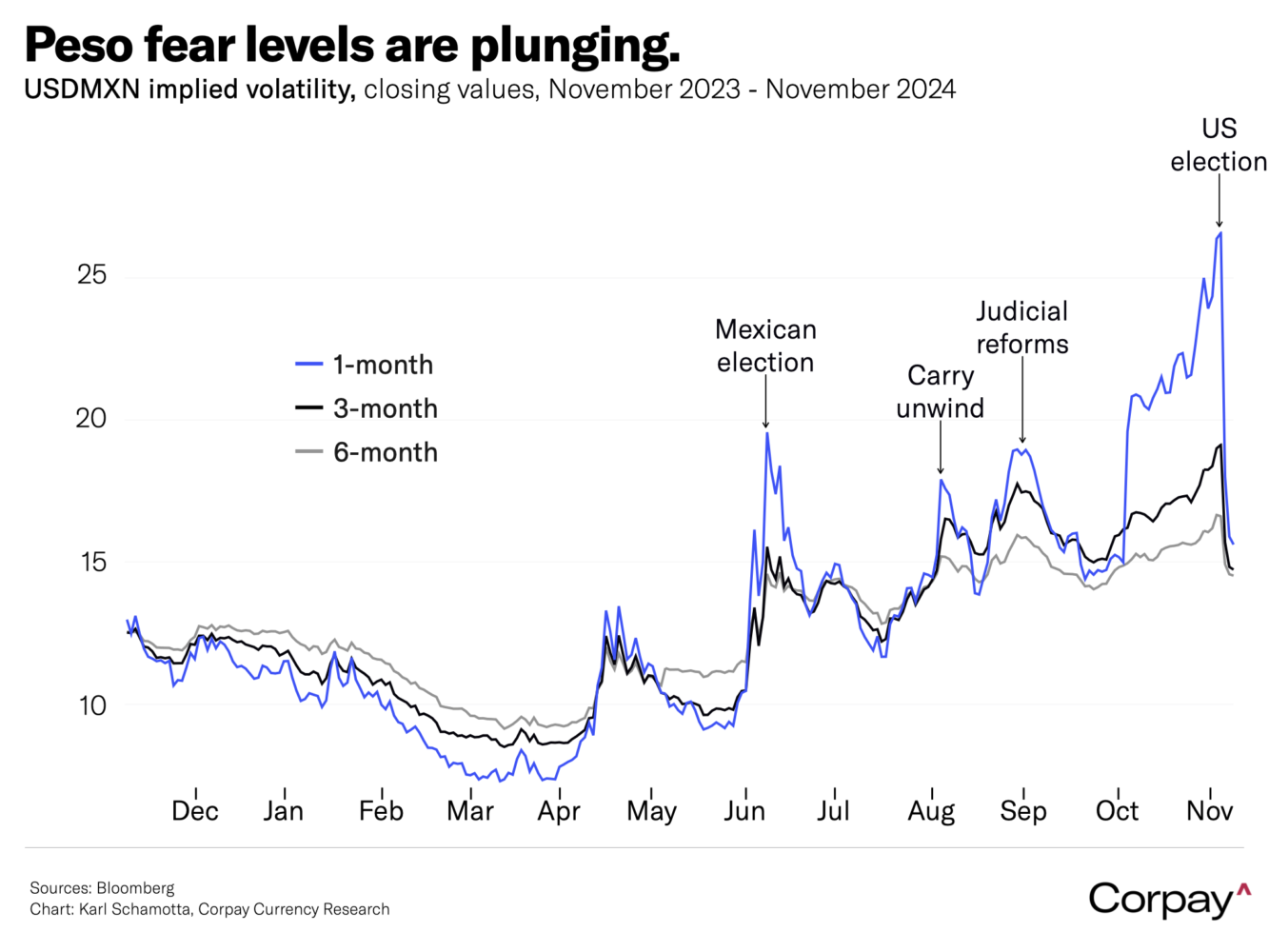

Implied volatility in the Mexican peso continues to drop, helping enhance the currency’s appeal to carry traders. The exchange rate dropped sharply ahead of Tuesday’s election, but has gained in the last few days, despite the likelihood of another quarter-point rate cut from the Banxico next week. Several factors may be at play: the peso’s mid-year declines likely outpaced economic weakness, inflation remains well above the central bank’s target, officials generally seek to preserve a wide policy rate differential over the Federal Funds rate, and experience from the last Trump administration has taught traders not to expect his bluster to translate into damaging trade action against the country. We expect the currency to continue appreciating, but would caution hedgers to avoid trying to pick up centavos in front of steamrollers – a resurgence in fear remains a strong possibility, and upward moves in the months ahead could still be punctuated by extreme selloffs.

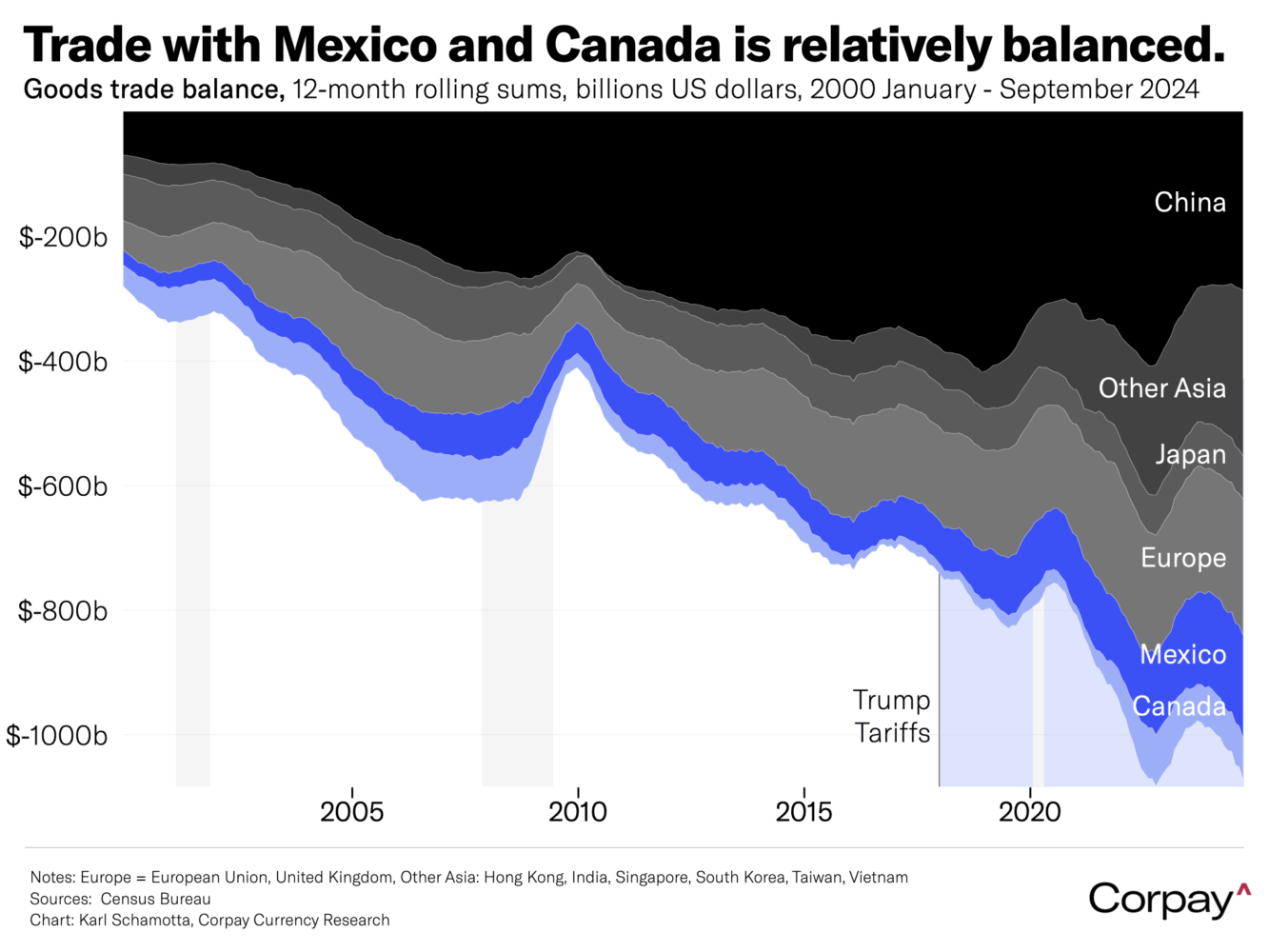

On that note, I may be ascribing more subtlety to foreign exchange markets than is deserved, but it is possible that they are approaching the risks associated with a Trump presidency from a deeper psychological level. With Republicans likely to take control of both houses of Congress, the incoming president won’t be restricted to using tariffs as a substitute for broader changes in economic policy – he could, therefore, feel less powerless – and less committed to hurting countries like Mexico and Canada, which arguably maintain some of the world’s most balanced trade relationships with the United States. To extend Kissinger’s “university politics are so vicious because the stakes are so low,” to the current situation, Trump’s approach to policy could moderate somewhat in an environment in which he feels less constrained or threatened**.