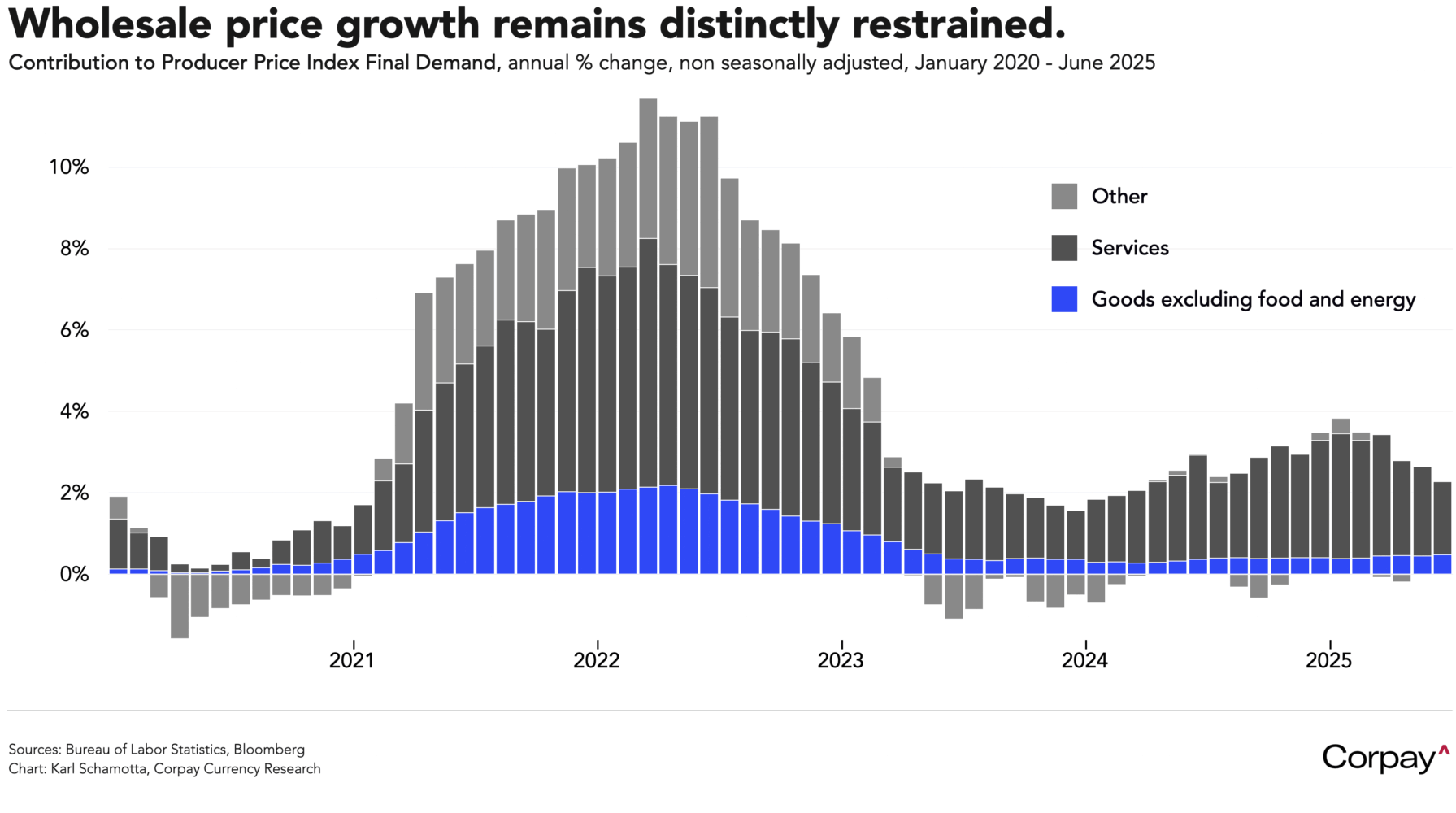

Bond yields and the dollar are giving back some of yesterday’s gains after US wholesale prices flatlined in June, helping assuage fears of a sharp acceleration in the Federal Reserve’s preferred inflation indicator—the core personal consumption expenditures index—when it is reported at the end of the month. The producer price index for final demand remained unchanged last month after rising 0.3 percent in May, the Bureau of Labor Statistics said this morning, below the 0.2-percent gain expected by economists. In the 12 months through June, the index advanced 2.3 percent after rising 2.7 percent in May, with the goods category—which excludes imports and captures tariffs only indirectly—contributing 0.48 percent to the headline, up marginally from 0.44 percent in the prior month.

As we had expected, data released yesterday failed to deliver conclusive insight into how the Trump administration’s trade policies are influencing inflation dynamics within the US economy. Core consumer prices rose 2.9 percent in June from a year earlier, in line with expectations. Prices of clothes, furniture, toys, and electronics climbed at a faster pace, indicating that companies were passing tariff increases on to consumers. However, car prices, airfares, hotels, and other discretionary services costs fell by more than expected, suggesting that household spending patterns simply shifted to accommodate higher goods costs, largely nullifying the impact on overall inflation measures.

The implications for the Fed are unclear. Most economists expect goods inflation will heat up in the second half of the year as tariff-related cost increases filter through to consumers, but there is considerable uncertainty around whether this will raise overall prices, or simply cannibalise demand in the services sector, keeping headline inflation relatively restrained. The July and August releases could provide a more meaningful view, allowing policymakers and market participants to draw better conclusions about the direction of travel—but we doubt perfect clarity will be achieved, and expect the economy to keep generating mixed signals for many months to come, at least until labour markets soften and deliver an obvious easing impetus.

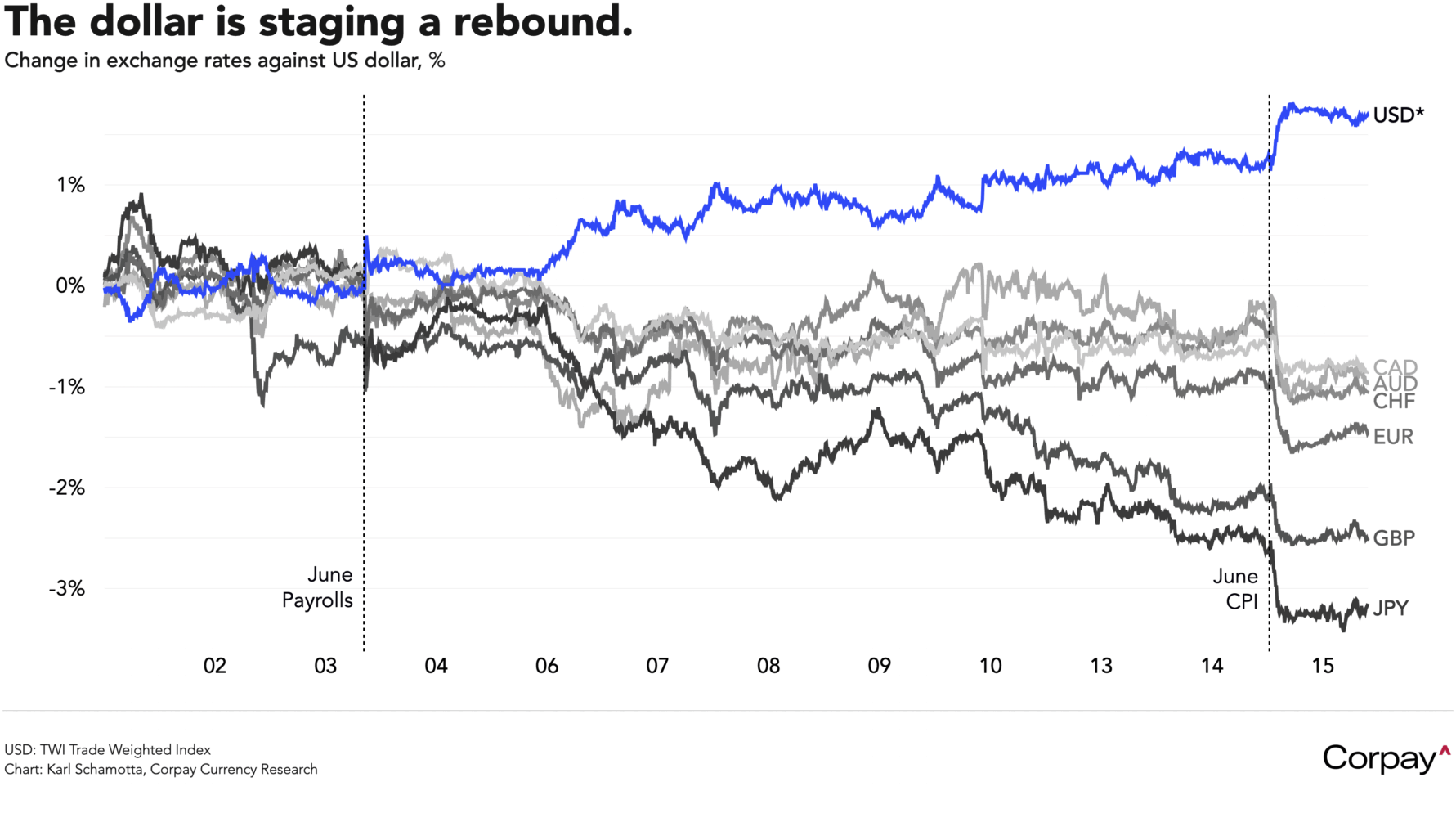

Markets have nonetheless concluded that policymakers are set to stay on hold for longer, and are back to bidding the dollar higher against most of its major rivals. With inflation firming, jobs creation still running strong, and the One Big Beautiful Bill expected to deliver a spending boost in the short term, odds on a September rate cut have dropped to coin-toss levels after being seen as a near-certainty a few weeks ago, and a growing number of economists see the central bank staying on hold into 2026. We also think a technical rebound in the greenback is unfolding as a recalibration in global growth expectations reaches its limits, changes in hedging behaviour among Asian and European real-money investors run their course, and outperformance in American equity markets pulls money onshore once again, putting the squeeze on overly-bearish speculative positions.

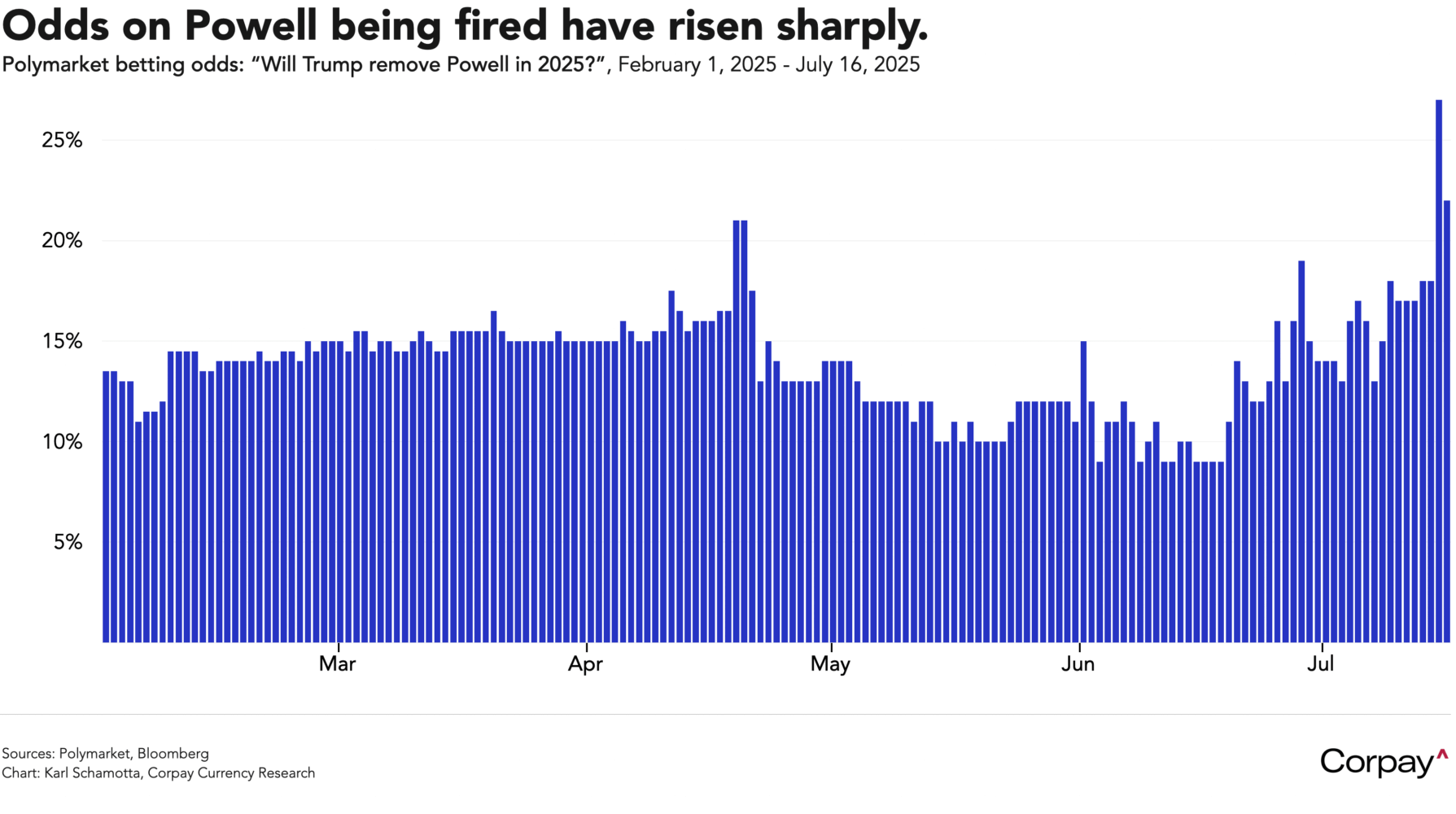

The dollar’s relative stability could last for several months, but could also come off the rails if growth falters under an ever-growing tariff burden, or the Trump administration moves to fire Jerome Powell—something that seems increasingly possible.

Things are considerably more clear-cut here in Canada. Yesterday’s inflation release delivered vivid evidence of an acceleration in underlying price pressures: an average of the Bank of Canada’s preferred core measures pushed through the 3-percent threshold on a year-over-year basis, and the number of components generating above-3-percent price increases climbed to 39 percent—well above the historical average. Odds on a July rate cut are down to around 6 percent from more than 40 percent at the end of June, and there are now just 16 basis points in easing priced in for year-end.

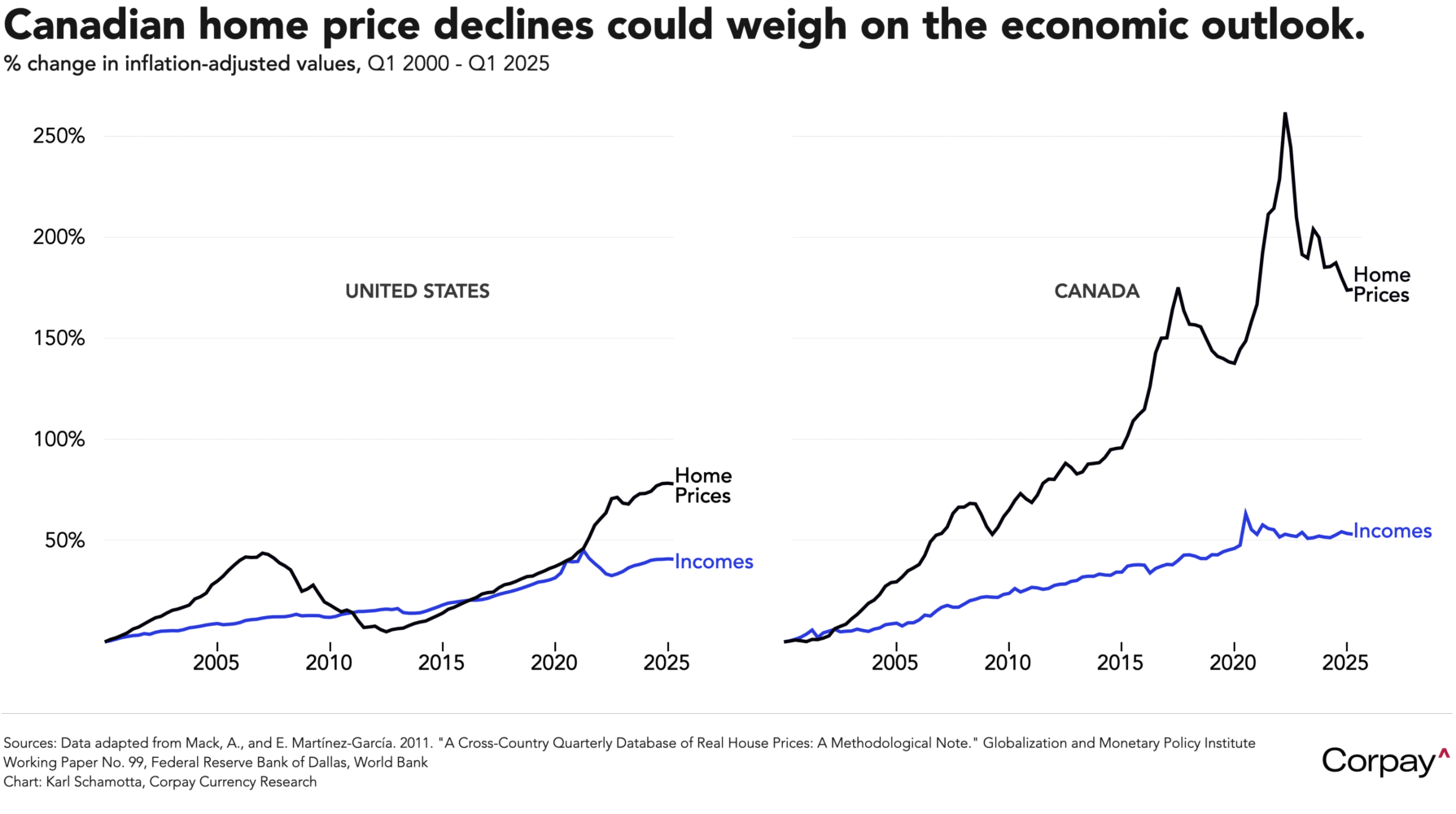

Although we agree that a July move has been taken off the table, we nonetheless expect a relatively-dovish set of communications, given that major uncertainties remain around the degree to which previous easing efforts—and the government’s stimulus spending—can counterbalance elevated uncertainty levels in driving business and consumer behaviours. Monday’s Business Outlook Survey and Survey of Consumer Expectations could prove us wrong, but we suspect that the psychological impact of declining home prices—Canada’s real estate market is arguably suffering its worst downturn since the early nineties—is also taking a toll on the economic outlook, rendering the country’s now-relatively-privileged access to US markets less important, and exerting downward pressure on expected investment and consumption levels.

Inflation pressures also intensified unexpectedly in the UK last month, complicating the Bank of England’s easing trajectory and giving the pound some respite after eight days of losses. Headline prices climbed 3.6 percent in the year to June—topping the consensus forecast and the level recorded in the prior month, which were both set at 3.4 percent. Perhaps more surprisingly, a narrower measure covering domestically-focussed services categories held at 4.7 percent, defying expectations for a softening to 4.5 percent or below. Officials on the central bank’s Monetary Policy Committee have clearly signalled a desire to push rates in a more accommodative direction as they work to forestall further weakening in labour markets, but with price growth proving more stubborn than expected, they may need to move more cautiously than previously anticipated. The swap-implied probability of an August cut is down to 80 percent from above 85 percent previously, and traders now see 49 basis points in easing this year, compared with 53 basis points yesterday.

Ahead today, the Fed’s Beige Book survey—a collection of anecdotes on current economic conditions collected by each of the central bank’s regional districts—is likely to exhibit signs of stability, with business contacts reporting a slight improvement in overall sentiment levels. Fed speakers will include Cleveland’s Beth Hammack at 9:15, Governor Michael Barr at 10:00, and New York’s John Williams at 5:30—with Williams winning our vote as most likely to move markets.