• Mixed signals. Positive US CPI offset by lack of US/China trade progress. S&P500 dipped, as did bond yields. AUD & NZD also eased back.

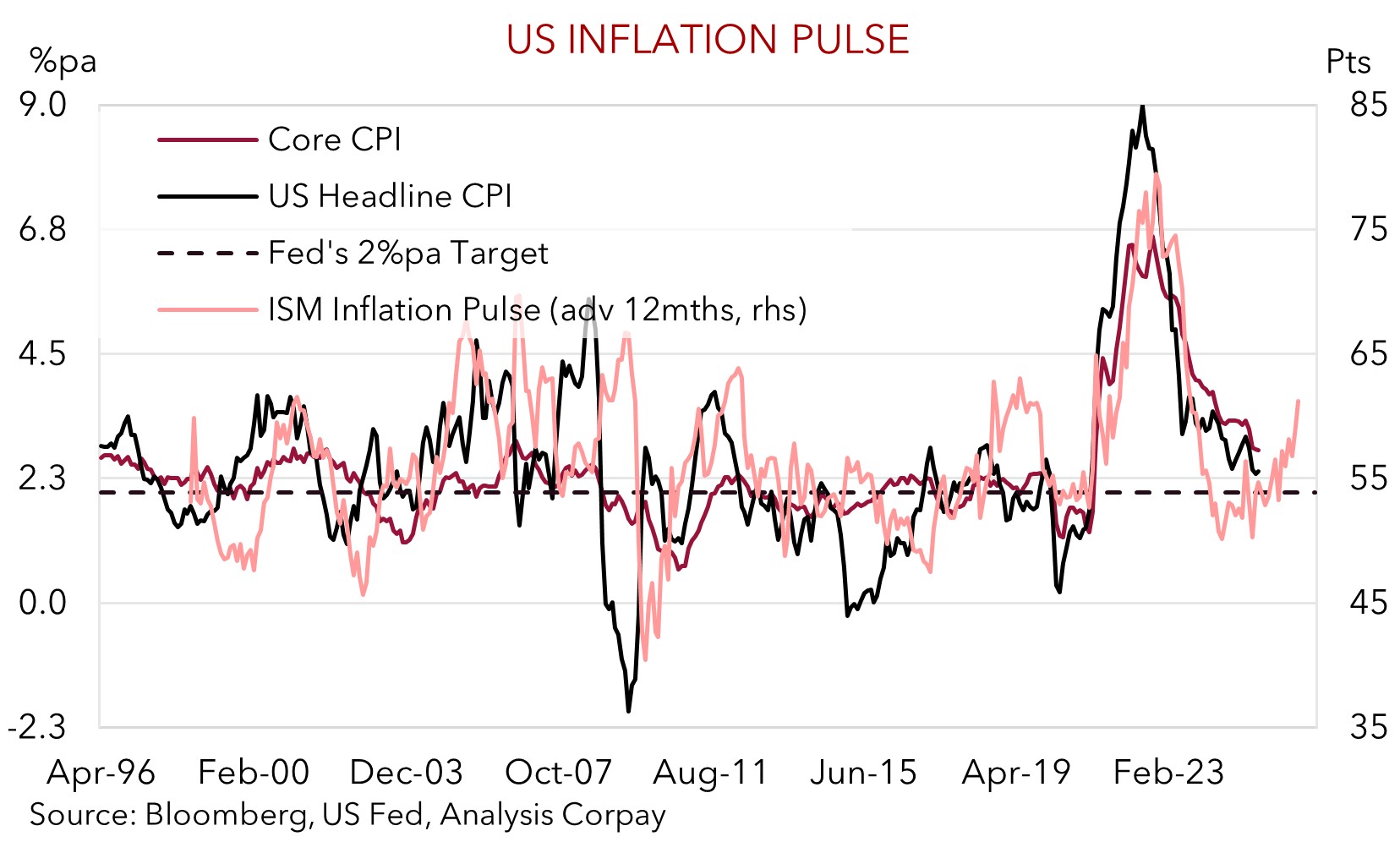

• Tariff impacts. Some signs of tariffs in US inflation. But other factors working the opposite way. Will US inflation re-accelerate down the track?

• Data flow. US producer prices & jobless claims tonight. Next week US Fed meets, China data is due, & the AU jobs report is released.

Global Trends

Contrasting US economic and trade tariff news generated a few intra-session market swings overnight. On the more positive front US CPI came in a little softer than predicted in May with headline and core inflation rising just 0.1% in the month. As a result, the annual pace of core inflation held steady at 2.8%pa. Tariff impacts are showing up across ‘goods’ categories with prices of toys and appliances rising, but heightened uncertainty, pre-tariff inventory accumulation, and the sluggish economy have offset this with prices in other areas such as travel and ‘services’ cooling. As our chart shows, the signal from business surveys is for US inflation pressures to re-emerge, however a lot will depend on how willing/able US corporates are to absorb the higher costs into their margins.

On the other hand, the latest round of trade talks between the US and China ended with a ‘framework’ to uphold the interim agreement announced last month. A lot of effort just to maintain the temporary status quo. This underwhelmed optimistic markets. The potential for tensions to re-emerge down the track given the complexity of the negotiations remains. Tariff related volatility might pick up over coming weeks with the 90-day pause on ‘reciprocal’ levies imposed on nations other than China due to end on 9 July.

On net, the initial lift in the US stockmarket post the favourable CPI report faded with the S&P500 ending the day lower (-0.3%). This snapped a 3-day rally, though in level terms the S&P500 remains less than 2% from its record highs. Elsewhere, the combination of softer US inflation and lingering trade uncertainty saw bond yields decline with US rates falling ~5-7bps across the curve. In FX, the USD index slipped back however this was reflected in strength in other major currencies such as the EUR (now ~$1.1492), GBP (now ~$1.3550) and JPY (now ~144.47). Cyclical currencies like the NZD (now ~$0.6029) and AUD (now ~$0.6501) lost a bit of ground.

Looking ahead, US weekly initial jobless claims and producer prices will be in focus tonight (10:30pm AEST). The latter will be looked at closely to see if upstream tariff price pressures are building. Signs they are may generate knee-jerk USD strength, in our opinion, however as outlined previously we don’t think this should extend too far or last too long. We believe widening cracks in the US labour market and weaker activity are likely to see the US Federal Reserve re-start its interest rate cutting cycle later this year, and this is a factor that can drag down the USD over the medium-term.

Trans-Tasman Zone

Cyclical currencies such as the NZD and AUD drifted back a little overnight. Disappointment about the lack of further positive developments during the latest round of US/China trade talks exerting some downward pressure (see above). That said, at ~$0.6029 the NZD is still hovering near the upper-end of its multi-month range, as is the AUD (now ~$0.6501). The AUD also underperformed on the crosses. AUD/EUR (-0.9%) has slipped back towards its 50-day moving average (~0.5656). It was a similar story for AUD/GBP (-0.7%), while AUD/JPY (-0.7%) has fallen under ~94.

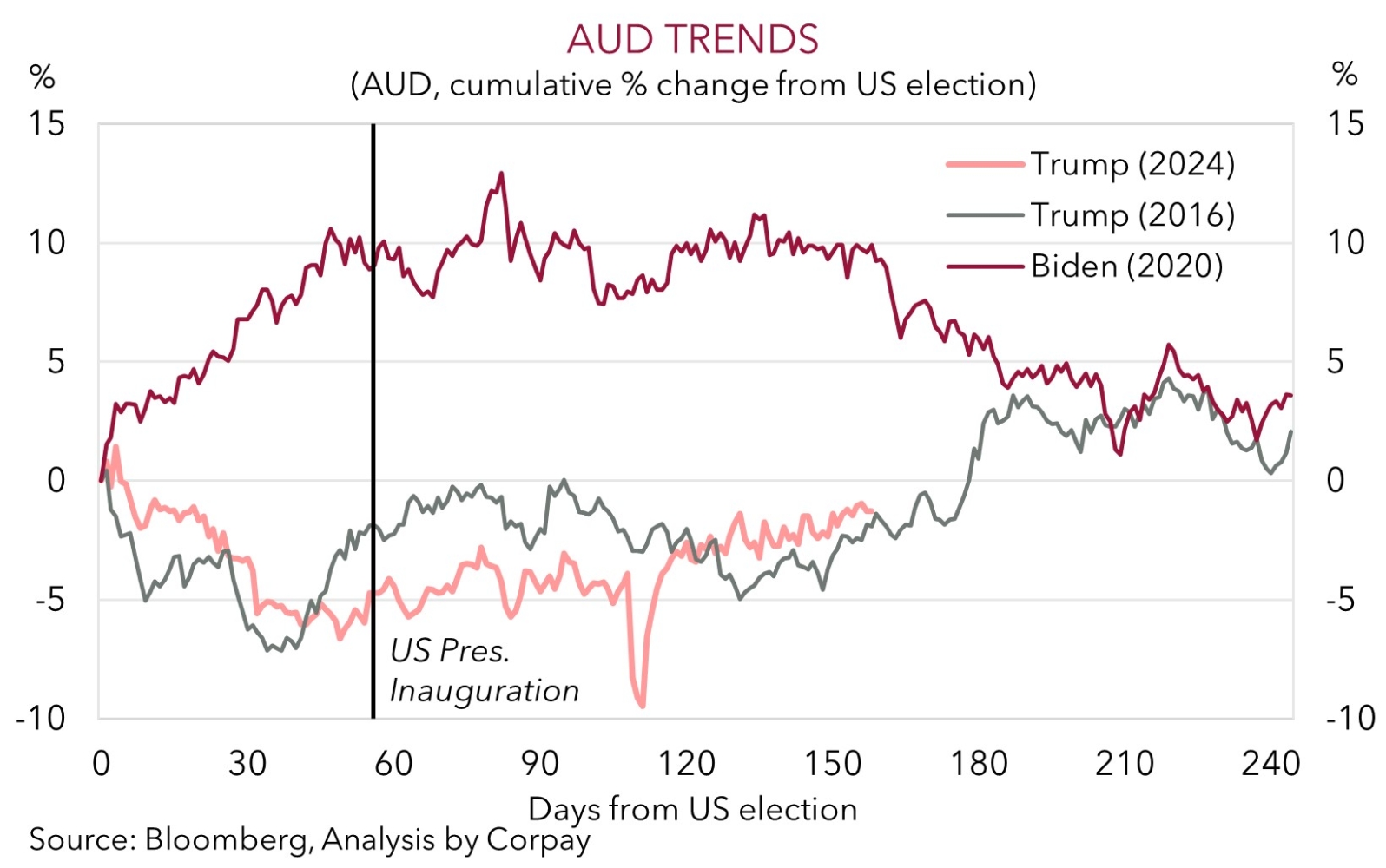

After its strong rebound over the past couple of months the AUD looks to be pausing for breath. As illustrated in the chart below, the AUD is following a similar path to what occured during President Trump’s first term. The AUD is now ~10% above its post US ‘Liberation Day’ April trough. As mentioned, we think there is a risk tariff-induced upstream price pressures show up in US producer prices (10:30pm AEST) and this may give the USD a helping hand. If realised, this might weigh a little more on the AUD, in our opinion. However, barring an exogenous shock we don’t think pull-backs in the AUD should be deep.

We remain of the opinion that the various Trump Administrations policies can constrain US growth and/or dampen investor confidence in holding US financial assets. In time, we believe this could see the USD steadily weaken, and this can help the AUD trend higher over the coming year. Also helpful for the AUD’s longer-term outlook are steps being taken by authorities in China to counter export sector headwinds via boosting domestic activity, particularly commodity intensive infrastructure investment. We also believe that with ~3 more RBA rate cuts priced in over the rest of 2025 the market may have reached peak ‘dovishness’. Momentum has slowed, but underlying trends in the Australian economy remain positive. A relatively more ‘cautious’ approach from the RBA could be AUD supportive, especially on the crosses.