• Market swings. US equities powered ahead, while bond yields & the USD gave back some of their post US election gains. AUD & NZD rose.

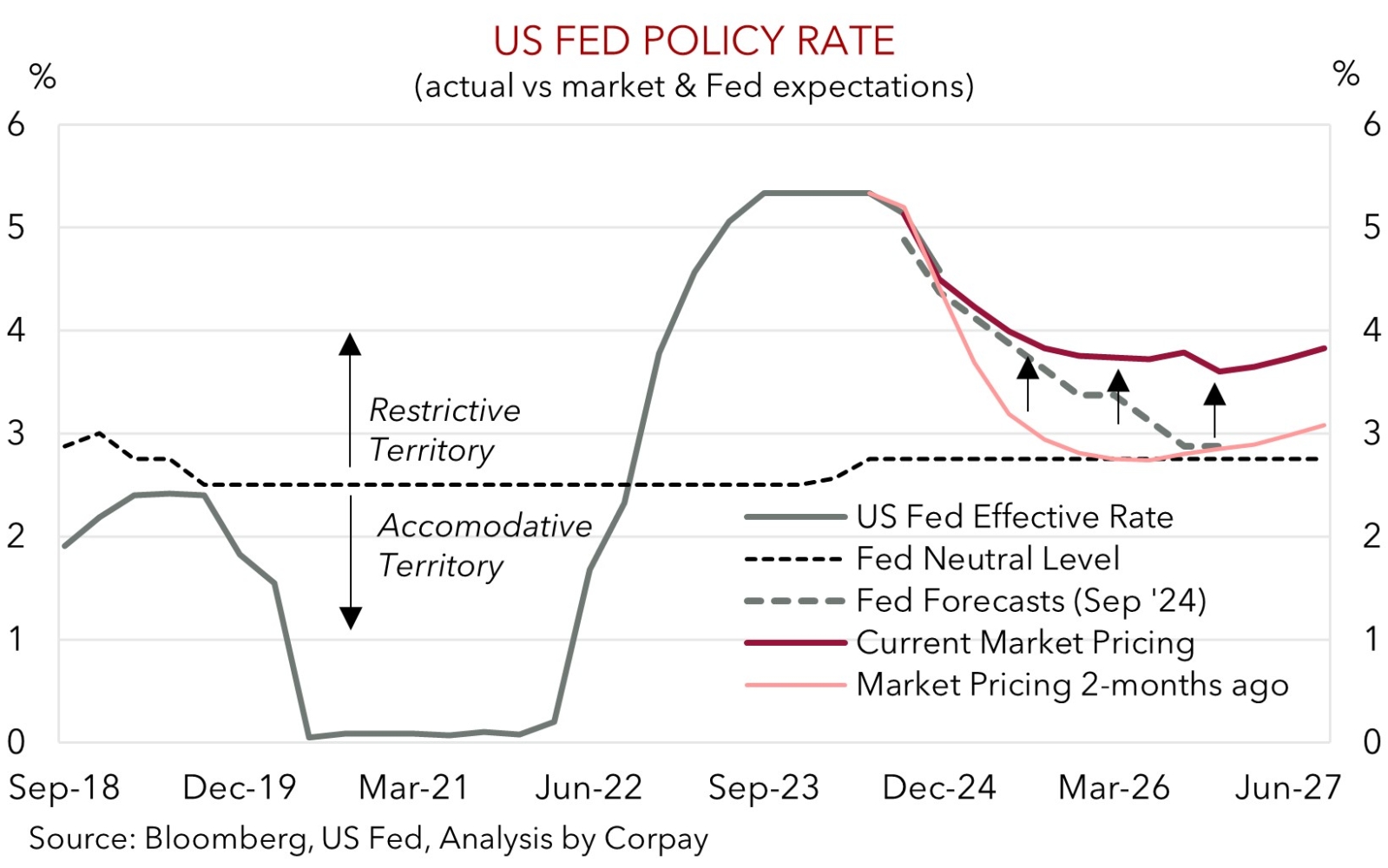

• Central banks. BoE & US Fed cut rates. Fed still on a path towards ‘neutral’. In time Trump policies may constrain its ability to lower rates as far as it thinks.

• China measures. AUD & other cyclical assets also boosted by expectations China will announce more stimulus. Will China underdeliver again?

A reversal of fortunes across most asset classes over the past 24hrs as markets cooled their jets a bit about President Trump’s second term policy mix, and as central banks and China stimulus expectations moved back into the spotlight. Remember, Trump doesn’t take office until 20 January so bursts of volatility (negative and positive) are likely over the period ahead.

In contrast to US equities which continued to power ahead (S&P500 +0.8%), US bond yields and the USD lost ground. US yields declined ~5-11bps across the curve, though this didn’t fully unwind the previous days jump. At ~4.34% the benchmark US 10yr rate is still tracking towards the upper end of its multi-month range. It was a similar story in FX with the USD tracking the move lower in US yields, yet it hasn’t completely unwound the post-US election bump that came through against the major currencies such as EUR (now ~$1.0802), JPY (now ~152.88), or GBP (now ~$1.2980). By contrast, NZD (now ~$0.6025) and AUD (now ~$0.6678) have outperformed thanks to the mix of lower US yields and positive risk sentiment. Expectations authorities in China could unveil fresh fiscal stimulus measures during today’s National People’s Congress boosted cyclical assets. Base metals rallied (copper +4.7%, iron ore +2.3%), with China’s stockmarket also up strongly (CSI300 +3%).

In terms of central bank actions, as anticipated the Bank of England and US Federal Reserve delivered 25bp rate cuts. The moves lowered the BoE rate to 4.75% with the Fed funds target range now at ~4.50-4.75%. According to the BoE, further gradual easing should be expected, assuming things evolve as expected. However, the “sizeable” growth and inflation impacts from policies contained in the recent UK budget have muddied the waters somewhat in terms of how far the BoE may end up going. Less than 3 more BoE rate cuts are factored in by markets by Q3 2025.

The US Fed’s second rate reduction this cycle was unanimous, with comments about labour market conditions and inflation largely neutralizing each other. With respect to future steps Chair Powell reiterated that while policy is on a path to a “more neutral stance” the Fed isn’t “on any pre-set course”. Decisions are meeting-by-meeting based on the data, and as such another cut in December can’t be ruled “out or in”. More broadly, when it comes to the US political changes Chair Powell stressed he won’t resign if asked (his term ends in 2026), that firing or demoting Fed governors is “not permitted under the law”, and that potential fiscal/trade policies only come into calculations once passed into law. In our opinion, once the latter happens the likely positive US inflation impulse could constrain the Fed’s ability to lower rates as much as would have otherwise been the case in 2025. As our chart shows markets are already starting to factor in a shallower Fed easing cycle. We believe this can act as a medium-term USD support (see Market Musings: US election – FX inflection point).

AUD Corner

The AUD has perked up over the past 24hrs. The combination of a retracement in US bond yields as markets pared back some of their ‘Trump trade’ enthusiasm and the US Fed cut rates, and expectations policymakers in China might announce new stimulus measures at todays National People’s Congress has given growth-linked assets such as the AUD, equities, and base metal prices a boost (see above). That said, the recent intra-day swings also need to be put into perspective. At ~$0.6678 the AUD is back where it was trading a few weeks ago and it is only just above its 1-year average.

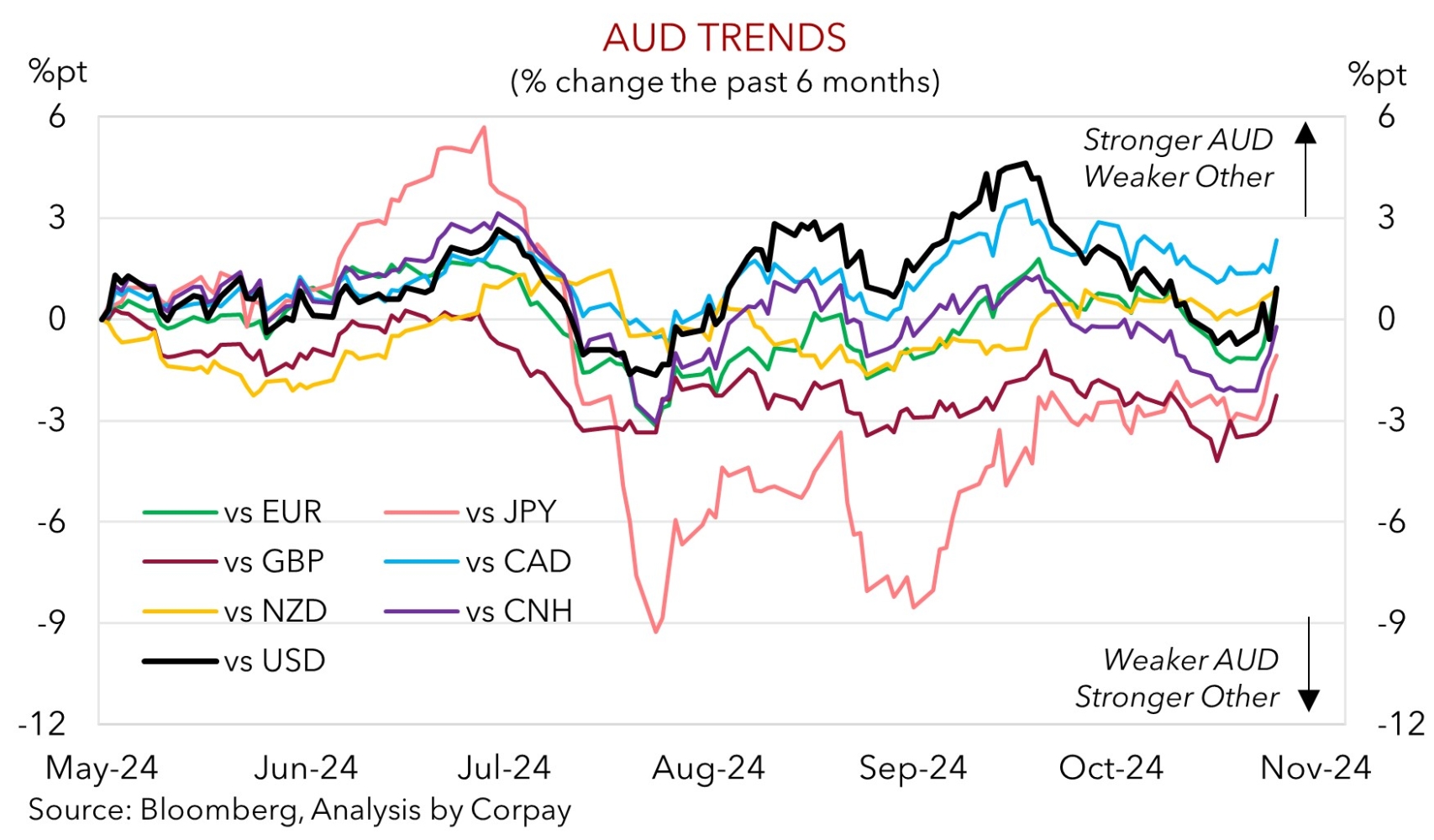

The backdrop has also helped the AUD outperform on the crosses (see chart below). AUD/EUR (+0.8% to ~0.6182) is back within striking distance of its 2024 highs; AUD/GBP (+0.7% to ~0.5144) is approaching its ~1-year average following the overnight rate cut by the BoE; AUD/JPY (+0.4% to ~102.09) is at levels last traded in late-July; AUD/NZD (now ~1.1084) is less than 1% from its cyclical peak; and AUD/CNH (now ~4.7741) has also rebounded above its 200-day moving average.

The relative strength in the AUD isn’t a surprise to us. As discussed yesterday, and in previous research, while we think the Trump policies should be USD supportive over the medium-term and may create a lower medium-term ceiling for the AUD (i.e. linger in the mid-$0.60s rather than kicking up towards ~$0.70), various relative fundamentals are still in the AUD’s favour (see Market Musings: US election – FX inflection point).

Domestically, the resilient labour market and stickiness in core inflation due to the still high level of aggregate demand stemming from strong population growth underpins our long-held view that the RBA will lag its peers in terms of when it starts and how far it goes during the easing cycle. We continue to believe that the start of a gradual/modest RBA rate cutting phase is a story for H1 2025. Over time we think the diverging policy trends between the RBA and other central banks and widening yield differentials should be AUD supportive versus EUR, CAD, GBP, and NZD. Moreover, while Trump trade and fiscal policies may create growth headwinds and/or inflation risks, nations in the firing line such as China are unlikely to stand still, especially as China’s economy is already stumbling along. In our judgement, China may try to offset any US tariff-induced export pain via moves to prop up commodity-intensive and internally focused infrastructure investment. This is the area Australia’s key exports are plugged into.