• Mixed messages. Softer tone in equities. Bond yields continue to push higher. USD treads water, with a firmer EUR offset by a weaker JPY.

• AUD & NZD. NZD tracking around levels last traded in late-2022. AUD near 2024 lows. Will this run continue or will the USD pause for breath?

• Event radar. The China data batch, global PMIs, and US Fed/Bank of Japan meetings are the key events to watch this week.

The divergent market trends continued into the end of last week. Equities had another soft session with a large drop in China (CSI300 -2.4%) leading the way after policymakers again pledged to boost consumption but failed to provide specific fiscal stimulus details. Initial gains in the US faded with the S&P500 closing the day flat and recording its first weekly fall (-0.6%) in a month. By contrast, the sell-off in bond yields continued ahead of this week’s central bank meetings. The benchmark US 10yr yield rose ~6bps to ~4.40%, with the sharp ~25bp jump over the past week pushing long end rates back to levels traded in the wake of the November US election. In FX, the USD index tread water, however this masked crosscurrents below the surface. The interest rate sensitive USD/JPY tracked the move up in yields to be at a multi-week high (now ~153.66), and while GBP weakened (now ~$1.2616) after UK GDP data showed the economy contracted for the second straight month, the EUR ticked up a little after its weak run (now ~$1.0496). Elsewhere, the NZD (now ~$0.5764) and AUD (now ~$0.6365) consolidated with the former tracking at levels last traded in late-2022.

Globally it is a fairly busy week in terms of scheduled economic events. Today, the November activity data from China is due (1pm AEDT), and the forward looking global business PMIs are released (Japan 11:30am AEDT, Eurozone 8pm AEDT, UK 8:30pm AEDT, and US 1:45am AEDT). Later this week focus will switch to monetary policy with the US Fed (Thurs morning AEDT), Bank of Japan (Thurs AEDT), and Bank of England (Thurs night AEDT) all meeting.

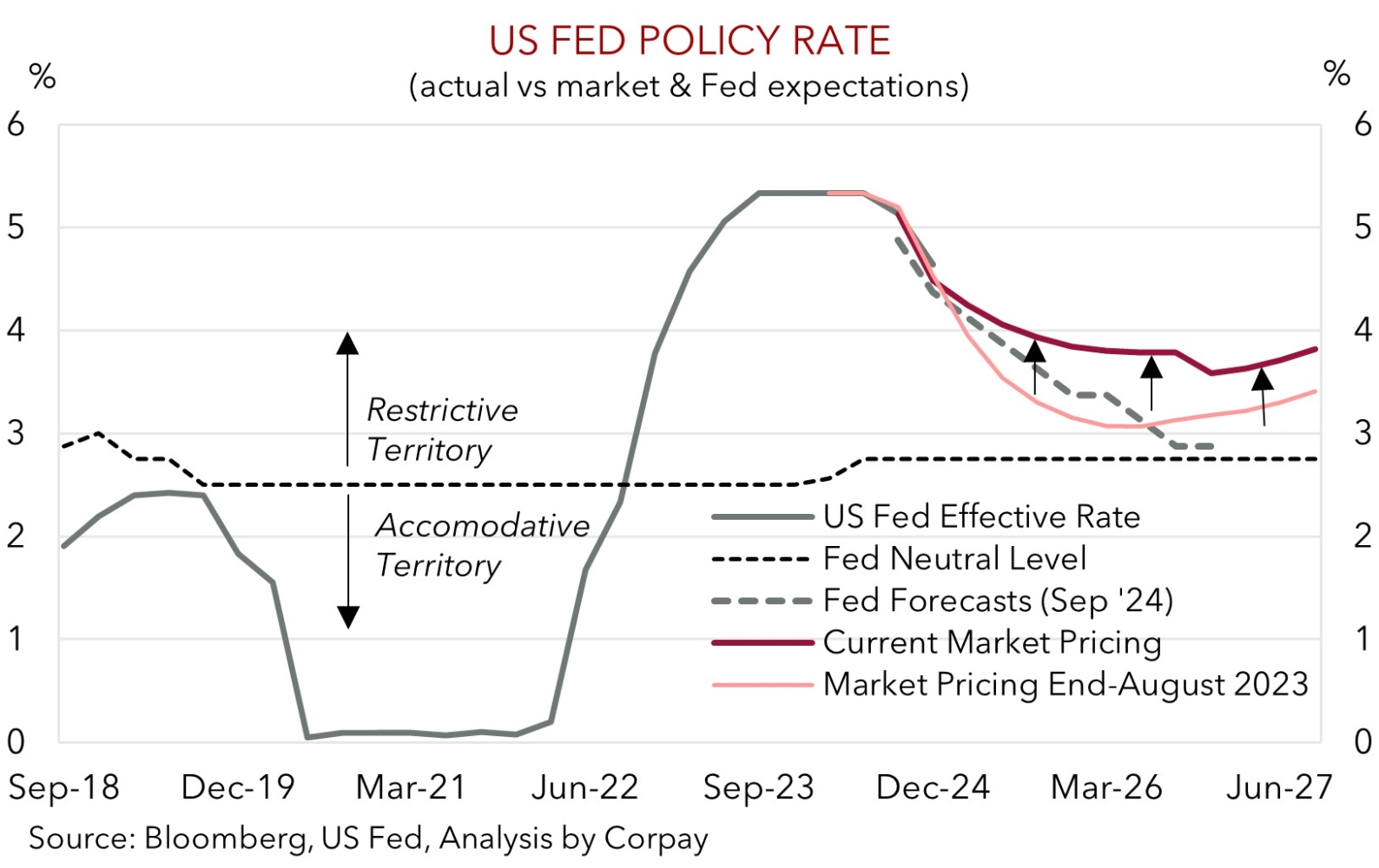

In our view, there could be some push-pull forces at work when it comes to the USD and broader risk sentiment over the next week days. We think signs the various stimulus measures injected into China’s economy (with more to come) are starting to boost activity, coupled with some potential softening in the US PMIs might drag on the lofty USD near-term. This could receive a bit of a kick along later this week if the US Fed delivers another rate cut (which is ~93% factored in) but isn’t as ‘hawkish’ as what markets currently predict. As our chart shows, the assumed path forward for US interest rates is already well above where the Fed’s ‘dot plot’ is sitting. Markets are driven by outcomes relative to expectations. If upgrades by the US Fed to its 2025/26 interest rate projections aren’t as aggressive as what is baked in we believe the USD may give back some ground. This could be compounded if the Bank of Japan delivers another surprise rate hike, which in our judgement is a matter of when, not if.

AUD Corner

The divergent market trends continued into the end of last week. Equities had another soft session with a large drop in China (CSI300 -2.4%) leading the way after policymakers again pledged to boost consumption but failed to provide specific fiscal stimulus details. Initial gains in the US faded with the S&P500 closing the day flat and recording its first weekly fall (-0.6%) in a month. By contrast, the sell-off in bond yields continued ahead of this week’s central bank meetings. The benchmark US 10yr yield rose ~6bps to ~4.40%, with the sharp ~25bp jump over the past week pushing long end rates back to levels traded in the wake of the November US election. In FX, the USD index tread water, however this masked crosscurrents below the surface. The interest rate sensitive USD/JPY tracked the move up in yields to be at a multi-week high (now ~153.66), and while GBP weakened (now ~$1.2616) after UK GDP data showed the economy contracted for the second straight month, the EUR ticked up a little after its weak run (now ~$1.0496). Elsewhere, the NZD (now ~$0.5764) and AUD (now ~$0.6365) consolidated with the former tracking at levels last traded in late-2022.

Globally it is a fairly busy week in terms of scheduled economic events. Today, the November activity data from China is due (1pm AEDT), and the forward looking global business PMIs are released (Japan 11:30am AEDT, Eurozone 8pm AEDT, UK 8:30pm AEDT, and US 1:45am AEDT). Later this week focus will switch to monetary policy with the US Fed (Thurs morning AEDT), Bank of Japan (Thurs AEDT), and Bank of England (Thurs night AEDT) all meeting.

In our view, there could be some push-pull forces at work when it comes to the USD and broader risk sentiment over the next week days. We think signs the various stimulus measures injected into China’s economy (with more to come) are starting to boost activity, coupled with some potential softening in the US PMIs might drag on the lofty USD near-term. This could receive a bit of a kick along later this week if the US Fed delivers another rate cut (which is ~93% factored in) but isn’t as ‘hawkish’ as what markets currently predict. As our chart shows, the assumed path forward for US interest rates is already well above where the Fed’s ‘dot plot’ is sitting. Markets are driven by outcomes relative to expectations. If upgrades by the US Fed to its 2025/26 interest rate projections aren’t as aggressive as what is baked in we believe the USD may give back some ground. This could be compounded if the Bank of Japan delivers another surprise rate hike, which in our judgement is a matter of when, not if.