• Cross-currents. Bursts of intra-day vol., but net market moves minimal. US equities flat on Friday. AUD & NZD ticked up a fraction.

• US data. With the government shutdown over US data flow picks up. Delayed September non-farm payrolls report due this week (Thurs night AEDT).

• Event Radar. Australian Q3 wages are out (Weds). Global PMIs are on the calendar (Fri). Several US Fed members also set to speak.

Global Trends

Intra-day market gyrations continued Friday, but the net moves were modest. After opening lower on the back of lingering valuation concerns across the tech-sector the S&P500 ended the session flat. It was a similar story when looking at things on a weekly basis with the S&P500 ticking up a fraction after enduring a daily zig-zag pattern. Bond yields edged up a little (US 10yr +3bps to ~4.15%) with the surge in UK rates leading the way (UK 10yr +14bps) on the back of reignited fiscal concerns after reports indicated the Chancellor won’t raise income taxes at the upcoming UK Budget. In FX, the USD index nudged up with EUR (now ~$1.1622) and GBP (now ~$1.3171) a touch weaker, while USD/JPY whipped around at the upper end of its multi-month range (now ~154.60). Elsewhere, the NZD extended its drift higher (now ~$0.5681), though it remains at low levels, and the AUD is hovering close to its 100-day moving average (now ~$0.6534).

Macro wise there were a few push-pull forces coming through. The monthly China activity data batch for October was generally a bit softer than anticipated with annual growth in retail sales and industrial production decelerating and the slump in fixed asset investment continuing. Holiday distortions likely played a role. A post-holiday recovery, an improvement in US/China trade relations, and support from the stimulus measures flowing through the system should see momentum pick up over coming months, in our view. In the US trade was in the news with a greater focus by the Trump Administration on cost of living resulting in the removal of tariffs on a variety of food products including beef, coffee, and bananas.

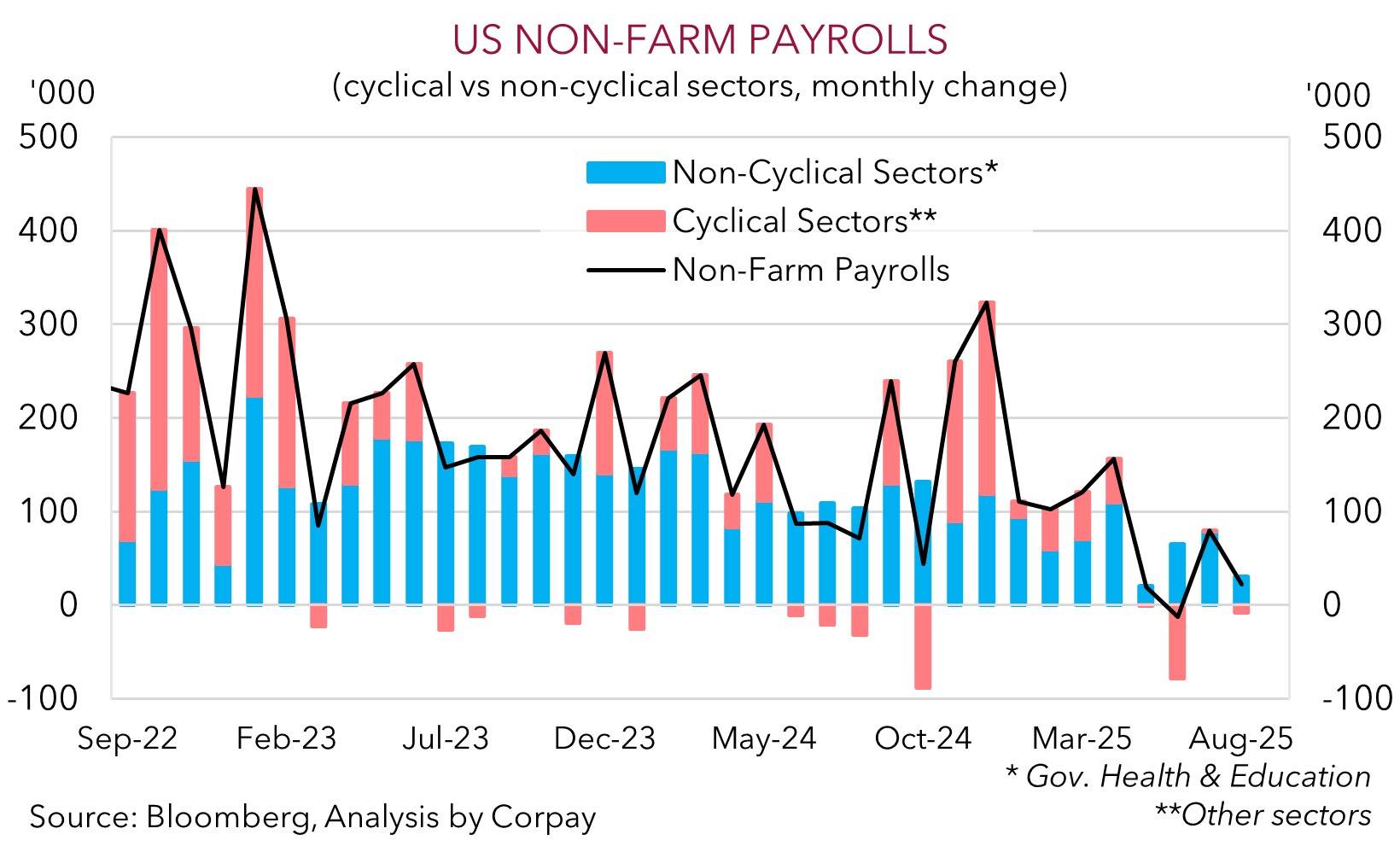

With the US government shutdown ending the backlog of US data will begin to be released. This week the delayed September non-farm payrolls figures are due (Thursday night AEDT). It won’t be a complete employment report with the household survey (which includes the unemployment rate) not included. The September non-farm payrolls data is pre-shutdown. After a weak run some relative improvement is looked for (mkt +50,000, up from +22,000 in August). In the near-term, we think firmer US jobs growth may see odds of a December US Fed rate cut trimmed back further (the market is now assigning a ~43% chance of a 25bp reduction). If realised, we feel this might give the USD a short-term boost. But we wouldn’t expect this to extend too far. Ultimately, we believe sluggish US economic trends and widening cracks in the jobs market should see the US Fed deliver a few more rate cuts over the next year. This coupled with structural pressures such as the US’ wide current account deficit could see the USD gradually re-weaken over the medium-term.

Trans-Tasman Zone

With the USD consolidating and other cross-currents running through markets it was a quiet end to last week for the AUD (see above). At ~$0.6534 the AUD is tracking near its 100-day moving average, and it is a bit above the midpoint of its 6-month range. On the cross-rates the AUD generally picked up a fraction with gains of ~0.1-0.2% recorded versus the EUR, JPY, GBP, and CNH. In level terms AUD/JPY (now ~101) is close to the top of its 1-year range, and in our view appears vulnerable to a pull-back given it is looking quite stretched compared to underlying drivers such as yield differentials. Elsewhere, the beleaguered NZD also recovered more lost ground, although at ~$0.5681 it remains in the lower half of its year-to-date range. AUD/NZD slipped back (now ~1.1504), but with relative macro and interest rate trends still firmly in Australia’s favour we don’t think the reversal should be overly pronounced.

Locally, Q3 wages are released this week (Weds). The tightness in the labour market points to wages growth holding up at ~3.4%pa. In terms of trade related news, we feel weekend developments should also be favourable for Australia (and the AUD), at the margin. As discussed above, the US is removing levies on some food products like beef. This is Australia’s largest export to the US (~A$4.4bn in the past year or ~18% of exports to the US). However the economic tailwinds shouldn’t be large given tariffs haven’t dampened demand (Australian beef exports to the US have risen over the past year).

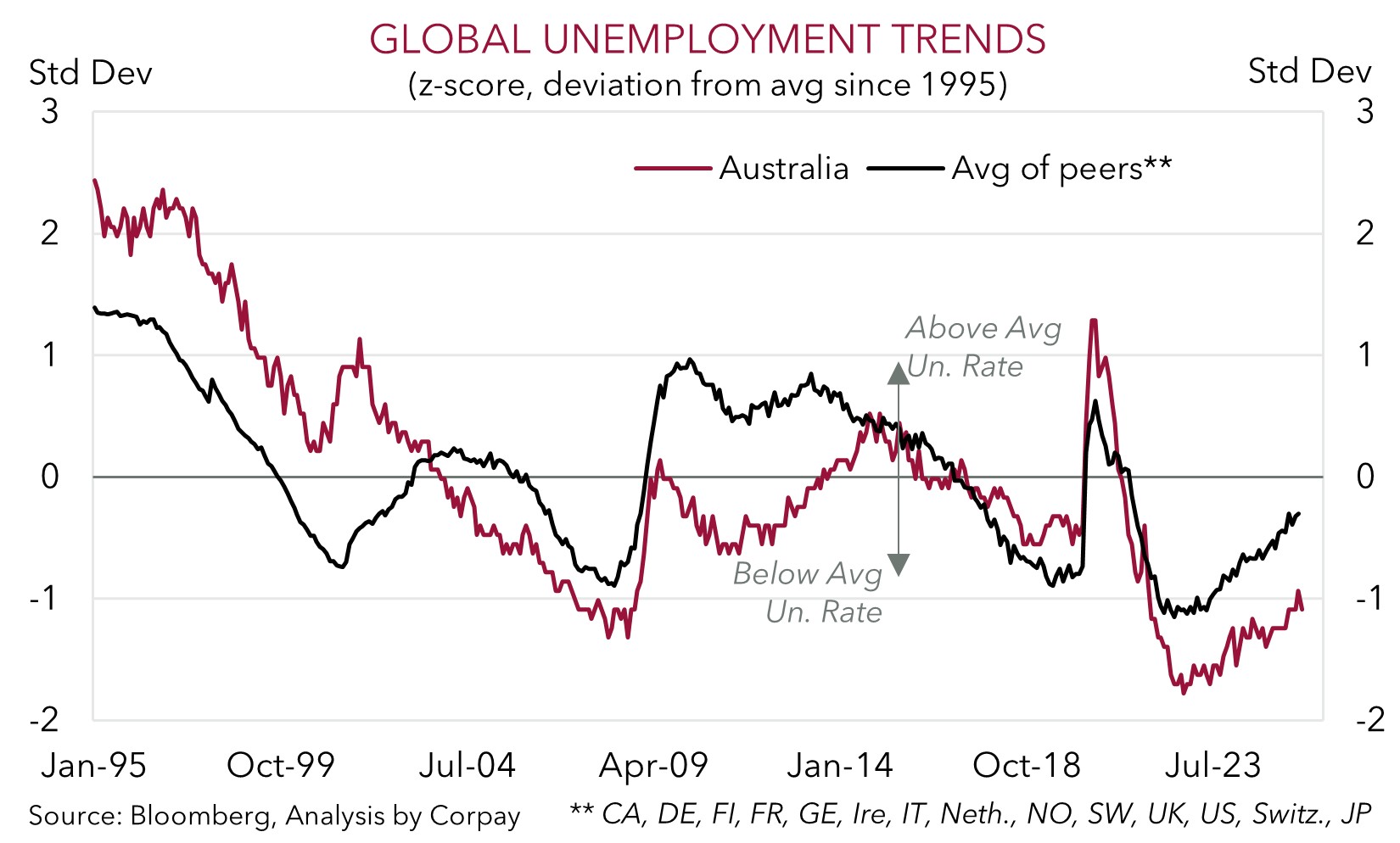

In the US this week, as mentioned above, the delayed September non-farm payrolls data is due (Thursday night AEDT). A modest improvement is looked for, which if realised could see the USD tick up and in turn exert some downward pressure on the AUD and NZD. That said, while more headline/data driven volatility in the AUD should be anticipated in the short-term, we remain of the view that an improvement in US/China trade relations, diverging policy trends between the RBA and central banks such as the US Fed, and favourable yield spreads, can help the AUD grind higher into year-end and over early 2026. As shown below, the Australian labour market remains in a healthier position to its peers with the upswing in unemployment not that large. This also suggests the RBA may be hard pressed to lower rates again this cycle given lingering inflation pressures across the economy.