• Positive vibes. Gains across the tech-sector pushed US equities to record highs. Base metals rose. AUD outperforms ahead of AU CPI data.

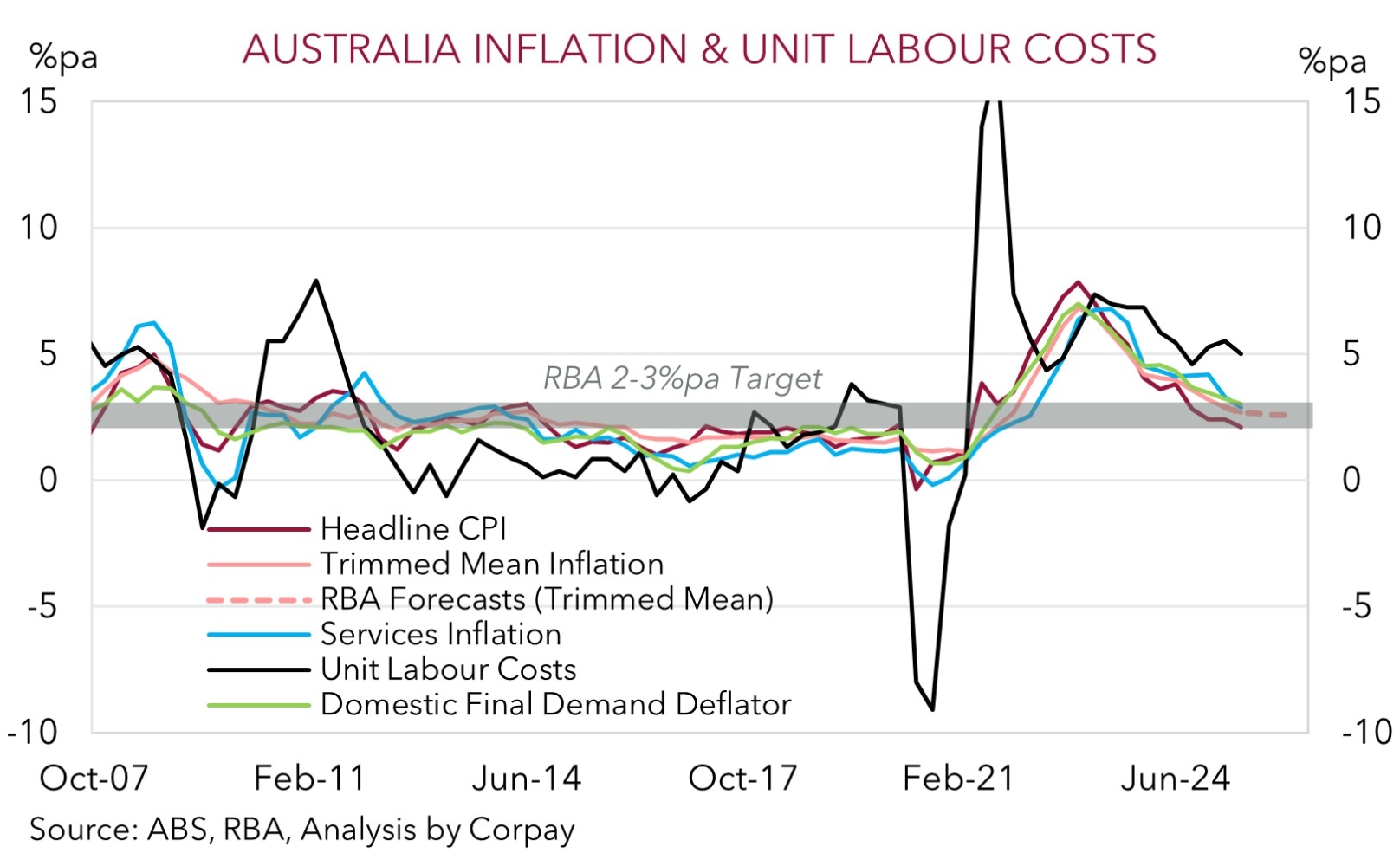

• AU inflation. Q3 CPI due today. Acceleration in core inflation forecast. RBA rate cut expectations have been pared back. This might have further to go.

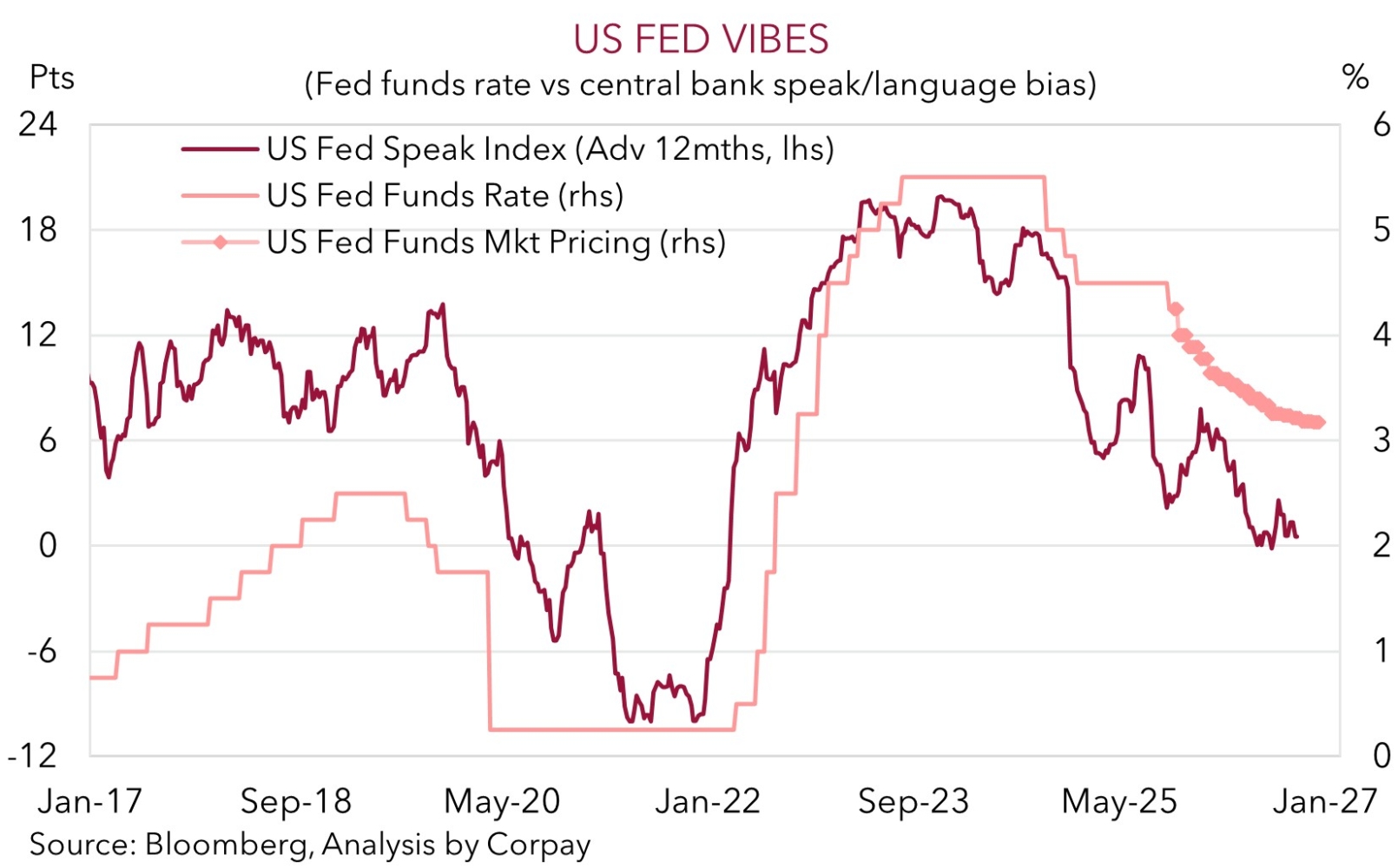

• US Fed. Another US Fed rate cut anticipated tomorrow morning. Guidance will be important. USD volatility likely around the event given what is priced in.

Global Trends

The upbeat tone in risk assets extended overnight. Gains across the tech-sector (NASDAQ +0.8%) pushed US equities to fresh record highs (S&P500 +0.2%) with solid corporate earnings and a new pact between OpenAI and Microsoft underlying drivers. On the trade front, further details about the latest US/China framework hit the wires. Reportedly the US might roll back some tariffs if China reduces the exports of chemicals that produce fentanyl. President’s Trump and Xi are set to meet later this week at the APEC summit.

Elsewhere, bond yields consolidated with the benchmark US 10yr rate at the lower end of its multi-month range (now ~3.98%), WTI crude oil lost ground (-2.2%), and base metal prices like copper (+0.2%) and iron ore (+1%) rose. In FX, the USD index tread water with EUR (the major USD alternative) range bound (now ~$1.1652). GBP underperformed (now ~$1.3274) following the recent run of weaker UK economic data and shift in Bank of England rate cut expectations, while a firmer JPY saw USD/JPY dip (now ~152.12). The JPY’s modest rebound after its bout of weakness is down to comments from US and Japanese officials pledging to monitor exchange rate volatility and strengthen security ties. The positive market sentiment helped NZD tick up (now ~$0.5781) and ahead of today’s Q3 Australian CPI (11:30am AEDT) the AUD added to its recent gains (now ~$0.6584).

Offshore, in addition to any additional US/China trade related comments, the macro focus will be central bank meetings. Another 25bp rate cut in Canada is anticipated (tonight 12:45am AEDT), and the US Fed also looks set to deliver another rate reduction (Thurs 5am AEDT). A 25bp rate cut by the US Fed tomorrow morning is fully priced in by interest rate markets. Hence, focus will be on the Fed’s guidance with Chair Powell due to hold his usual press conference (Thurs 5:30am AEDT). The US government shutdown is still in place, and this is creating a data vacuum. That said, from what has been flowing through we think Fed Chair Powell may note upside risks to inflation seem to be fading yet downside labour market risks remain. In our opinion, this type of mix points to the US Fed delivering another rate cut in December and a few more over H1 2026. As our chart shows, the Fed’s language has turned increasingly ‘dovish’ the past few months and this typically leads a downshift in interest rates. We remain of the view that the outlook for lower US interest rates coupled with slower economic activity because of higher import costs should see the USD weaken over the medium-term.

Trans-Tasman Zone

The upbeat tone in markets overnight, as illustrated by the rise in equities and base metal prices, has supported the AUD and NZD (see above). At ~$0.5781 NZD is approaching the middle of its 1-year range, while the AUD (now ~$0.6584) is just shy of where it started the month (and ~2.2% above its mid-October low). The backdrop has also helped the AUD outperform on most of the major cross-rates. Outside of AUD/JPY (now ~100.15) which has been pushed/pulled by JPY-specific and global forces over the past 24hrs the AUD has recorded gains of ~0.1-0.4% versus the EUR, NZD, CAD, and CNH. AUD/GBP (now ~0.4961) has strengthened by ~0.9% to be at levels last traded in late-February. We would also note that we believe AUD/JPY remains stretched compared to various drivers such as yield spreads and are projecting it to fall back over the medium-term.

In addition to the positive risk sentiment the AUD has also been boosted over the past few sessions by the repricing in RBA rate cut expectations. Markets are now only assigning a ~35% chance of a RBA rate cut in November, with another move not fully discounted until February. Comments by RBA Governor Bullock earlier in the week were the catalyst. Governor Bullock doesn’t look like she was swayed by the uptick in unemployment stating it was “surprising”, but the monthly data can be volatile, and that the Board “just have to wait for more data” when deciding its next step given the labour market and inflation trends.

Focus today is on the Q3 Australian CPI (11:30am AEDT). As discussed earlier this week the monthly partial data points to a pickup in the Q3 trimmed mean that might make the RBA uncomfortable. The trimmed mean is the RBA’s preferred measure of core inflation. According to Governor Bullock an outcome ~30bps over its forecast would be a “material miss” (the RBA is penciling in ~0.6-0.7%qoq while the consensus is looking for ~0.8%qoq). We believe the risks reside with inflation coming in north of the RBA’s predictions, and possibly even stronger than consensus. As our chart shows, unit labour costs are still growing briskly. This, combined with Australia’s poor productivity, suggests domestic/services inflation may remain sticky for a while yet. If realised, we think an acceleration in quarterly inflation could see odds of another RBA rate cut, particularly in November, pared back further, which in turn might give the AUD more of a helping hand. As would another US Fed rate cut tomorrow (5am AEDT) and guidance pointing to additional moves down the track.