• Consolidation. Modest moves across markets. US bond yields fell again. AUD ticked higher. AUD also strengthened a bit on most of the major crosses.

• AU CPI. Inflation re-accelerated with base-effects related to electricity subsidies a factor. We expect the RBA to continue to ease policy slowly.

• Data flow. Fed Governor Waller speaks tomorrow. US PCE deflator due Friday night. Next week AU GDP & US non-farm payrolls are on the schedule.

Global Trends

Fairly modest moves across markets overnight with little new information coming through to shift the dial. US equities ticked higher (S&P500 +0.2%), though stocks have lost a bit of ground in after hours trading following an underwhelming earnings update from tech heavyweight Nvidia. Data wise there were no major offshore release, while on the policy front NY Fed President Williams spoke. Williams noted current Fed settings are “modestly restrictive” and he thinks every meeting from here is “live” for a policy change. Markets are factoring in a ~89% chance the US Fed re-starts its rate cutting cycle in mid-September with close to 5 reductions factored in over the next year.

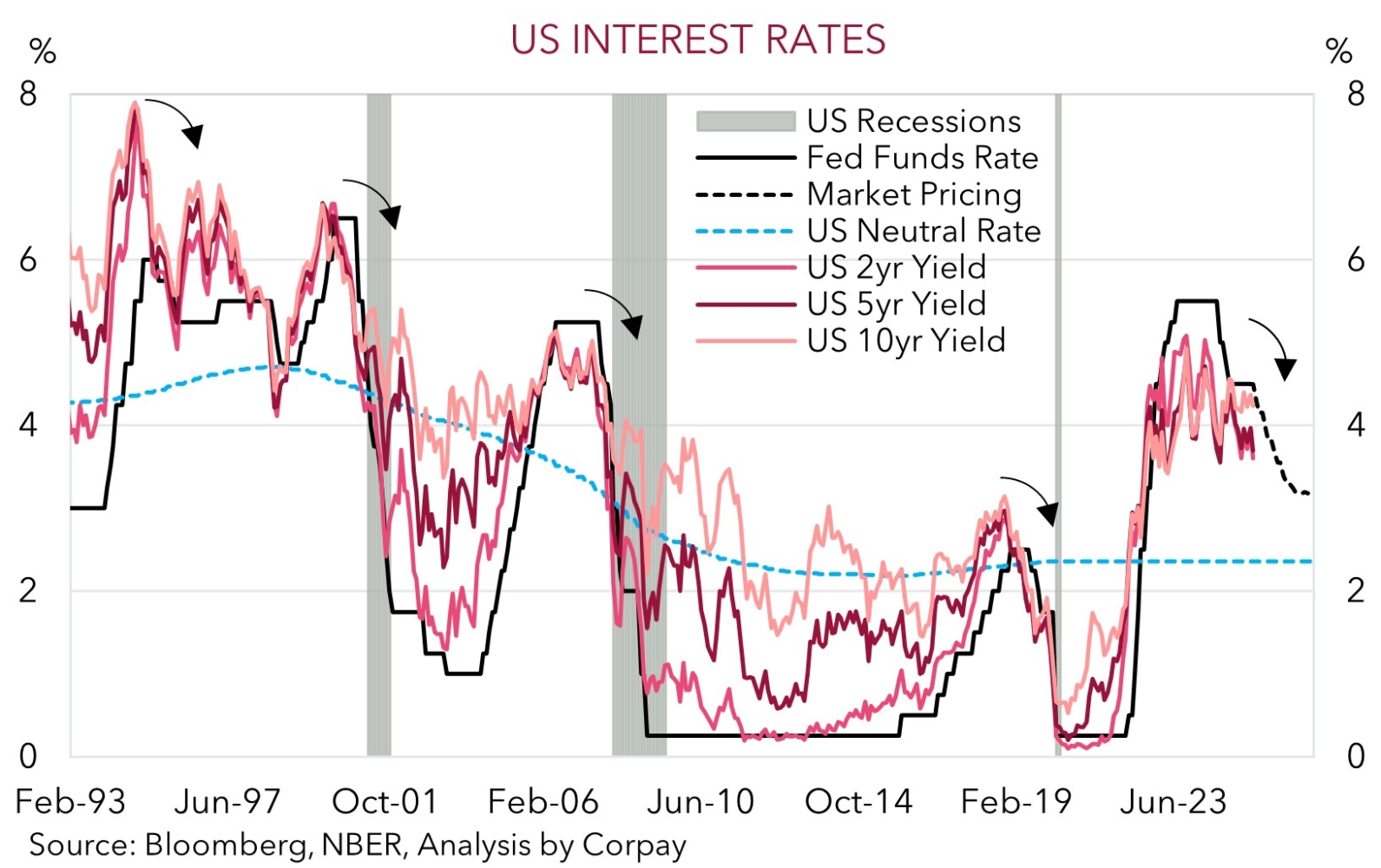

The outlook for lower US interest rates, which is being driven by the combination of shifting US economic risks and external political pressure on the US Fed, exerted more downward pressure on bond yields. The US 2yr rate declined another ~7bps and is now tracking at levels last traded in early-May (now ~3.61%). In FX, the USD swung around intra-day but on net is broadly inline with where it was this time yesterday. EUR is near ~$1.1640 and USD/JPY is at ~147.40 with the former continuing to shrug off political developments in France where the current government could be toppled by a confidence vote as soon as next month. Closer to home the NZD (now ~$0.5858) is near its 1-year average, while the AUD (now ~$0.6506) nudged up slightly after the July Australian CPI data showed there has been a re-acceleration in annual inflation.

Tonight in the US weekly initial jobless claims (a real time reading on the state of the labour market) and the final reading of Q2 GDP are due (10:30pm AEST). Tomorrow, Fed Governor Waller speaks on the outlook (Fri 8am AEST) and the monthly PCE deflator (the Fed’s preferred inflation gauge) (Fri 10:30pm AEST) is released. Based on where expectations for a Fed move in September now sit we think an uptick in US inflation could give the USD a bit of renewed short-term support. However, over the longer-run (i.e. the next 3-12 months) we continue to expect the USD to steadily depreciate with the more challenging US growth outlook generated by higher import costs/tariffs and prospect for US Fed interest rate cuts compounded by the politicization of US institutions. This mix may reduce foreign demand/inflows into US financial assets.

Trans-Tasman Zone

In contrast to the NZD which has been rangebound close to its 1-year average over the past 24hrs (now ~$0.5858) the AUD has ticked a bit higher (now ~$0.6506). The AUD has also outperformed, albeit modestly, on most of the major crosses with gains of ~0.2% recorded against the EUR, JPY, NZD, and CNH. In level terms AUD/EUR (now ~0.5590) is hovering close to its 50-day moving average, AUD/CNH (now ~4.6540) is near its 1-year average, and AUD/NZD (now ~1.1107) is at the top of the range occupied since late-February.

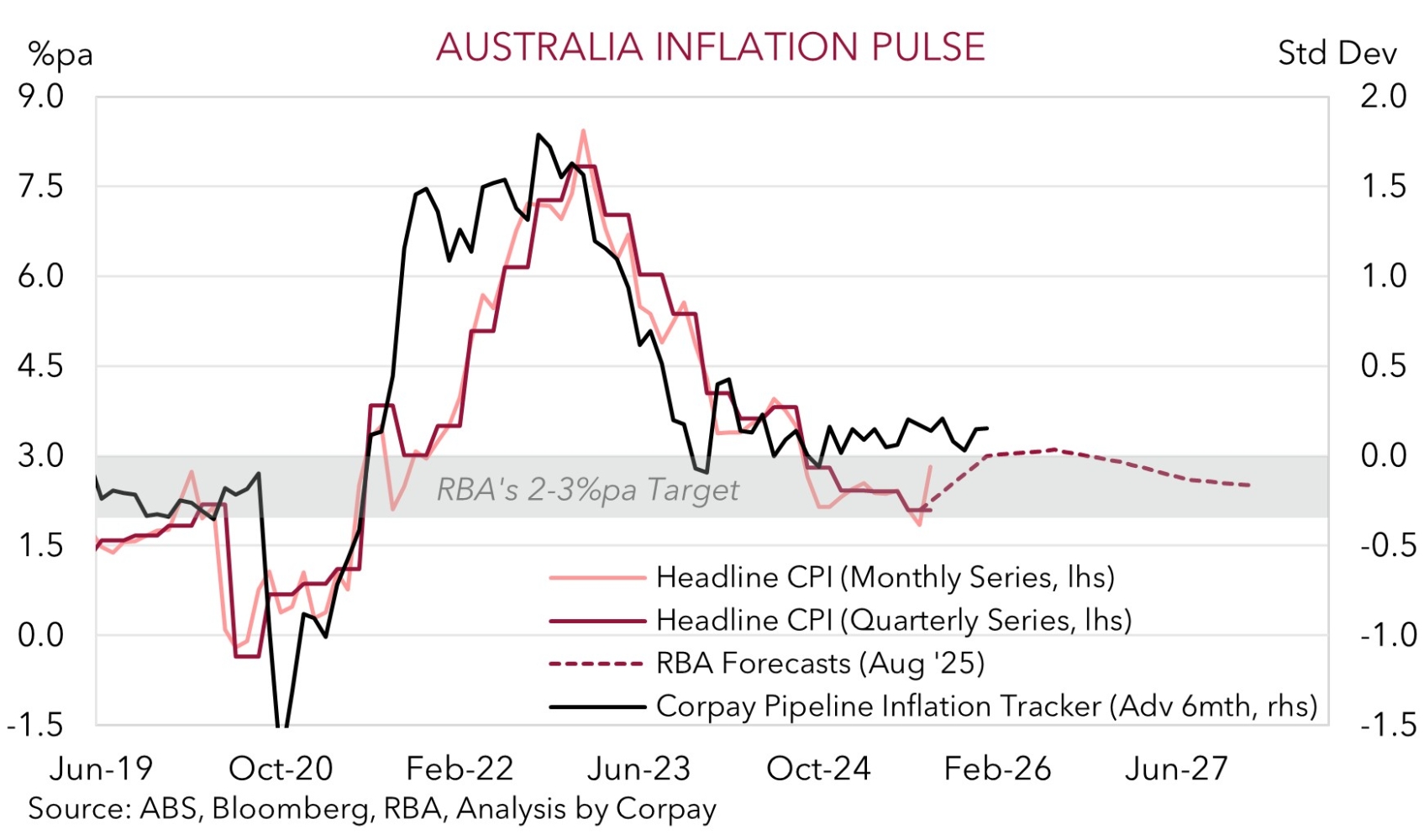

In addition to the soggy USD the AUD has been supported by higher-than-expected Australian inflation. There was a sizeable step up in the monthly CPI indicator in July with headline inflation reaccelerating to 2.8%pa (a high since last July) and core inflation jumping up to 2.7%pa. The largest contributor was housing which itself reflected increased electricity costs as base-effects from Governments subsidies kicked in. The subsidies had artificially lowered inflation late last year, so this mechanical snapback was inevitable, though it could be somewhat short-lived as payment of rebates for households in NSW and ACT will re-commence in August. That said, as shown in the chart below, our pipeline inflation tracker is pointing to somewhat sticky/persistent inflation over the next few months.

Overall, although the monthly CPI indicator provides more noise than signal in the early part of the new quarter like July it still supports our thoughts that the RBA should continue to ease policy in a cautious/gradual manner. Markets agree with the next RBA rate cut assumed to occur in November and only ~2 more reductions discounted over the next year. More US Fed or data-related headlines might generate some intermittent bursts of AUD/USD volatility over the short-run. But over the longer-term (i.e. next 3-12 months) we continue to expect the AUD to edge higher with a weaker USD, measured approach from the RBA, and signs of improvement in China’s economy as its stimulus push helps counteract tariff headwinds across its export sector supportive factors.