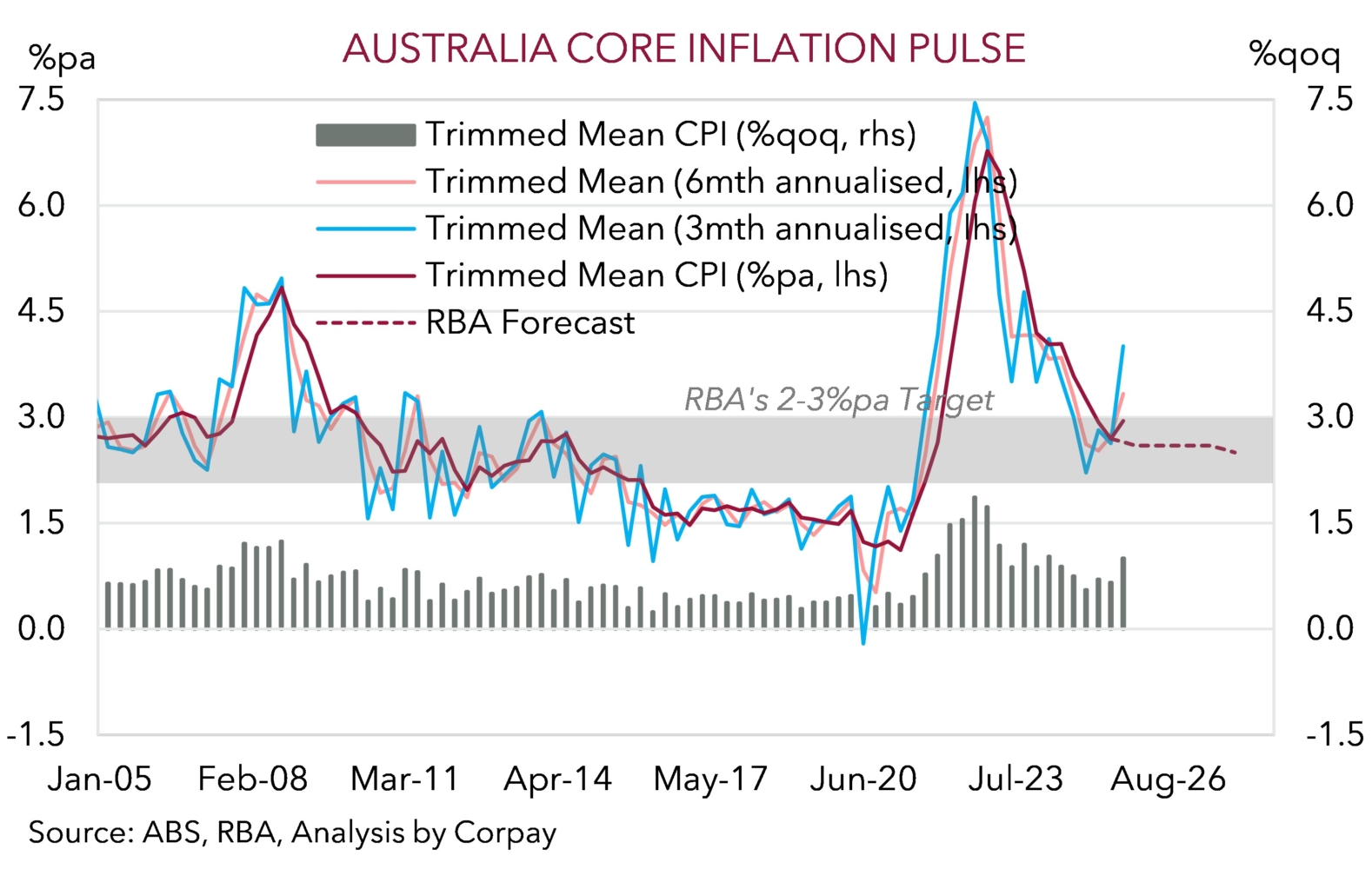

So much for the inflation dragon being slayed. The Q3 Australian CPI data was a jolt to the system. Headline inflation rose 1.3% in Q3 to be 3.2% higher compared to a year ago, while the trimmed mean (the RBA’s preferred gauge which gives a better guide to inflation persistence) rose 1% in the quarter or 3%pa. Inflation momentum has turned up with 3-month and 6-month annualised run-rates at levels that haven’t been seen since H1 2024 (chart 1). On our figuring a slightly greater share of the CPI basket is also rising by 3%pa or more.

The Q3 CPI result was stronger than the signal coming from the monthly partial indicator, and importantly it is well north of the RBA’s expectations. Indeed, earlier this week RBA Governor Bullock noted that a result ~30bps above its ~0.6%qoq estimate would be a “material miss”. The actual outcome is more like an “uber miss” that should rattle a few policymaker nerves about the inflation trajectory.

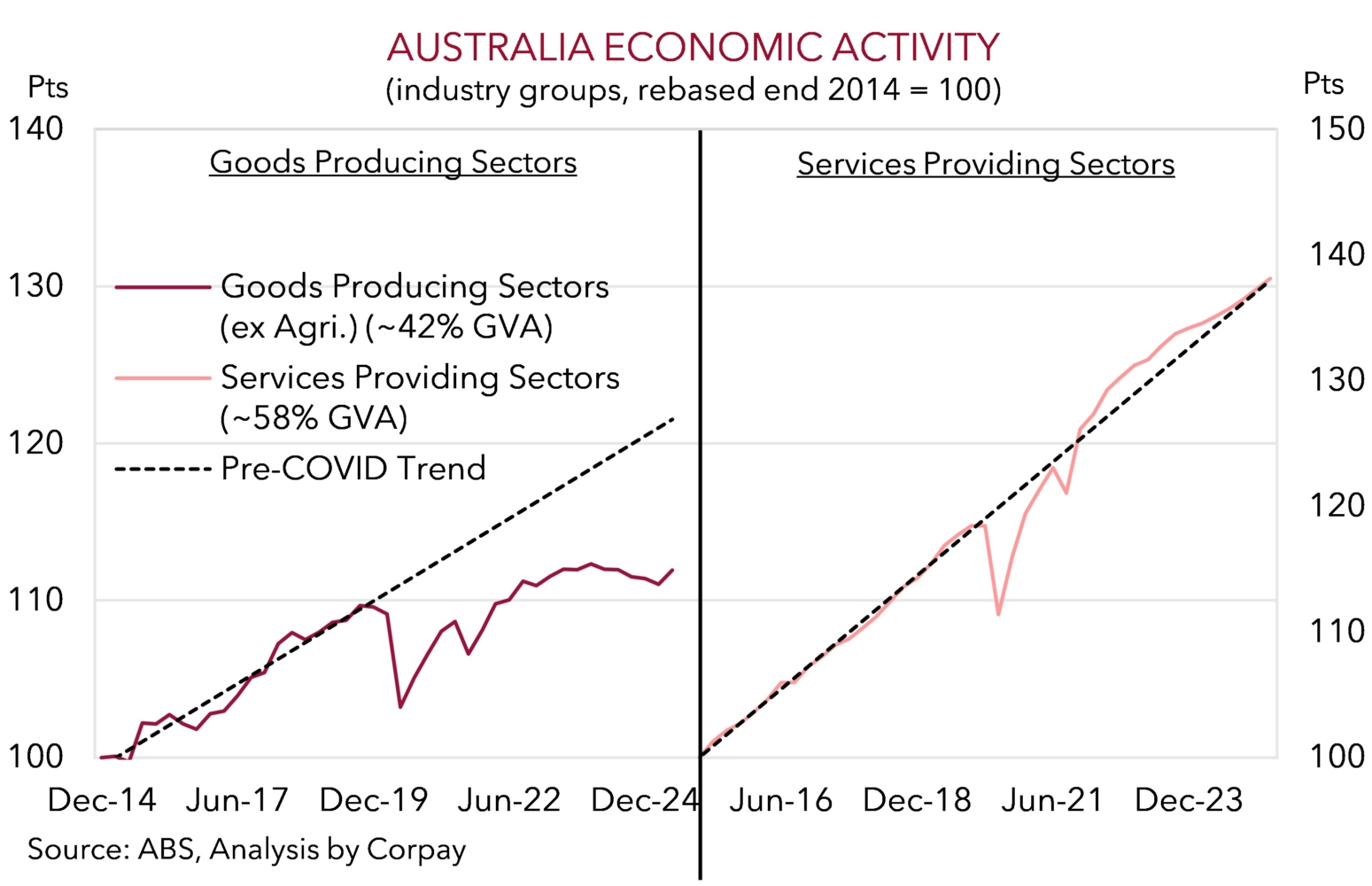

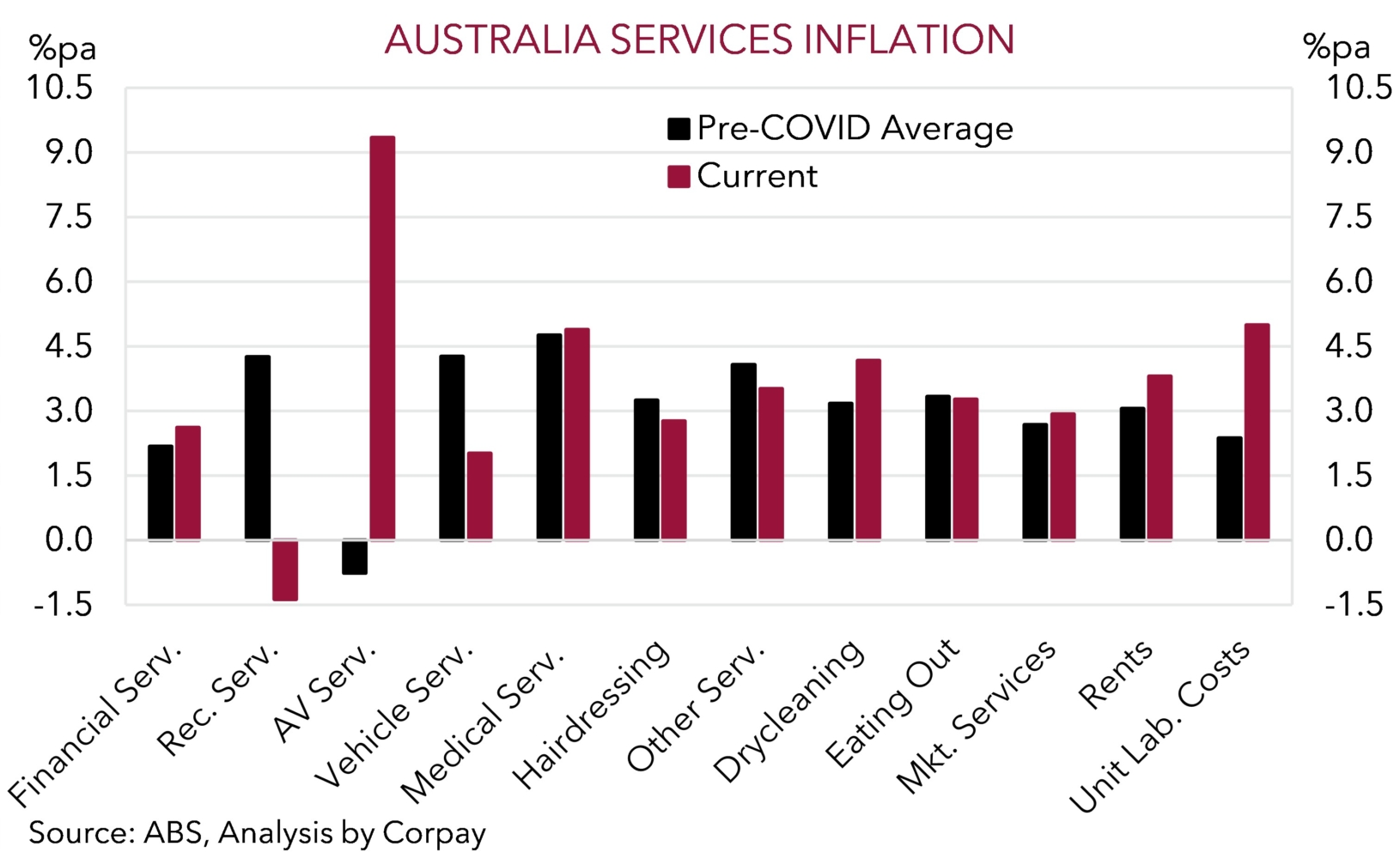

A closer look under the hood finds that the RBA’s nervousness about housing related inflation was on the money. New dwelling inflation increased, as did rents. More broadly, sticky ‘services’ inflation quickened, in some part due to rents but this was also a function of the elevated level of activity across the economy, especially labour intensive sectors (chart 2). Unit labour costs are still growing briskly. When combined with Australia’s poor productivity domestic/services inflation may remain sticky for a while yet, at a time ‘goods’ prices have also begun to perk up again (chart 3).

The inflation pulse in Australia remains firm, and from our perspective this should see the RBA hold steady at its 4 November and 9 December meetings. The jobs data released on 12 November and GDP out on 3 December are the major Australian data releases ahead of the December meeting. We think they would have to be quite weak to put a RBA rate cut back in play this year given the inflation story.

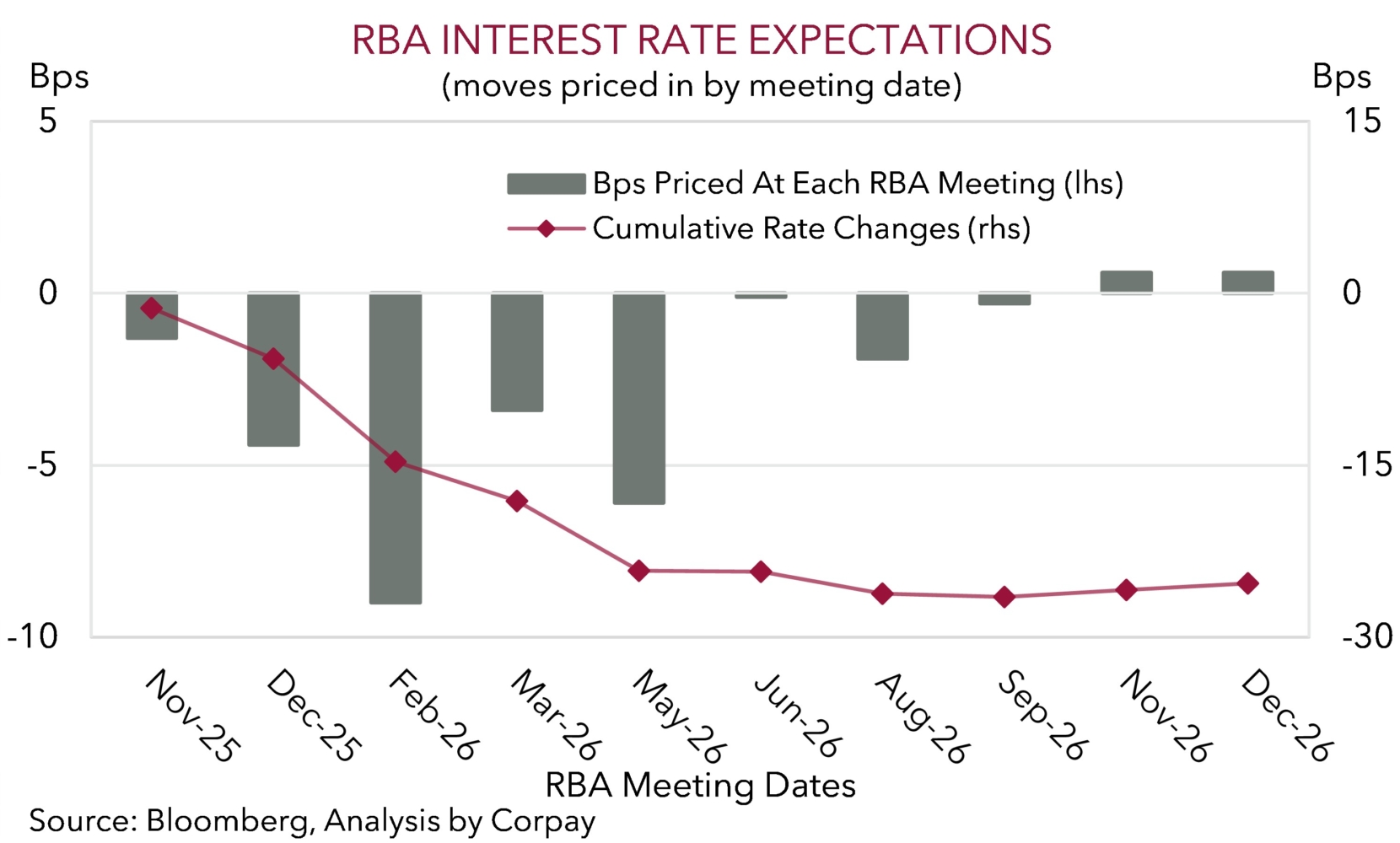

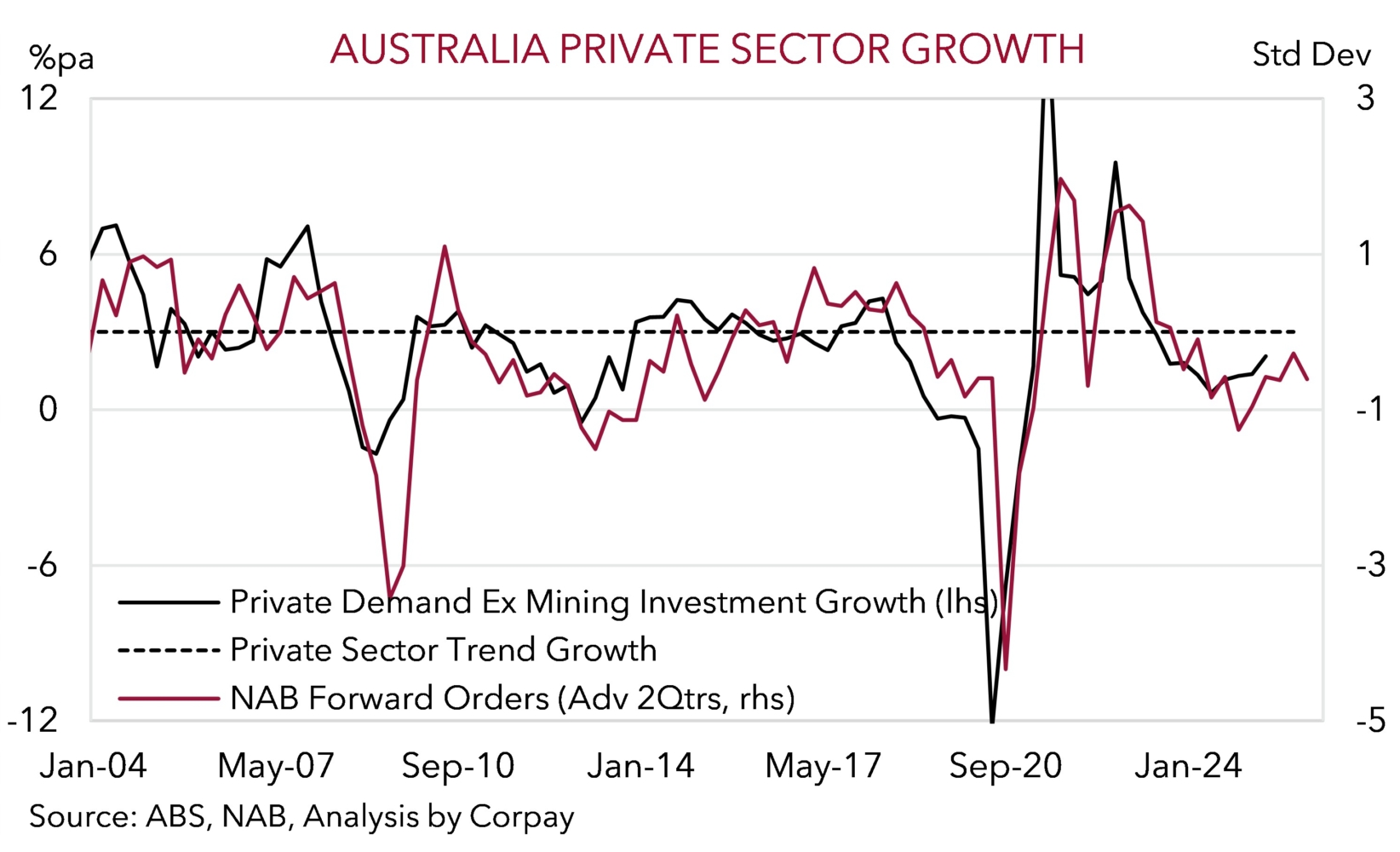

From our perspective, various signals suggest Australian inflation may struggle to settle near the middle of the RBA’s 2-3% target band, the medium-term aim of policymakers. This in turn points to the RBA holding interest rates in slightly “restrictive” territory for even longer to achieve the desired outcome. More clarity on the inflation picture won’t be known until the next quarterly release which is due in late-January. By this time, based on forward looking indicators, we think momentum in the economy could be improving, while the employment situation (which is itself a lagging indicator of the activity trends) might also have bounced back (chart 4). The RBA will outwardly continue to take things “meeting by meeting” however as outlined previously we feel that without a sustained upturn in unemployment there is a good chance the RBA doesn’t cut interest rates again this cycle. This is something markets are slowly shifting towards with a full 25bp rate reduction now only factored in by May 2026 (chart 5).

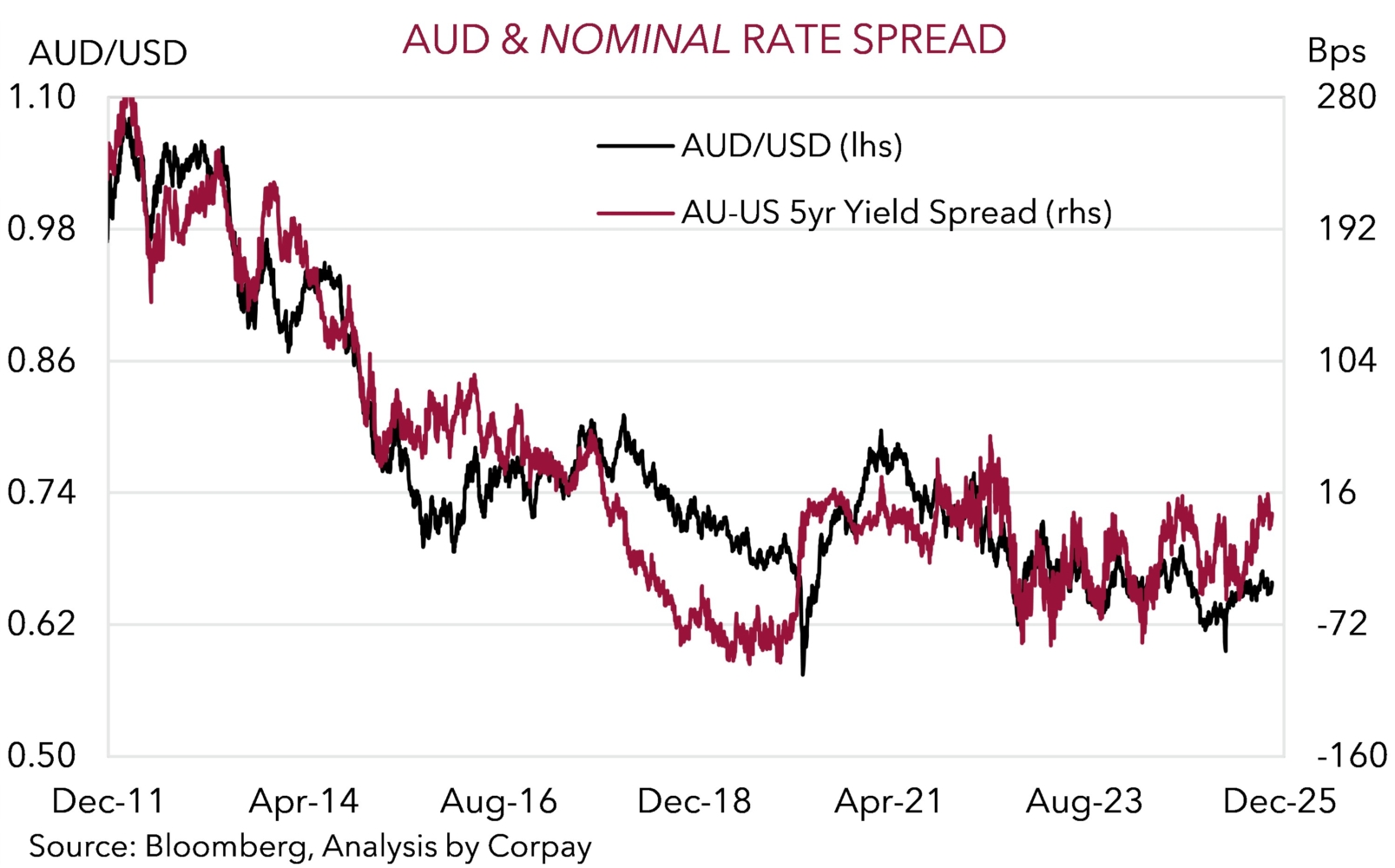

Markets seldom move in straight lines, and more bouts of headline/data driven AUD volatility should be anticipated over the period ahead with the US Fed meeting (Thurs 5am AEDT) the next major focal point. But on balance, as per our long-held view, we continue to forecast the AUD grinding higher into year-end (i.e. towards ~$0.67-0.68) on the back of improvement in US/China trade relations, diverging policy trends between an on hold RBA and interest rate cutting US Fed, more favourable yield spreads, upbeat risk sentiment, and firmer growth in China as its stimulus push gains traction (chart 6).