• Positive tone. Soft US producer prices reinforced Fed easing expectations. Equities rose & yields dipped. AUD touched highest point since November.

• Fed pricing. US CPI due tonight. May generate some vol. But outlook for a steady stream of US rate cuts should remain. This is a USD headwind.

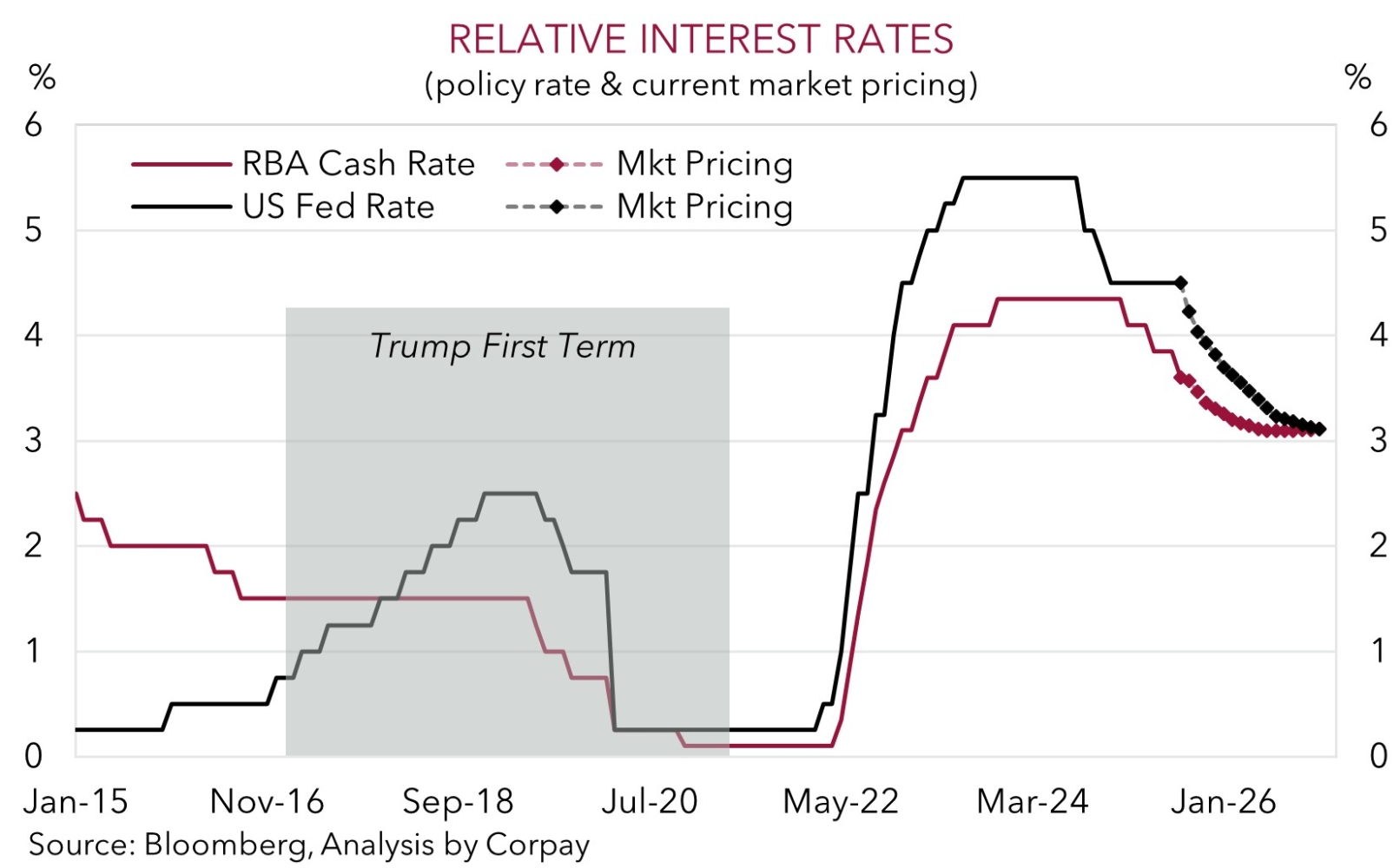

• Policy convergence. Further RBA easing anticipated. But more aggressive steps by US Fed could see rates switch in favour of RBA in late-2026.

Global Trends

A generally positive session in markets overnight with weaker than predicted US producer prices setting the tone. Equities rose with the S&P500 (+0.3%) touching another record, while reinforced US Fed easing bets saw bond yields slip back a little with long end rates like the 10yr leading the way. In FX, the USD index consolidated with EUR (now ~$1.17) and USD/JPY (now ~147.40) treading water. Cyclical currencies such as the NZD and AUD strengthened. The AUD was a relative outperforming with AUD/USD (now ~$0.6614) hitting its highest point since last November.

In terms of the data, total US producer prices unexpectedly declined by 0.1% in August due to soft prices for food and energy and a decline in ‘trade services’. Under the hood there are ongoing signs of a pass-through from tariffs in some areas, but the bigger story this month was the compression of trade margins as firms try to absorb higher costs in an effort to maintain volumes/market share in a more sluggish economic environment. Leading indicators continue to point to a pick up in producer prices over coming months. The extent to which that happens will depend on how much is passed along by firms.

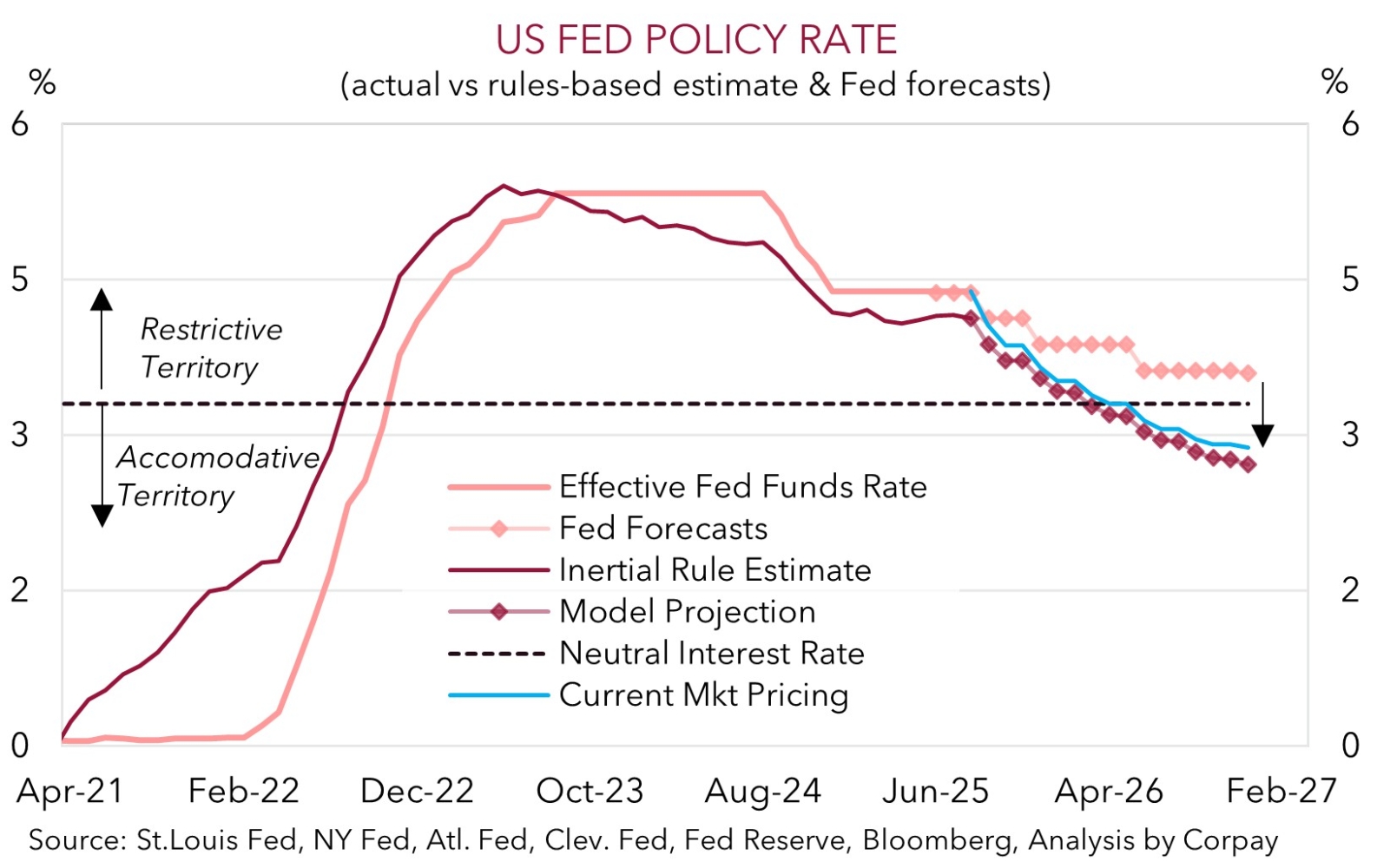

On the back of the muted inflationary pulse, and recent negative revisions to the US jobs market, traders are pricing in a stream of rate cuts by the US Fed. A move next week is more than fully baked in with markets toying with the idea the US Fed plays ‘catch up’ and delivers a larger 50bp cut. By the end of 2026 markets are assuming the US Fed pushes through close to ~145bps worth of rate reductions. We think this medium-term path looks fair, and that the US Fed is falling behind the curve when comparing its previous forecasts and our replication of its ‘policy-rule’ models (see chart below).

Tonight, the ECB looks set to keep interest rates steady (10:15pm AEST) with focus on how high the hurdle is for any further action down the track. In the US, consumer price inflation will be in the spotlight (10:30pm AEST). A mix of firmer ‘services’ prices and tariff impacts on ‘goods’ could keep US inflation somewhat sticky. Based on current aggressive near-term US Fed easing expectations an uptick in US CPI might generate a bit of a repricing which in turn may give the USD a little short-term support, in our view. That said, we believe these types of moves should be limited. The outlook for slower US growth and downshift in US interest rates is expected to exert more downward pressure on the USD over coming months, in our opinion.

Trans-Tasman Zone

The upbeat tone in markets, dip in bond yields, and sluggish USD performance on the back of softer than anticipated US producer prices has helped the NZD and AUD strengthen (see above). The AUD (now ~$0.6614) has been trending higher over the past few weeks and it touched its highest level since early November overnight. The NZD (now ~$0.5941) is north of its 50-day moving average, a technical indicator it hasn’t been above since late-July. The backdrop also saw the AUD outperform on the cross-rates with gains of ~0.4-0.6% recorded against the EUR, JPY, GBP, CAD, and CNH over the past 24hrs. AUD/NZD (now ~1.1132) is approaching the top of the range it has occupied since February, while AUD/CNH (now ~4.7084) is near the upper end of its multi-month range.

As mentioned above, tonight the market focus will be on the ECB decision (10:15pm AEST) and US CPI (10:30pm AEST). The ECB is expected to keep interest rates on hold, while leading indicators point to a modest uptick in US inflation. If realised, we think this might see markets pare back their aggressive near-term US Fed easing bets which in turn may generate a little renewed support for the USD (and take a bit of heat out of the AUD).

That said, we don’t think rebounds in the USD/pull-backs in the AUD should be overly large. Over the medium term (i.e. next ~3-12 months) we believe the AUD can continue to grind higher. In our opinion the AUD can be underpinned by a combination of a weaker USD as US Fed rate cuts re-start, signs of improvement in China’s economy as its stimulus push helps counteract tariff headwinds across its export sector, stronger momentum in Australia’s economy, and/or ongoing cautious approach from the RBA. Indeed, based on market pricing (which assumes some more easing by the RBA over the next year) the RBA cash rate is projected to end up slightly above the US Fed equivalent in late-2026 because of more aggressive Fed actions. This is something that hasn’t happened since 2017. Back then AUD/USD was tracking, on average, a few cents higher than where it now is.