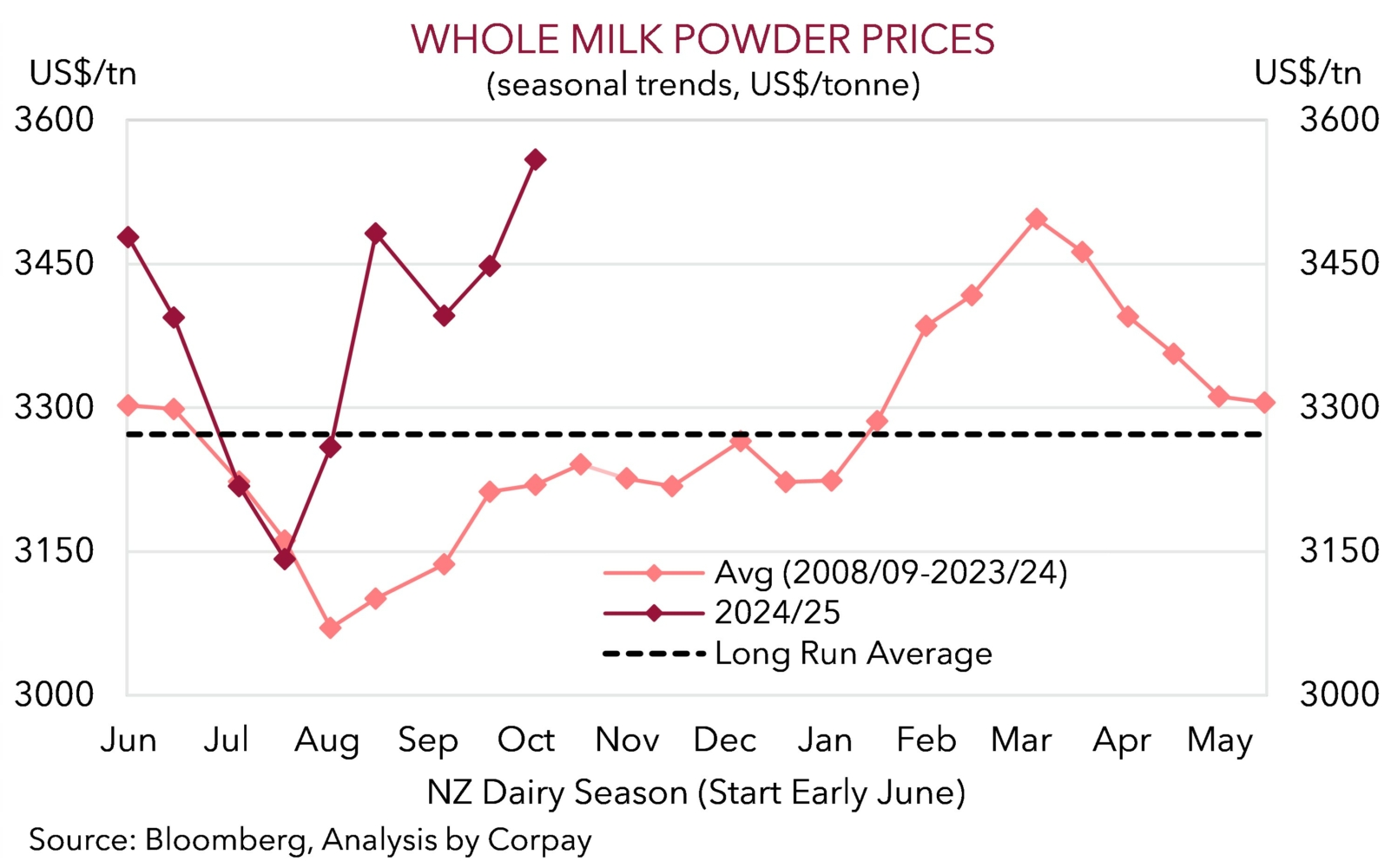

The NZD’s revival against the AUD, which washed through from end-July to mid-September on the back of stronger dairy prices (NZ’s major export) at the start of the new season and concerns about China’s property sector, looks to have run its course (chart 1). Fundamentals are swinging back in favour of the AUD, and in line with our long-held view, we think these underlying trends could persist over the medium-term.

Externally, policymakers in China have been stepping up to the plate recently to bolster ‘animal spirits’ across spending and investment and boost growth. Various monetary and housing support measures have been unveiled in China over the past few weeks, and expectations more will follow have ramped up after the Politburo’s quarterly meeting of economic affairs stressed “forceful” rate cuts are in the pipeline, there is a need to “maintain necessary fiscal expenditure”, and that greater efforts to stop the declines in housing and promote a recovery are likely.

The shift in stance won’t solve all of China’s structural issues, such as poor demographics and high debt, but it should mitigate the downside macro risks that were unnerving investors. The sharp adjustment higher in China’s equity market and base metal prices, especially iron ore (Australia’s major export), illustrates the more positive outlook that is being factored in. From our perspective, given Australia’s stronger direct trade and economic linkages, this should be more of a medium-term tailwind for the AUD than the NZD. ~3/4’s of Australia’s merchandise exports are sent to Asia, while only ~52% of NZ’s are (this share is ~63% if exports to Australia are also included).

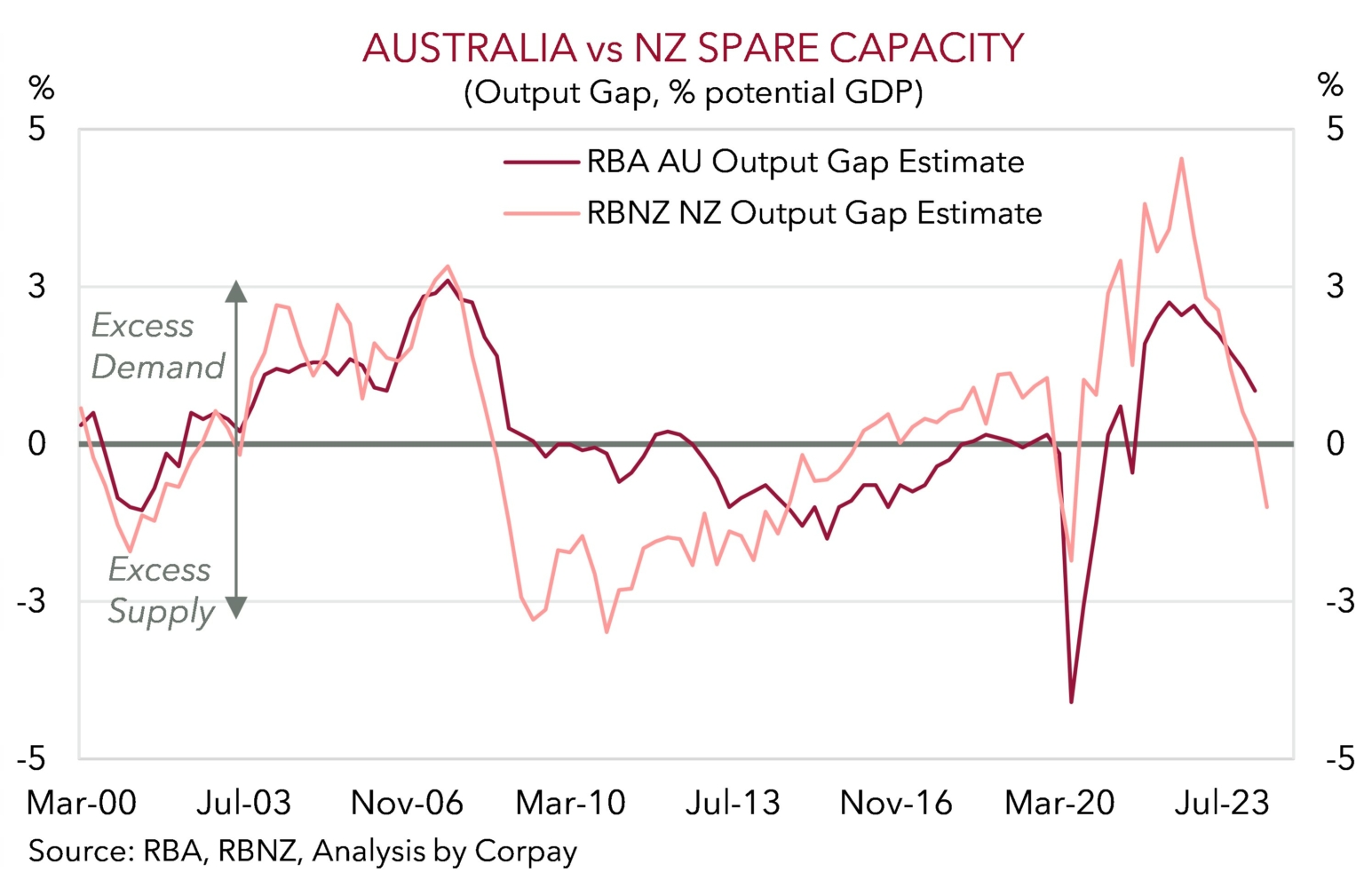

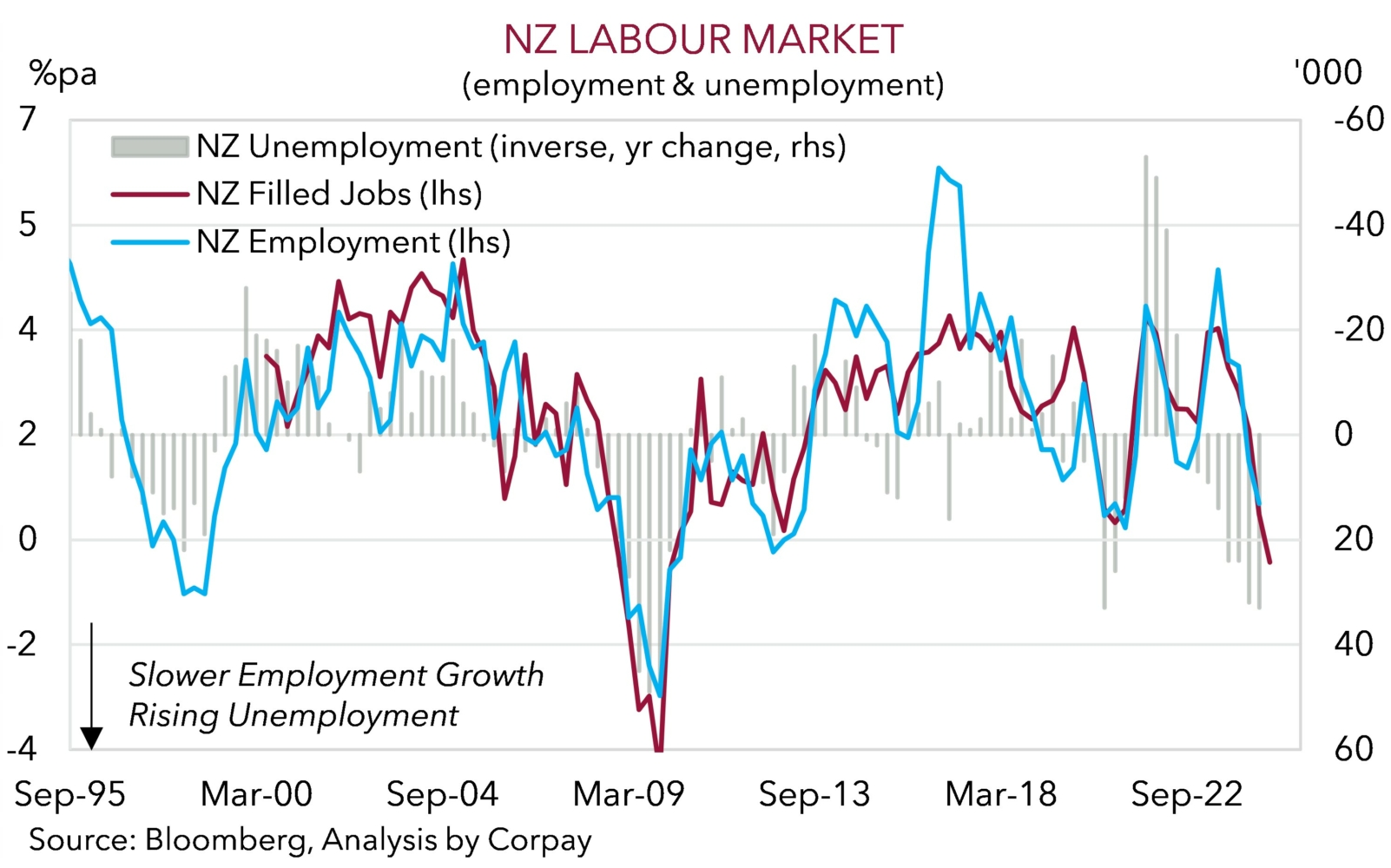

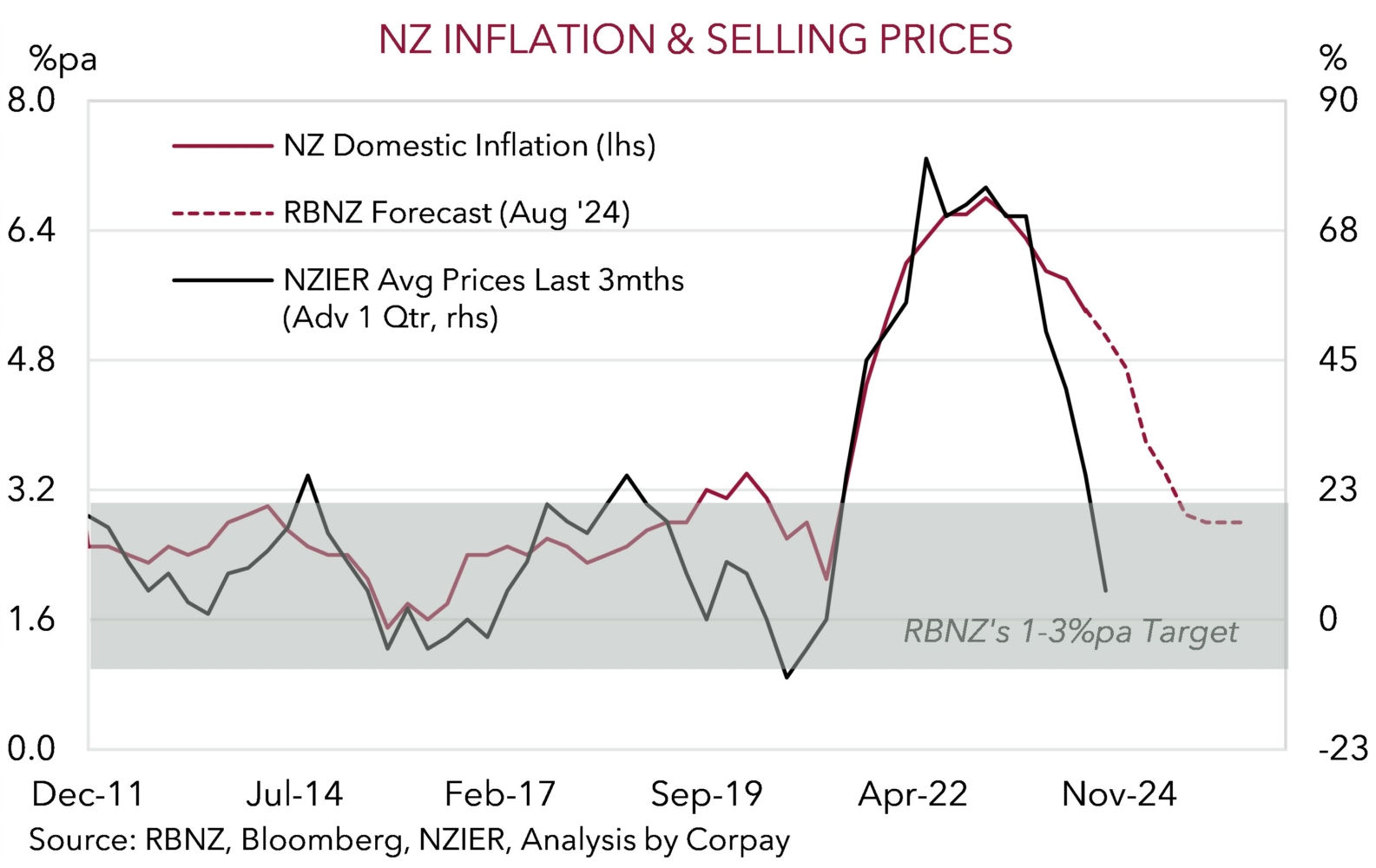

Domestic fundamentals are also moving in support of more upside in AUD/NZD (downside in NZD/AUD), in our opinion. The harsher economic climate in NZ we have been lasering in on continues to unfold. The RBNZ’s still very ‘restrictive’ monetary settings are working their way through the NZ economy a little too well. NZ’s economy has now effectively been in recession for ~2-years, with GDP per capita contracting by a sizeable 4.6% since Q3 2022. The move to a ‘negative output gap’ (i.e. the economy is operating below its potential) contrasts to Australia (chart 2) largely due to the RBNZ’s more aggressive moves during its policy tightening cycle. The RBNZ official cash rate peaked at ~5.5% compared to 4.35% in Australia. This is also now clearly manifesting in the NZ labour market and inflation. Timelier measures of employment indicate job losses are mounting (chart 3). The labour market is a lagging economic indicator, so more pain and higher unemployment looks to already be in train. The ‘excess slack’ and weaker demand environment is also spilling over into inflation with the latest NZIER quarterly business survey showing price pressures have tumbled. This is opening the door to inflation hitting the RBNZ’s target sooner than it was envisaging only a couple of months ago (chart 4).

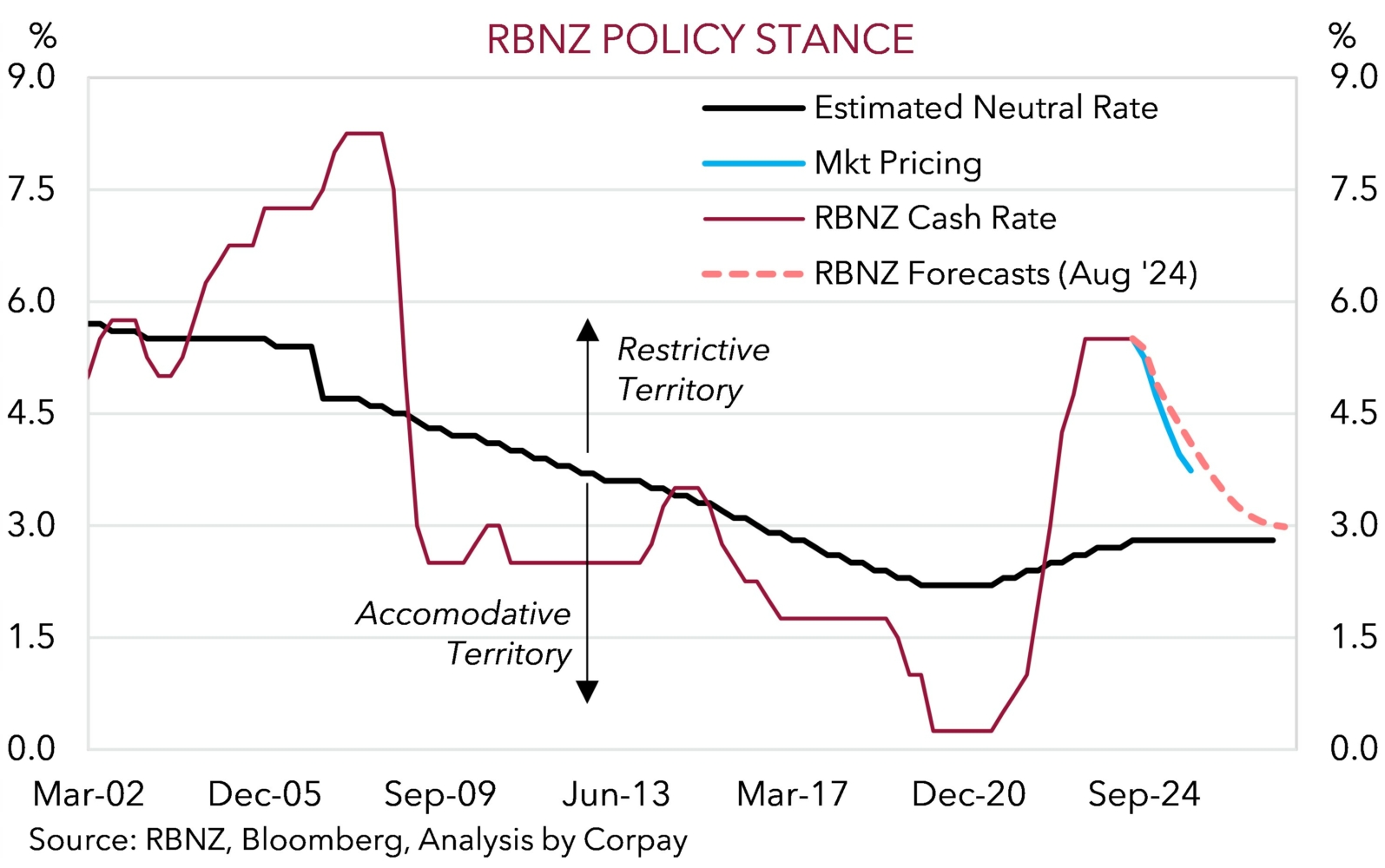

In our mind, this means the RBNZ will have to get interest rates down towards ‘neutral’ or slightly into ‘accommodative’ territory more quickly than it had been anticipating (chart 5). Importantly, during its COVID-era easing cycle and subsequent inflation driven tightening phase the RBNZ operating under a ‘least regrets framework’. This meant that it was willing to over-deliver in terms of stimulus and rate hikes to best ensure its inflation and employment mandates would be met. From our perspective, maintaining this approach under NZ’s current economic conditions, and based on the time gap between when policy is changed and its impacts are fully felt, suggests outsized 50bp rate cuts by the RBNZ over its next few meetings to lower interest rates to a more appropriate level are more likely than not. The RBNZ next meets on 9 October with its 27 November meeting its last for 2024 before it meets again on 19 February 2025. This policy outlook is in stark contrast to our thinking for the RBA where we continue to believe that the flowing fiscal/income support, resilient labour market, sticky domestic inflation, and lower interest rate starting point means the start of a gradual and limited easing cycle is a story for H1 2025.

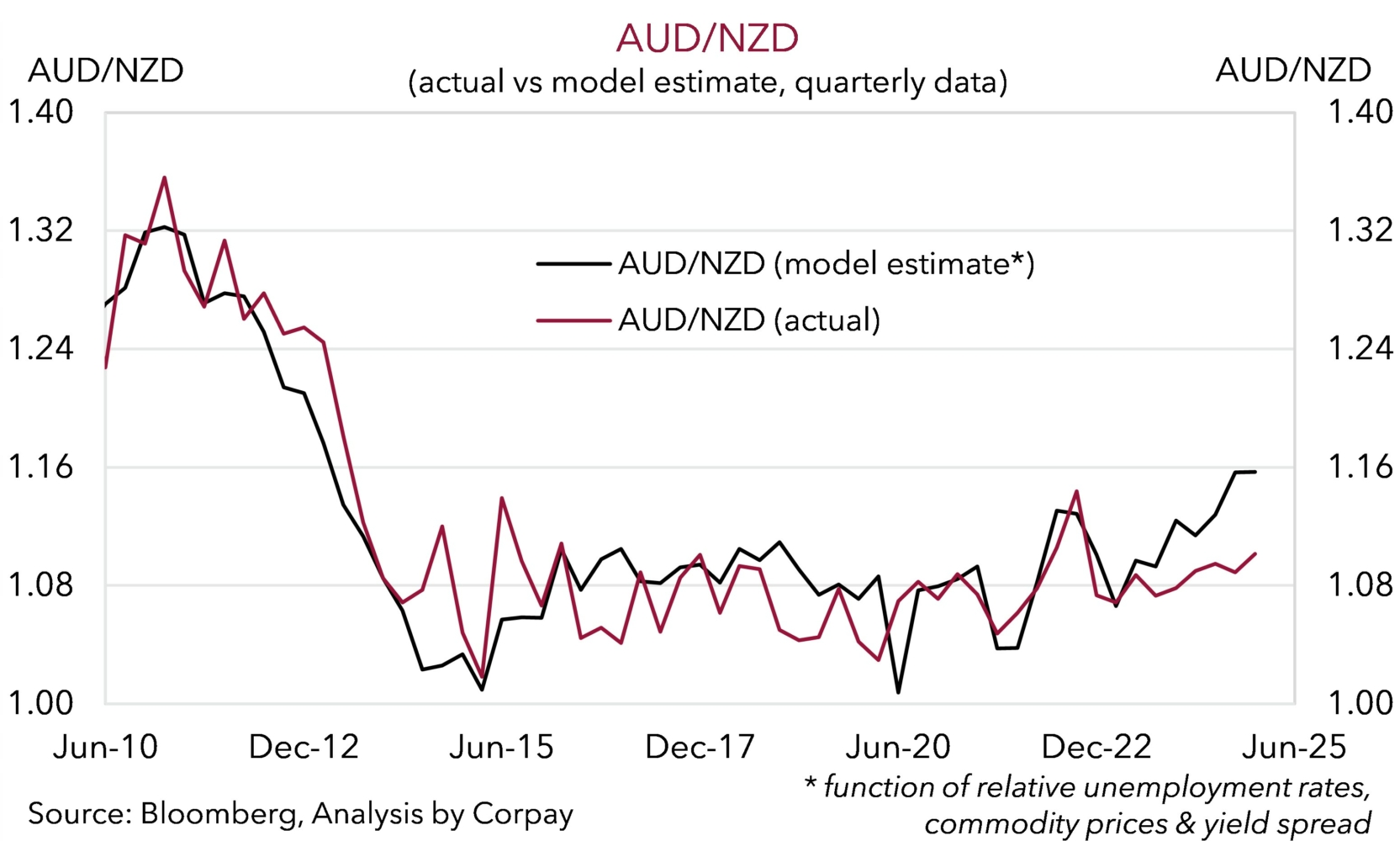

The contrasting fortunes between Australia and NZ, and diverging RBA and RBNZ policy impulses with interest rates looking set to step down quite quickly in the latter, points to a further reversal higher in AUD/NZD (move down in NZD/AUD) over the next few quarters. As shown, our models are indicating AUD/NZD is currently too low (NZD/AUD is too high) based on its broader suite of drivers (chart 6). We are projecting AUD/NZD to edge up towards ~1.15 by Q1 2025 (NZD/AUD down towards ~0.87).