• Peacemaker. De-escalation of Israel/Iran conflict boosted sentiment. Equities rose, oil declined. This dragged down the USD. AUD & NZD higher.

• Fed comments. Fed Chair Powell also spoke. Noted there is no rush to act, but kept door open to more policy easing if inflation remains contained.

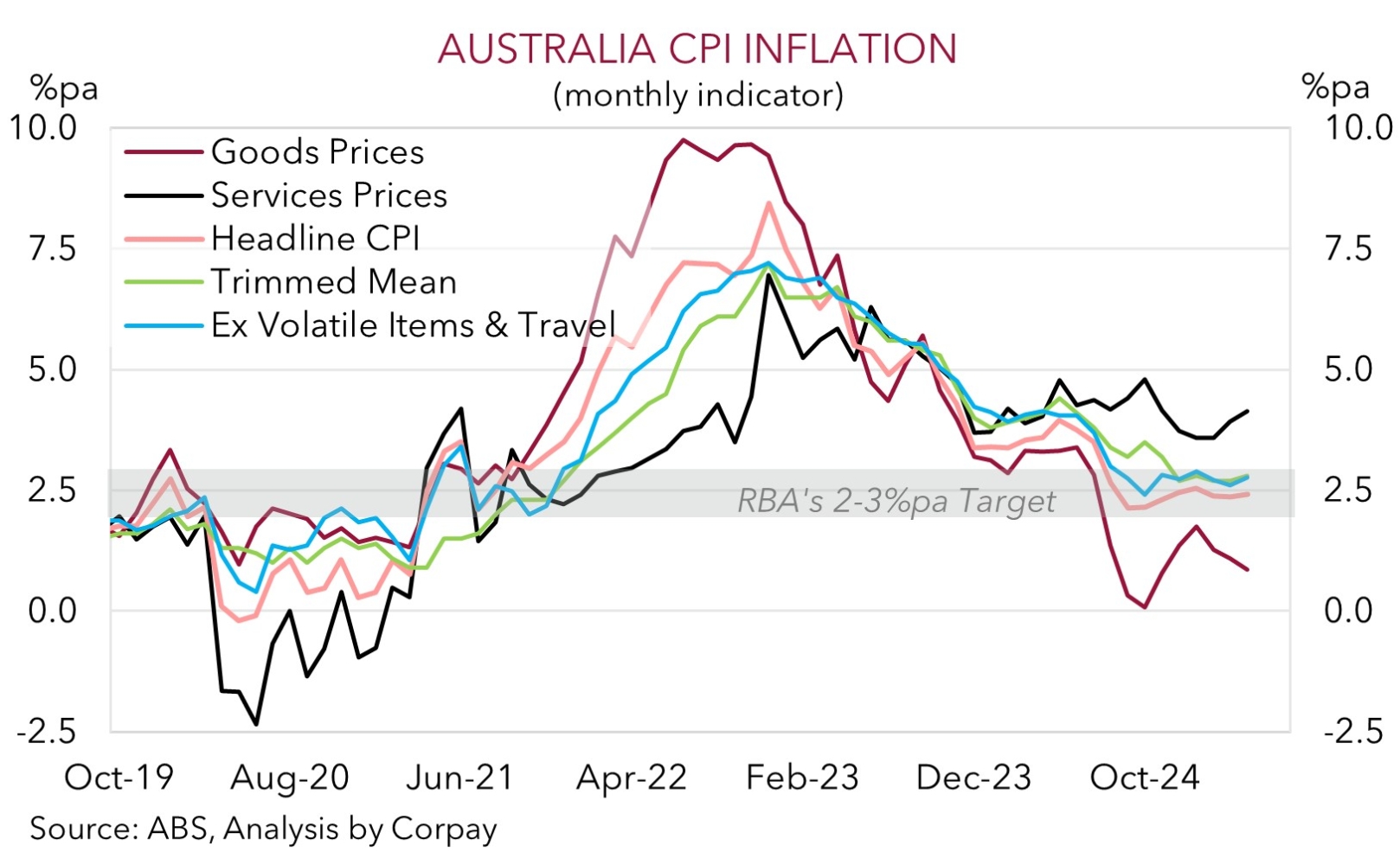

• AU CPI. CPI indicator due today. More info on services prices this month. Will the CPI show sticky core inflation? RBA next meets on 8 July.

Global Trends

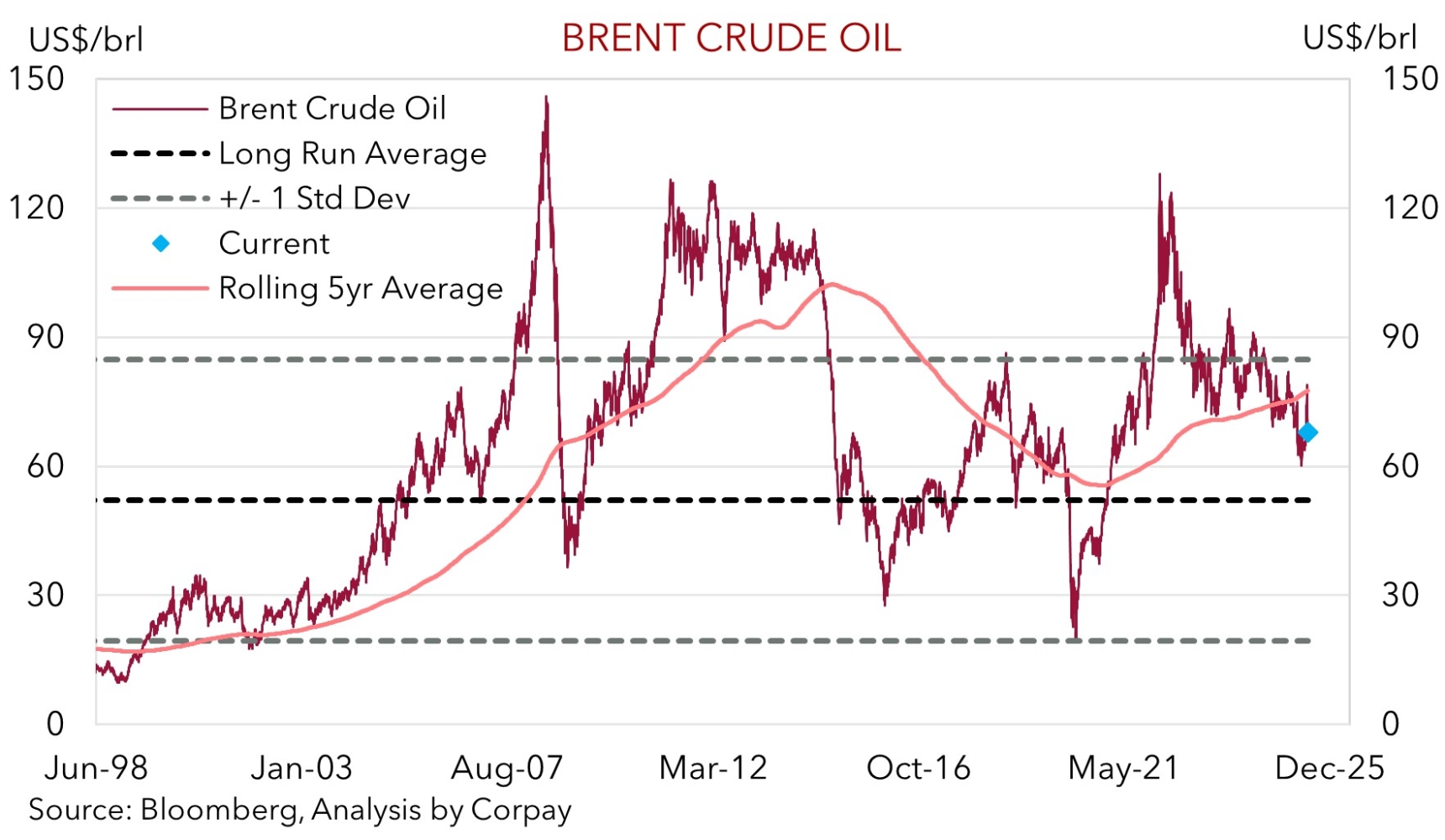

Yesterday’s Israel/Iran ceasefire announcement improved the market mood with risk sentiment quite positive over the past 24hrs. After US President Trump criticized both sides for early breaches the fragile truce seems to be holding, at least for now. The de-escalation, particularly after the weekend worries following the US’ attacks, has seen oil prices (a barometer of underlying risks) tumble. Brent crude oil is ~12% below where it closed last week and at ~US$67.80/brl is a little under the levels it was trading before the Israel/Iran conflict kicked off nearly two weeks ago. Elsewhere, equity markets rose with the S&P500 (+1.1%) within striking distance of its February record highs with the index ~26% above its early-April ‘Liberation Day’ panic low point.

In FX, the USD lost ground. Reduced safe-haven demand was compounded by the drop in oil prices. As discussed before, increased domestic production and the US’ shift to a ‘net energy exporter’ has seen the USD become positively correlated with oil prices. Also exerting some downward pressure on the USD and underpinning risk appetite was the ~4-5bp decline in US bond yields. At ~4.29% the benchmark US 10yr rate is close to its 1-year average. The latest read on US consumer confidence showed sentiment dipped with tariff nervousness keeping households on edge. This and a few select comments by Fed Chair Powell at his semi-annual testimony reinforced views that rate cuts could restart in September. While Chair Powell noted the Fed is in no rush to act given the solid labour market and outlook for inflation to pick up because of tariffs he also outlined that if inflation is contained policymakers may “cut rates sooner rather than later”.

The backdrop of a softer USD flowed through to other currencies. EUR (now ~$1.1610) is close to its cyclical peak, as is GBP (now ~$1.3615), while USD/JPY declined (now ~144.87). USD/SGD is back near its multi-year lows (now ~1.28), NZD (now ~$0.6005) is ~1.2% from its year-to-date highs, and although the AUD drifted back a bit the past few hours it remains (now ~$0.6490) towards the upper-end of its 6-month range ahead of today’s monthly Australian CPI data (11:30am AEST).

US Fed Chair Powell speaks again tonight (12am AEST), but he is unlikely to deviate from the recent script. For markets, a flare-up of tensions in the Middle East is possible and may generate a renewed burst of volatility. That said, barring a complete breakdown of the ceasefire we think the fundamental forces of US growth challenges, expectations of Fed interest rate cuts, and reduced investor demand for US assets are reasserting themselves and this should see the USD weaken over the medium-term.

Trans-Tasman Zone

The Israel/Iran ceasefire driven improvement in investor sentiment, as illustrated by the rise in equity markets and lower oil prices, has weighed on the USD over the past 24hrs and this has boosted the NZD and AUD (see above). At ~$0.6005 the NZD is closing in on its year-to-date highs and while the AUD has eased a little from its overnight peak at ~$0.6490 it is still hovering towards the upper-end of its multi-month range. The AUD has also perked up a bit on some crosses with gains of ~0.2-0.4% recorded against the EUR, CAD, and CNH. That said, it hasn’t been one-way traffic with the AUD softening versus the JPY (-0.4%) and GBP (-0.2%). At ~0.4767 AUD/GBP is near the bottom of its 1-month range.

Today, the Australian monthly CPI indicator for May is released (11:30am AEST). Given it is the mid-quarter month the CPI indicator will have more info on services prices. About 2/3’s of the CPI basket is updated this time around. Headline inflation is predicted to moderate a touch (mkt 2.3%pa), but we think core inflation may continue to linger towards the top of the RBA’s 2-3% target band. While it doesn’t capture the entire CPI basket the monthly indicator is one of the few remaining data releases ahead of the 8 July RBA meeting where markets are factoring in a ~85% chance another interest rate cut is delivered. The market is baking in ~3 rate cuts by December. Based on the ‘dovish’ skew in interest rate pricing we believe there could be an uneven reaction to today’s data with an upside surprise likely to generate a larger positive intra-day reaction in the AUD as RBA expectations are pared back compared to if the CPI came in below consensus forecasts.

However, barring renewed market turbulence we don’t think retracements in the AUD should be overly pronounced. We remain of the view that the various Trump Administration policies should act to constrain US growth and/or dampen investor confidence in holding US financial assets over the medium-term. In time we believe this backdrop could see the USD weaken further, and this can help the AUD push higher over the coming year. Also helpful for the AUD’s longer-term outlook are steps being taken by authorities in China to counter export sector headwinds via boosting domestic activity, particularly commodity intensive infrastructure investment. This is where Australia’s key exports are plugged into.