• Holding firm. US equities ticked up overnight, while bond yields consolidated & USD weakened. AUD rose with AUD also outperforming on the crosses.

• RBA holds. No change by RBA. Comments leant more ‘hawkish’. Sticky inflation & improving growth means another rate cut isn’t guaranteed.

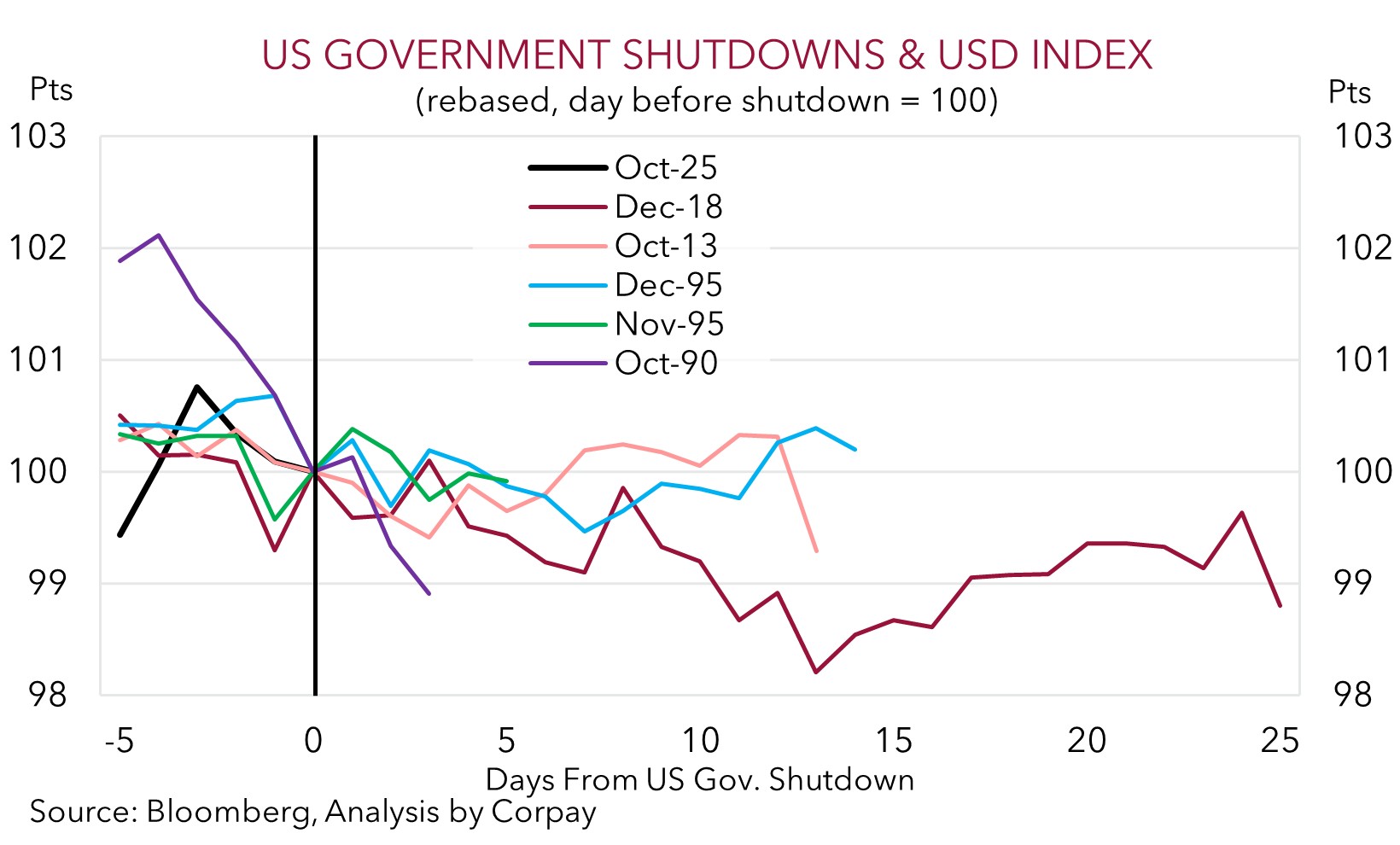

• US shutdown. Without a last minute deal another US government shutdown will kick off today (~2pm AEST). We think this may be a drag on the USD.

Global Trends

Modest moves across markets overnight with another US government shutdown looking likely to kick off today (see below). US and European equities ticked up with the S&P500 (+0.4%) posting its 3rd straight daily rise and recording its 5th consecutive monthly increase. Bond yields consolidated with the US 10yr rate hovering in the bottom half of its 1-year range. In FX, the USD index drifted lower, thanks in large part to the dip in USD/JPY (now ~147.88). EUR (the major USD alternative) tread water (now ~$1.1736), as did GBP (now ~$1.3448). Closer to home NZD ticked a bit higher (now ~$0.5796) and ‘hawkish’ vibes from yesterdays RBA meeting helped the AUD outperform (now ~$0.6613).

Data wise, US JOLTS job openings were close to expectations, however the lower ‘quits rate’ suggests there is less confidence about the labour market with fewer people looking to jump ship to another employer potentially due to reduced job prospects. Elsewhere, US consumer confidence fell to a 5-month low, and inline with the signals from other indicators there was a further deterioration in the net balance of consumers saying jobs are plentiful versus those saying they are hard to get. Outside of the US, German CPI was hotter than anticipated pointing to upside risks to tonight’s Eurozone inflation figures (7pm AEST). In China the business PMIs were mixed with manufacturing improving in September while services lost steam. China’s Golden Week holiday starts today. Markets will be on the lookout for how robust holiday spending is.

As mentioned, another US government shutdown is looming given neither the Republicans nor Democrats are showing signs of budging. Barring a very last minute deal to fund government functions operations will begin to be shutdown from ~2pm AEST. This isn’t one of those instances where the US ‘debt ceiling’ is also involved but there can be economic and market consequences. US federal workers will be furloughed, while President Trump has warned of mass layoffs. This might weigh on US economic activity. On top of that things like official economic statistics, such as this Friday’s US jobs report, could be put on hold. Looking back, there have been 19 US government shutdowns since the late-70s, ranging from 1 to 35 days. The longest occurred in President Trump’s 1st term, and there is a chance this iteration drags out given reduced pressure to strike a deal because there isn’t a risk of a US debt default. In the current environment we think the failure to avoid a government shutdown may further highlight the more challenging backdrop in the US which in turn may exert downward pressure on the USD. As our chart shows, the USD has tended to weaken a little during the past few US shutdowns.

Trans-Tasman Zone

The mix of relatively upbeat risk sentiment (as illustrated by the uptick in US equities) and softer USD have given the NZD and AUD a little boost over the past 24hrs (see above). The AUD (now ~$0.6613) has also been helped along by its outperformance on the major cross-rates post yesterday’s RBA meeting. The AUD has risen by ~0.2-0.6% versus the EUR, GBP, NZD, CAD, and CNH. More specifically AUD/NZD (now ~1.1410) is at levels last traded ~3-years ago with relative economic and interest rate trends still firmly in Australia’s favour. AUD/EUR (now ~0.5636) has ticked back over its 100-day moving average, AUD/CNH (now ~4.7141) is north of its 1-year average, and AUD/JPY (now ~97.79) is at the upper end of its year-to-date range.

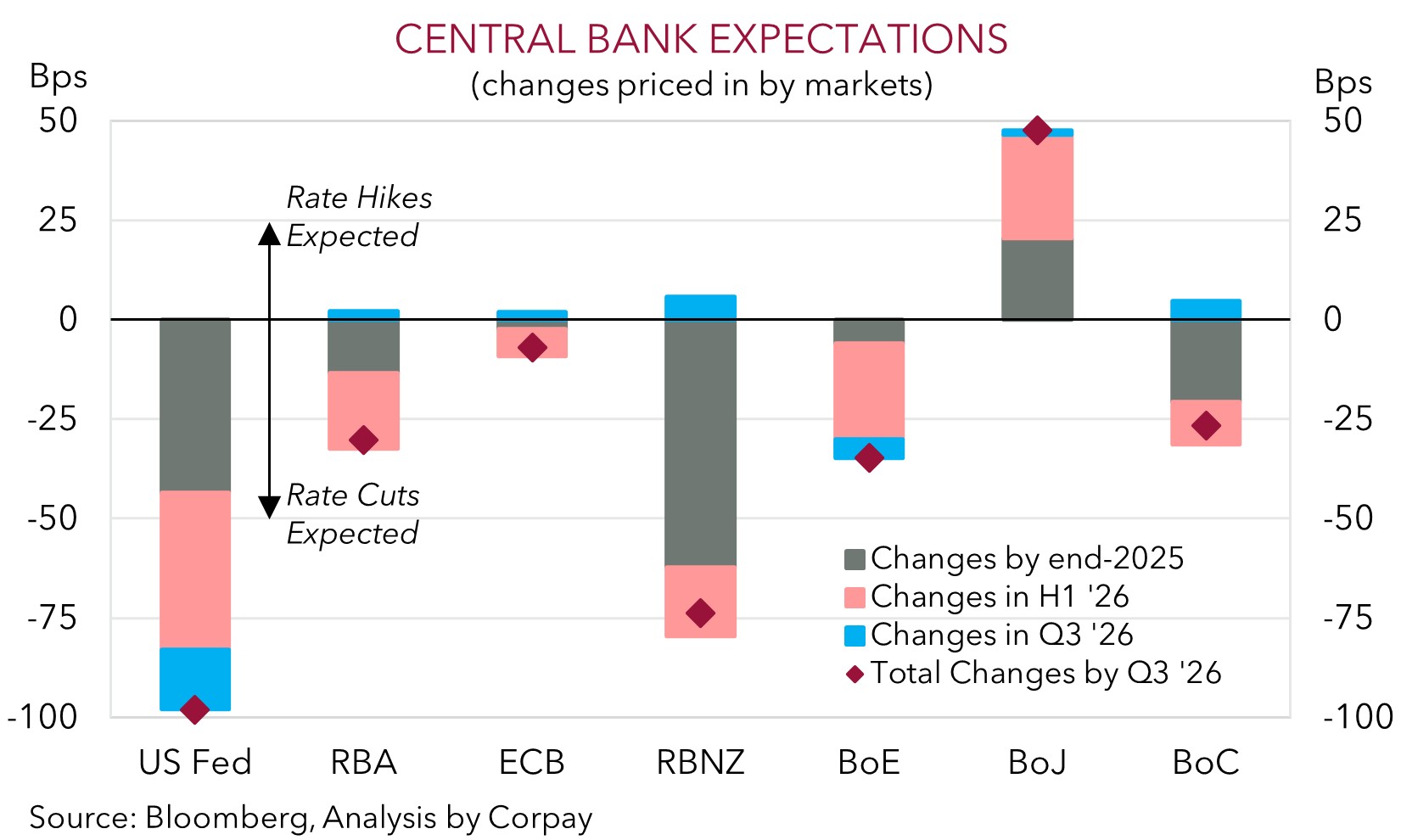

As widely expected, especially after last week’s hotter monthly Australian CPI figures, the RBA kept the cash rate at 3.6%. The Board’s decision was unanimous and there was little firm guidance suggesting any degree of urgency to lower interest rates again in the near-term, in our view. From our perspective key comments leant relatively more “hawkish”. The RBA noted that based on the recent data Q3 inflation might be “higher than expected” and that the decline in core inflation has slowed. Added to that, the June quarter national accounts showed “private demand is recovering a little more rapidly” than predicted, while labour market conditions “remain a little tight”. The RBA Board believe it should “remain cautious” with Governor Bullock noting things will be looked at “meeting by meeting” and that it is “difficult to say” if the RBA still has an easing bias. In our view, given improving momentum across the economy, sticky inflation, and resilient jobs market another interest rate cut by the RBA this year appears unlikely. Markets agree with the next RBA rate cut now not fully priced in until May 2026.

Looking ahead, we continue to forecast a further grind higher by the AUD into year-end and over H1 2026. We think the combination of: (a) a cautious/gradual approach by the RBA; (b) upswing in Australia’s economy; (c) an improvement in China’s growth pulse (as its domestically focused stimulus push aimed at counteracting tariff headwinds gains traction); and (d) a weaker USD as the US Fed steadily lowers interest rates to combat growth challenges and downside labour market risks should be AUD supportive over coming months. For more see Market Musings: RBA – any more easing left?