Foreign exchange markets are looking somewhat rudderless this morning after a technology-led selloff hammered the biggest US stocks yesterday and dampened global risk appetite. The dollar is extending its gains in thin trading, Treasury yields are modestly lower, and equity futures are pointing to another downward lurch at the open. The latest US government shutdown has ended, but key data releases including Friday’s non-farm payrolls report have been delayed, which should limit volatility—provided that White House social media accounts don’t light up once again.

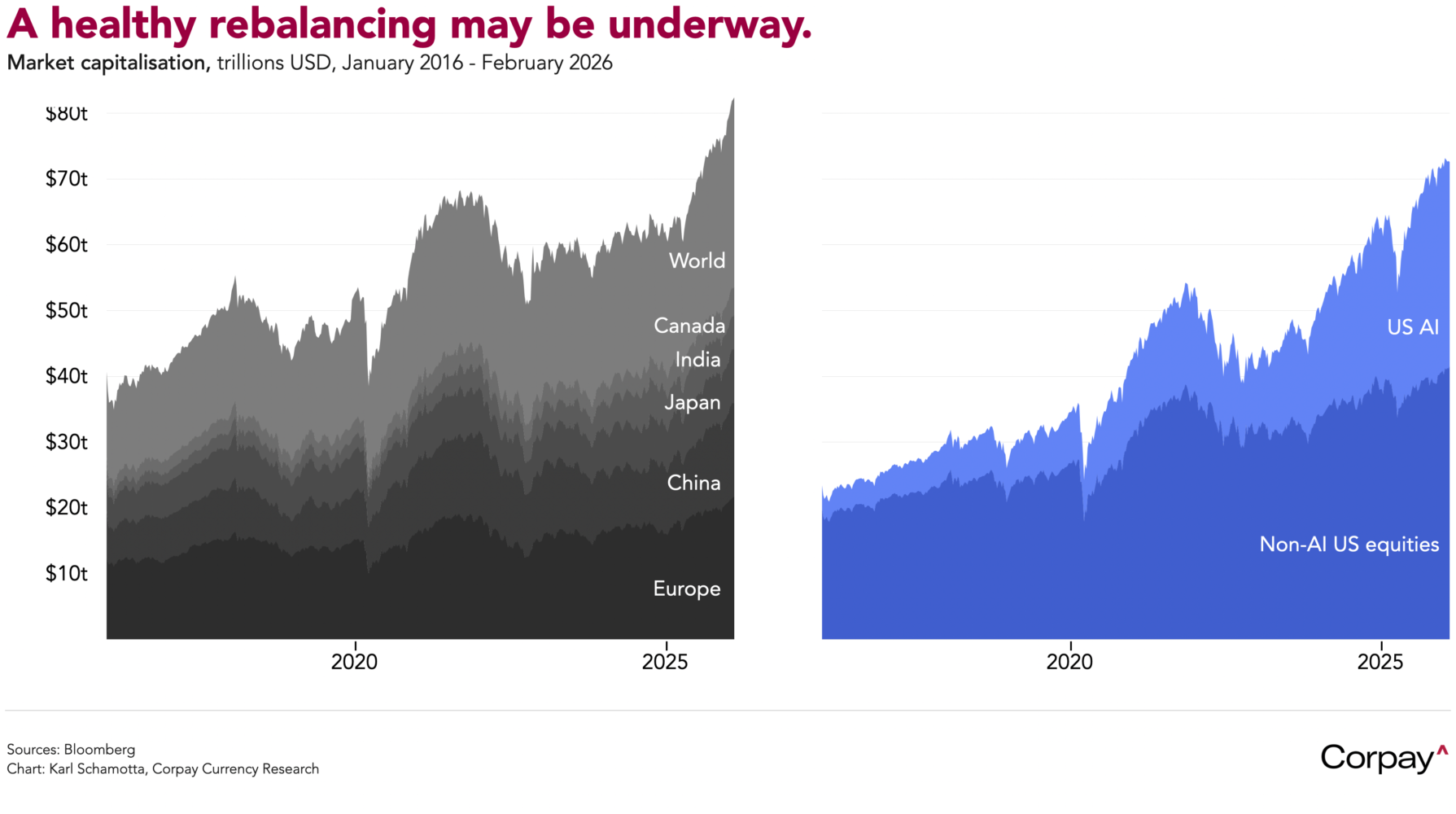

An rollout of productivity tools by Anthropic triggered yesterday’s rout, punishing companies that provide data and analytics to the legal sector, along with other software-as-a-service firms, but the washout fits into a months-long pattern in which artificial intelligence advancements counter-intuitively weaken the technology sector’s dominance over US (and global) equity markets. This carries negative portents for the economy in the near term as disruption grows, but should also lead to faster productivity, and could put markets on a more stable footing in the months ahead . If other industries begin to narrow the performance gap, the risk of an outright collapse in broader markets should decline.

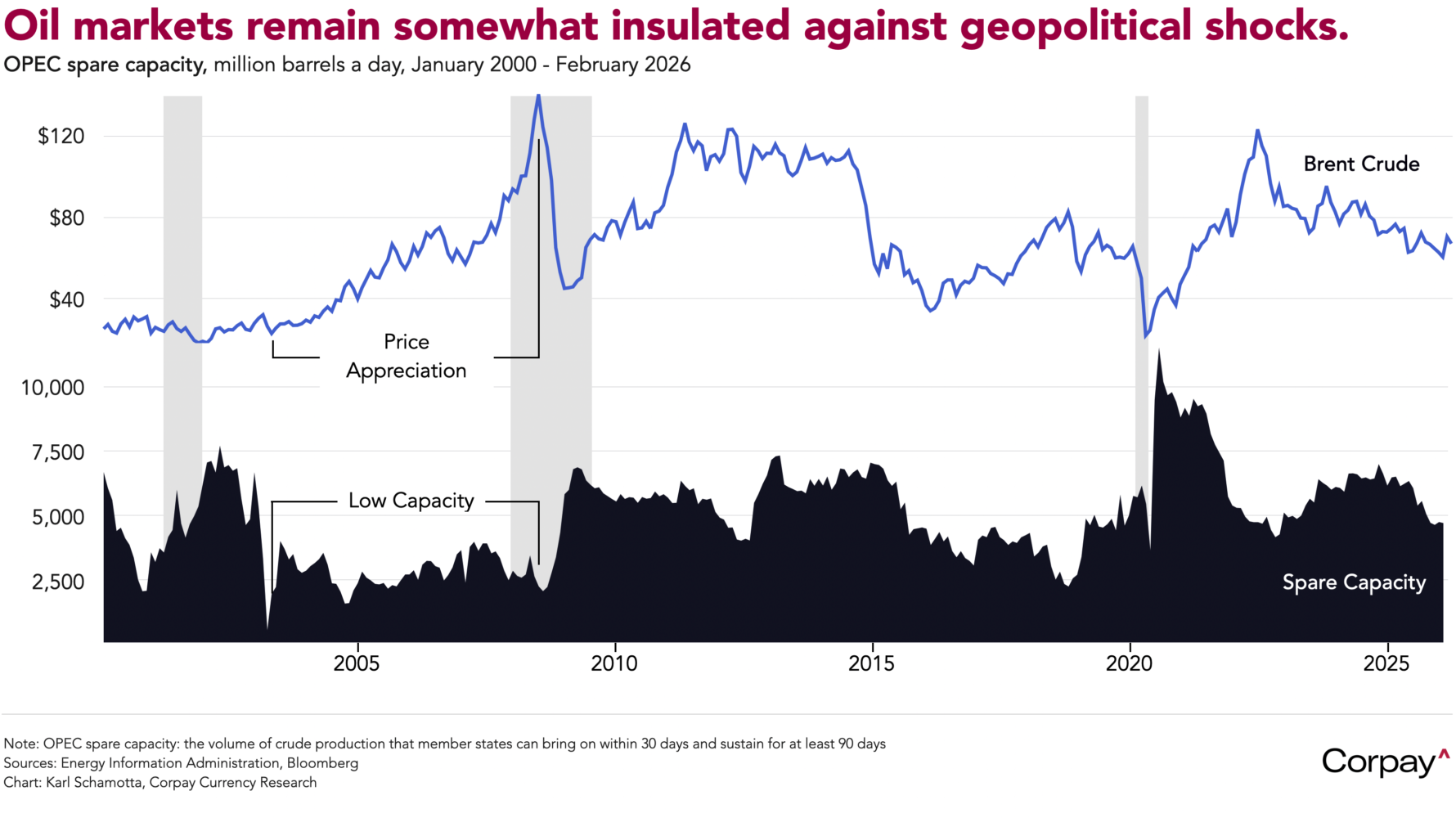

Oil prices are edging higher after tensions between the US and Iran escalated yesterday. American naval forces shot down an Iranian drone in the Arabian Sea, and the Islamic Revolutionary Guard Corps reportedly threatened to seize a US-flagged tanker, heightening concerns over supply and shipping disruptions in the Strait of Hormuz. Stronger than expected demand from China and India has lifted prices over the past month, and traders are pricing in a significant geopolitical risk premium, but gains have been capped by rising global inventories and ample spare capacity among OPEC members. Unfortunately for the Canadian dollar, we don’t see runaway price increases triggering another capex cycle in the energy sector anytime soon.

Inflation fell below the European Central Bank’s target last month, reinforcing expectations for a dovish bias in communications at tomorrow’s meeting. According to Eurostat, the headline all-items consumer price index rose just 1.7 percent in the year to January, undershooting the central bank’s 2 percent target as falling energy prices and a stronger euro helped dampen price appreciation. More significantly, services inflation—viewed as the clearest gauge of domestic price pressures—eased to 3.2 percent from 3.4 percent, a decline that—if sustained—could eventually give policymakers room to cut rates further. Markets expect an extended pause and are pricing in only a 20 percent chance of another reduction this year, though that could shift if Governing Council members emphasise downside risks to the inflation outlook. Against this backdrop, we remain sceptical of calls for another year of significant gains in the euro.

The pound is trading firmly against both the dollar and the euro ahead of tomorrow’s Bank of England meeting. Although the labour market is softening and unemployment climbing, the economy has improved in recent months and inflation has proved sticky, giving policymakers reason to move cautiously. A more hawkish than expected vote split on the Monetary Policy Committee—perhaps 7-2—could widen rate differentials in the pound’s favour, while a more dovish tilt, with four or more members backing another cut, could push it lower.

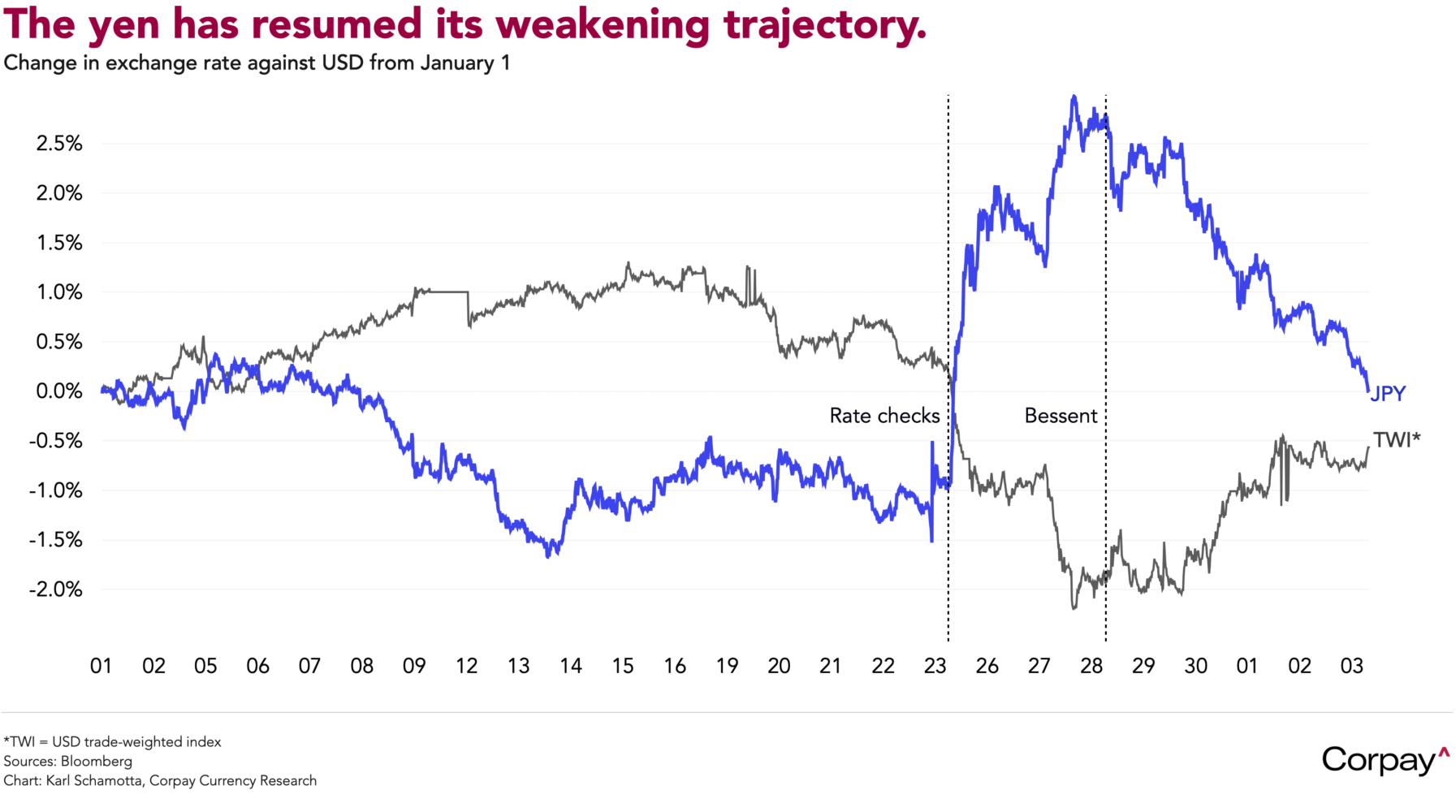

The Japanese yen is rapidly unwinding gains achieved when US authorities performed “rate checks” in late January. With this weekend’s snap election expected to deliver a solid majority for Sanae Takaichi’s Liberal Democratic Party, investors are bracing for a raft of spending measures that would widen the fiscal deficit and push long-term yields higher. We are unconvinced such concerns are warranted—policymakers are wary of reigniting inflation and mindful of the fiscal mishaps that have befallen governments elsewhere. But further sustained declines in the yen could yet prompt intervention, which would almost certainly generate another drop in the dollar.