• Positive tone. Sentiment improved overnight. US equities rebounded. Bond yields rose. Oil fell. AUD ticked up thanks to some relative outperformance.

• Data flow. Limited releases today. Next week things pick up with China GDP (Mon), AU jobs (Thurs), PMIs (Fri), BoJ (Fri), & US PCE (Fri) due.

Global Trends

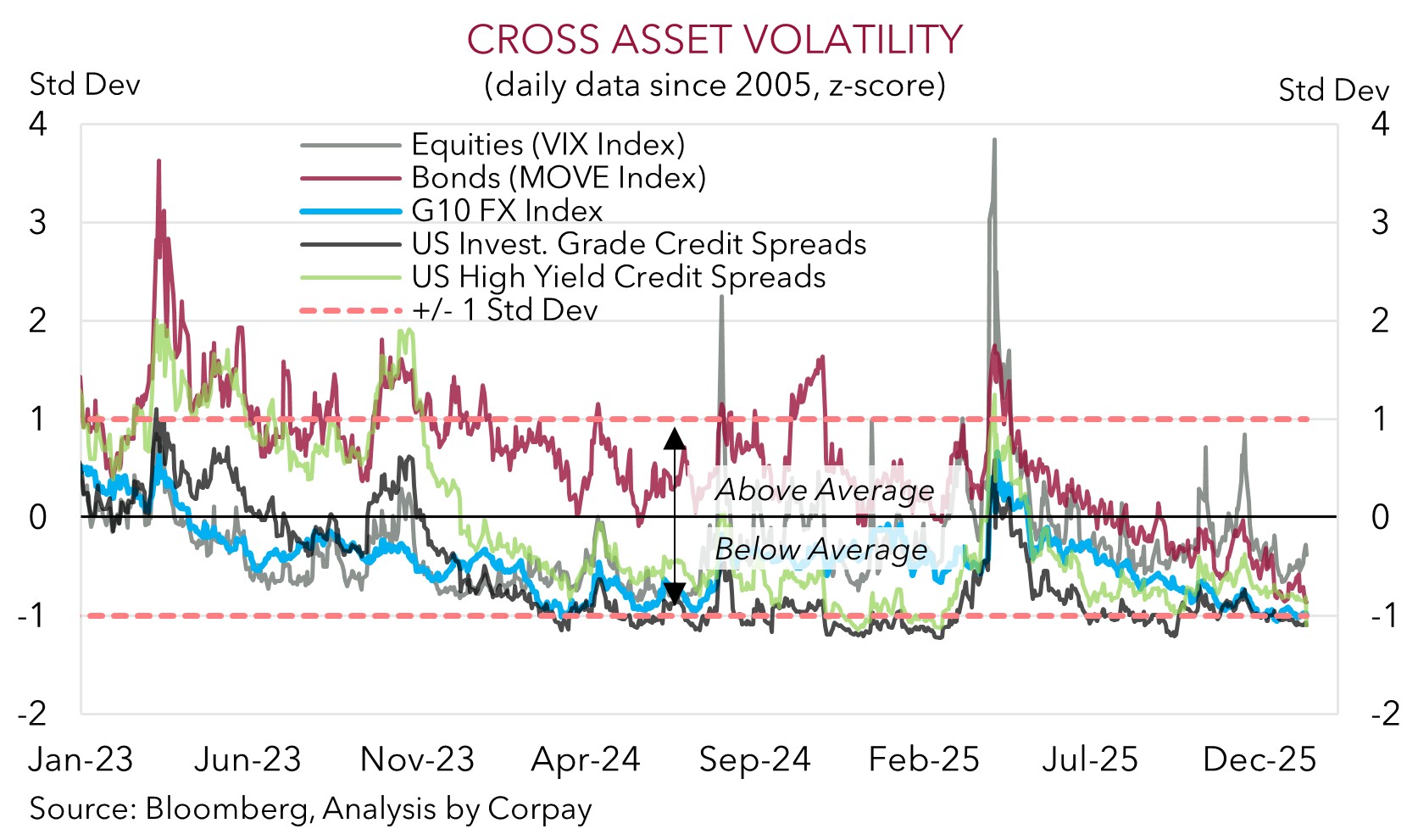

Geopolitical related headlines generated a few minor bursts of volatility across a couple of asset classes the last few days. However, as our chart below shows, cross-asset volatility remains below average with the headline noise not having a lasting impact. Indeed, this was the case once again with the latest Iran-related tensions appearing to ease, helping risk sentiment to improve overnight. US equities rebounded with the S&P500 (+0.3%) ticking higher after back-to-back losses. Similarly, if you take a step back the moves have been modest with the S&P500 still hovering near record highs. Elsewhere, oil prices declined (WTI crude -2% to ~US$58.95/brl) on receding fears of a military response in Iran.

US bond yields ticked higher with the benchmark 10yr rate (+3bps) around the upper end of its recent rather tight range. Data wise, in addition to a recovery in the US empire manufacturing index in January, weekly initial jobless claims (a gauge of the number of people applying for unemployment benefits) dropped with the 4-week average falling to its lowest in ~2-years due to limited post-holiday firing. This suggests the US jobs market may be on firmer footing than feared. Time will tell as various other indicators indicate conditions have deteriorated. In the UK, monthly GDP for November was also stronger than predicted. This saw markets trim Bank of England policy easing expectations a bit.

In FX, the USD is a little firmer against the European currencies with EUR (now ~$1.1604) and GBP (now ~$1.3376) slipping back. USD/JPY tread water (now ~158.64) towards the top end of its 1-year range. And while NZD softened (now ~$0.5737) the AUD nudged up thanks in part to relative outperformance on the cross-rates (now ~$0.6697).

There isn’t a lot on today’s global event calendar. Next week things pick up with China GDP (Mon), the US PCE deflator, Bank of Japan meeting, and global PMIs (all Friday) on the radar. The US Federal Reserve also meets later this month (29 Jan AEDT), though market odds of another rate cut being announced are now at a slim ~5%. In our view, the USD may hold some ground near-term because of geopolitical concerns and the prospect of more headline volatility, however over the medium-term we continue to see the USD weakening as structural and cyclical headwinds such as further US Fed rate cuts fall into place.

Trans-Tasman Zone

The improvement in risk sentiment, as illustrated by the rebound in US/global equities and dip in volatility, has helped AUD edge higher (now ~$0.6697). The AUD has also strengthened against the other major currencies over the past 24hrs with gains of ~0.2-0.6% recorded versus EUR, JPY, GBP, NZD, and CAD. In level terms AUD/EUR (now ~0.5772) it at the top of the range occupied since last May, AUD/GBP (now ~0.5007) is around the upper end of its ~11-month range, AUD/NZD (now ~1.1673) is tracking near multi-year highs, and AUD/JPY (now ~106.24) is close to its ~18-month peak.

As outlined previously, we think the tide is turning in NZ’s economy with cyclical indicators for household spending and housing improving on the back of lower interest rates. This is starting to feed through to the labour market with data released yesterday showing filled jobs rose in November. As momentum improves and broadens out, we believe markets will start to seriously contemplate an (eventual) RBNZ rate hiking cycle. This should be supportive for the NZD over the medium-term, and in turn this points to AUD/NZD easing a bit (down towards ~1.1400-1.1450) over coming months, in our view.

Similarly, we believe there are uneven risks for AUD/JPY up at current levels as it is rarefied air. Since 1995 AUD/JPY has only been above where it now is in ~0.3% of trading days (i.e. 23 out of 8095 days). AUD/JPY is looking stretched and somewhat ‘overvalued’ compared to underlying drivers such as relative interest rate differentials. Over time, we expect the JPY to re-strengthen and for AUD/JPY to moderate to ~101 later this year.

In terms of AUD/USD, as mentioned above, the global data calendar is limited today. Next week the monthly Australian jobs report is due (Thurs), while China GDP is out earlier in the week (Mon). Markets are now factoring in a ~25% chance the RBA delivers a rate hike in early-February. We think this might be on the low side as we deem policy is not where it needs to be to get inflation sustainably back to the mid-point of the RBA’s target. Barring a sustained deterioration in sentiment we don’t see near-term pullbacks in the AUD being overly deep or lasting too long. Over the longer-term, we continue to see the AUD grinding up into the high-$0.60s with more favourable yield spreads between Australia and others such as the US a factor.