• Positive trends. Risk sentiment remained positive on Friday. US & European equities rose, as did cyclical currencies like the NZD & AUD.

• AU/NZ factors. After last week’s AU CPI & signals from the RBNZ, markets are toying with the idea the next move in AU & NZ rates may be up not down.

• Event Radar. Australia Q3 GDP is out (Weds). In the US, focus should be on the ISM indices, ADP employment, & other labour market indicators.

Global Trends

It was a quiet end to last week (and November) with the US Thanksgiving Holiday period depressing trading activity. In a shortened session on Friday the US S&P500 ticked up ~0.5%. This extended the equity market recovery with the S&P500 ending little changed over November after being down almost ~5% for the month about a week ago. Elsewhere, bond yields nudged up with US rates rising ~1-2bps across the curve, and while oil dipped again (WTI crude fell ~1% to ~US$58.48/brl, towards the lower end of its 3-year range) base metal prices rose (copper +2.2%). In FX, the USD index tread water with EUR (now ~$1.1598), GBP (now ~$1.3237), and USD/JPY (now ~156.14) consolidating. By contrast the NZD (now ~$0.5733) and AUD (now ~$0.6546) added to recent gains with thoughts that the RBNZ may have delivered its last rate cut and that the RBA might need to hike again next year to squash inflation underpinning the antipodean currencies.

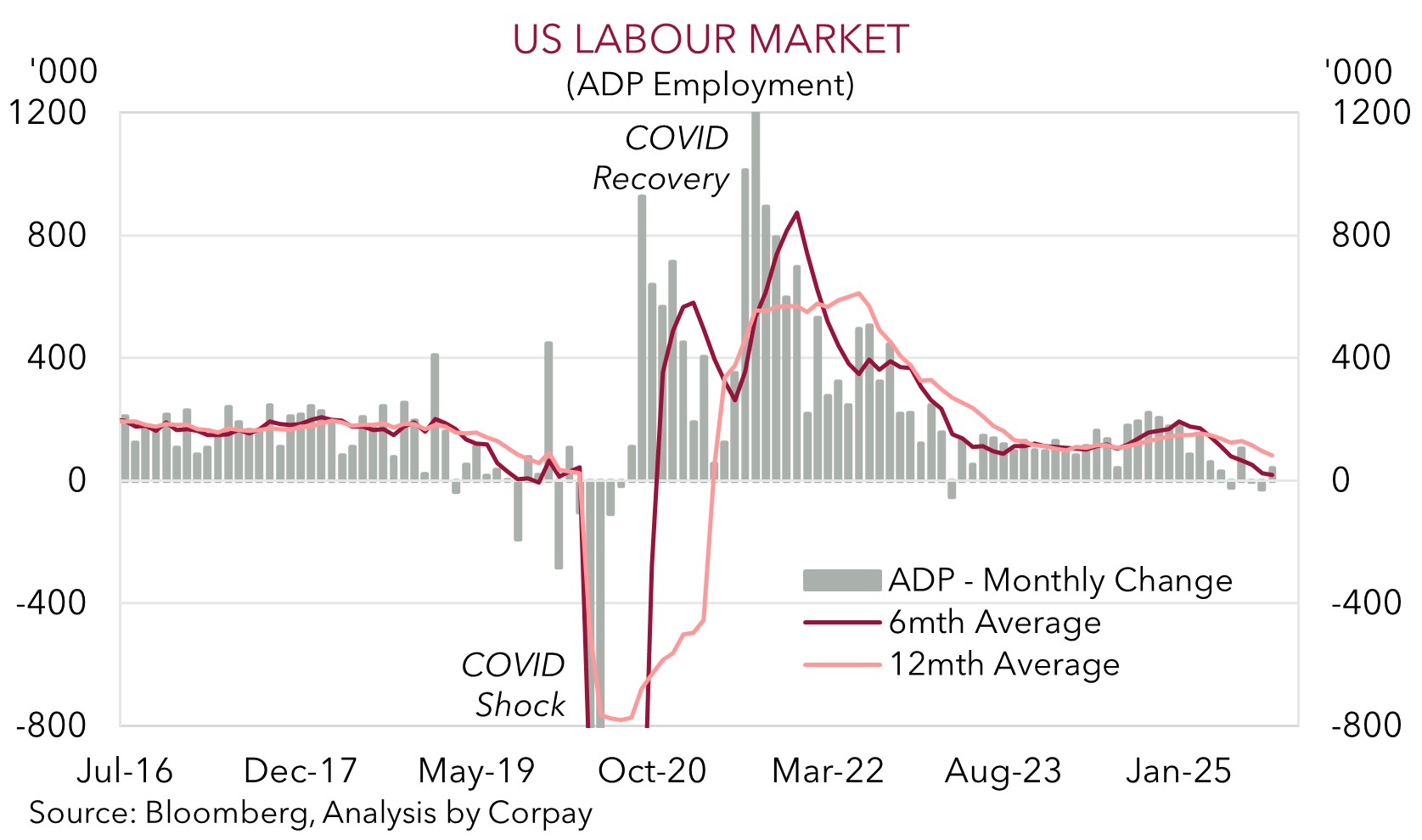

Data wise it is a busier week ahead with more US government shutdown delayed releases on the schedule including September readings of US industrial production (Weds night AEDT) and the PCE deflator (the US Fed’s preferred inflation gauge) (Fri night AEDT). That said, more timely indicators such as the ISM manufacturing (tonight 2am AEDT) and services (Weds night AEDT) indices, ADP employment (Weds night AEDT), and Challenger job cuts (Thurs night AEDT) are likely to garner more attention given the potential impact on US Fed policy expectations. The monthly ADP employment figures will have added significance this month as they look set to be the most up-to-date jobs data US Fed officials will have on hand ahead of their next meeting (11 Dec AEDT).

Markets have adjusted meaningfully recently with odds of a December US Fed rate cut now sitting at ~83% (up from ~28% about a week or so ago). We think the incoming US data could show growth momentum remains sluggish and/or labour market conditions are continuing to soften. If realised, we believe this can keep the USD on the backfoot as markets laser in on the prospect of another US Fed interest rate cut later this month and that a few more might be delivered over the next year.

Trans-Tasman Zone

The more upbeat tone across markets over the past week, coupled with domestic NZ and Australian factors have helped the NZD and AUD perk up (see above). At ~$0.5733 the NZD is back inline with where it started November, ~2.6% above the low touched in the second half of the month. It is a similar story for the AUD (now ~$0.6546) which ended up little changed in November thanks to a rebound over the backend of the month. The AUD also ticked up on most of the major crosses on Friday with gains of ~0.1-0.3% recorded against EUR, JPY, GBP, and CNH. AUD/EUR (now ~0.5645) is approaching its 200-day moving average, AUD/GBP (now ~0.4946) is above its 1-year average, and AUD/JPY (now ~102.22) is at elevated levels. Since 1995 AUD/JPY has only traded above where it is in ~2% of trading days and based on various underlying drivers such as yield differentials we feel it looks quite stretched.

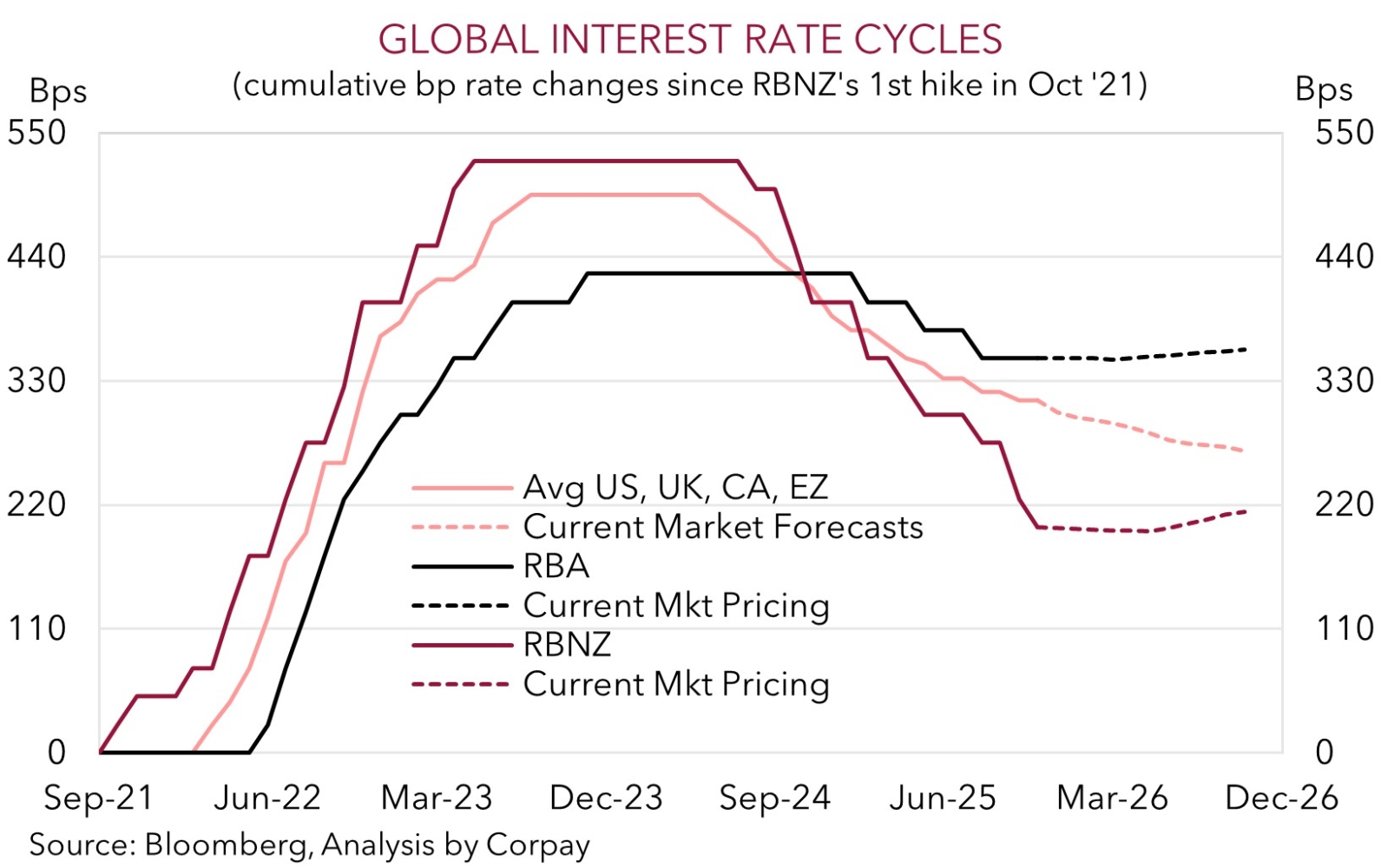

In terms of the AUD, last week’s monthly CPI data, which showed the broad-based inflation pressures evident in Q3 persisted into October, reinforced views the RBA probably won’t cut interest rates again this cycle. Markets and economists are toying with the notion the next move could (eventually) be an interest rate rise. This week Q3 Australian GDP is due (Wednesday). Based on the partial data already released momentum looks to have accelerated in Q3 with growth possibly coming in north of the RBA’s forecasts (mkt 0.7%qoq/2.2%pa). This run-rate is around trend growth, and if realised would mean the economy continues to operate close to capacity. In our opinion, this might bolster the case for the next move in rates being up not down, which in turn may give the AUD more near-term support. As outlined previously, barring a sharp deterioration in risk sentiment we feel the underlying improvement in US/China trade relations, more favourable yield spreads between Australia and other nations, and/or firmer domestic/Asian growth should help the AUD climb gradually higher over coming months.

Across the Tasman, the RBNZ delivered another 25bp rate reduction last week, lowering the OCR to 2.25%. However, it also gave strong signals this could be the end of the easing phase. We believe there is a significant hurdle for further action and as outgoing RBNZ Governor Hawkesby noted you cannot be “forever lowering and keeping the door open” to do more. Much like during the global tightening phase the RBNZ has been one of the most aggressive central banks during the rate cutting cycle. This has weighed on the NZD. But the shift in thinking and prospect that the next move by the RBNZ might now be a rate hike is generating renewed support for the beaten down NZD. There are other things that go into it, like broader risk sentiment, USD trends, and commodity prices, but monetary policy regime shifts do have an impact on the AUD and NZD.