The US dollar, Treasuries, and stock market indices are all trading slightly lower this morning after the Trump administration stepped up its assault on the Federal Reserve, launching a criminal investigation into Chair Jerome Powell’s management of a headquarters renovation project. According to a highly unusual video statement published last night, the Chair said he had received grand jury subpoenas from the Justice Department that threaten a criminal indictment in a case that most market participants see as part of an effort to reduce the Fed’s independence and push monetary policy into more accommodative territory. “This is about whether the Fed will be able to continue to set interest rates based on evidence and economic conditions,” said Powell, “or whether instead monetary policy will be directed by political pressure or intimidation”.

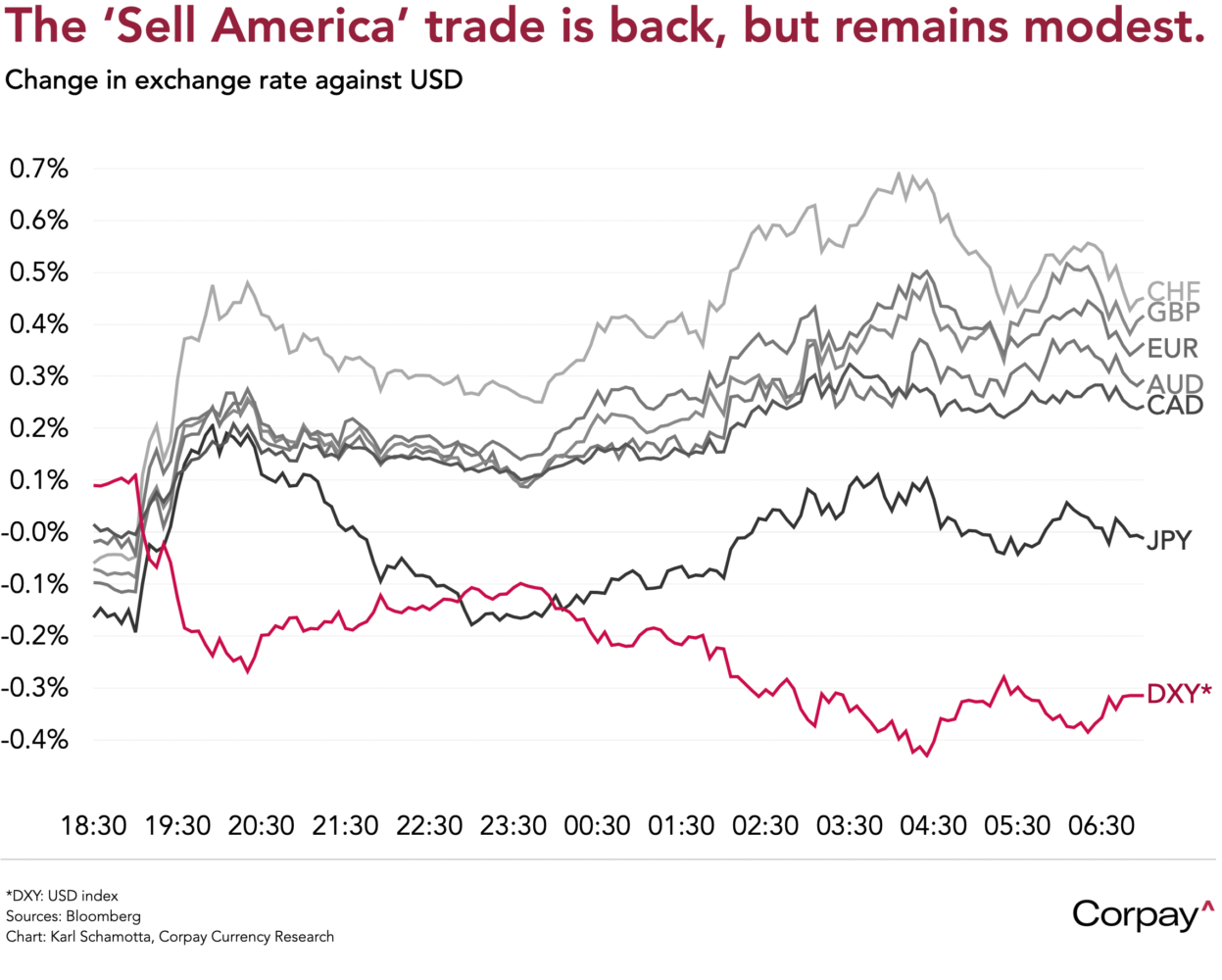

Market reaction could prove somewhat nuanced over the coming hours. Gold and silver prices could extend gains as investors double down on “Sell America” trades, and alternatives to the dollar might grind higher as traders anticipate an increase in diversification flows over the months ahead. Yield curves should steepen in line with lower short-term rate views and higher long-term inflation expectations. But moves are likely to be relatively small, given that the administration’s charges are unlikely to hold up in court, and that Trump himself could slow-walk the process. In an interview with NBC News last night, the president claimed that he didn’t know about the Justice Department’s actions and wasn’t conducting a legal pressure campaign against the Fed, saying “I wouldn’t even think of doing it that way. What should pressure him is the fact that rates are far too high. That’s the only pressure he’s got”.

From a more fundamental standpoint, job growth slowed last month, even as a slight drop in the unemployment rate left near-term policy expectations largely unchanged and supported risk appetite. Friday’s non-farm payrolls report showed employers adding a seasonally adjusted 50,000 jobs in December—well below the 72,000 consensus forecast—but the jobless rate unexpectedly edged down to 4.4 percent from 4.5 percent, suggesting that the non-linear labour market deterioration feared by policymakers has yet to materialise.

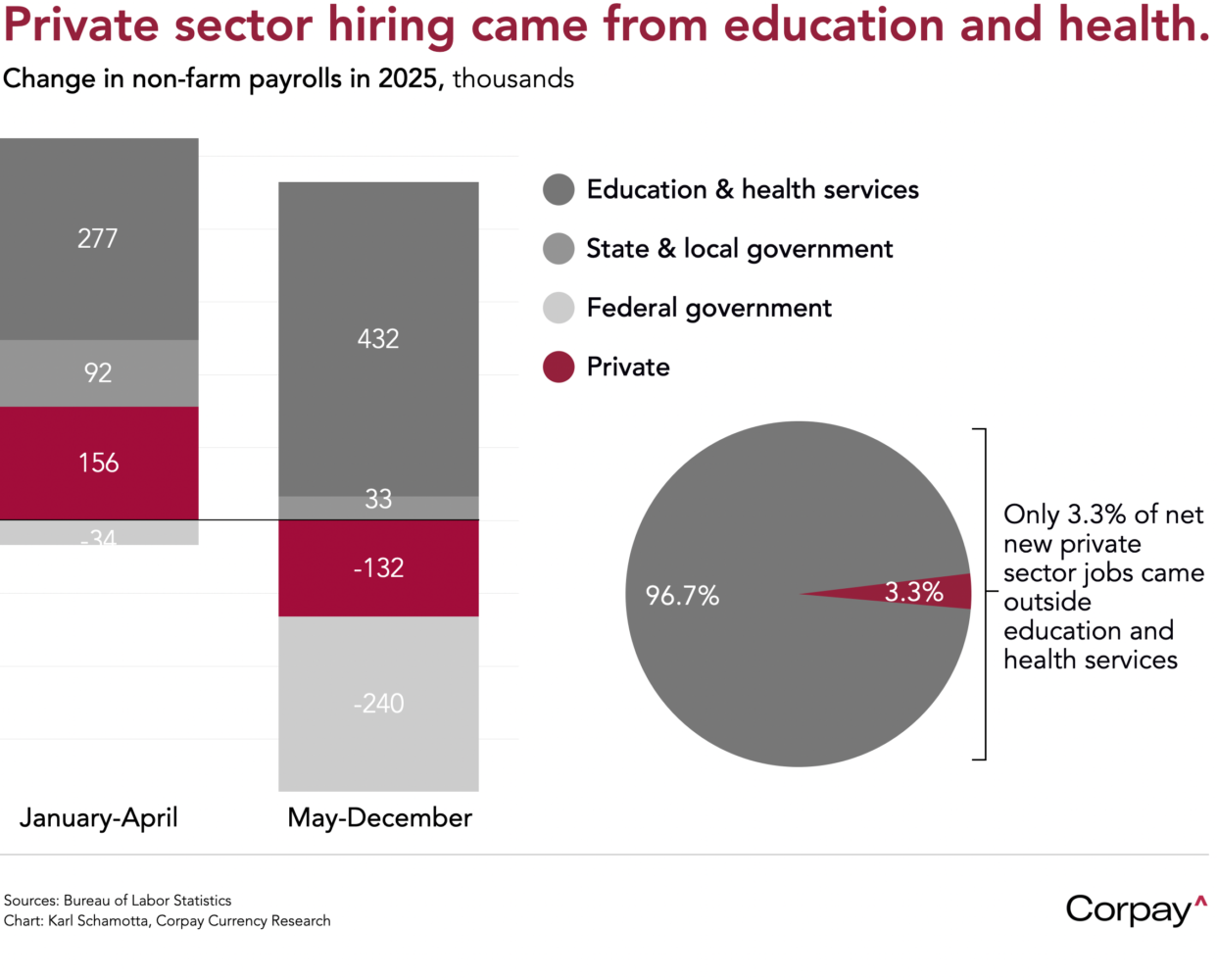

The details were less promising, however. Overall payrolls grew by an average of 49,000 a month in 2025, down from 168,000 the year before, and business hiring turned net negative after Liberation Day in April, with 96.7 percent of all private sector jobs added in the education and healthcare sectors alone. Companies aren’t laying off workers in significant numbers, yet appear reluctant to increase payrolls against a deeply uncertain backdrop, with operating costs climbing, tariff policies in flux, and artificial intelligence advancements potentially substituting for new employees.

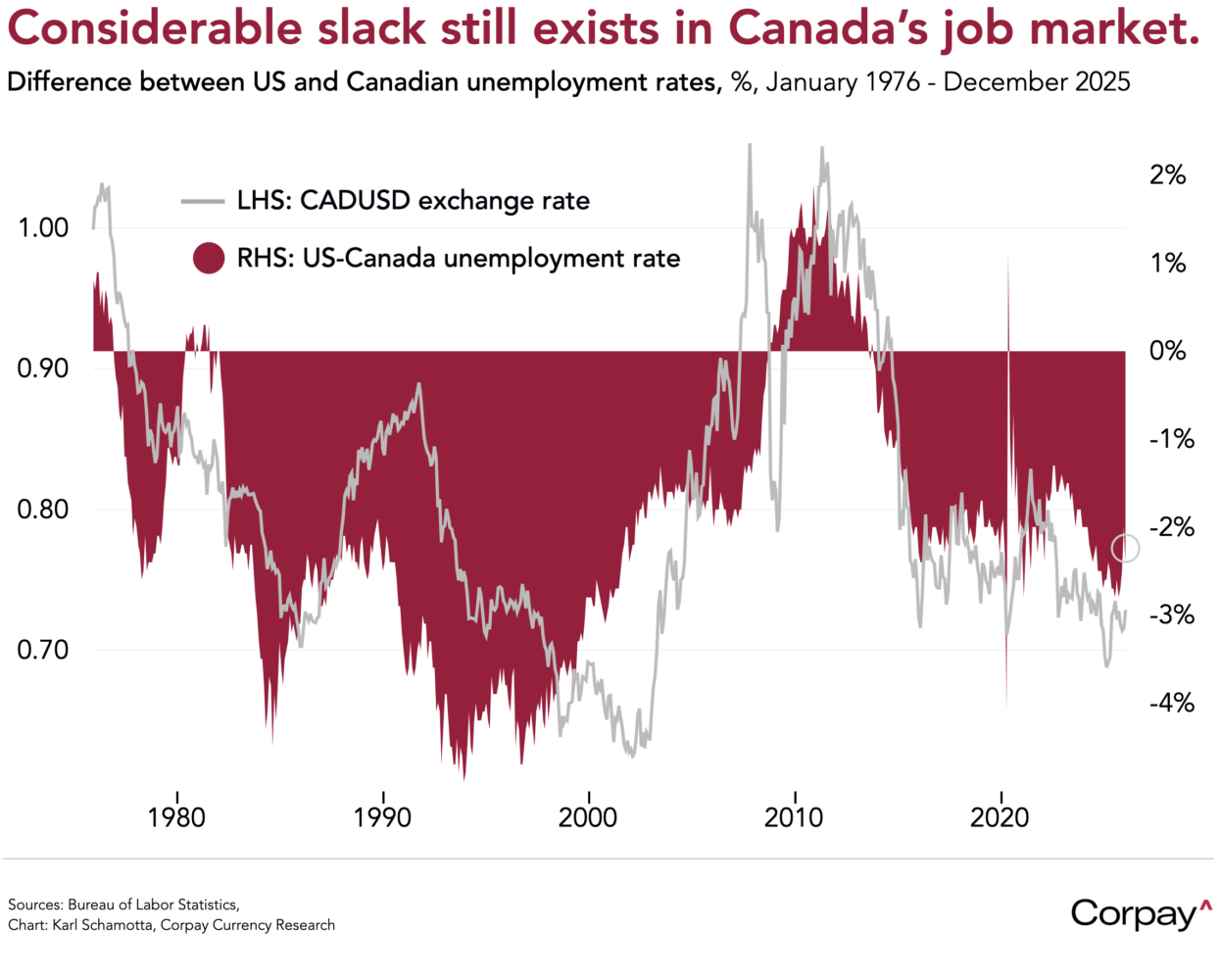

North of the 49th parallel, job creation stayed positive for a fourth straight month, but the unemployment rate rose as labour force growth exceeded expectations. That underscored lingering slack in Canadian labour markets and slightly widened the gap with the US, capping the loonie’s upside. While the economy has outperformed recent fears, it remains cyclically weak. Housing and energy investment—its two main growth engines—are still subdued, in my opinion leaving the Bank of Canada unlikely to contemplate tightening any time soon.

Investors will be watching this evening when John Williams, president of the New York Fed, takes to the podium at around 6:00 Eastern. As one of the Federal Open Market Committee’s most influential members, his remarks on the economy will be parsed closely, but any guidance on his willingness to defend the central bank’s independence in the months ahead could prove more meaningful.

Tomorrow’s US December inflation report looms as the next obvious volatility catalyst, with economists expecting a somewhat-confusing release after the prior month’s exaggerated softness. After the Bureau of Labor Statistics acknowledged flaws in the methodology used to calculate shelter prices and other inputs in the shutdown-inflected November print, the consensus expects an unusually-sharp 0.4-percent month-over-month jump in both the core and headline measures of inflation, while year-over-year comparisons are seen looking more sedate, coming in around the 2.7-percent mark. A surprise could see the dollar and yields reprice, but any reaction could prove short-lived given the frailty of underlying data collection processes, so we would suggest viewing market moves as tactical trading opportunities, not changes in fundamental trends.