The slow-motion flight to safety that began on the weekend is showing signs of exhaustion in currency markets this morning, but sentiment remains fragile. Japanese government bond yields are stabilising after a hawkish speech from Bank of Japan governor Kazuo Ueda triggered a selloff in yesterday’s session, and rates are edging down across most advanced-economy debt markets. Benchmark ten-year US Treasury yields are holding firm after an eight-basis-point jump, equity futures are reversing higher, cryptocurrencies are slowing their decline, and the dollar is trading sideways as participants keep a wary eye on the exits.

Calm should return. The weekend’s bringing-forward in Japanese monetary tightening expectations was not terribly momentous in the grand scheme of things, and the country’s vast pool of domestic savings should be more than enough to absorb government debt issuance for the foreseeable future. We expect yields to revert lower, supporting an incremental retracement in the yen and a resumption in the trends that were driving currency market price action in recent weeks.

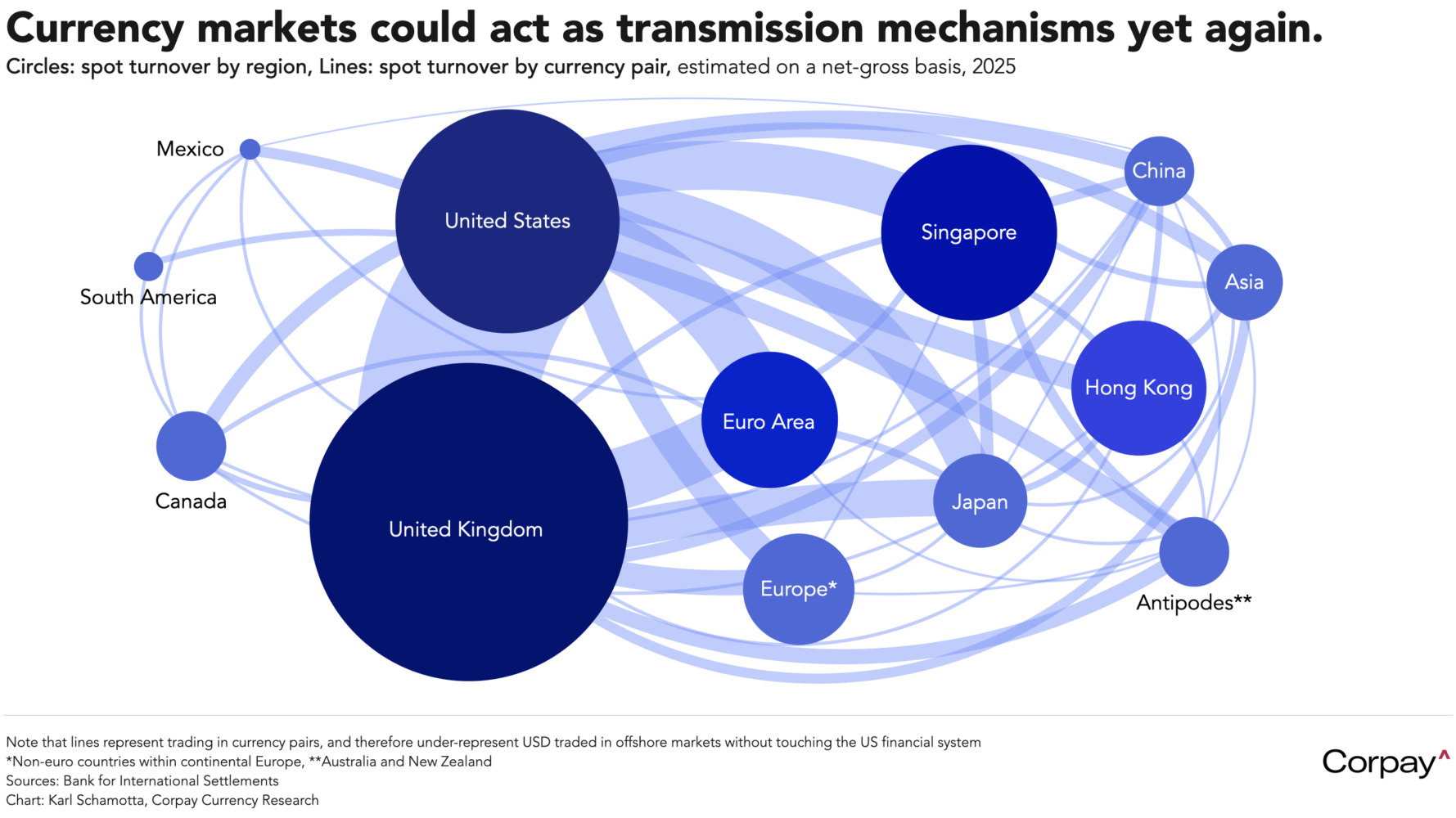

At the same time, it has become clear that global investors are running the same macro trades across multiple asset classes, with Japanese bond markets, short-term Treasuries, and even cryptocurrencies acting as funding instruments for bets that hinge on low or declining volatility in longer-duration assets. With moves across markets becoming increasingly synchronised, today’s market moves may prove a dress rehearsal for sharper episodes of global financial turbulence—transmitted, as so often before, through the foreign-exchange market. Once again, there is a risk that the tail of finance may wag the dog of the real economy in the months ahead.

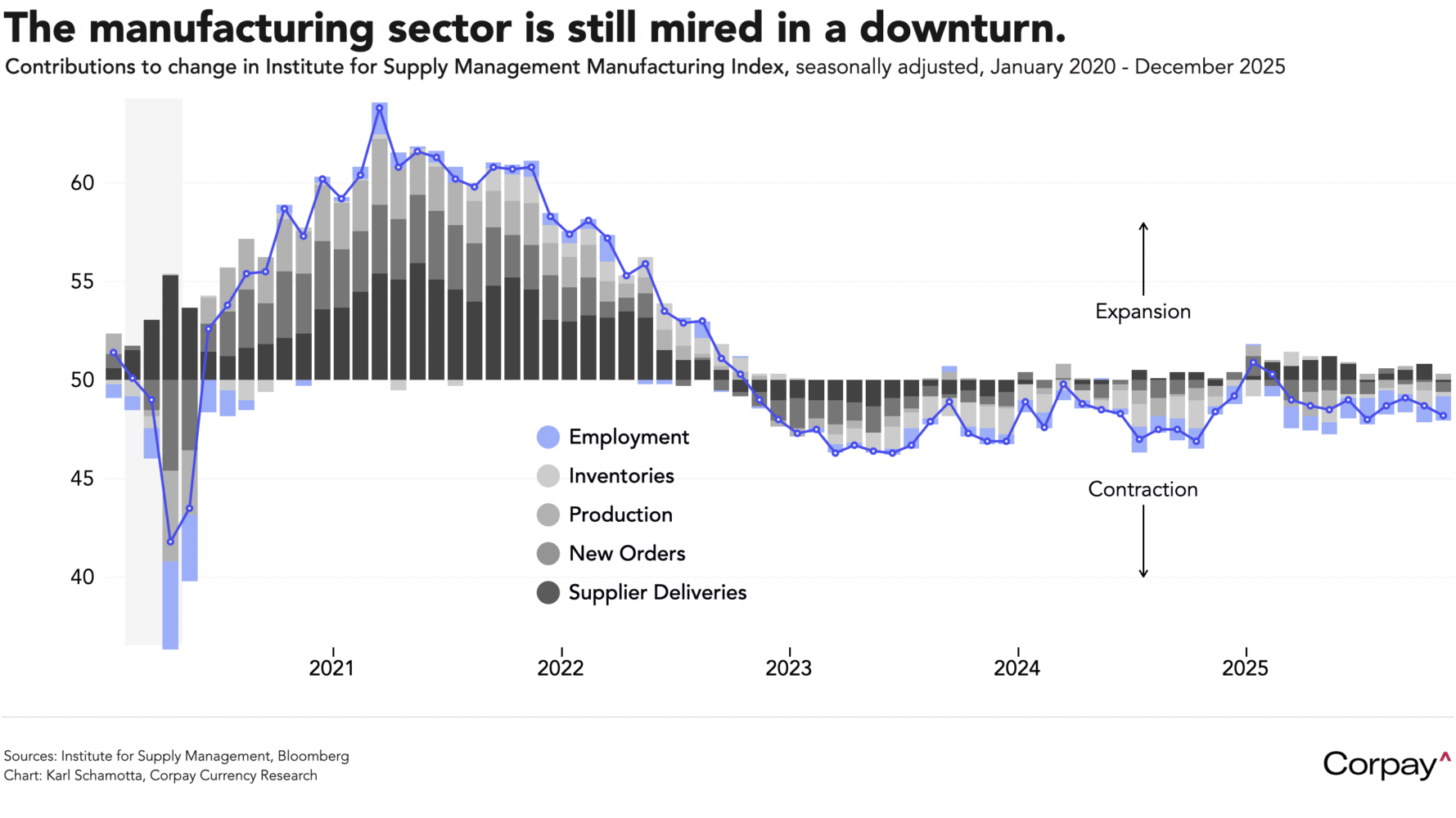

Meanwhile, from a fundamental standpoint, the US economy continues to throw off mixed signals. Yesterday’s update in the Institute for Supply Management’s survey showed manufacturing activity remaining subdued in late November, with the headline index slipping to 48.2—its ninth consecutive reading below the 50 mark that separates expansion from decline—undershooting expectations and underscoring a still-fragile industrial backdrop. The imprint of tariffs was also evident: new orders and employment weakened, even as input costs climbed, pushing the prices-paid gauge higher. But consumers are going strong: bricks-and-mortar retailers reported seeing strong traffic over the weekend, and according to Adobe Analytics, online spending on Black Friday and Cyber Monday was up 9.1 percent and 6.3 percent respectively, from last year.

The Fed could—and probably should—deliver a risk management cut at next week’s meeting, but market expectations for at least three more moves over the next year seem vulnerable to revision. If economic data surprises to the upside over the coming months, a rebound in the dollar could play out in the early new year, wrongfooting those who expect a continued decline.

The euro is almost unmoved after inflation in the 20-country currency bloc unexpectedly accelerated in November, suggesting that market participants don’t expect the European Central Bank to change course in response. Eurostat’s all-items consumer price index climbed 2.2 percent in the year to November—slightly above consensus expectations—after inflation in Germany rose 2.6 percent, speeding up from the 2.3 percent recorded in the prior month. Bloc-wide services inflation reached 3.5 percent in November, marking the highest level since April, and core price growth held steady at 2.4 percent. Investors and policymakers alike see price pressures subsiding gradually over the next year, leaving swaps markets to put the odds on another rate cut from the central bank at less than 25 percent by October 2026—an outlook that should, in theory, support gradual appreciation in the euro.

On the other side of the Channel, the British pound is enjoying a modicum of stability as traders put the acute fiscal concerns surrounding last week’s Autumn Budget in the rear-view mirror. We don’t yet have hard numbers on shifts in speculative positioning—US data is still coming out at a delay—but short bets against the currency have likely pulled back from the levels reached a few weeks ago, and options-market proxies like risk reversals are pointing to a more neutral outlook relative to the dollar and euro. The Bank of England’s December 18 meeting looms as the next major idiosyncratic event risk, and might keep yields and the exchange rate under pressure—especially if officials opt to ease policy further—but we suspect this is now mostly priced in by markets, and think the pound could grind higher if the dollar resumes its softening trend before year end.