• US data. Weaker US ADP employment reinforced US Fed rate cut bets. US equities ticked up & the USD lost ground. AUD & NZD supported.

• AU GDP. Topline growth a bit softer than anticipated in Q3, but under the hood private sector momentum picked up speed. Price pressures still evident.

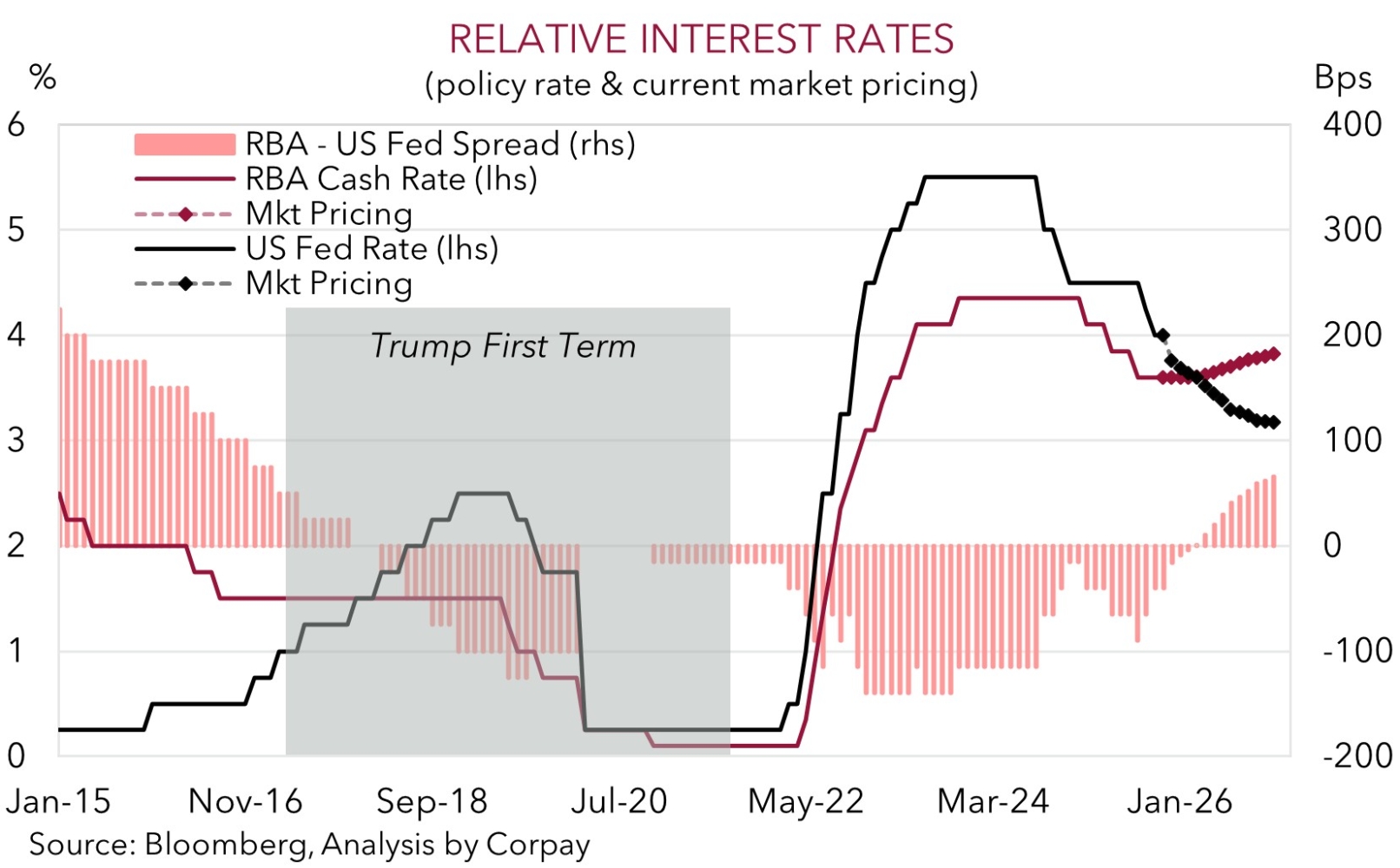

• RBA & Fed. Odds next move by RBA is up not down continue to rise. By contrast, a series of US Fed cuts are anticipated over the next year.

Global Trends

It was a case of “bad US economic news is good news for markets” overnight. More signs growth momentum remains sluggish and cracks in the labour market are widening underpinned risk sentiment as the run of data reinforced expectations the US Fed may cut interest rates next week and follow through with more moves in 2026. More specifically, ADP employment fell 32,000 in November, the fourth negative print in six months, with the broad-based slowdown led by a pullback among small businesses. Added to that the ISM services index indicated overall activity is “good but not great” with employment/hiring intentions still in “contractionary” territory.

In response US bond yields shed another ~2-3bps with the 2yr rate (now ~3.48%) near the lower end of its range. Elsewhere, the outlook for lower US interest rates supported equities (S&P500 +0.4%) and weighed on the USD. The EUR (the major USD alternative) edged up (now ~$1.1666), GBP rose ~1% (now ~$1.3348), and the interest rate sensitive USD/JPY slipped back (now ~155.25). Cyclical currencies like the NZD (now ~$0.5774) and AUD (now ~$0.6601) extended their upswings with the detail in yesterday’s Q3 Australian GDP report also bolstering the risk the next move by the RBA could be up not down.

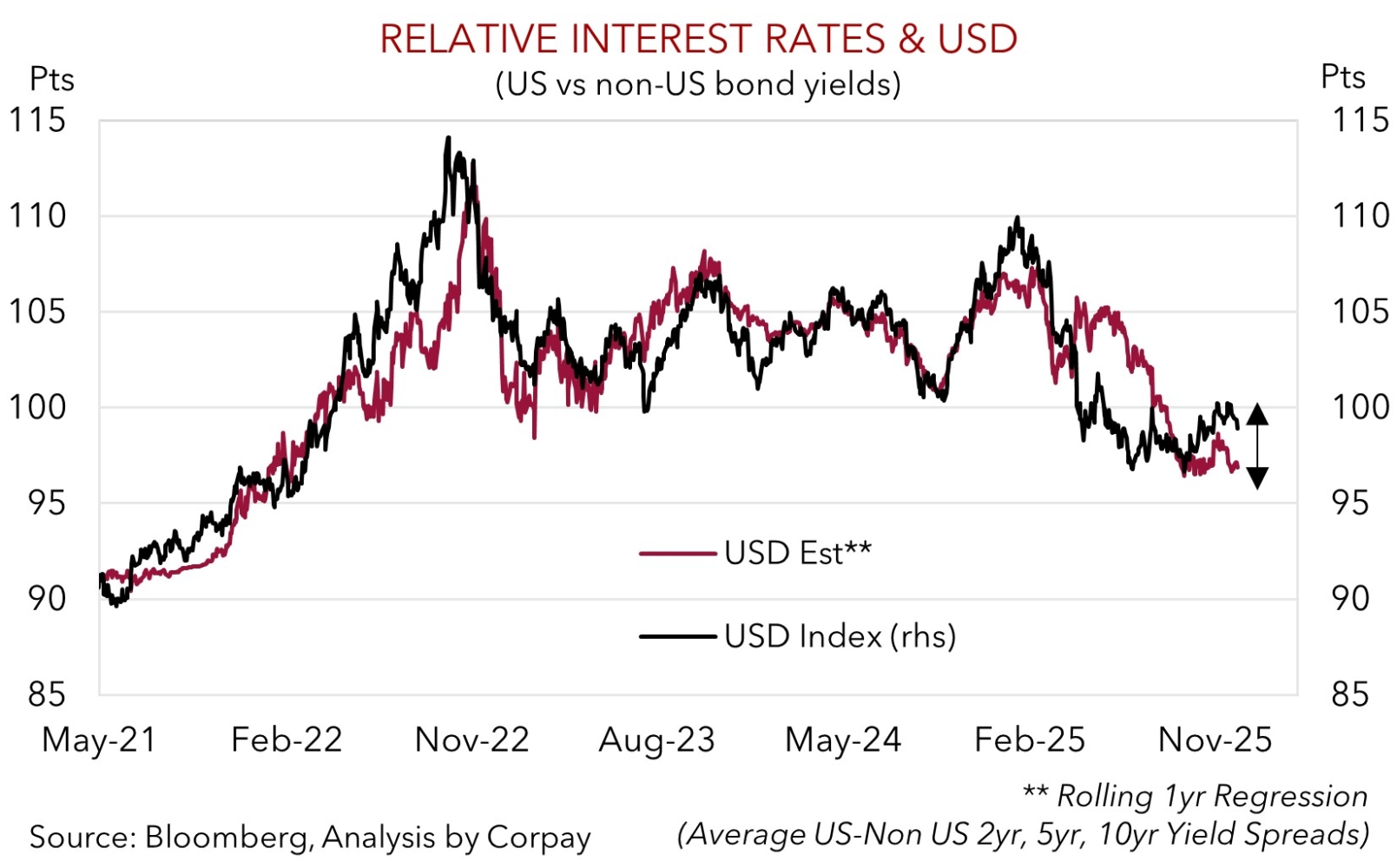

The overnight ADP employment figures have added significance as they are the most up-to-date jobs data US Fed officials will have on hand at their upcoming meeting (11 Dec AEDT). Odds of another interest rate reduction being announced by the US Fed are now tracking north of ~90% with over 3 cuts factored in by next October. Monthly Challenger job cuts data (11:30pm AEDT) and weekly initial jobless claims (12:30am AEST) are due tonight. These data points will provide a bit more colour about US labour market conditions. On net, we remain of the view that the step down in US growth, weakening jobs market, and outlook for lower US interest rates may continue to exert downward pressure on the USD. As our chart shows, the USD looks to be tracking too high compared to where relative yield spreads suggest it should be.

Trans-Tasman Zone

The weaker USD stemming from the disappointing US jobs data released overnight and outlook for US interest rate cuts has helped the NZD and AUD add to recent gains (see above). At ~$0.5774 the NZD is ~3.5% above the low touched around the RBNZ’s recent meeting where it cut interest rates but gave signals the move could be the last this cycle. The AUD (now ~$0.6601) is near the top of its 2-month range with strength on a few of the major cross-rates also supportive. AUD/EUR (+0.2%) nudged up further, as did AUD/CAD (+0.4%) and AUD/CNH (+0.4%). AUD/JPY (+0.1%) has also ticked up a bit more to levels last traded in mid-2024. As outlined previously, we believe AUD/JPY is looking stretched compared to drivers such as yield differentials with the cross-rate also tracking in somewhat rarefied air (since 1995 AUD/JPY has only been above where it is in ~2% of trading days).

Domestic data has also given the AUD a helping hand. While aggregate GDP growth was a touch softer than forecast in Q3 (+0.4%qoq), some of that reflected positive upward revisions to previous quarters. Moreover, private sector momentum picked up speed thanks to solid household spending, greater investment in machinery/equipment, and housing related activity. This compounded robust government spending. Indeed, annual GDP growth quickened to 2.1%pa in the year to Q3. This was a little faster than the RBA’s predictions and in line with ‘trend’ growth.

The Australian economy continues to operate at a high level and close to capacity. With the economy hitting up against constraints the inflation pressures evident in Q3 and early-Q4 could persist, which in our opinion, reinforces the argument for the RBA not to cut rates again. The longer the RBA holds steady the greater the chances the next move ends up being a rate hike. As mentioned previously, without a sharp deterioration in risk sentiment we think the underlying improvement in US/China trade relations, more favourable yield spreads between Australia and other nations, softer USD, and/or firmer domestic/Asian growth should help the AUD climb gradually higher into year-end and over early-2026.