• Metal vol. Large swings in gold & silver prices. Positive US data supported the USD index. AUD held up thanks to some relative outperformance.

• RBA today. On net, a RBA rate hike looks more likely than not. But there is the chance of a surprise. What the RBA says about the future also matters.

Global Trends

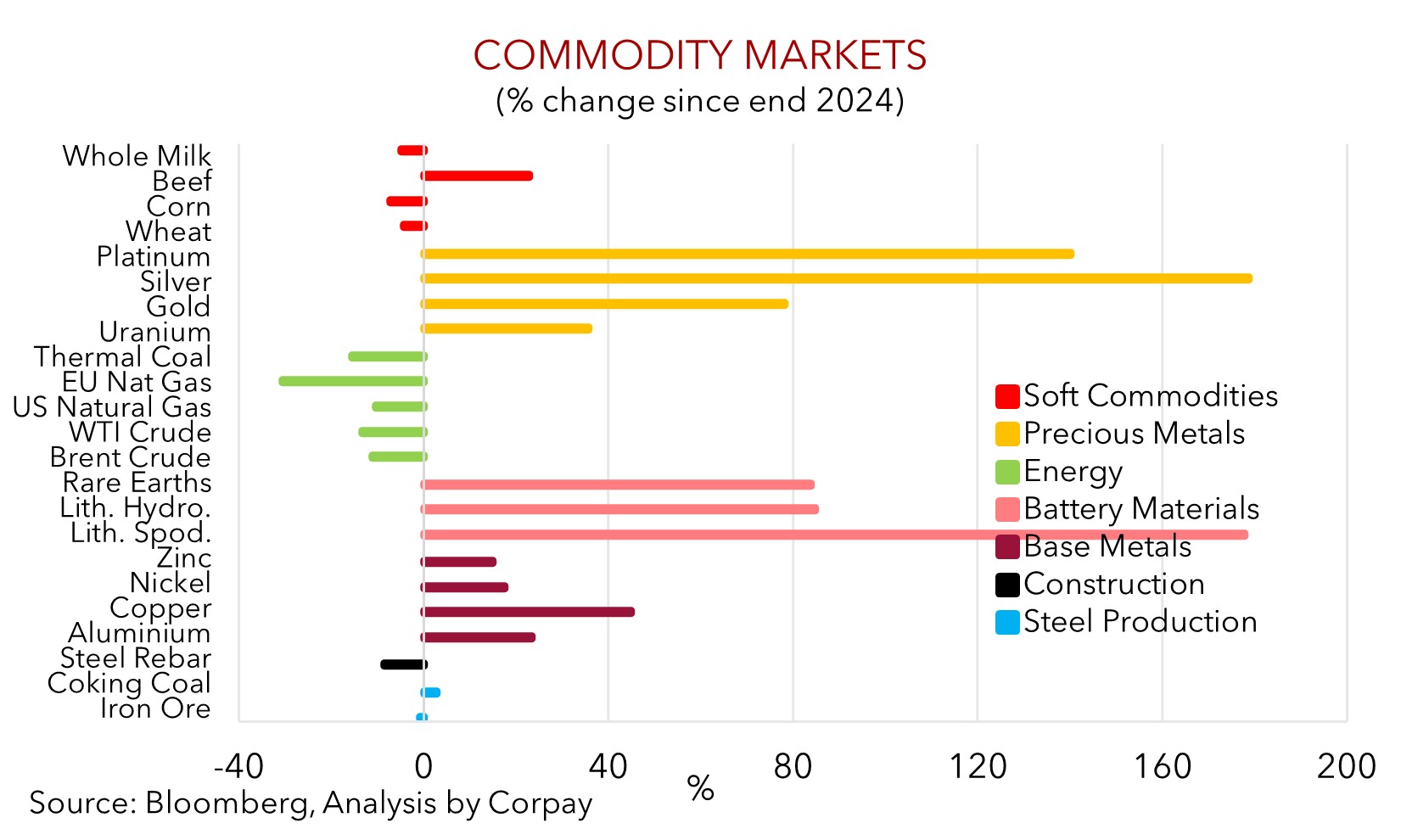

Various financial markets continue to whip around with volatility continuing at the start of the new week. During yesterday’s Asian session gold and silver prices tumbled further, US equity futures opened lower, and the USD recouped a little more lost ground as markets continued to digest President Trump’s next Federal Reserve Chair announcement. Overnight, gold and silver fell a bit more before snapping back. Gold swung around in a 10% range yesterday, while silver traded in an even wider ~18% range. As our chart below shows, the prices of precious metals like silver and gold, and battery related materials (i.e. lithium, rare earths) have risen substantially since the end of 2024 as demand and supply factors have washed through. Given the still lofty heights of some commodity prices such as silver and gold, and the uncertain economic environment, more bursts of volatility appear likely over the period ahead.

Elsewhere, US equities reversed course and ended the day higher (S&P500 +0.6%), as did US bond yields (US 2y & 10yr +5bps). In FX the USD index rose. The EUR shed ~0.5% (now ~$1.1792), GBP eased (now ~$1.3666), and the interest rate sensitive USD/JPY nudged up (now ~155.54). The NZD consolidated near US$0.60, and ahead of today’s RBA decision (2:30pm AEDT) the AUD remained range bound after weakening over the previous couple of days (now ~$0.6951).

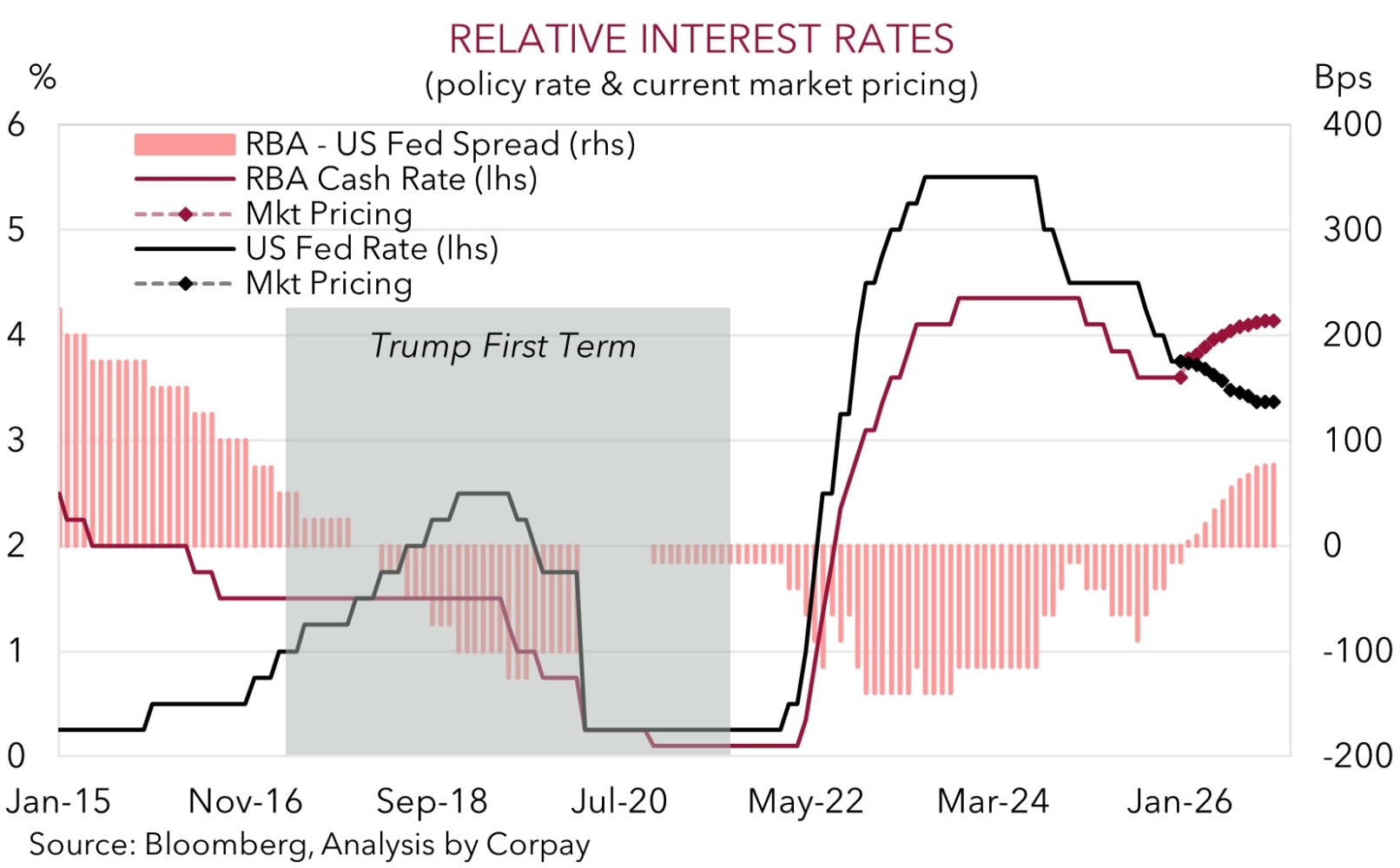

A better-than-expected US ISM manufacturing survey boosted US market sentiment and underpinned the uptick in bond yields and the USD index. The ISM jumped back into ‘expansionary’ territory and reached its highest level since 2022 thanks to an encouraging increase in new orders and improvement in hiring intentions. As discussed yesterday and late last week, we think the rebound in the beaten-up USD has further to go given it is still below our ‘fair value’ model estimate. However, on the data front the US government shutdown related fog will persist a little longer with JOLTS job openings (which was to be released tonight) and monthly non-farm payrolls report (which was due this Friday night) set to be delayed because of funding/data collection issues. Markets are of the view that the US Fed won’t lower interest rates again until the new Chair takes the job in May. Another US Fed rate reduction isn’t fully discounted until July.

Trans-Tasman Zone

In the face of a data driven uptick in the USD index, and acute intra-day volatility in precious metals like silver and gold, the NZD and AUD have been range-bound at the start of the week (see above). Though this comes after a decent pull-back over the prior few sessions with the NZD (now ~$0.6004) ~1.5% below last week’s multi-month peak and the AUD (now ~$0.6951) ~2% from its recent peak. Relative outperformance on some of the major crosses helped the AUD hold its ground against the firmer USD. The AUD edged up by ~0.2-0.4% versus the EUR, JPY, GBP, and CAD over the past 24hrs.

Today, AUD focus will be on the RBA decision (2:30pm AEDT) and Governor Bullock’s press conference (3:30pm AEDT). Governor Bullock is also due to speak again later this week (Fri morning AEDT). As discussed previously, with the Australian economy operating at a high level (as shown by above average capacity utilization and still low unemployment), private sector growth picking up, and inflation running above target we believe current interest rates settings aren’t ‘restrictive’ enough and a RBA policy U-turn is likely. There are arguments for the RBA to stay on hold, but on balance we expect a 25bp interest rate ‘recalibration’ to be announced. This is also the view of the bulk of surveyed economists (25 out of 32 are predicting a rate hike) with the market assigning it a ~70% chance (note, a rate rise is fully priced in by May with 2 hikes discounted by August).

Outcomes compared to expectations matter in markets. With this in mind, and with the AUD still tracking a bit above our ‘fair value’ models, we think there is a risk the RBA isn’t ‘hawkish’ enough which in turn could see the AUD unwind more of its upswing in the near-term. As mentioned, there is a chance the RBA doesn’t lift rates (this happened last July when the market was geared up for a rate cut but the RBA held steady). The decision might not be ‘unanimous’, and/or if interest rates are increased the messaging about further moves could be ‘cautious’, non-committal, and data dependent. This in turn might see medium-term interest rate expectations adjust slightly lower, exerting a little more downward pressure on the AUD. That said, this is a short-run move with the AUD projected to remain firm and bounce back over the medium-term due to wider interest rate differentials, a gradual weakening in the USD, and potentially more stimulus out of China as it looks to support its domestic growth.