As widely anticipated, particularly after last week’s hotter monthly Australian CPI figures, the RBA kept the cash rate at 3.6% at today’s meeting. The Board’s decision was unanimous, and there was little firm guidance suggesting any degree of urgency to lower interest rates again in the near-term, in our view.

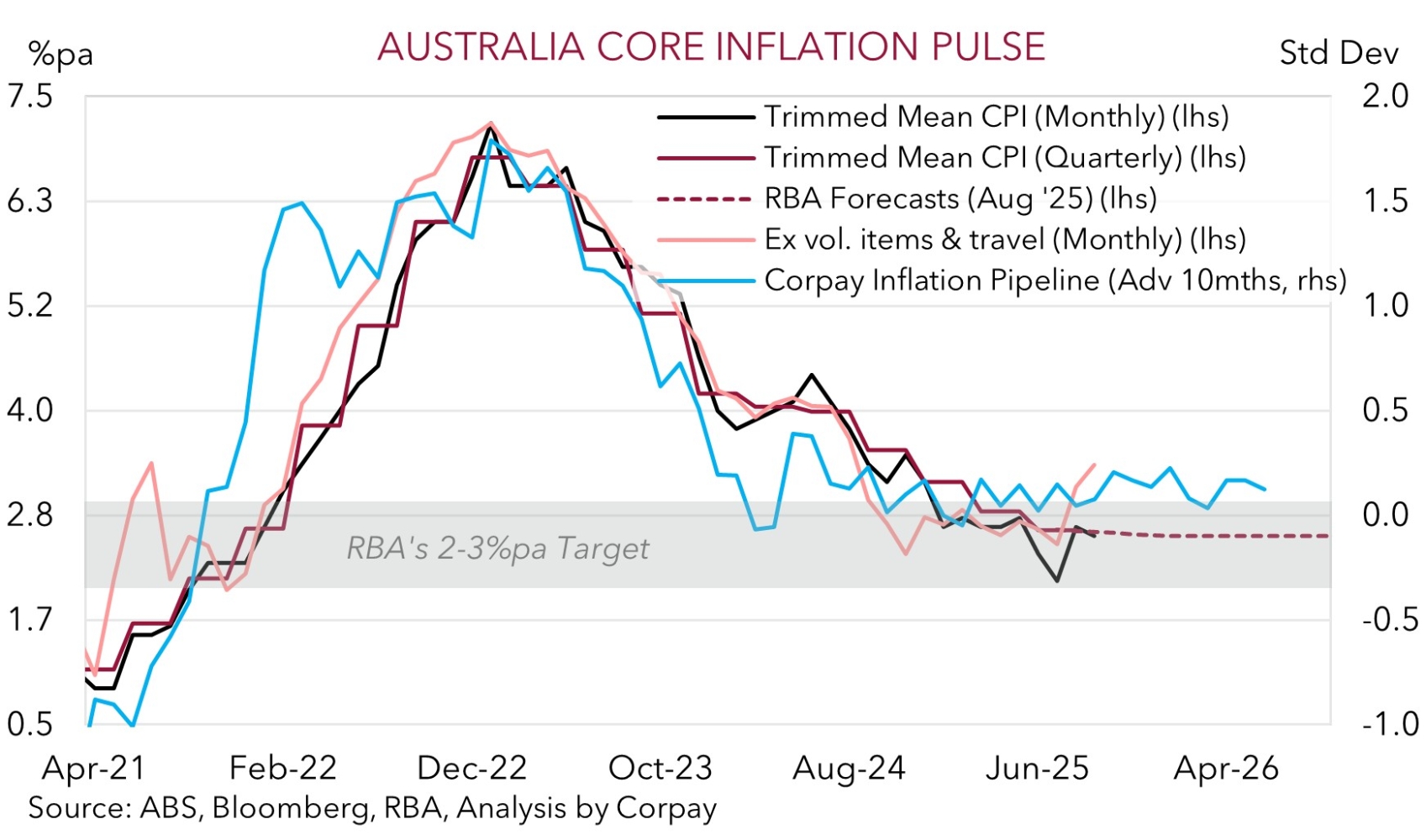

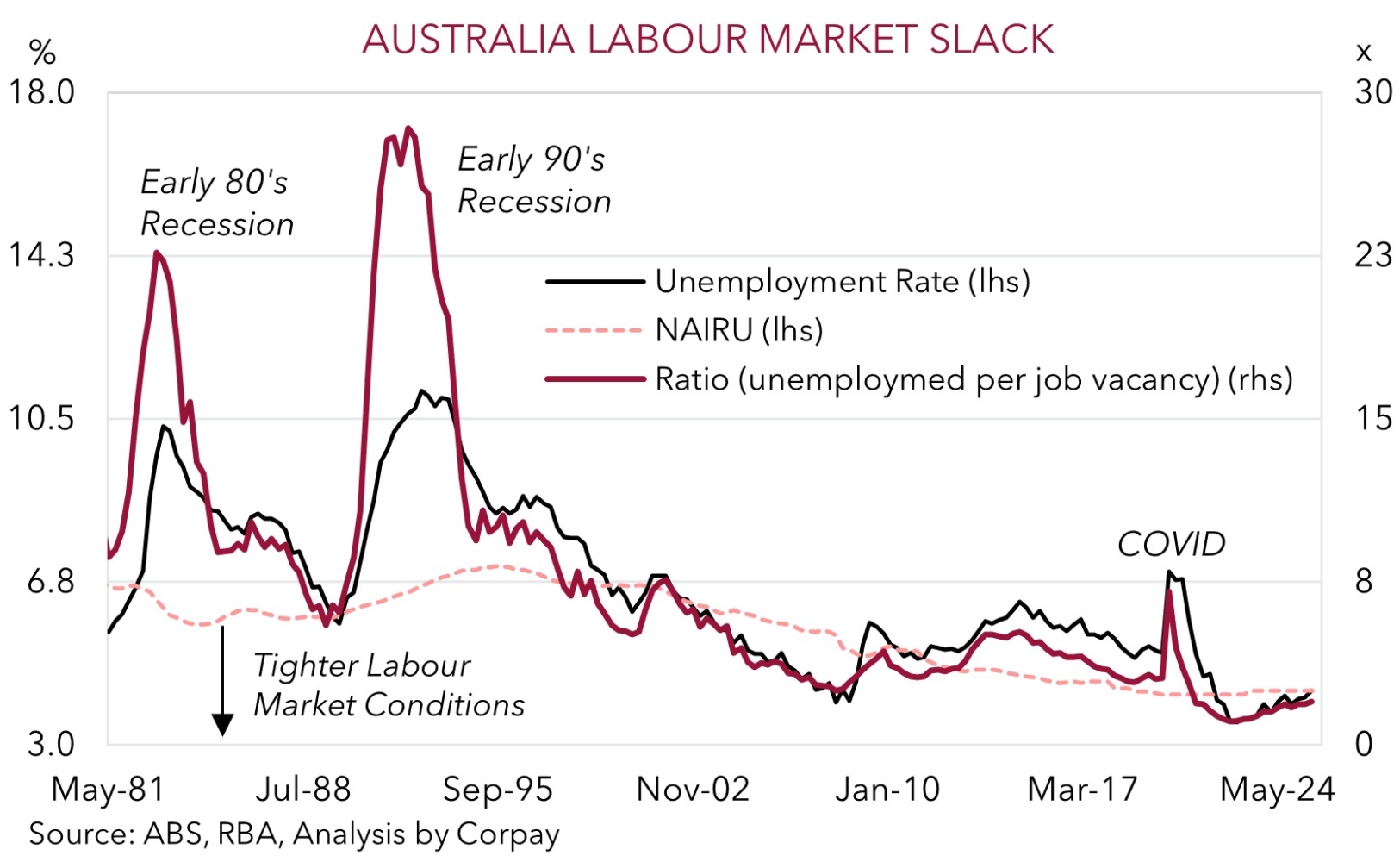

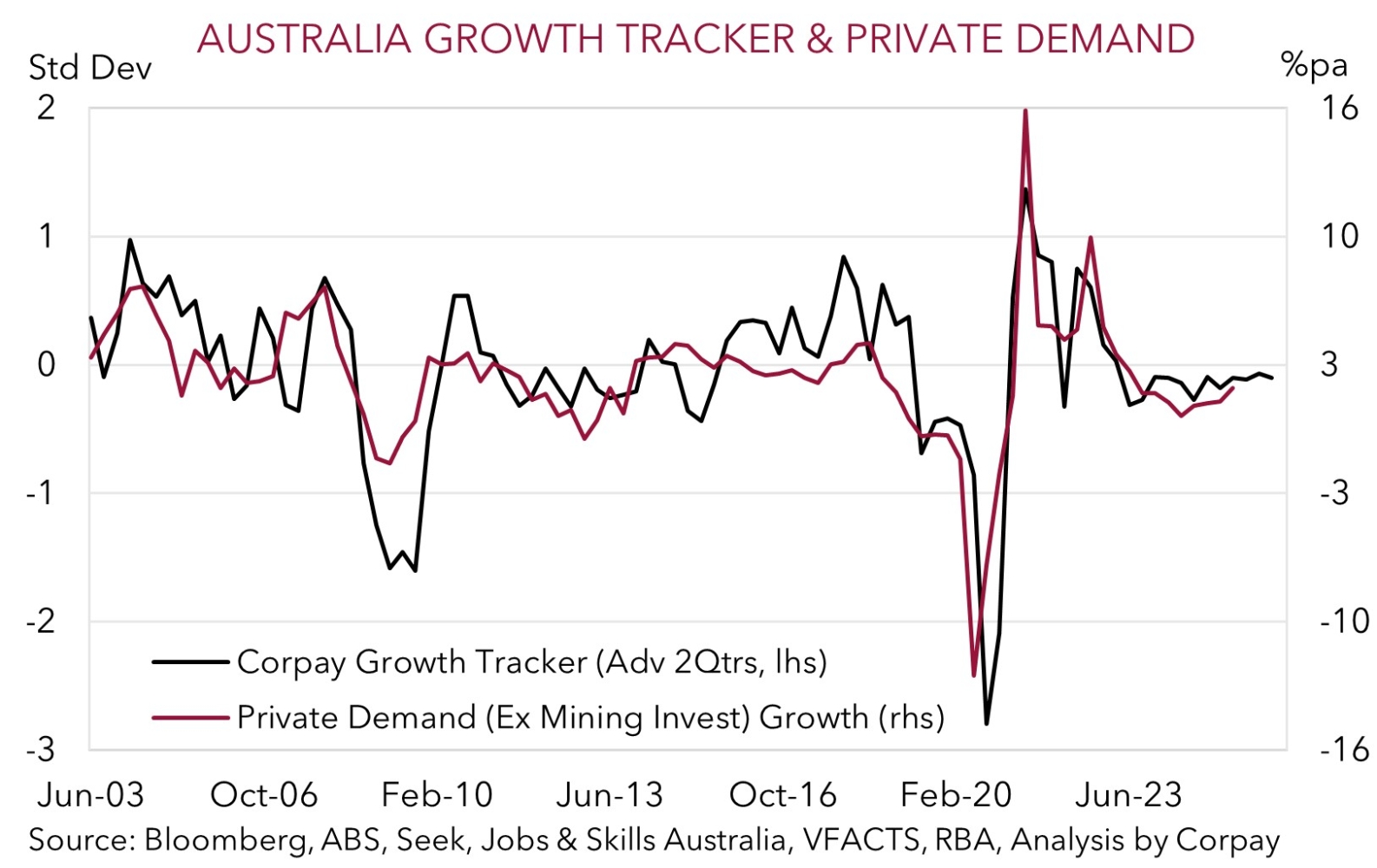

From our perspective key comments within the post meeting statement leant relatively more “hawkish”. More specifically the RBA noted that based on the recent data Q3 inflation might be “higher than expected” and that the decline in core inflation has slowed. This is the signal coming from our pipeline inflation tracker (chart 1) with the broader set of indicators pointing to inflation settling towards the upper end of (or a bit above) the RBA’s 2-3%pa target band. Added to that, the June quarter national accounts showed “private demand is recovering a little more rapidly” than predicted, while labour market conditions “remain a little tight” with the latter a function of the level of activity across the economy still elevated (chart 2). These trends are also being picked up by our activity and labour demand gauges (chart 3).

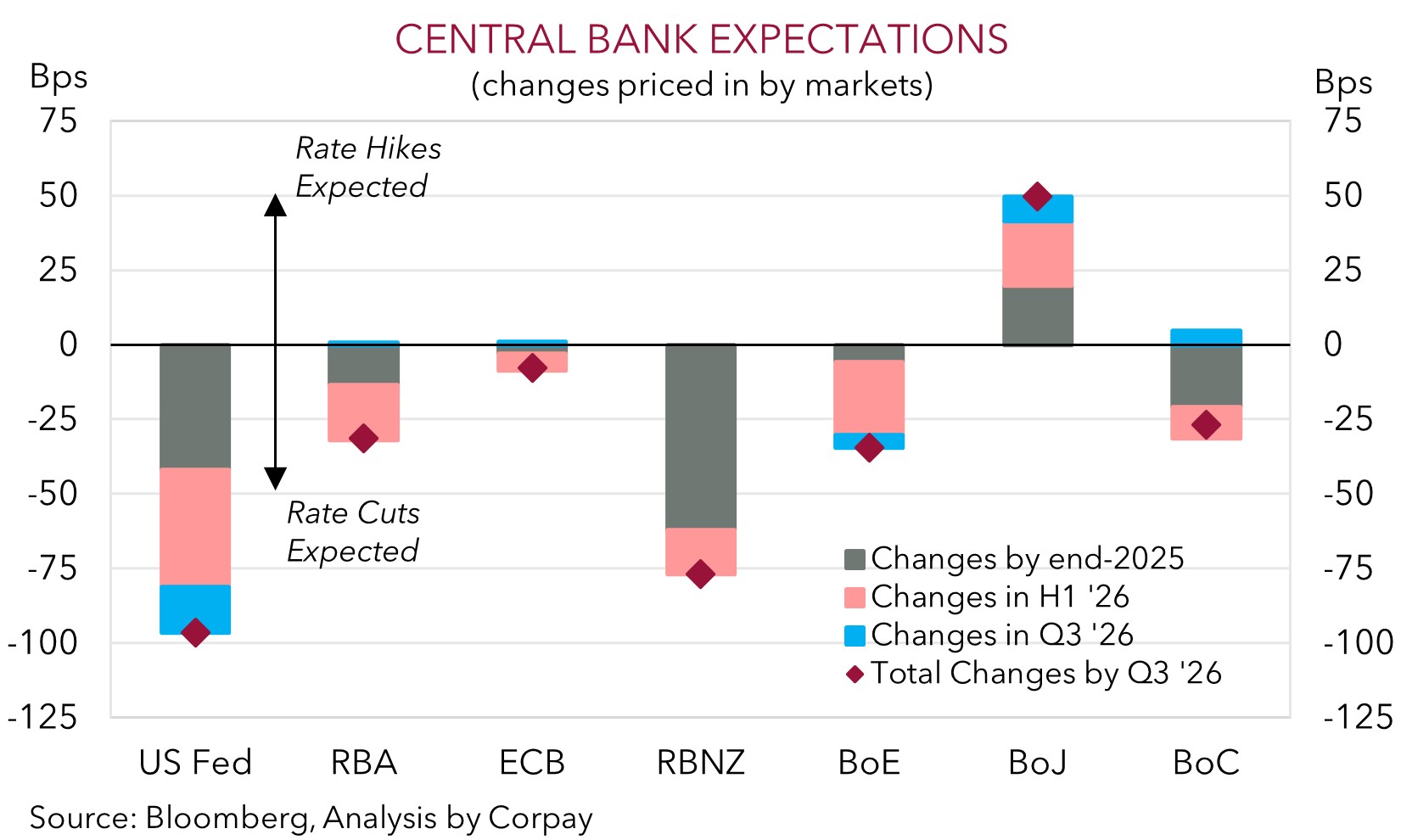

As a result, the RBA Board believe it should “remain cautious” and in addition to the data the “evolving assessment of the outlook and risks” will guide its decisions. Governor Bullock added that things will be looked at “meeting by meeting”, that the RBA’s projections about the future provided in November are a key input in its thinking, and it is “difficult to say” if the RBA still has an easing bias. In our view, given improving momentum across the Australian economy, sticky inflation, and resilient jobs market another interest rate cut by the RBA this year appears unlikely (chart 4). Indeed, without an upturn in unemployment we believe there is a growing risk the RBA doesn’t deliver any further policy easing this cycle.

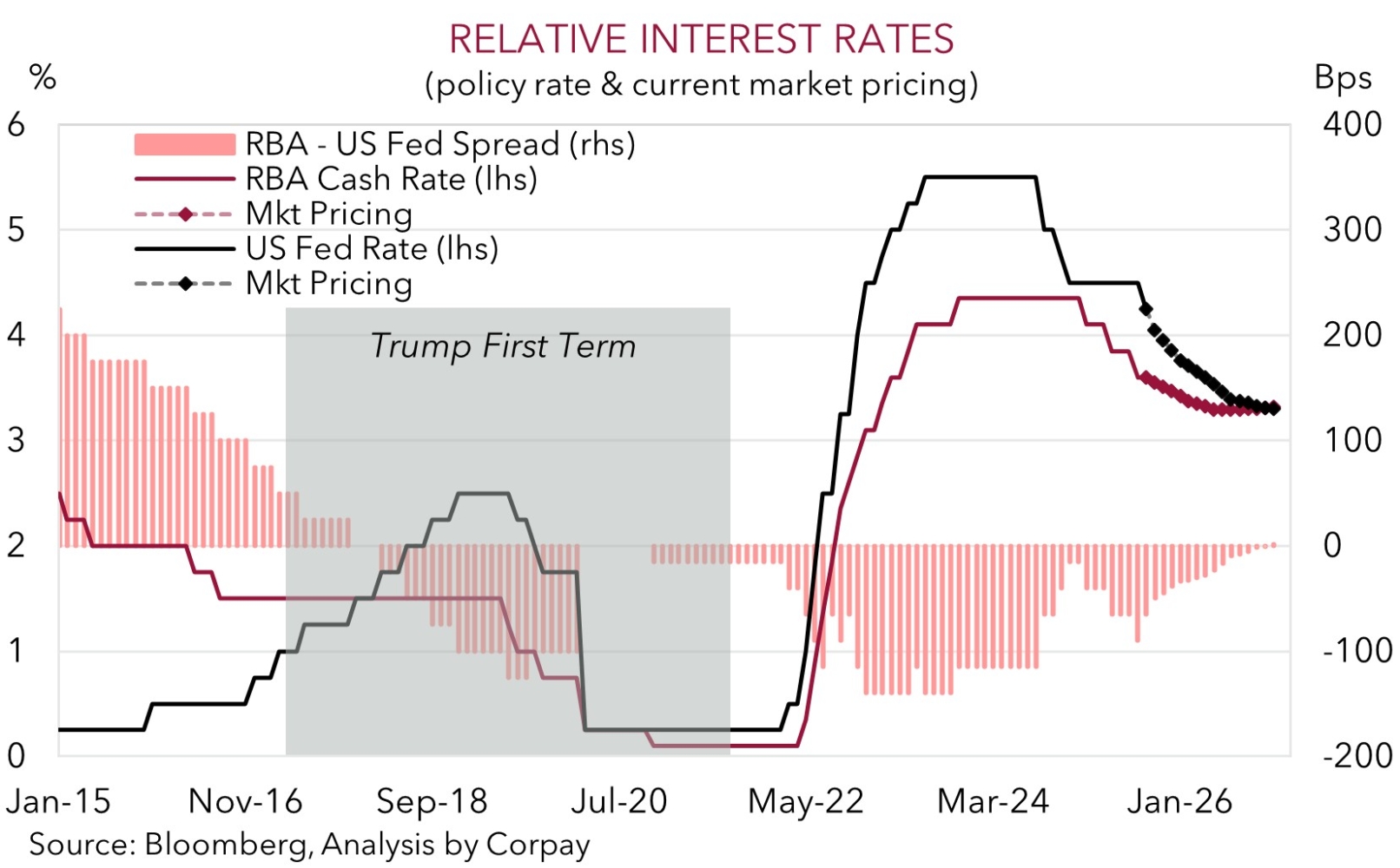

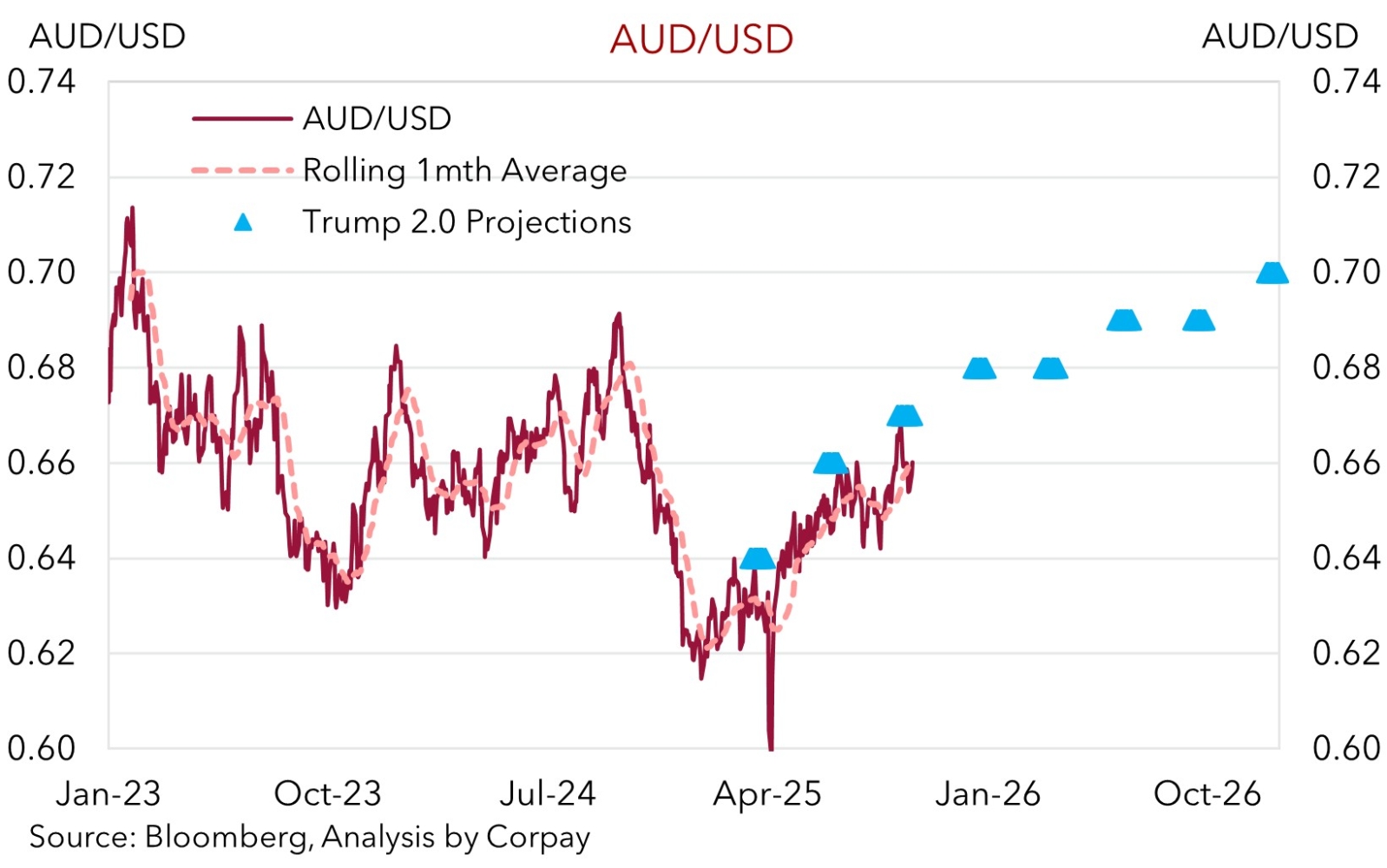

Looking ahead, we continue to forecast a further grind higher by the AUD into year-end and over H1 2026. We think the combination of: (a) a cautious/gradual approach by the RBA; (b) upturn in Australia’s economy; (c) an improvement in China’s growth pulse (as its domestically focused stimulus push aimed at counteracting tariff headwinds gains traction); and (d) a weaker USD as the US Fed steadily lowers interest rates to combat growth challenges and downside labour market risks should be AUD supportive over coming months (chart 5). Our long held forecast is for the AUD to edge up to ~$0.68 in Q4/Q1 (chart 6). We also think the underlying factors outlined should be helpful for the AUD against other currencies such as the EUR, NZD, and CNH.