• Push-pull. A few equity market wobbles overnight. USD a bit firmer. NZD underperforms. AUD retraces its RBA rate hike induced uptick.

• Macro events. ECB & BoE expected to hold rates steady tonight. US JOLTS also due. US jobs report has been delayed until next week.

Global Trends

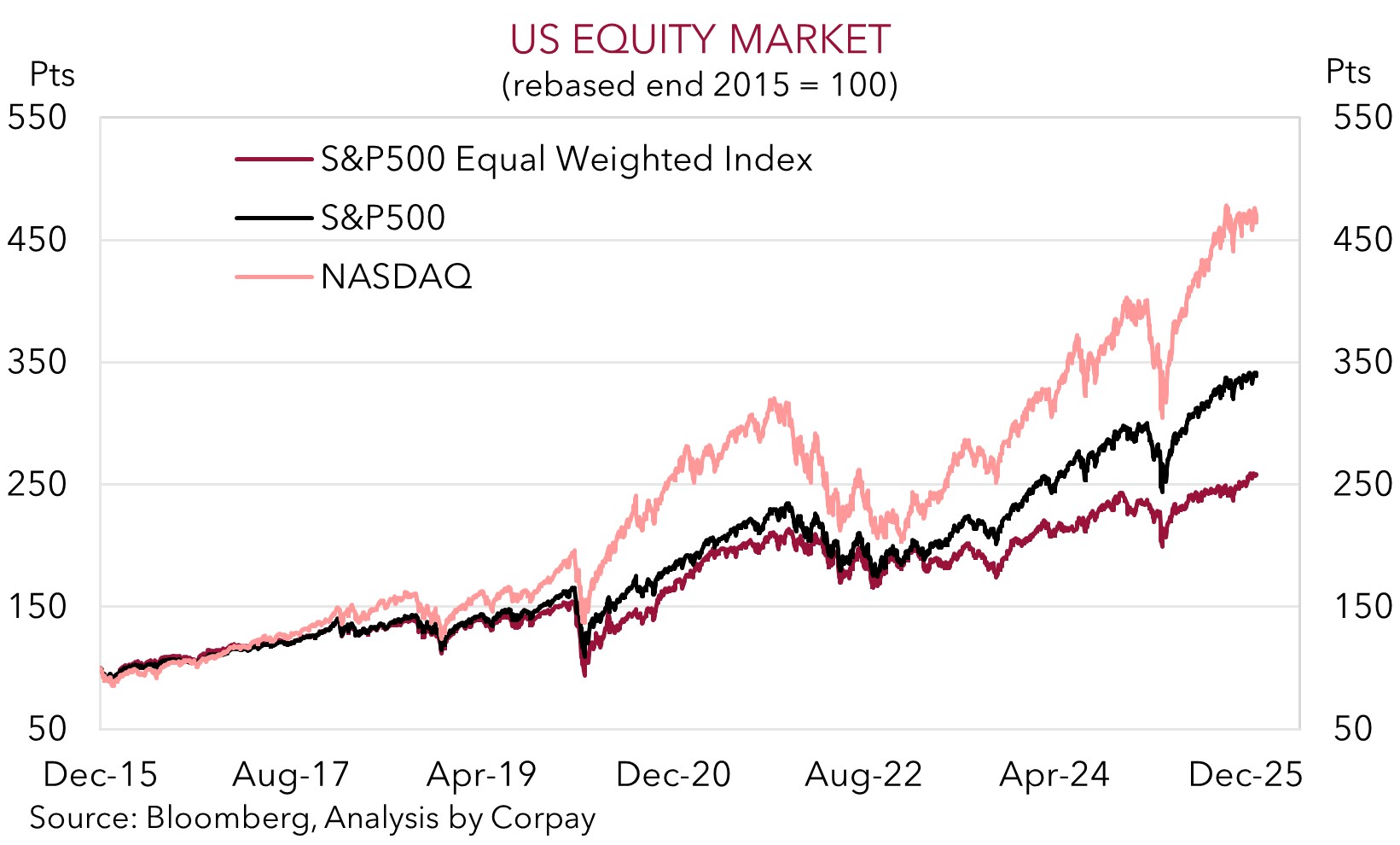

There were a few market wobbles overnight as various forces pushed and pulled on sentiment. US equities slipped back with the tech-focused NASDAQ underperforming (-1.5% vs S&P500 -0.5%). Some disappointing earnings results and a rotation out of the software and chipmaking tech stocks that have driven the market rally were factors at play. Given the lofty market valuations and strong run up in prices it doesn’t take much to generate a pull-back. As our chart shows, the NASDAQ/major tech stocks have significantly outperformed the broader US stockmarket over the past few years.

Elsewhere, bond yields consolidated with the benchmark US 10yr rate (now ~4.28%) hovering just north of its 1-year average. Across commodities, WTI crude oil edged higher (now ~US$64.40/brl, the middle of its 1-year range), while copper (-3.2%) and iron ore (-1.6%) lost ground. In FX, the USD index rose a little with EUR easing towards ~$1.18 and GBP drifting to ~$1.3650 ahead of tonight’s ECB (12:15am AEDT) and BoE (11pm AEDT) meetings. No change in rates by either central bank is expected. USD/JPY (now ~156.90) extended its recovery and is now less than 1.5% from levels it was trading at in late-January before the threat of intervention by Japanese officials to prop up the weak yen rattled nerves. The NZD weakened a touch to be near the bottom of its recent range (now ~$0.60), and the AUD (now ~$0.6997) has also retraced its modest RBA rate hike induced uptick.

Data wise, while the US services ISM was stronger than predicted, this reflected higher ‘prices paid’ with other demand components such as ‘employment intentions’ and ‘new orders’ underwhelming. Similarly, US ADP employment was weak with only 22,000 jobs added in January. Looking ahead, government shutdown issues will play a bit of havoc with the release of a few important US data points. The latest monthly non-farm payrolls report will be delayed until next week (12the Feb AEDT) and CPI inflation has been pushed back (now 14th Feb AEDT). Tonight, in addition to the ECB and BoE decisions, in the US JOLTS job openings (a gauge of labour demand and turnover) is out (2am AEDT). As discussed over the past week we think signs of stabilization in the US data could give the beaten-down USD some short-run support, especially as it is still below our ‘fair value’ estimate.

Trans-Tasman Zone

The slightly firmer USD index, coupled with shaky risk sentiment (as illustrated by the dip in US equities) has exerted a bit of pressure on the NZD and AUD overnight (see above). At ~$0.60 the NZD is tracking near the lower end of its 1-week range. Yesterday the NZ jobs report was better than the headline lift in unemployment suggests (from 5.3% to 5.4%). This largely reflects more labour supply with jobs growth positive in NZ for the first time since mid-2024 as lower interest rates and improving momentum across the economy feed through. We expect this more positive trend in NZ’s economy to continue, opening the door for the RBNZ to take its foot of the accelerator by raising rates later this year. As mentioned previously the NZD has tended to rise between the last RBNZ rate cut and first hike of the next cycle.

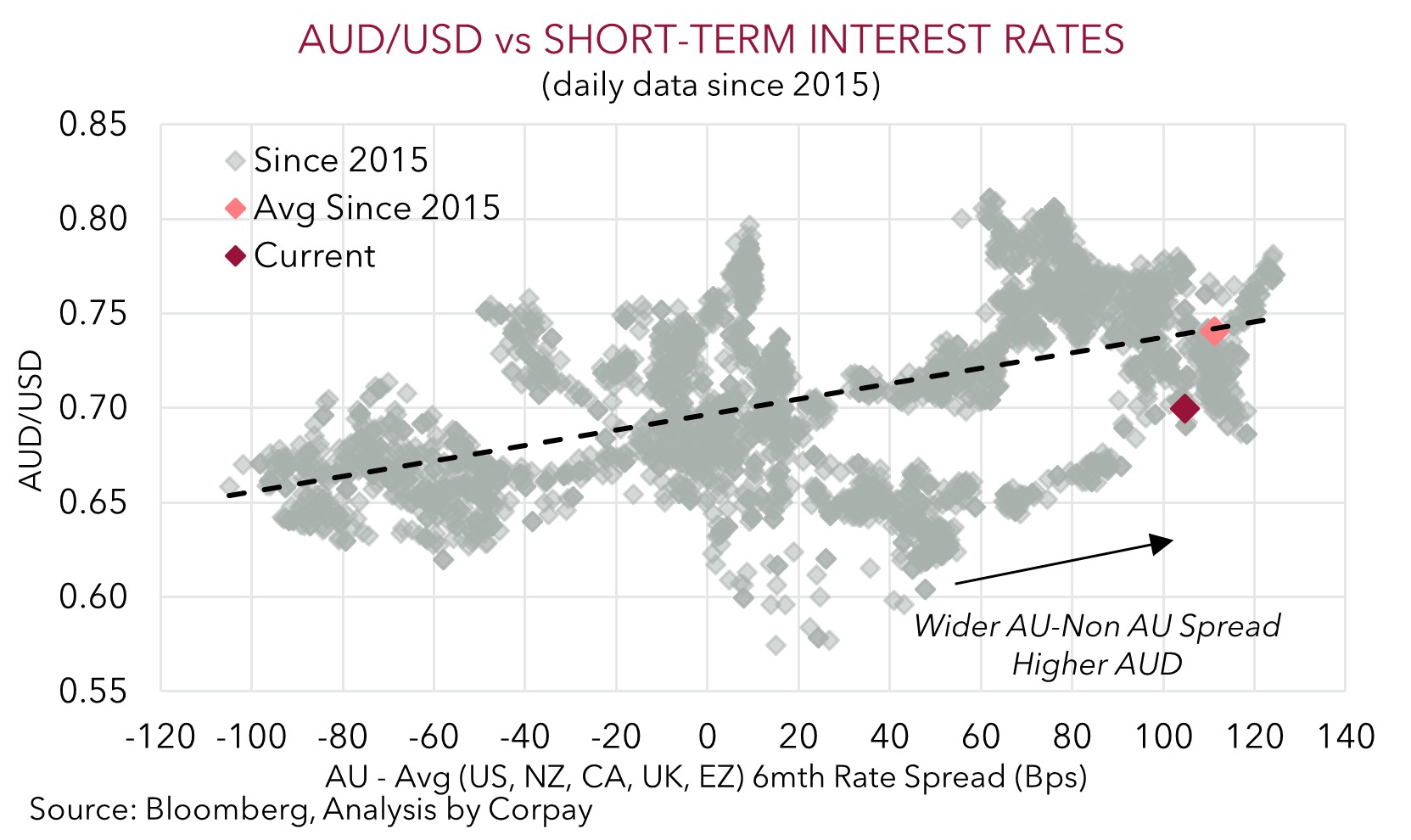

The AUD (now ~$0.6997) has given back its modest RBA rate hike uptick, although it remains at the higher end of its 3-year range. The AUD was mixed on the crosses over the past 24hrs with small falls versus EUR (-0.2%) and CNH (-0.2%) offset by gains against NZD (+0.5%) and JPY (+0.4%). AUD/JPY (now ~109.81) has rebounded sharply over the past couple of weeks, and hit a new cyclical peak overnight. We think AUD/JPY may have gone too far, largely due to our thoughts the JPY is too weak compared to underlying fundamentals. Indeed, relative interest rate spreads suggest AUD/JPY should be closer to ~90 rather than ~110 (a level it has only been above in 3% of trading days since 1988).

With respect to the RBA and AUD, we believe this week’s 25bp hike won’t be the only adjustment with the high level of activity across the economy and sticky inflation pointing to at least one more rate rise. We think it could happen at the 5 May meeting, after the release of the next quarterly CPI. That said, there is a risk the RBA lifts rates even further to break the back of inflation. However, that will have a negative economic impact with growth set to slow and unemployment likely to move up. The shift in relative interest rates in Australia’s favour should be AUD supportive over the medium-term, in our view, and points to the AUD tracking in a higher average range than the past few years. But with the negative economic effects of higher interest rates set to materialise down the track we continue to think ~$0.71-0.72 may prove to be a ceiling for the AUD. For more see Market Musing: RBA – Back in the inflation fight.