• Headline noise. Markets continue to take geopolitical/macro developments in stride. US equities rose overnight. AUD ticked higher.

• US Fed. Investigation into Fed Chair Powell raises concerns about central bank independence. US CPI out tonight. US retail sales due later this week.

• AU data. Household spending firmer than expected. AU jobs data (22 Jan) & Q4 CPI (28 Jan) important for RBA. A February rate hike is ~30% priced in.

Global Trends

A few geopolitical and economic crosscurrents such as developments in Venezuela and some US data have generated modest bursts of intermittent volatility over the past few weeks. But on net the headline noise has been taken in stride. Equities have pushed higher over early 2026 with the US S&P500 (+0.2% overnight) at record levels after only posting one negative day since the turn of the year. Elsewhere, the benchmark US 10yr bond yield has whipped around near the upper end of the range occupied since early-December (now ~4.19%). In commodities WTI crude oil has perked up recently but it remains below US$60/brl, while iron ore is north of US$108/tn and copper is near the top of its cyclical range. In FX, EUR is slightly below where it ended 2025 (now ~$1.1665), GBP has been range bound (now ~$1.3464), and USD/JPY has edged higher (now ~158.19). The NZD is hovering close to the middle of its 1-year range (now ~$0.5767) and the AUD has nudged up at the start of the week (now ~$0.6713).

Over the past 24hrs investors have had to navigate renewed questions/concerns regarding the US central bank independence after it was announced that the US justice department had launched a criminal investigation into Chair Powell about renovations to the Federal Reserve building. President Trump has repeatedly stated his displeasure at the level of US interest rates and the job done by Chair Powell (someone who he appointed in his first term). However, this move is unprecedented (it is the first time the DoJ has threatened legal action against a sitting Fed Chair), and as Chair Powell outlined in a response this has more to do with whether the Fed will be able to set policy on “evidence and economic conditions” or whether policy “will be directed by political pressure”. The latter is something that has traditionally been reserved for emerging market economies. Powell’s time as the Fed Chair is due to end in May. There is a chance these legal threats/processes work to strengthen the resolve of members of Congress to constrain the Trump Administration’s ability to reshape the Fed in a ‘less independent way’. Time will tell.

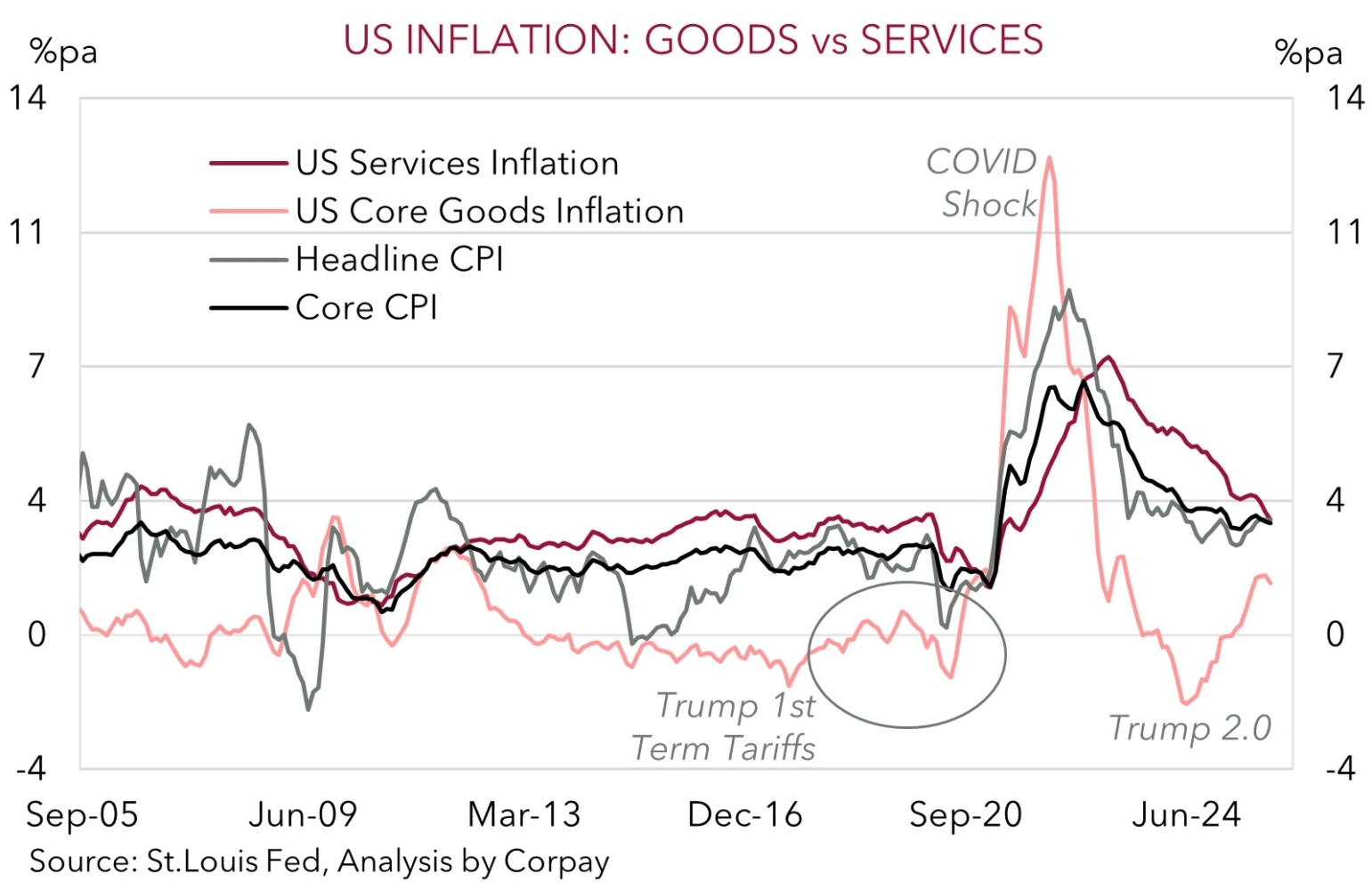

That said, the ructions about the Fed feed into our thoughts that over coming quarters the USD should gradually lose ground. In our opinion, the sluggish underbelly of the US economy and cracks in the jobs market point to the US Fed steadily lowering interest rates further over time. The step down in US interest rates could be compounded by investor concerns about Fed independence which generate potential capital outflows. More near-term attention will be back on the US economic data with CPI inflation (tonight 12:30am AEDT) and retail sales (Thurs 12:30am AEDT) on the horizon. A few government shutdown related quirks mean US CPI risks coming in a bit hotter than anticipated. If realised we believe this might give the USD a short-term boost, however we don’t expect it to be overly large or long-lasting due to the structural USD headwinds that are falling into place.

Trans-Tasman Zone

Despite the various geopolitical/macro headlines that have hit the wires over the past few weeks, asset markets have generally held up well (see above) and this has supported the AUD. At ~$0.6713 the AUD is ticking up towards the top of its 1-year range with the AUD also performing well on the cross-rates recently. More specifically, AUD/EUR (now ~0.5755) is around levels traded last May, AUD/JPY (now ~106.19) is at a ~18-month high, and AUD/NZD (now ~1.1640) has pushed up towards the upper end of its multi-year range. In contrast to the AUD the NZD (now ~$0.5767) has slipped back a bit at the start of the new year, although this comes after a solid rebound over late-2025.

Over time, we think the NZD should grind higher (and bounce back a little against the AUD). In NZ, cyclical indicators for household spending and housing appear to be turning the corner. In time this should feed into the NZ jobs market, which itself can generate a positive feedback loop across the broader economy. This is the signal coming from the latest forward looking NZIER business opinion survey. As momentum improves we believe markets could start to factor in a series of RBNZ rate hikes for later this year. This could be a relative boost for the NZD over the medium-term.

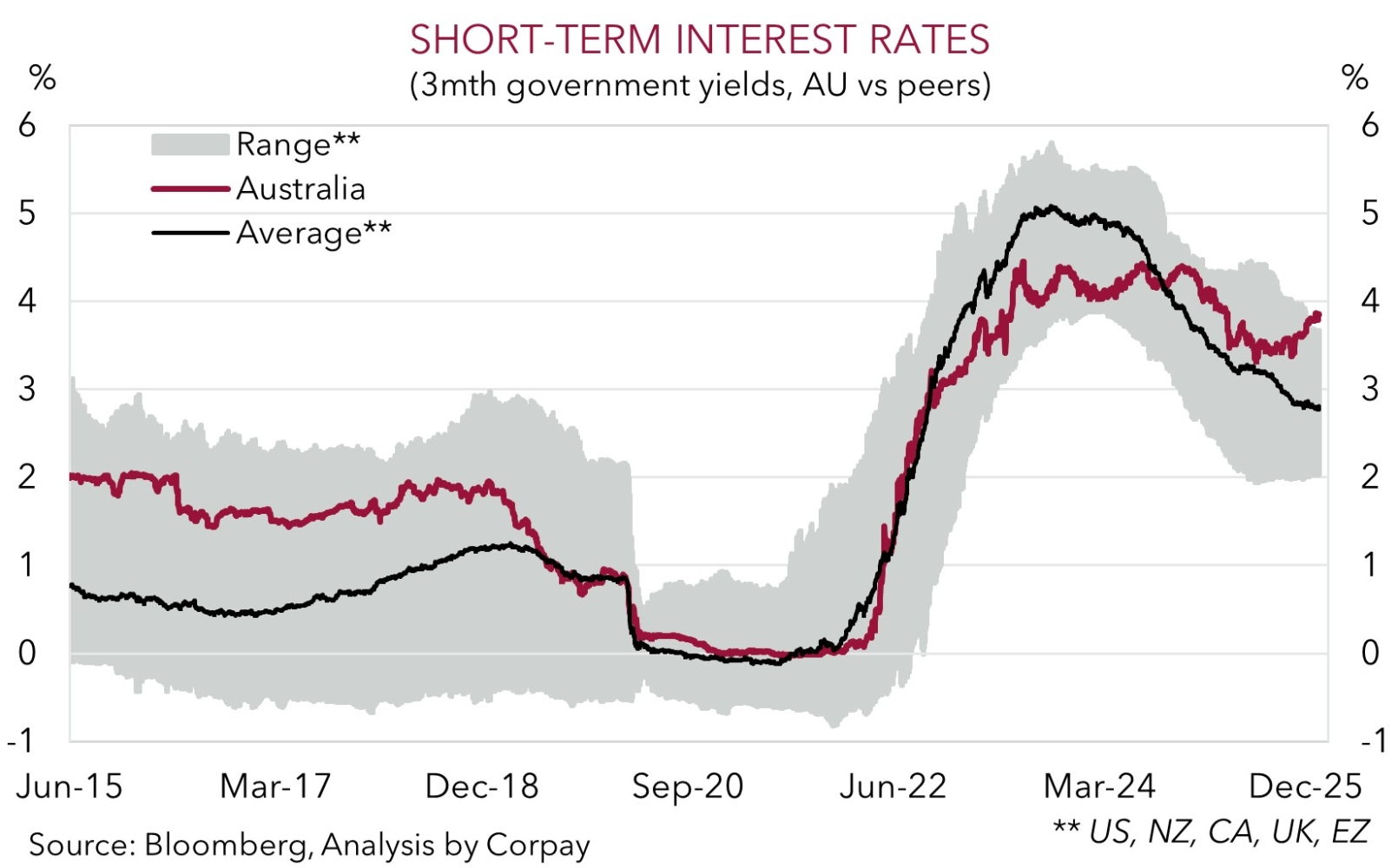

In terms of the AUD, yesterday’s reading on household spending for November (+1%mom, +6.3%pa) was stronger than predicted thanks in part to the Black Friday sales. Household spending looks to have strengthened over Q4. In our view, this is another sign that RBA settings might be too accommodative. US CPI inflation is out tonight (12:30am AEDT) and US retail sales are due later this week (Thurs 12:30am AEDT). Locally, December jobs figures (22 Jan) and the Q4 CPI report (28 Jan) are the last major releases the RBA will be looking at to see if inflation pressures are persistent ahead of its 3 February meeting. Markets are now pricing in a ~30% chance the RBA delivers a rate hike in early-February. We feel this could be on the low side as we think policy is not where it needs to be to get inflation sustainably back down to the mid-point of the RBA’s target band. While we believe a USD rebound on the back of firmer US inflation could weigh on the AUD a little near-term, barring a sustained deterioration in sentiment we don’t see pullbacks being overly deep. Over the longer-term, we continue to see the AUD grinding up into the high-$0.60s with more favourable yield spreads between Australia and others such as the US a factor. For more see Market Musing: RBA & AUD – Stars Aligning.