Financial markets are kicking off December in a turbulent fashion as policy tightening hints from the Bank of Japan nudge global rates higher and dull the dollar’s appeal. Ten-year Treasury yields are up nearly four basis points, equity futures are pointing to small early declines, and the greenback is slipping against a broad basket of peers ahead of the North American open.

The yen is outperforming its counterparts after Bank of Japan governor Kazuo Ueda appeared to lay the groundwork for a December rate hike. The currency advanced as much as 0.6 percent against the dollar this morning when Ueda acknowledged policymakers will consider the “pros and cons” of raising rates at its next meeting, saying “if the outlook for economic activity and prices outlined so far is realised, the Bank… will continue to raise the policy interest rate and adjust the degree of monetary accommodation,” while stressing that financial conditions would remain supportive even after a hike. He added that he had held “frank, good conversations” in recent weeks with the prime minister and economic ministers, a comment widely interpreted as a signal that Sanae Takaichi’s government had given political cover for tightening. Swap-implied odds on a move at the Bank’s December 19 meeting are holding near 82 percent, up from less than 60 percent on Friday, and rates are higher across the curve, putting pressure on yen-funded carry trades across the currency markets.

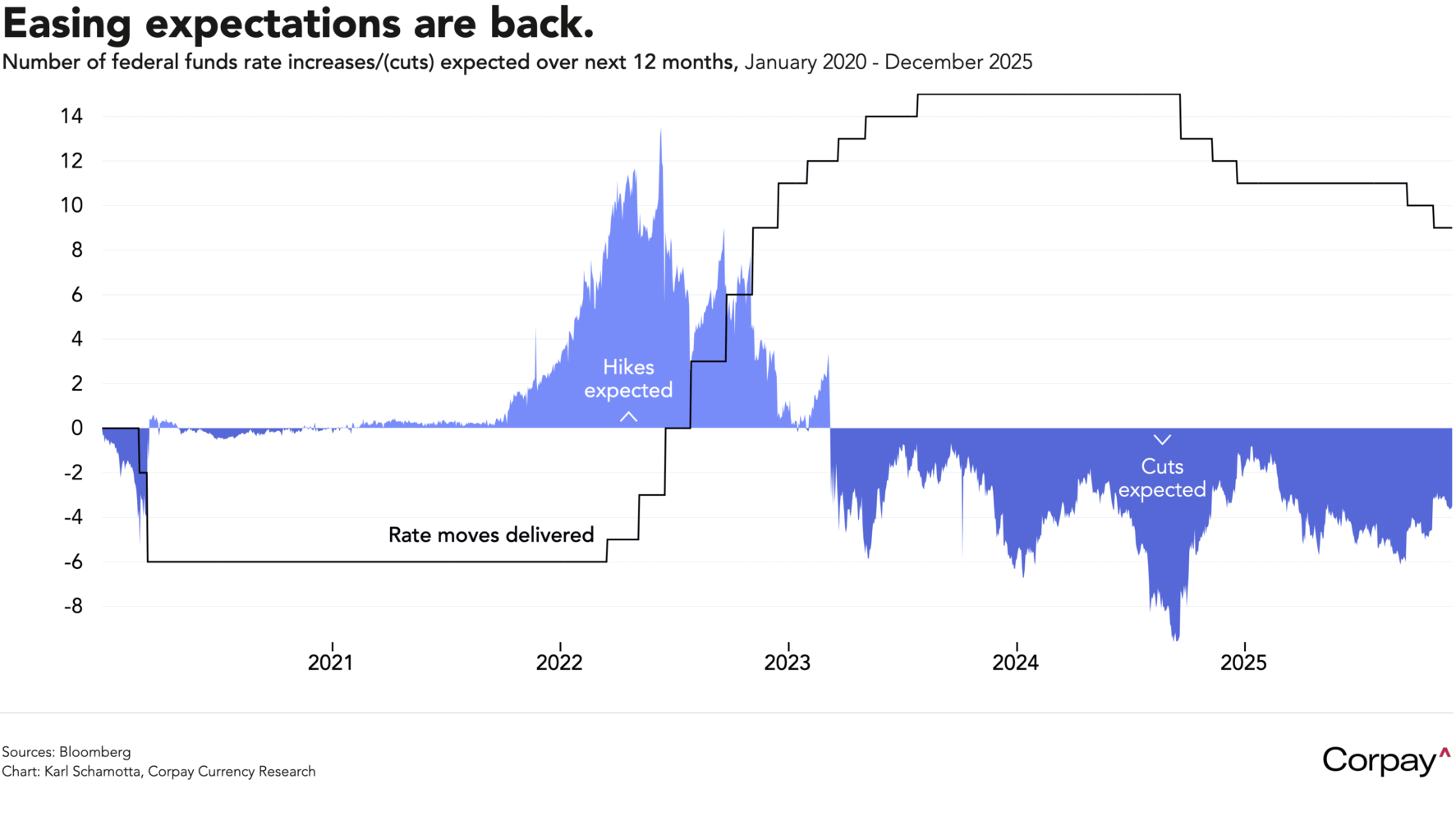

On this side of the pond, investors are now overwhelmingly positioned for a quarter-point rate cut at next week’s Federal Reserve meeting, followed by almost three more over the next year. Chair Jerome Powell warned such a move was not a “foregone conclusion” after the October policy decision, but the preponderance of private-sector indicators since then—reinforced by the Fed’s Beige Book—has pointed to downside risks in the labour market. That has been underscored by dovish remarks from a number of policymakers, including New York Fed President John Williams, who said he continues to see “scope for further adjustment in the near term…to bring policy closer to a neutral setting.”

Sentiment could shift several times over the coming week. US statistical agencies have said that they will not deliver more recent employment and inflation data until after the December 10 policy decision. Still, Black Friday and Cyber Monday results from major retailers will arrive alongside a raft of purchasing-manager surveys from the Institute for Supply Management and S&P Global, updated labour market snapshots from ADP and Challenger, the weekly jobless-claims figures, and the September report on personal income and spending. Confirmation of Kevin Hassett’s nomination as Federal Reserve chair could also impact near- and medium-term policy expectations, given his reputation as a Trump loyalist. Speaking to reporters on Air Force One last night, the president said “I know who I am going to pick… We’ll be announcing it.”

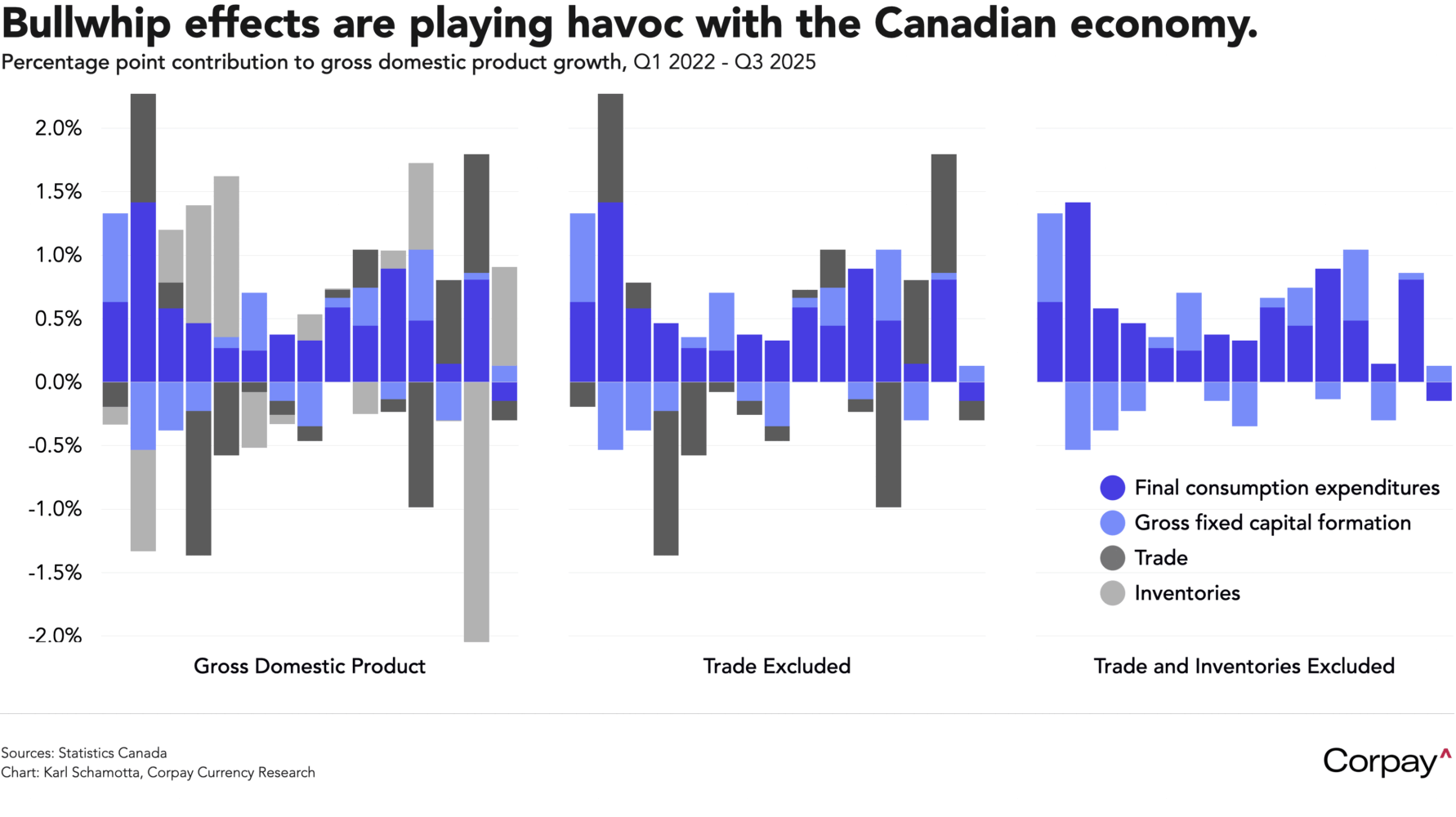

The Canadian dollar is trading with a firmer bias after Friday’s update showed the economy growing more quickly than expected in the third quarter, helping ratify market expectations for an extended pause from the Bank of Canada. According to Statistics Canada, gross domestic product expanded at an 2.6-percent seasonally-adjusted annual rate in the three months ended in September, beating consensus forecasts and marking a substantial improvement from the second quarter, which saw output contracting at an -1.8-percent pace.

We don’t see this as a game changer for the Canadian dollar… yet. Front-end USD-CAD rate differentials narrowed materially on the print, but details below the headline level remained consistent with an economy that is struggling to generate growth outside the public sector. Net exports generated the bulk of the gain as ‘bullwhip effects’ related to tariff front-running distorted quarter-over-quarter comparisons, and the cleanest read on underlying conditions—final domestic demand—contracted, suggesting that weak investment and household spending continued to generate serious headwinds. We do expect some stabilisation in the months ahead as government spending, the lagged impact of monetary easing, and reductions in trade uncertainty help boost activity, but suspect that it will take time before sentiment begins to shift on a more sustained basis. The Canadian dollar could remain oversold for at least a few weeks yet.

Tomorrow’s euro-area consumer price print is unlikely to move currency markets. With the “big four”—Germany, France, Italy, and Spain—already having reported, investors see inflation holding at 2.1 percent in the year to November, matching the prior month, and closely pacing the central bank’s 2-percent target. Traders are universally convinced the European Central Bank will stay on hold in December, and most see policy remaining on hold for at least a year. For now, we think the biggest opportunity for euro upside could come from meaningful progress toward a truce in the Russia-Ukraine conflict, not from domestic data releases.