Good morning. The dollar is outperforming all of its major counterparts as the aftermath of yesterday’s more hawkish-than-expected Federal Reserve minutes puts upward pressure on yields and weakens demand for speculative asset classes. Ten-year Treasury yields are inching higher, equity futures are setting up for modest losses ahead of the North American open, and the euro, pound, and Mexican peso are all coming under mild selling pressure even as rate curves shift upward in sympathy.

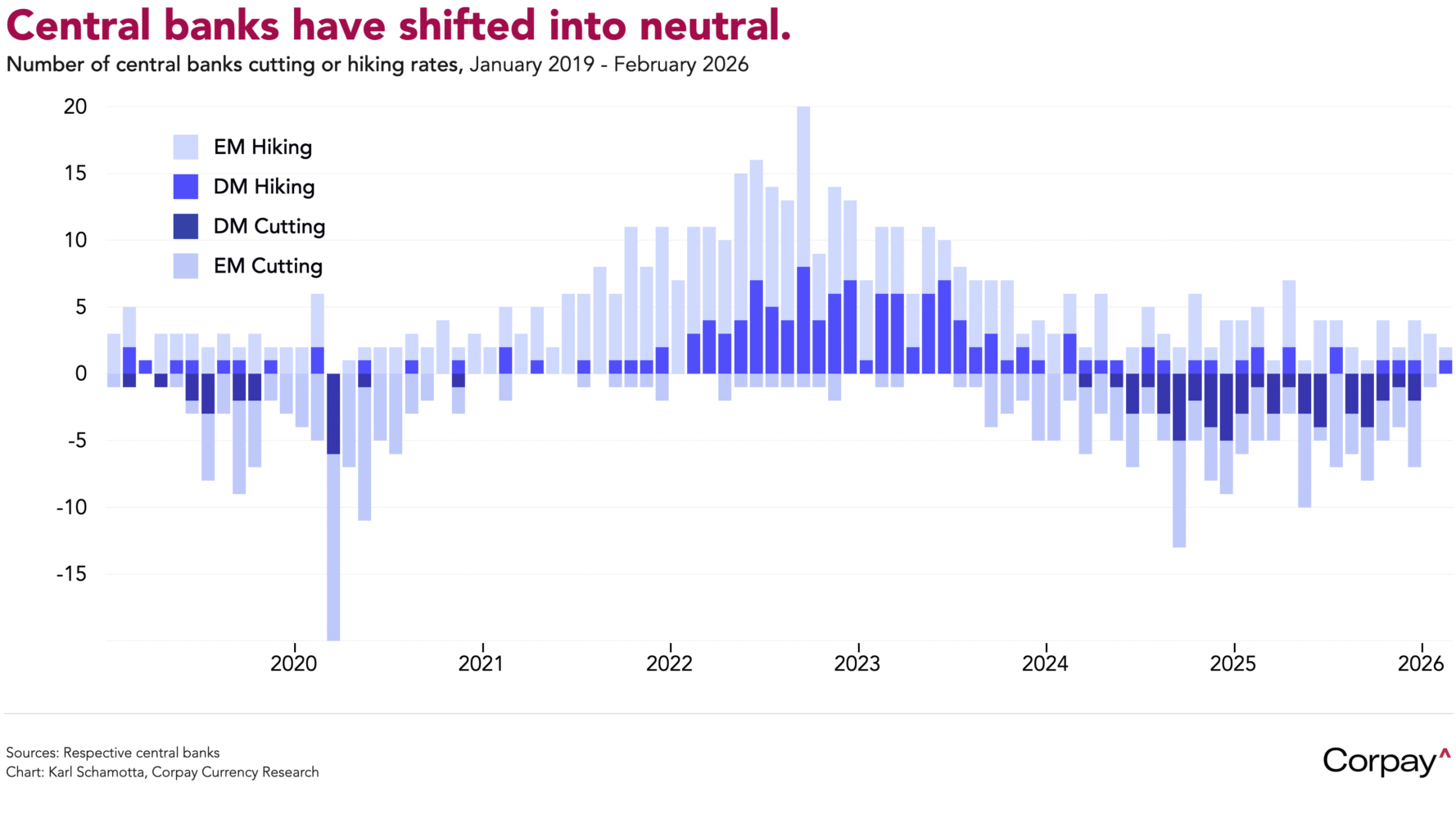

Federal Reserve officials showed little inclination to ease policy at last month’s meeting, with the bulk of the rate-setting committee hoping to see further progress on inflation before cutting again. According to a record of January’s meeting published yesterday, “several” officials said they were open to easing if price pressures continue to subside as expected, but Governors Miran and Waller remained the only participants lobbying for an imminent move, and others suggested changing the statement to reflect the possibility that rates could be hiked if “inflation remains at above-target levels”. Language describing the economic outlook turned more positive, with labour markets seen stabilising, growth accelerating slightly from last year’s below-trend levels, and financial conditions remaining loose. This modestly-hawkish turn mirrors a broader global shift: most central banks have moved toward neutral over the past year*, leaving the Fed as a relative outlier in considering further cuts.

The US goods and services trade deficit widened in December and fell just -0.2 percent in 2025 from a year prior, countering last night’s social media post from Donald Trump, which said that it had dropped by 78 percent and would flip into surplus territory in 2026. According to this morning’s update from the Census Bureau and the Bureau of Economic Analysis, the difference between US exports and imports climbed to -$70.3 billion in December, up -$17.3 billion from a revised -$53.0 billion in November, and significantly larger than the -$50-billion consensus estimate among economists. On a year-over-year basis, the inflation-adjusted goods** deficit hit record levels, and is expected to weigh on tomorrow’s fourth-quarter gross domestic product print, arithmetically lowering reported growth numbers.

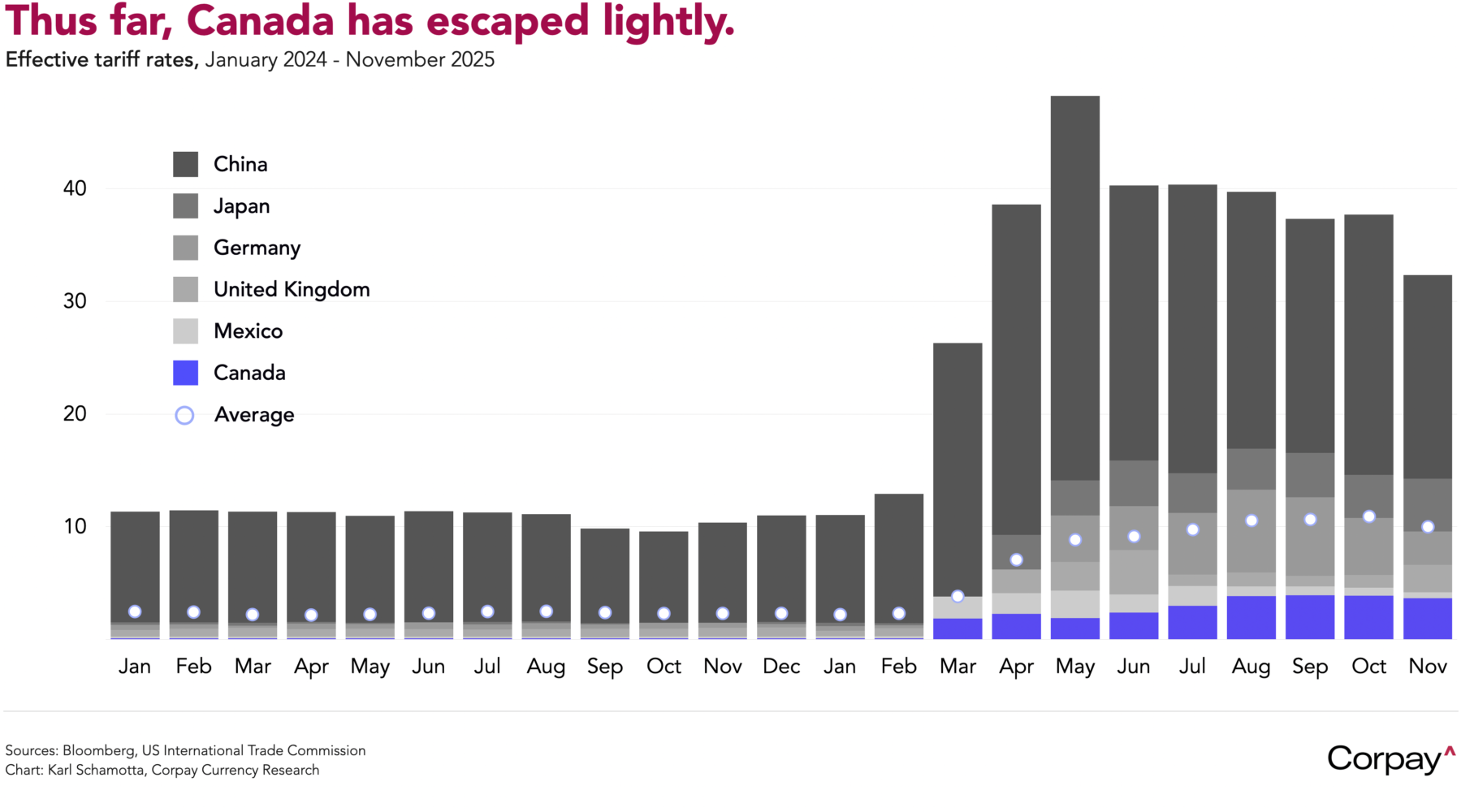

The Canadian dollar is trading sideways even after the New York Times said Trump is considering abandoning the USMCA trade agreement entirely in favour of bilateral deals with Canada and Mexico—an arrangement that might result in higher tariffs being applied to the country’s exports. It’s unclear whether the Times article was based on new reporting or simply summing up what is known about the administration’s internal discussions. Canada has thus far escaped the worst of the trade blow, with exports excluding unwrought precious metals down a modest 3 percent in 2025 relative to the year prior, and effective tariff rates remaining well below global averages, but officials on both sides of the border are preparing for acrimonious negotiations in the months ahead—and we think hedgers should be doing the same.

Oil prices are climbing as the US builds up military assets in the Middle East ahead of a potential attack on Iran. The global Brent benchmark is trading hands for $71 a barrel while the North American equivalent, West Texas Intermediate, is going for closer to $66. Global markets remain well supplied and OPEC members are sitting on considerable excess capacity that can be brought online in the event of a serious disruption, but traders are bracing for a more prolonged conflict than last year’s Iran-Israeli missile exchange. Although a serious US attempt to force regime change in Tehran remains an unlikely possibility, the risk premium embedded in prices is justifiably grinding higher.

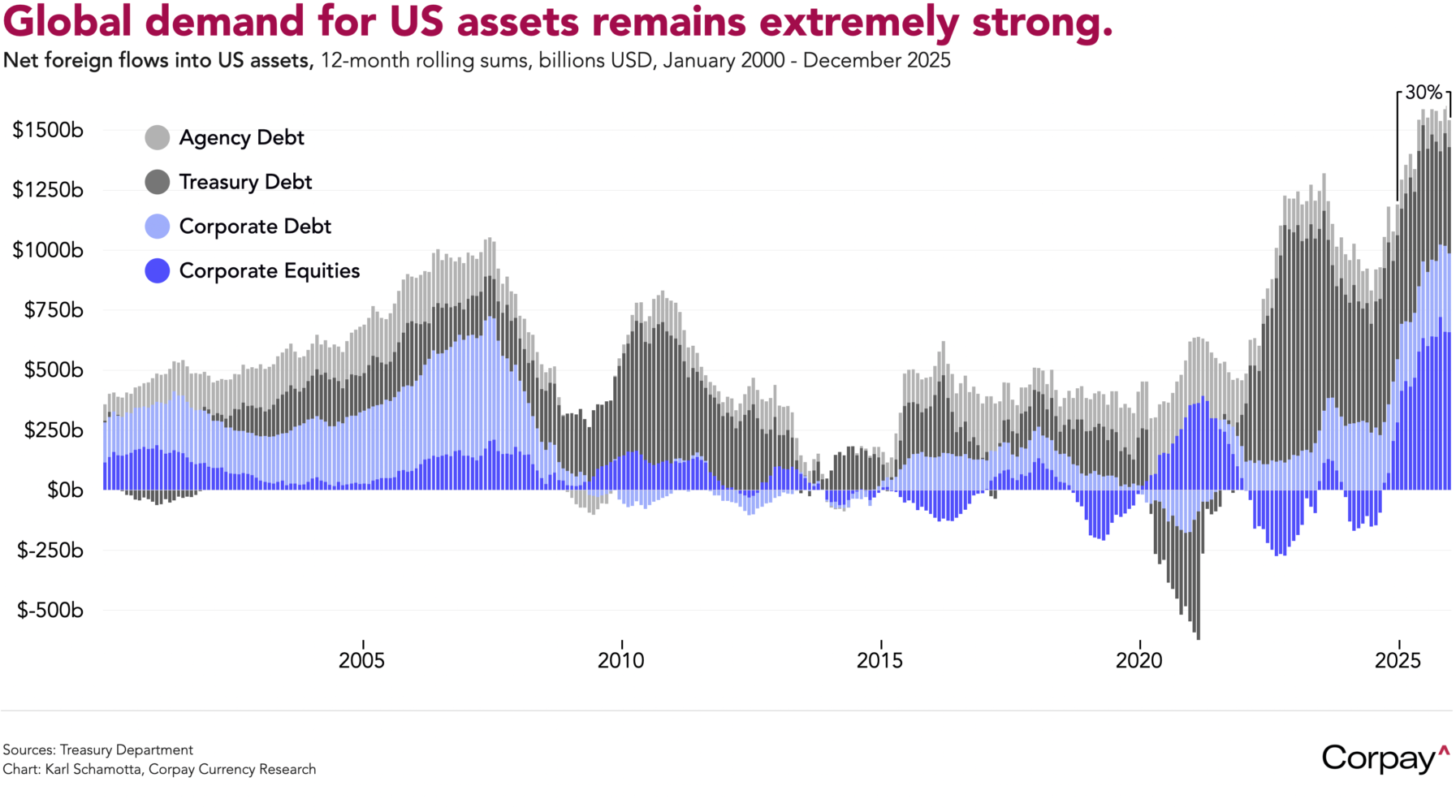

Demand for US assets ebbed in December, but remained near record levels on a 12-month rolling basis, casting doubt on the ‘Sell America’ narrative that dominated financial media through much of last year. Data published by the Treasury Department yesterday showed net inflows into US financial assets slipped into negative territory only once—during April’s ‘Liberation Day’ tariff debacle—and climbed almost 30 percent from the year before as investors chased soaring returns in the American technology sector. This supports our view that the dollar’s decline has been driven more by higher hedge ratios and long-standing “dollar smile” dynamics than by any broad reassessment of US exceptionalism.

*Note that a weekly-updated version of this chart is available on our site here

**Goods being the category targeted by tariffs*. Ahem.

***I’ll deliver a more precise breakdown of the numbers in tomorrow’s missive, but the data available thus far suggests that tariffs have delivered no appreciable reduction in US trade imbalances****.

****Yes, this is a footnote on a footnote. Don’t ever claim your FX guys aren’t capable of innovation.