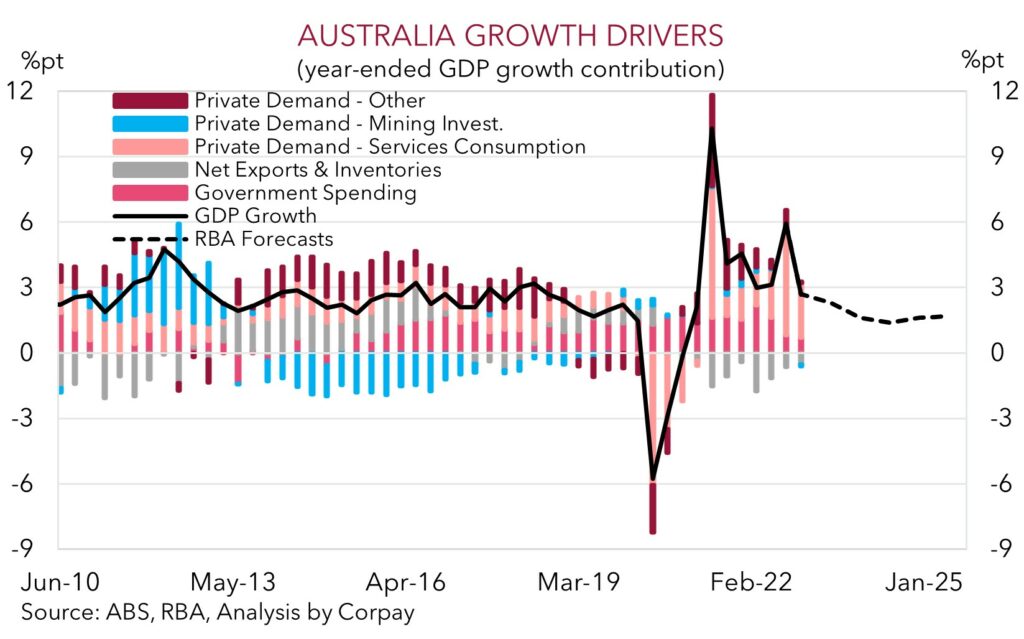

Q4 2022 Australian GDP was weaker than predicted. The domestic economy expanded by a sluggish 0.5% (mkt 0.8%), with annual growth stepping down to 2.7%pa. A closer look at the detail doesn’t paint that much of a rosy picture. Net exports were a large positive contributor to growth in Q4 (adding 1.1%pts to the quarterly result), thanks to a rebound in coal exports and travel services which were boosted by the inflow of tourists and returning students. Consumption of services was also positive once again, though the slowing trend suggests the post-lockdown catch-up spending on services has now largely run its course. By contrast, other areas of private demand were weak. Business investment, residential construction and housing, and consumption of discretionary goods all dragged on overall activity, as did a drawdown of inventories.

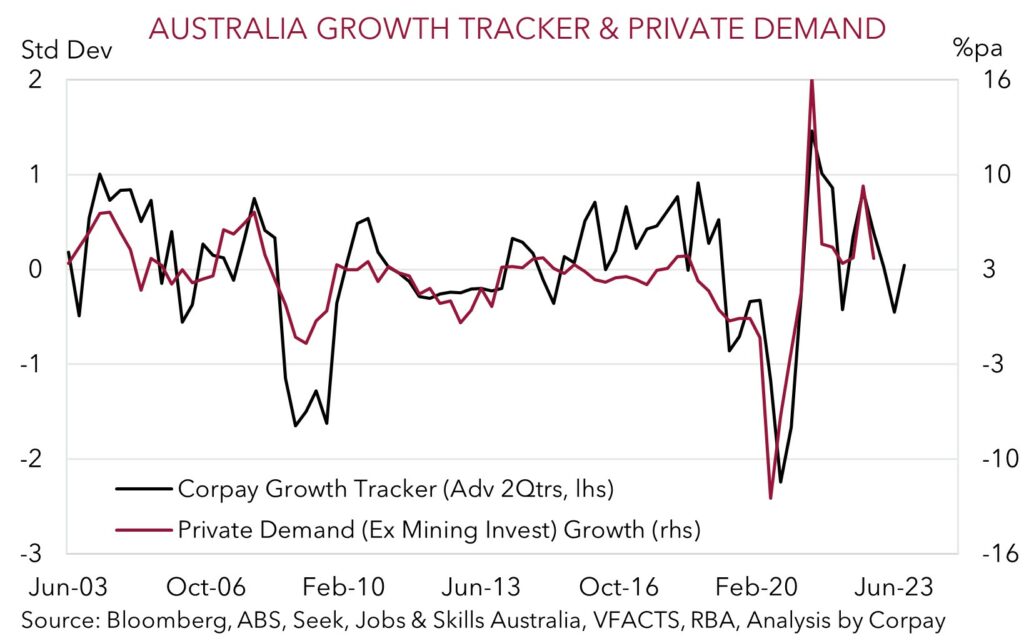

Australian GDP data is notoriously backward looking (we are now ~2/3’s of the way through Q1), but it is still very useful in providing a guide to the underlying picture across a broad range of areas, and helps us benchmark how domestic trends are unfolding compared with our thoughts. In our view, the outlook for slower economic activity over 2023 remains firmly intact. Our Private Demand Tracker is pointing to a material deceleration in private sector activity over H1 (see Market Musings: Navigating the minefield).

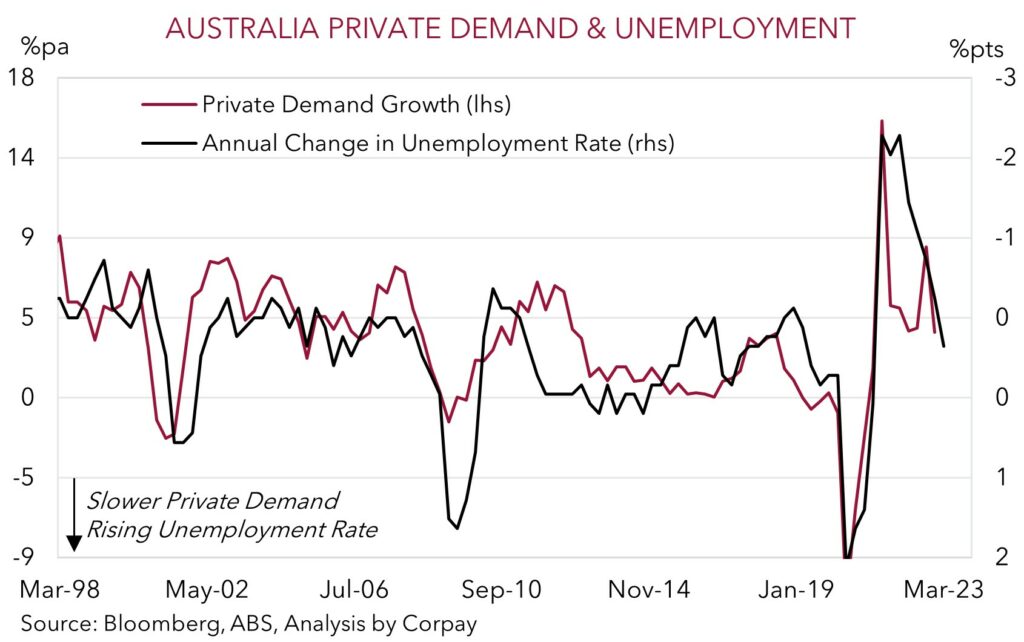

Breaking things down, we expect the sharp rise in interest rates, with a bit more to go, coupled with other cost-of-living pressures to weigh on household consumption over coming quarters, especially in areas of discretionary spending. The large fall in the household savings ratio in Q4 (down to 4.5%, below where it was pre-COVID) indicates many consumers are already feeling the pressure. At the same time, higher mortgage rates and the resultant reduction in borrowing capacity should continue to constrain new lending, housing turnover and in turn spending on goods, and push house prices lower. In time this is anticipated to feed through to residential construction. Overall, we are looking for the slowdown in private sector activity to spillover into the labour market, with the unemployment rate forecast to move higher over 2023. It is a hard pill to swallow, but this is the price that needs to be paid to bring inflation under control.

Domestic recession risks are rising, and we think the odds should lift with each RBA rate hike from here as every move pushes settings further into ‘restrictive territory’. However, while it is likely to be an increasingly difficult year for many households and businesses as higher mortgage costs gain traction, there are some offsets to consider which may hold up aggregate GDP and mask the deceleration across various parts of the private sector. CAPEX intentions remain elevated and point to solid business investment over 2023. Elsewhere, there is still a pipeline of residential construction and infrastructure work yet to be completed, China’s reopening should be supportive for exports and tourism, and the reopened international borders and re-accelerating population growth also looks set to supportive for GDP given it is a volume measure.

While the Q4 GDP and January reading of the monthly CPI indicator were a little weaker than markets were forecasting, we don’t think the results will stop the RBA from delivering on its guidance looking for further interest rate hikes over the next few months due to the solid labour market and fact inflation is still too high. Inflation looks to have peaked in late-2022, but at 7.4%pa the headline rate in January remains well above the RBA’s target band.

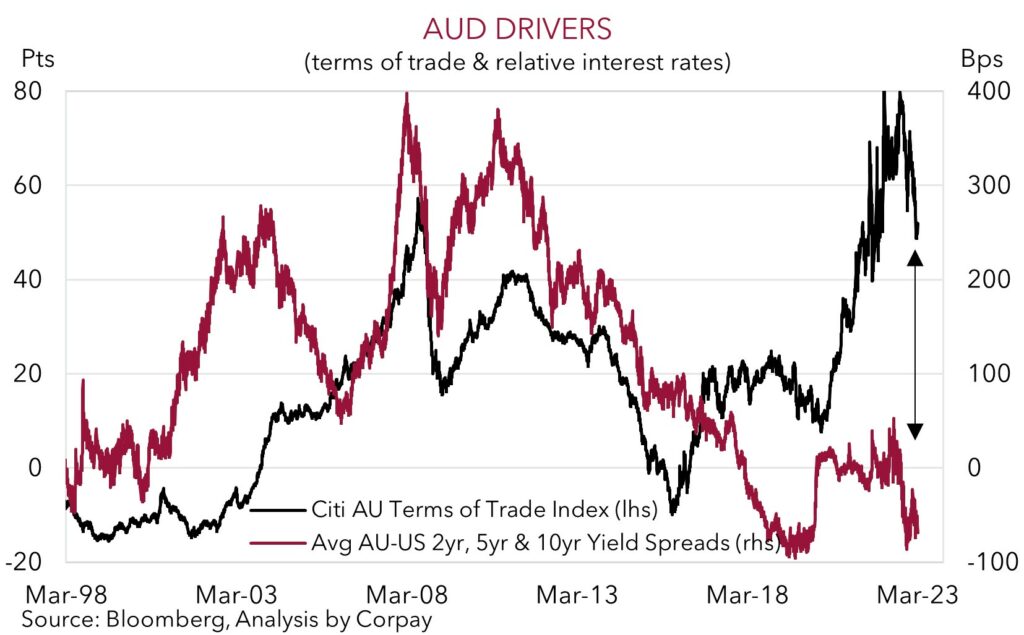

Market pricing has adjusted lower after the release of the Australian data, but at ~4.2% we continue to think expectations for how high the RBA could reach this cycle remain too aggressive given the sensitivity of the indebted household sector to rising interest rates and the other interconnected economic trends that are developing. We see the RBA cash rate topping out at ~3.85-4.10% over the next couple of months. In our view, relative interest rate differentials should remain in the USD’s favour because of the stronger and stickier US inflation pulse, and this can exert some further downward pressure on the AUD in the near-term, though we also continue to think the AUD should find solid support ~$0.66-0.67 on the back of the elevated level of commodity prices and China’s reopening. The large lift in the China PMIs in February, with the manufacturing measure jumping up to a multi-year high, illustrates that China’s economy is reawakening from its COVID hibernation.