The dollar is cruising toward an eighth consecutive day of losses—its longest losing streak since 2020—as the Japanese yen climbs and traders double down on expectations for an aggressive easing campaign from the Federal Reserve.

Japanese ten-year yields are holding near their highest levels since the global financial crisis and rate differentials are tightening in the yen’s favour after Bloomberg reported that Prime Minister Sanae Takaichi’s government wouldn’t oppose a rate hike at the Bank of Japan’s meeting on December 19. Odds on a hike have climbed to 89 percent from less than 17 percent in late November after Governor Kazuo Ueda on the weekend noted that policymakers would “consider the pros and cons of raising the policy interest rate and make decisions as appropriate”—echoing language used ahead of the Bank’s January move—but the yen’s upside has been relatively limited, suggesting that Takaichi’s spending plans are helping crimp demand for the currency. It’s difficult to know how this will play out, but it is worth noting that the last significant gap between rate differentials and the exchange rate—in July 2024—ended with an aggressive move higher in the yen, and a surge in volatility across global markets.

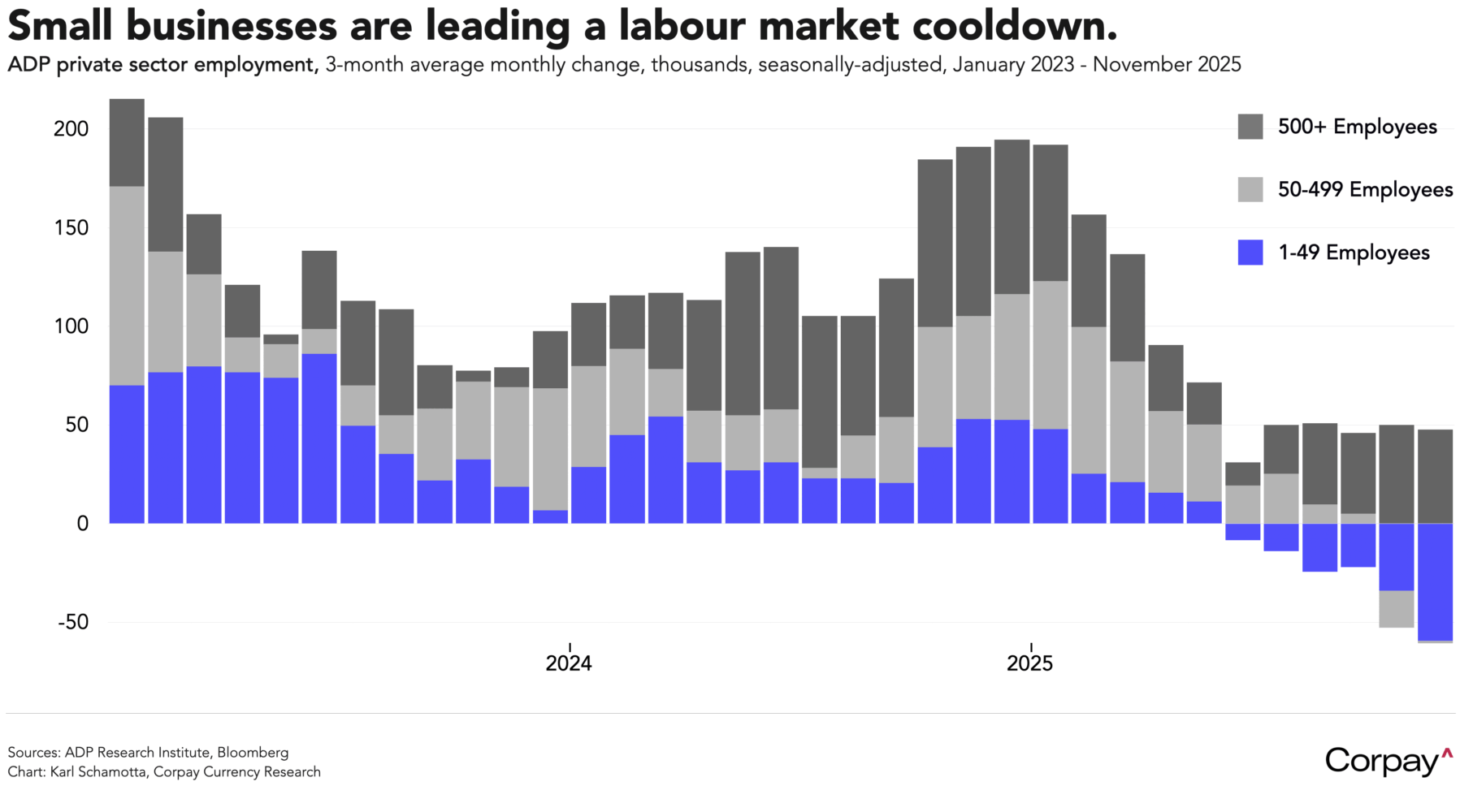

Yields fell and odds on a December rate cut climbed to near-certain levels in yesterday’s session after ADP said net job creation fell into negative territory last month, helping ratify official fears of a cooling in labour markets. According to the payrolls processor, the private sector shed 32,000 jobs in November, with losses concentrated among companies with less than 50 employees. Small businesses cut payrolls by 120,000, marking the worst month since the pandemic, and more than offsetting a 90,000-position gain among larger employers. The ADP report is not necessarily representative of broader job market trends—it tends to capture older, more established firms and has a flimsy relationship with non-farm payrolls numbers—but the softness will increase the focus on today’s weekly jobless claims data.

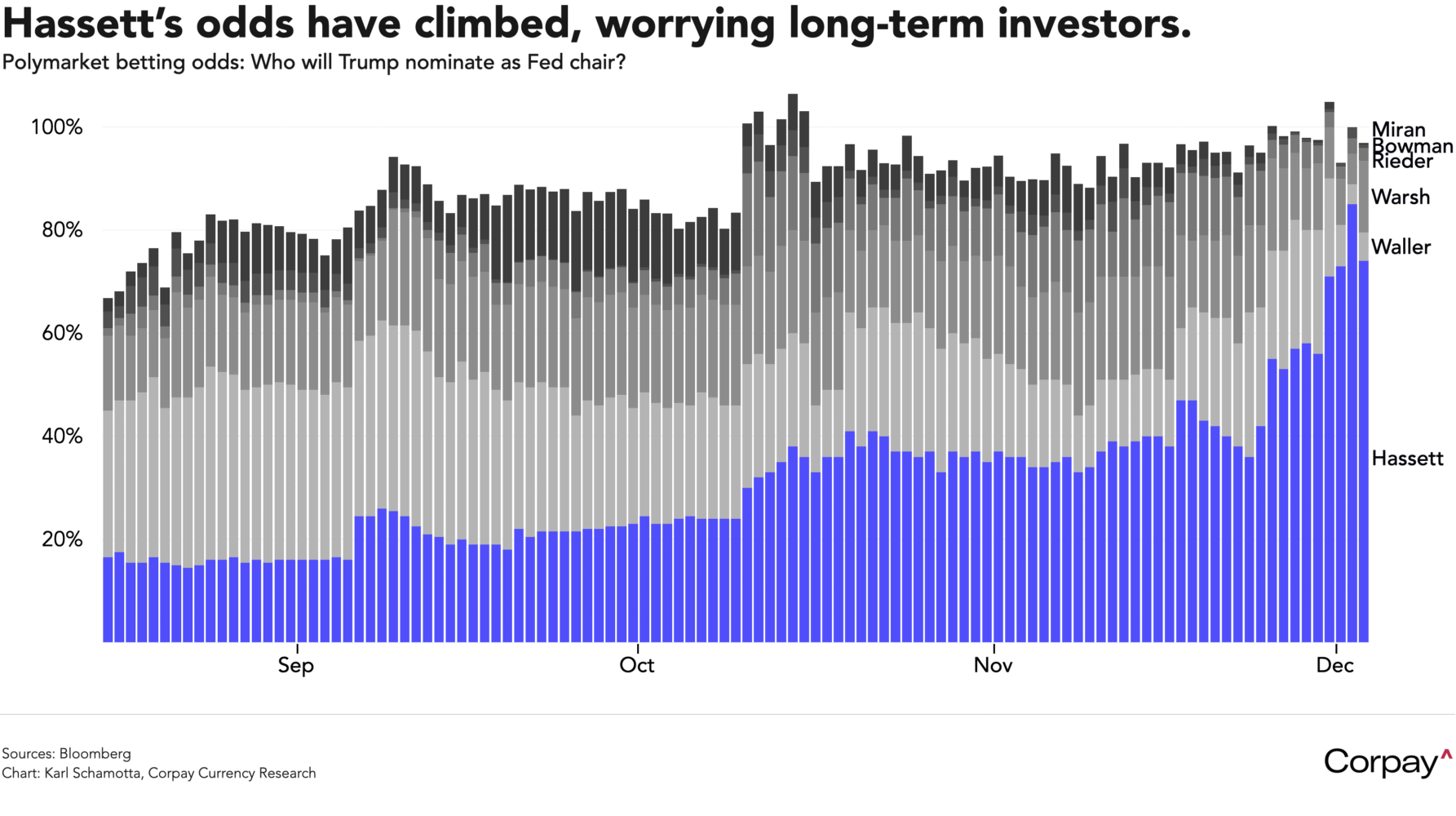

The dollar may also be weakening as investors grow more convinced that President Trump will elevate a political loyalist, Kevin Hassett, to the Fed’s top job. The president has pledged to name Jerome Powell’s successor “early next year,” and a drumbeat of well-sourced reporting has led prediction markets to anoint Hassett as the favourite, relegating rivals like Christopher Waller and Kevin Warsh to long-shot status.

But this conviction may prove short-lived. A remarkable scoop from the Financial Times yesterday revealed serious doubts were uncovered among major bond-market participants when the Treasury canvassed senior executives last month, with many suggesting that the Fed could trigger a rout similar to the one that felled Liz Truss’ government by easing policy too aggressively against a stubborn inflationary backdrop. Others echoed our own reservations, questioning whether Hassett’s overtly-political profile would afford him the credibility to forge consensus across an increasingly fractious rate-setting committee, or to communicate policy shifts with sufficient authority. We suspect that Scott Bessent is acutely aware that a Hassett nomination could push long-term yields higher, and that alternative names on his short list may yet emerge as serious contenders.

Still ahead: the US will publish weekly jobless claims at 8:30, and September’s personal-consumption expenditures price index tomorrow, giving Fed officials a last look at inflation dynamics ahead of next week’s meeting. Canada will also drop its latest job numbers tomorrow morning. This will undoubtedly trigger a move in the exchange rate, but market consensus is now overwhelmingly in favour of a hold at the December Bank of Canada meeting, and we don’t think any impact will last. For now, the loonie and most of its global counterparts will be driven by shifts in monetary policy expectations ahead of Wednesday’s all-important Fed meeting.