Good morning. The dollar is back on the defensive as investors digest weekend comments from President Donald Trump, who threatened tariffs on European countries that do not support his push to acquire Greenland and later sent a letter to foreign embassies linking the move to Norway’s refusal to award him the Nobel Peace Prize.

US markets are closed for the Martin Luther King holiday and liquidity conditions are thin, but the greenback is trading roughly a quarter-percent lower against a basket of its rivals, and the euro is climbing even as European leaders prepare a package of retaliatory measures. The Canadian dollar is little changed after December’s inflation report broadly met market forecasts, leaving expectations for the Bank of Canada’s policy trajectory effectively unmoved.

Global investors are clearly adding to the risk premium embedded in US assets, and diversification flows are picking up. But, as during last year’s “Liberation Day” episode, the surrounding rhetoric is becoming overheated. Over the weekend, some strategists, economists and media outlets suggested the EU could weaponise its US Treasury holdings to retaliate against the administration, reviving fears of a sell-off in the world’s most important bond market.

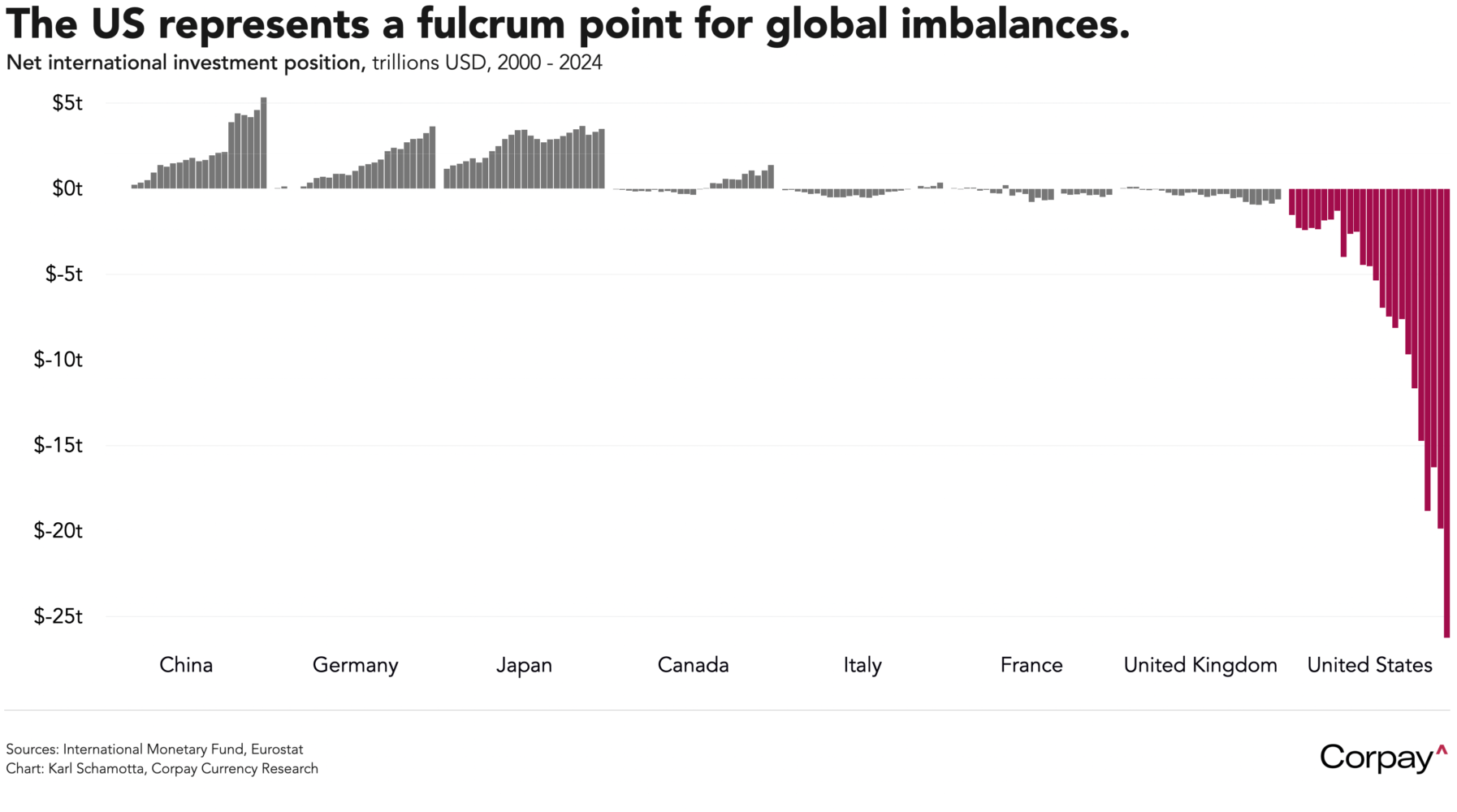

The claim that other countries could leverage their holdings has intuitive appeal. The United States is running vast trade and capital flow deficits that have driven the country’s net international investment position—the difference between what its residents own abroad and what foreigners own domestically—to an astonishingly-negative $26 trillion, with international holdings of US Treasury debt nearing $9.4 trillion. After several decades in which overseas investors played a key role in funding the US government, market and media narratives are well entrenched.

It is possible that Trump himself sees this as a credible threat, but the logic of international capital flows suggests that it is not:

Any entity selling US dollar-denominated assets into a politically-driven “fire sale” would suffer a serious haircut as Treasury prices fall and yields climb, and there’s little evidence to suggest that groups other than Chinese state-owned banks or Norway’s sovereign wealth fund could be compelled to take those losses.

An economic bloc selling US dollar-denominated assets and converting them into domestic currency would necessarily drive up its own exchange rates, damaging export competitiveness and generating other distortions.

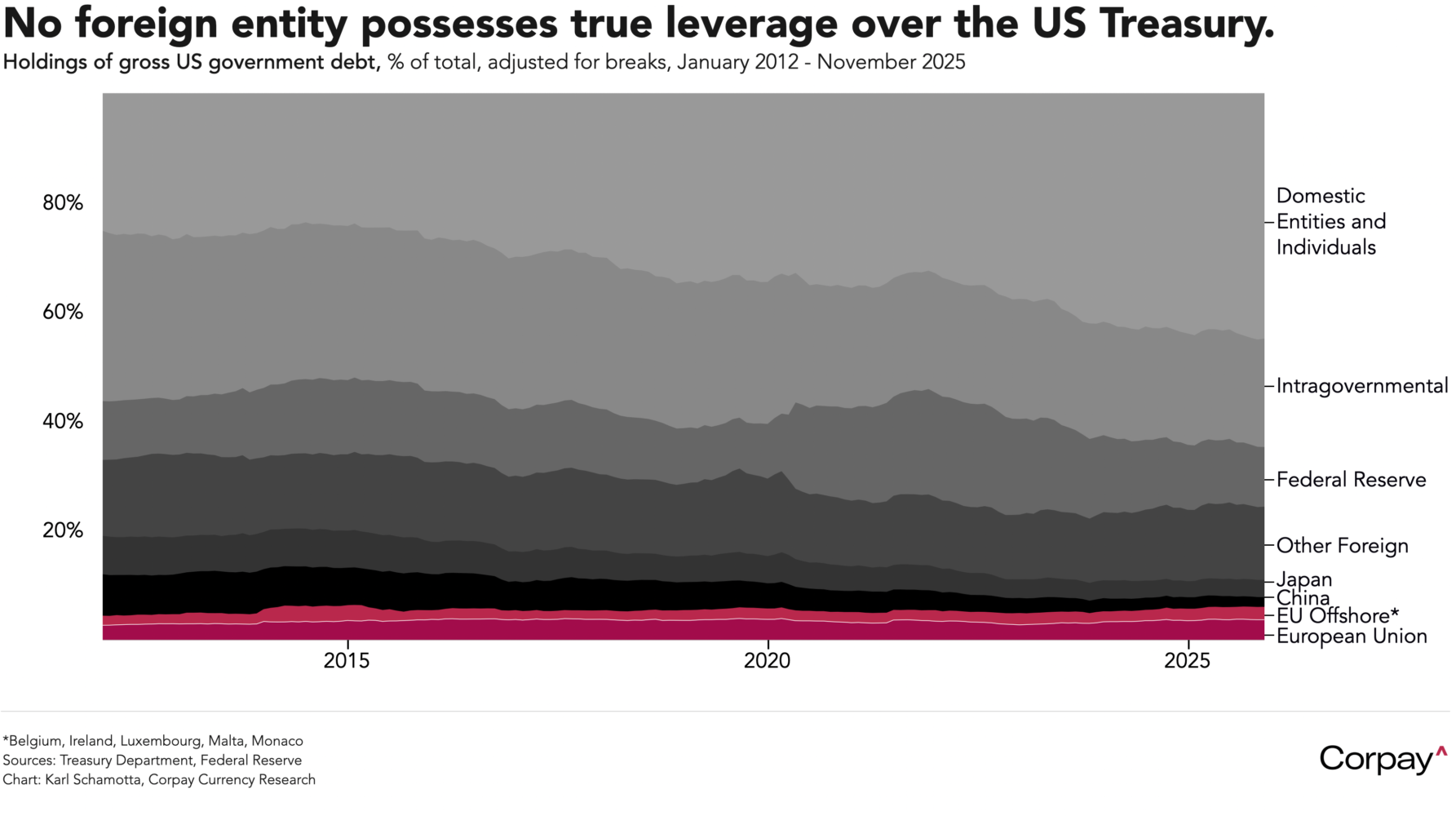

Ownership of the Treasury market has shifted considerably over the last decade, with Japan replacing China as the top foreign holder, and domestic investors taking a far larger share of issuance. No country or conceivable alliance of countries currently holds enough to outweigh buying activity among other market segments.

There are no alternative asset classes that match the depth, liquidity, legal certainty, and collateral utility embedded in US Treasuries—European, Japanese, and Chinese markets are all too small and constrained, and even the global gold market remains far too small. Foreign holders would struggle to find an alternative parking place for large-scale moves without incurring meaningful cost or risk

Treasury markets act as the linchpin of the global financial system, underpinning international trade financing chains and ensuring the smooth functioning of funding transactions across most major economies. Any country initiating an attack could easily find its own economy brought to the brink of ruin.

It would be well within the Federal Reserve’s mandate to act as a buyer of last resort in the event of a geopolitically-driven selloff in Treasury markets, and it has demonstrated that it has more than enough firepower to stabilise markets through asset purchases, repo facilities, and liquidity operations.

In my opinion, hedgers would be better served by discounting this narrative and focusing instead on the more durable economic consequences of rising government intervention and more policy uncertainty.