Good morning. Risk aversion is dominating markets as trading resumes after yesterday’s North American holiday. The dollar and safe-haven yen are extending their gains, two-year Treasury yields are sliding toward three-year lows, and equity futures are pointing to a weaker open as investors brace for a continuation of last week’s rotation away from AI-exposed businesses. Oil prices are slightly higher on reports that Iran has closed parts of the Strait of Hormuz for military exercises.

Here in Canada, inflation pressures eased more than expected last month. Data released by Statistics Canada this morning showed the headline consumer price index climbing 2.3 percent on a year-over-year basis in January, decelerating from the 2.4 percent increase recorded in December, and flatlining in month-over-month terms. Core inflation—which strips out food and energy prices—and is computed as the average of the two price measures now preferred by the Bank of Canada (trim and median), increased 2.5 percent over the same period last year, down from 2.7 in the prior month.

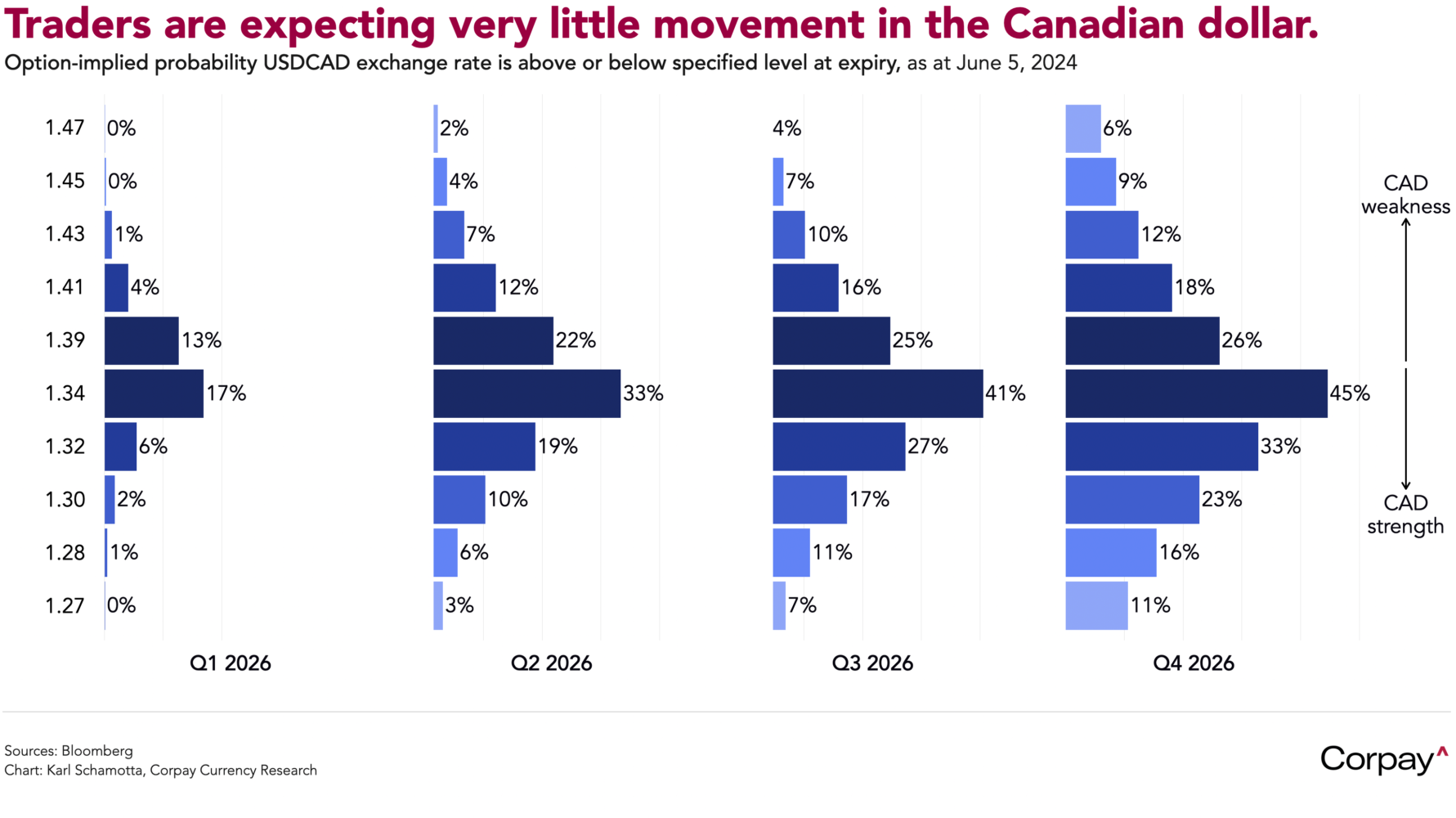

The monetary policy implications are minimal. Officials have clearly articulated a desire to leave rates unchanged for an extended period as they wait for greater clarity on the economy’s direction, and overnight index swap traders largely agree, with no movement seen by year end. Options markets are also pricing a prolonged range in the Canadian dollar, assigning low odds to a move outside the 1.33–1.39 band. That may prove reasonable if current assumptions on growth and US trade relations hold. But for hedgers, this subdued volatility backdrop offers an opportunity to buy inexpensive protection against adverse moves—the loonie has a extensive history of abrupt breakouts, and there’s little to suggest that the Trump social media account will remain quiet for long.

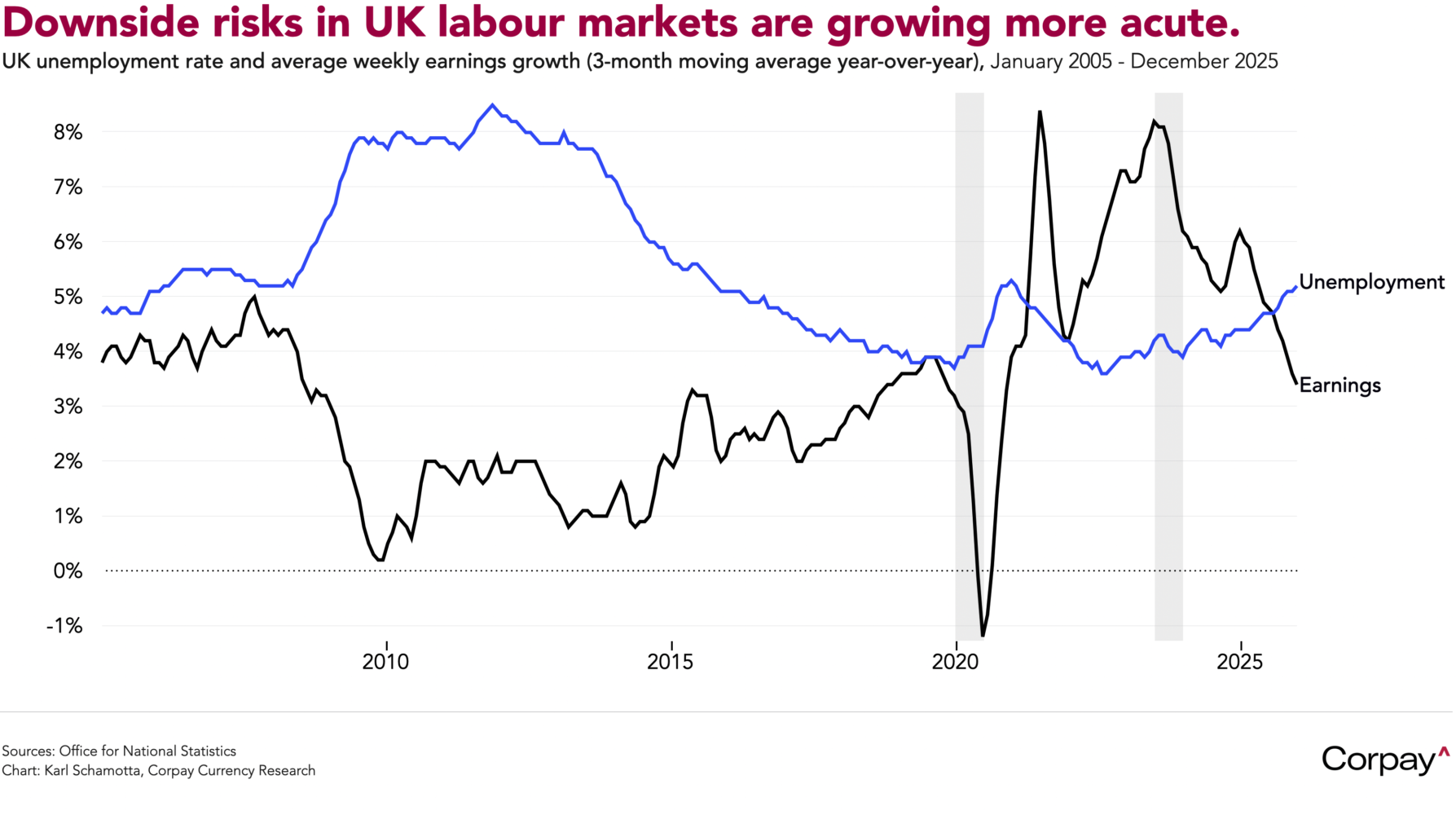

Sterling, meanwhile, is sharply lower after unemployment rose to a five-year high, reinforcing expectations that the Bank of England could deliver its next rate cut as soon as next month. According to data published this morning, the jobless rate climbed to 5.2 percent in the three months to December, topping market forecasts, while regular annual earnings growth in the private sector—a key measure of price pressure in the UK’s services-driven economy—fell to 3.4 percent, down from 3.6 percent in the prior month. Tomorrow’s inflation print is expected to show headline consumer price growth decelerating to 3 percent in January from 3.4 percent a month earlier, alongside softer core and services readings. After the Monetary Policy Committee narrowly held off easing earlier this month, markets now see a March “insurance” cut as increasingly likely, with an 80 percent probability priced in, up from 50 percent in late January.

Macroeconomic fundamentals have taken a back seat to political and market developments in driving currencies, but a number of releases in the days ahead could generate trading interest. Tomorrow, the Federal Open Market Committee will publish the minutes from its January meeting, offering insight into how firmly policymakers have shifted toward an extended pause. Friday brings the delayed December personal income and spending report, along with fourth-quarter gross domestic product. Economists expect a modest uptick in the Fed’s preferred inflation gauge, the core personal consumption expenditures index, alongside a solid growth print, but uncertainty remains over how the government shutdown and ongoing trade “bullwhip effects” could distort the headline figures. We will focus on the ‘final sales to private domestic purchasers’ measure, which strips out inventories, trade and government spending to provide a cleaner read on underlying demand.

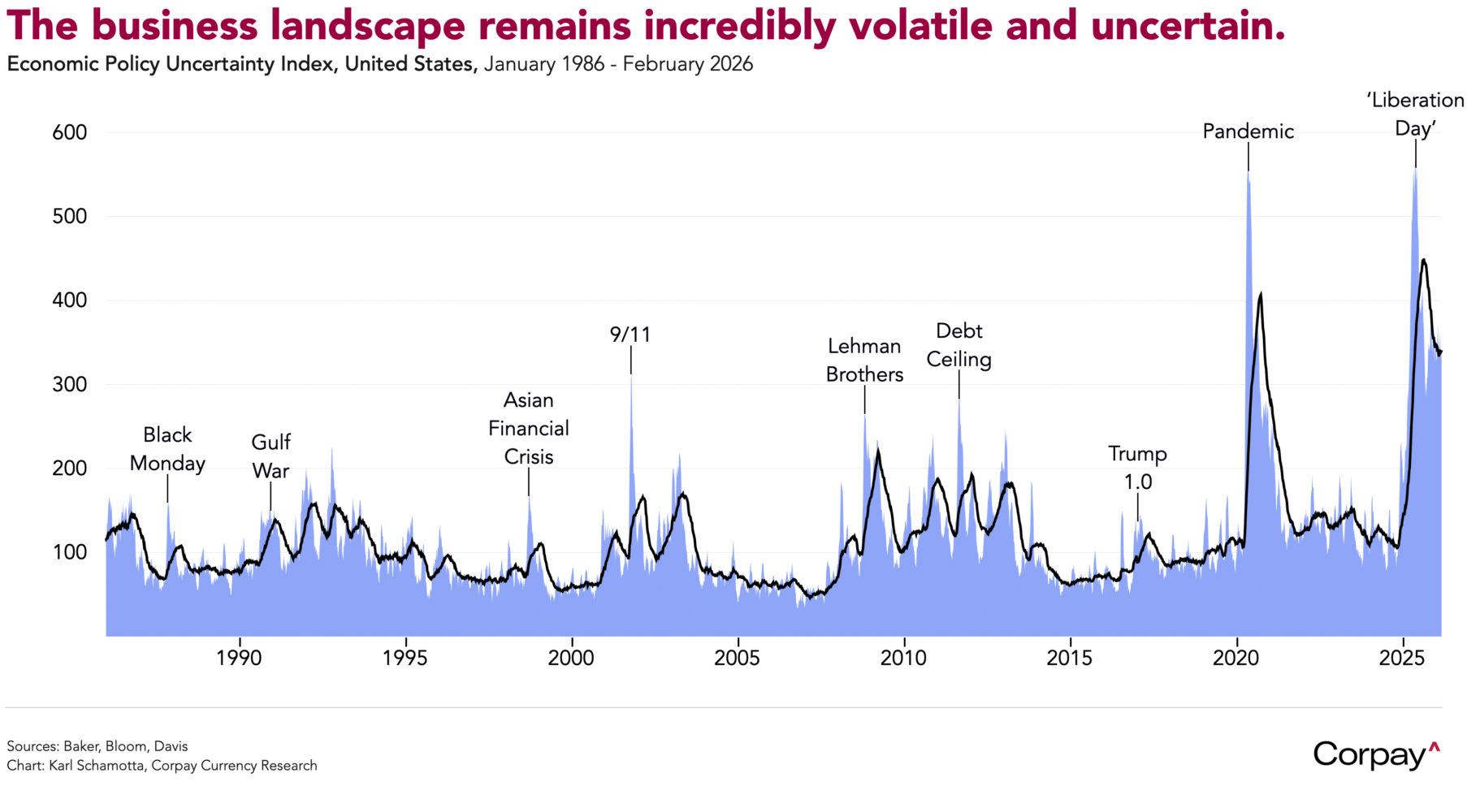

We’re also watching the Supreme Court, which is scheduled to release opinions this Friday, next Tuesday, and next Wednesday. A ruling against the Trump administration’s tariff regime is unlikely to be a game-changer for currency markets, since investors expect many levies to be replaced quickly. But it could reduce tail risks weighing on business investment and consumer demand, and ease policy uncertainty—which has remained near historic highs throughout the president’s second term.