Good morning. Foreign exchange markets are caught between conflicting forces as precious metals extend their decline and a sell-off in technology stocks shows signs of exhaustion. Gold and silver prices are tumbling once again, North American equity futures are setting up for modest gains at the open, and the dollar is advancing against most of its major peers amid choppy trading conditions.

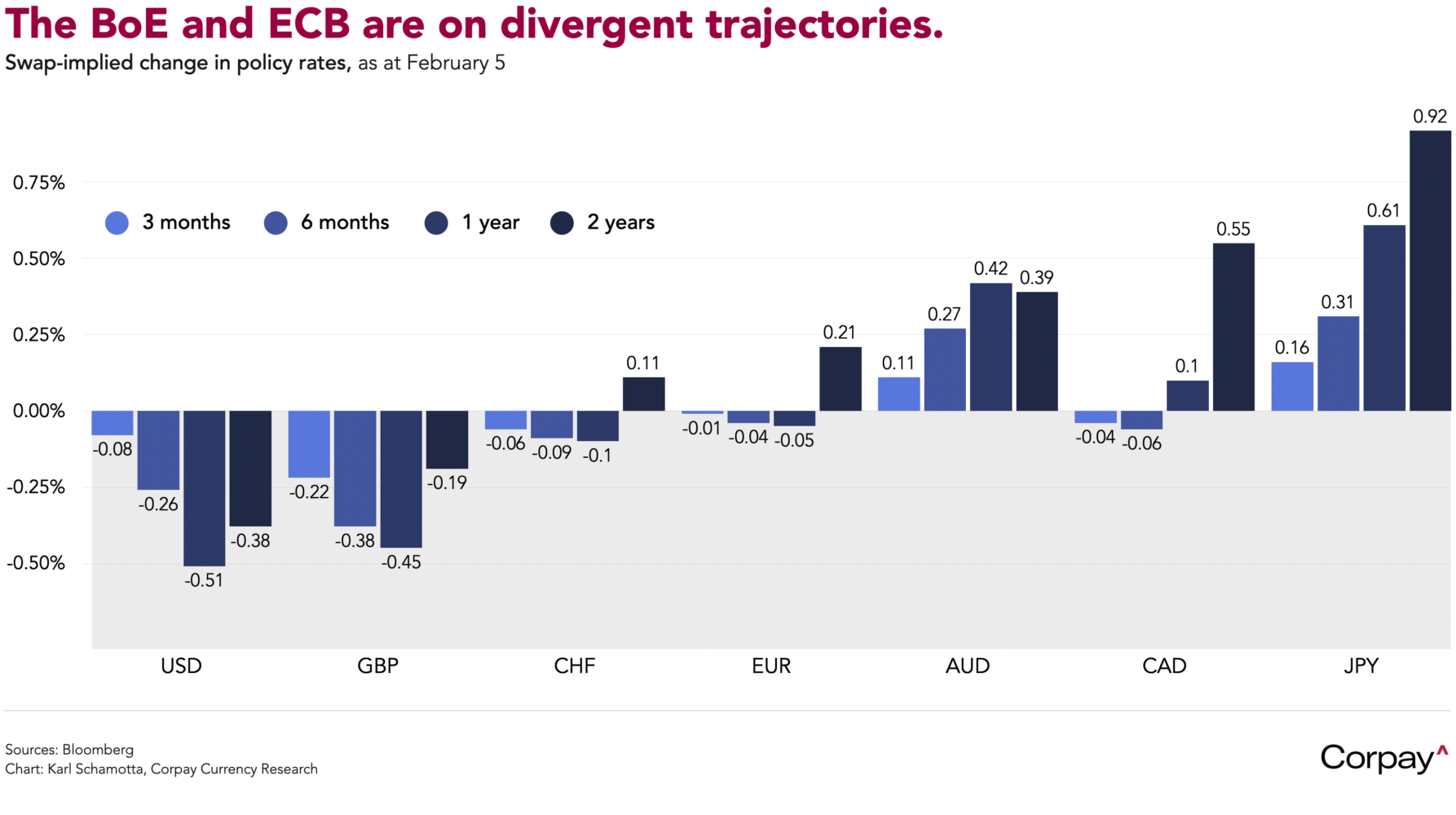

The pound is down sharply after the Bank of England narrowly avoided cutting rates in its latest decision, shocking observers expecting a far more neutral outcome. Four of nine Monetary Policy Committee members voted to cut rates—well beyond the two priced by markets in advance—while staff economists downgraded growth, employment, and inflation forecasts, suggesting that a more aggressive easing cycle is in the offing. An accompanying statement from Governor Bailey, who acted as the tie-breaker, said “Overall, the risks from inflation persistence appear to have continued to reduce. I therefore see scope for some further easing of policy”. Odds on a move at the March meeting have leapt from around 20 percent to more than 50, and swap markets are now pointing to roughly 45 basis points in easing by year end, up from 35 prior to the decision.

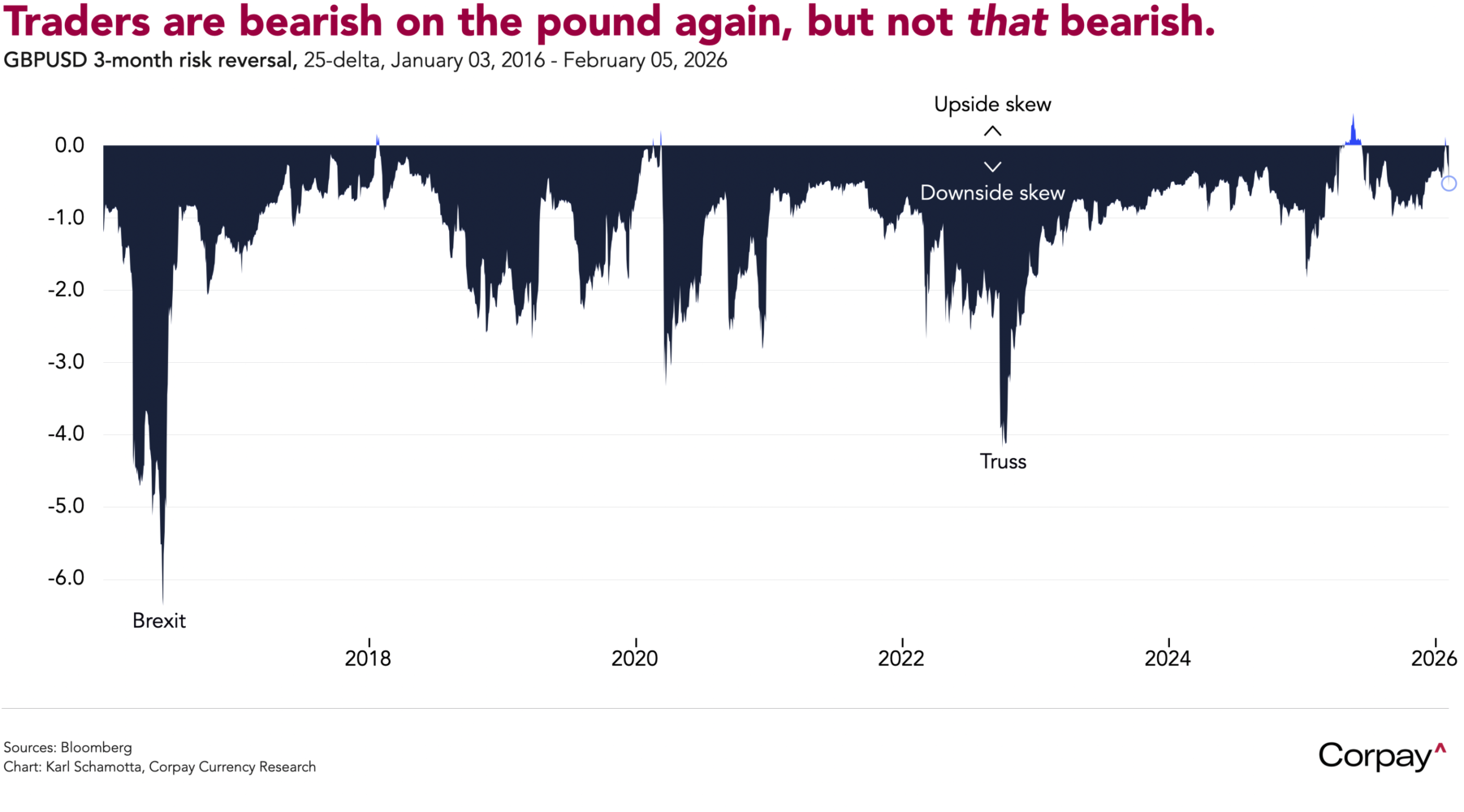

Sterling had come under selling pressure earlier in the session amid speculation that Keir Starmer could be forced from office before the end of his term. The prime minister has become embroiled in a row over his appointment of Lord Mandelson as ambassador to the US despite knowing of the latter’s links to Jeffrey Epstein, with betting markets now putting material odds on his early departure. Traders view Starmer and chancellor Rachel Reeves as relatively market-friendly figures within Labour, and credit the pair with stabilising gilt yields since taking office, but haven’t yet resigned themselves to a dramatic increase in downside risk. Three-month risk reversals—which use pricing differences between option puts and calls as a proxy for market positioning—have understandably turned bearish once again, but the embedded risk discount pales with recent history.

The European Central Bank surprised no one with a fifth consecutive hold and showed little discomfort with the euro’s recent appreciation. Officials said the economy remained “resilient in a challenging global environment” and warned that trade policy uncertainty and geopolitical tensions clouded the outlook, but left forward guidance unchanged, repeating that they were not “pre-committing to a particular rate path”. Growth is gaining momentum—particularly in Germany—and inflation is running just below target, giving policymakers little reason to adjust course. The euro is little changed and swap pricing is holding firm.

Traders expect the two central banks to remain on somewhat-divergent paths over the next year or two as British officials ease policy and their European counterparts stay on the sidelines. A narrowing in rate differentials is seen supporting the pound-euro cross on foreign exchange markets, but the dollar’s direction remains the major uncertainty facing both currencies.

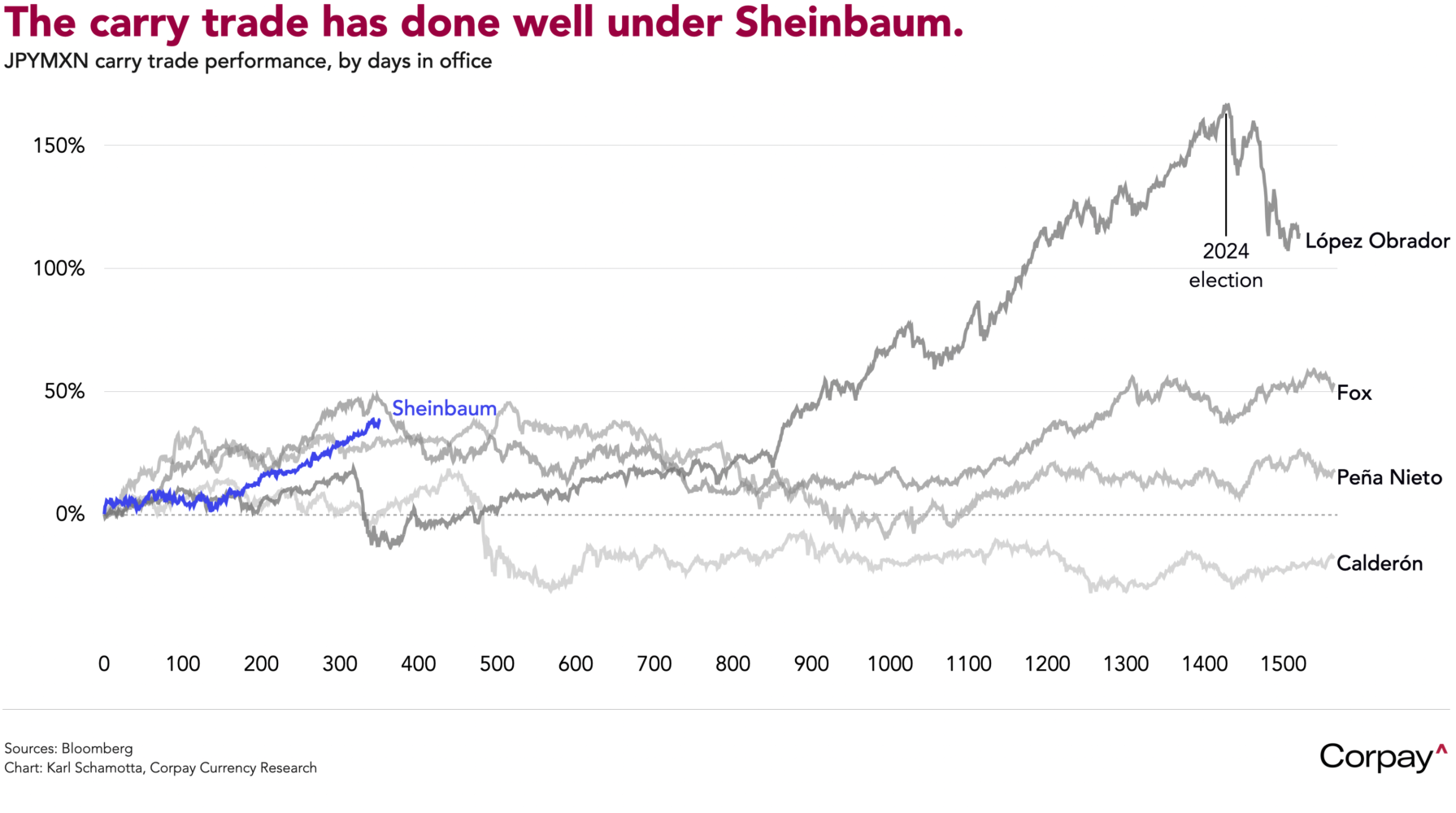

In North America, a reshuffled economic calendar should offer a number of tradeable opportunities in the days ahead. In the US, the December Job Openings and Labor Turnover report, due at 10:00 this morning, may show whether firmer growth is translating into stronger labour demand. Banco de México’s rate decision this afternoon should clarify whether policymakers intend to preserve the wide carry differentials that have supported the peso under Claudia Sheinbaum. Tomorrow’s Canadian jobs report will shed light on momentum heading into the new year and could shift one-year policy expectations if hiring again surprises on the upside. Finally, next week’s January non-farm payrolls report will be a key market catalyst, with direct implications for the Fed’s near-term rate trajectory.