Good morning. Foreign exchange markets are trading on a more stable footing as tumult in the precious metals complex eases and the White House leaves its social media accounts in a state of benign neglect. Gold and silver prices are up five and ten percent respectively from their lows, North American equity markets appear set for an advance at the open after yesterday’s higher close, Treasury yields are little changed, and commodity-linked currencies are reversing some of their weekend losses. The euro, pound, and yen are all trading sideways as investors await Thursday’s central bank meetings and brace for the weekend’s Japanese election.

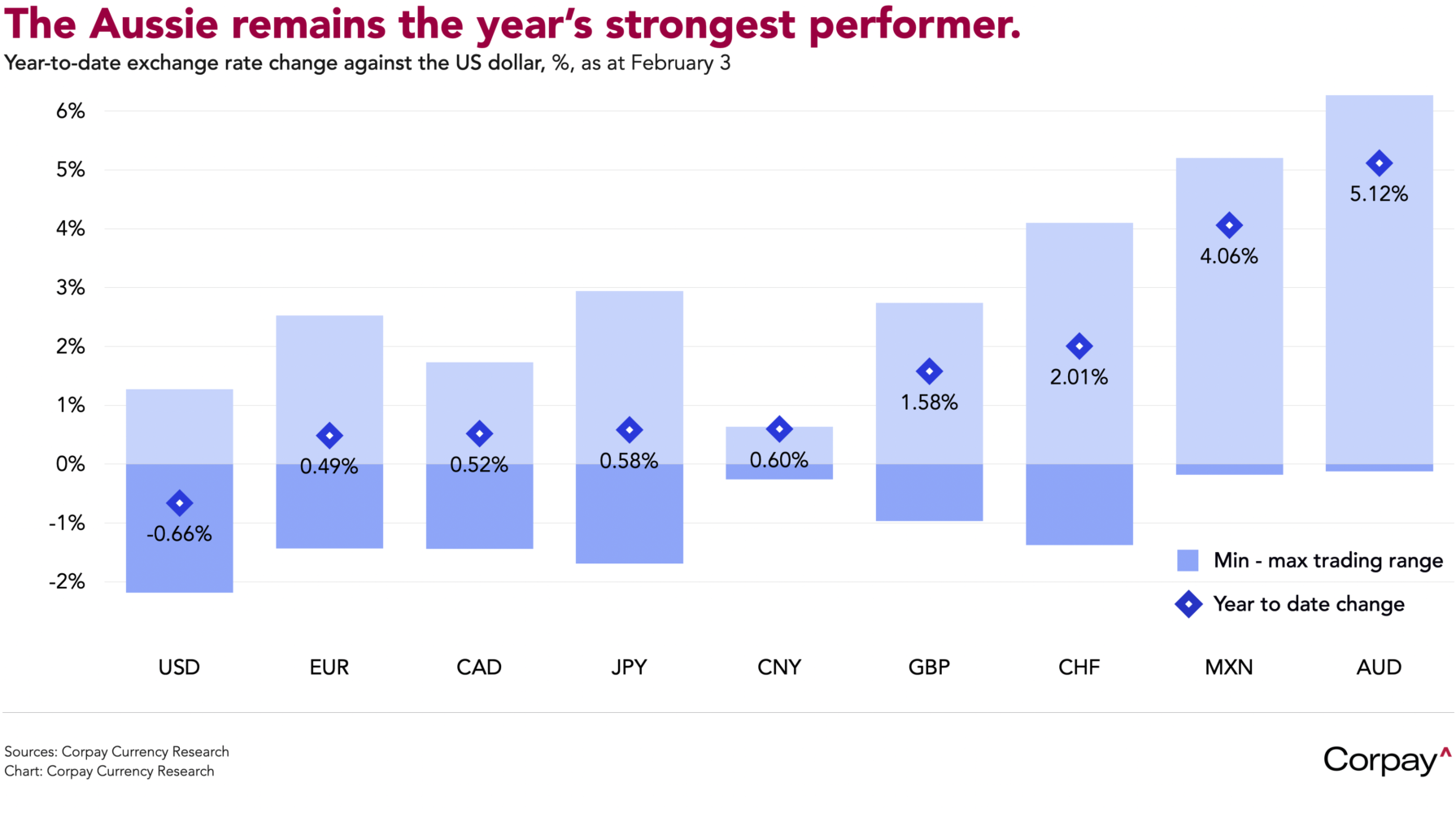

The Australian dollar is a clear outperformer after the Reserve Bank raised rates and published an updated forecast showing core inflation accelerating in the coming months—an outlook that should pave the way for at least one additional rate hike this year. The move reverses last year’s modest easing cycle and reflects tightening capacity constraints, but the read-across to global markets should be limited, given Australia’s unusual position in the world economy.

Although negotiations to end the US government shutdown appear close to a resolution, jobs data scheduled for today and Friday will be delayed. The Bureau of Labor Statistics said yesterday that both December’s Job Openings and Labor Turnover report and January’s non-farm payrolls will be held until government operations resume. Unlike last year’s shutdown, the data has been collected—meaning investors should not face a long wait, and analysts like myself will be spared gaps in our precious charts.

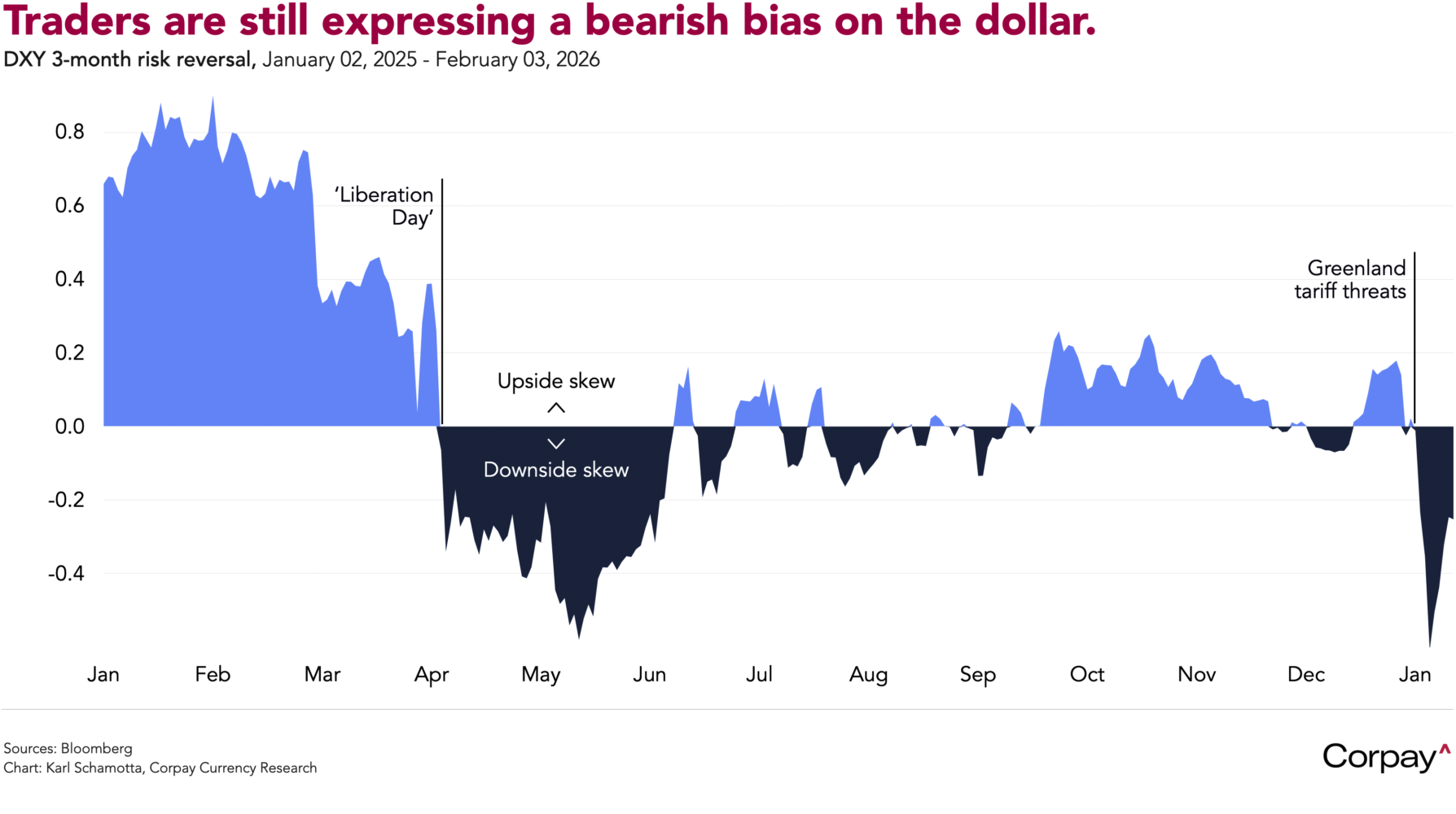

Continued dysfunction in Washington is weighing on the dollar. After a series of shocks, including April’s “Liberation Day” tariff announcement, threats over Greenland, and repeated policy reversals and shutdowns, confidence in US policymaking has taken a beating, and the currency is now trading at a wide discount to interest rate differentials and other measures of fair value. Risk reversals—which measure the difference between options that protect against upside and downside risks in the greenback—are back in firmly bearish territory, even after last week’s nomination of Kevin Warsh helped alleviate fears of an overly-aggressive easing cycle from the Federal Reserve.

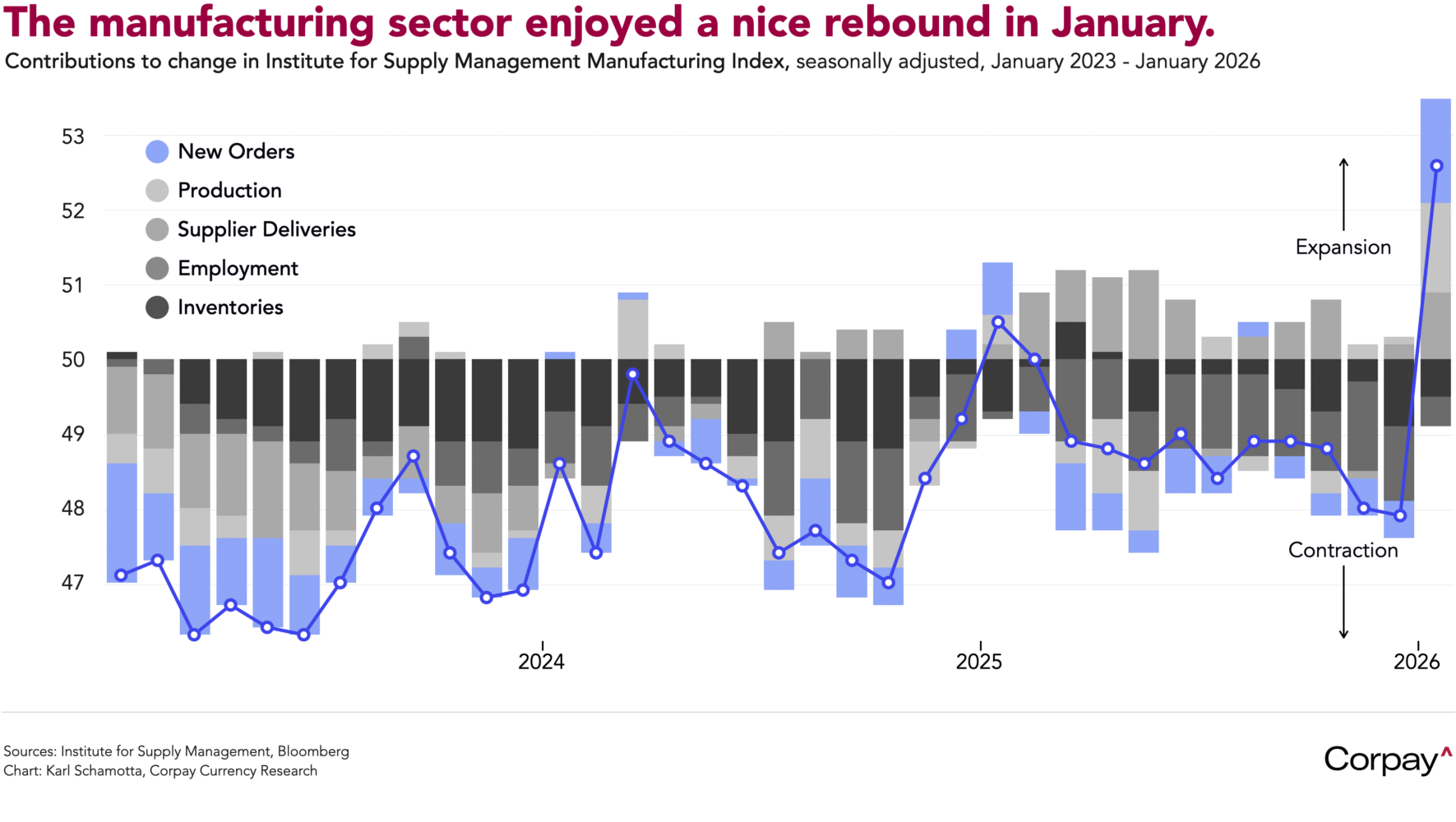

There’s no question that the outlook for US exceptionalism has dimmed, but the near-term case for the dollar remains strong, given the continued outperformance of American companies, the vast scale of government spending, the strength of consumer demand, and the implications for monetary policy. Data like yesterday’s Institute for Supply Management survey—which showed manufacturing activity expanding at the fastest pace in three years last month as new orders jumped—should warn market participants against expecting continued declines.