• Positive tone. Limited news flow. Upbeat market vibes continue. US equities rose again. Cyclical currencies like the AUD & NZD ticked up further.

• AU GDP. Australian Q3 growth data out today. Partial indicators point to solid private sector activity. This may bolster the case for no more RBA rate cuts.

• US data. ADP employment & services ISM out tonight. ADP is last major jobs report before next US Fed meeting. It could generate some USD volatility.

Global Trends

Modest moves across markets over the past 24hrs, though the underlying tone has remained upbeat. News flow has been limited, but the economic release calendar does pick up over the next few sessions which in turn might see volatility lift. In terms of the specifics US equities rose with the tech-sector leading the way (NASDAQ +0.6%, S&P500 +0.4%). After a bit of a torrid spell over the first half of November US equities have rebounded strongly with the S&P500 posting its seventh increase in nine sessions. Elsewhere, front-end US bond yields lost a little more ground with the 2yr rate shedding ~2bps to be back down at ~3.51%, near the lower end of its range. The USD has also slipped back with EUR nudging up (now ~$1.1623) and GBP consolidating (now ~$1.3210). The positive risk sentiment has helped cyclical currencies like the NZD (now ~$0.5735) and AUD (now ~$0.6565) extend their recent upswing. Q3 AU GDP is out today (11:30am AEST). USD/JPY also perked up a fraction (now ~155.86) with the positive JPY impact from BoJ Governor Ueda’s suggestions earlier this week that a December rate hike was ‘live’ fading overnight.

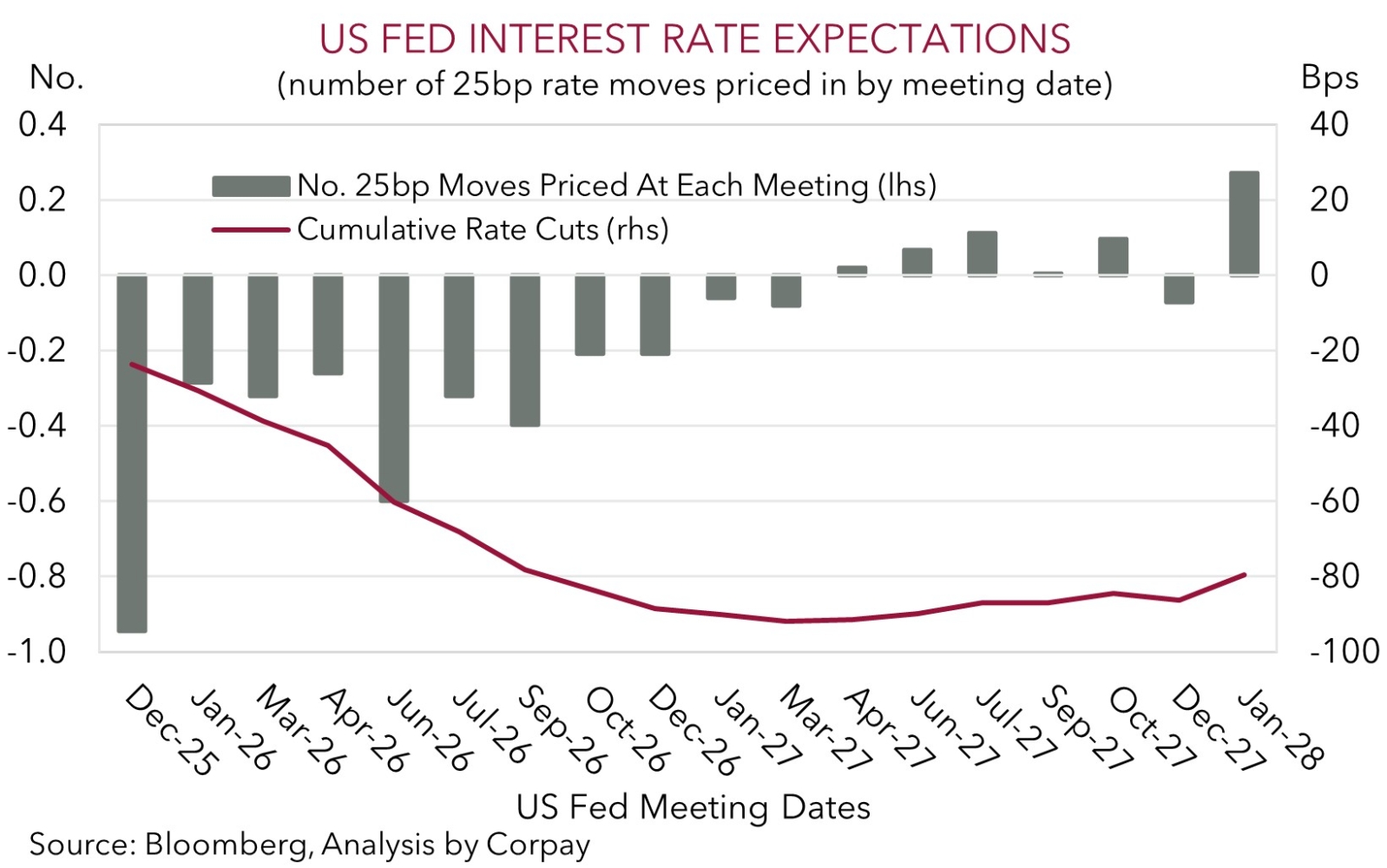

Data wise more US government shutdown delayed releases are due the next few days including the September industrial production figures (tonight 1:15am AEDT). However, more timely indicators such as the ISM services index (2am AEDT) and ADP employment report (12:15am AEDT) should get greater attention given the possible impact on US Fed interest rate expectations. The monthly ADP employment figures will have added importance as they are likely to be the most up-to-date jobs data US Fed officials have on hand at their next meeting (11 Dec AEDT).

Markets have swung around substantially the past few weeks with odds of a December US Fed rate cut now tracking at over 90% (they were less than 30% a couple of weeks ago). We believe the incoming US data could indicate growth momentum remains sluggish and/or labour market conditions are continuing to soften. If realised, we think this may keep the USD under some downward pressure as markets laser in on the prospect of a steady stream of US Fed interest rate cuts over the next year.

Trans-Tasman Zone

The positive vibes across risk markets (as illustrated by firmer equities and low volatility) have helped the NZD and AUD add to recent gains (see above). At ~$0.5735 the NZD is closing in on its 1-year average, and is ~2.7% above the low point touched just ahead of the RBNZ’s recent meeting where it cut interest rates but gave hints the move may be the last this cycle. There are other things that go into it, like broader risk sentiment, USD trends, and commodity prices, but monetary policy regime shifts do have an impact on the NZD.

At ~$0.6565 the AUD is around the top of its 1-month range with gains on the major cross-rates also supportive. The AUD rose by ~0.2-0.6% versus the EUR, JPY, GBP, NZD, CAD, and CNH over the past 24hrs. AUD/EUR is hovering near its 200-day moving average (~0.5650), AUD/CNH is above its 1-year average, AUD/GBP (now ~0.4970) is ticking up towards the top of its multi-month range, and AUD/JPY (now ~102.33) is close to levels last traded in mid-2024. We would note that since 1995 AUD/JPY has only traded above where it is in ~2% of trading days and based on various drivers such as yield differentials we feel it is looking stretched.

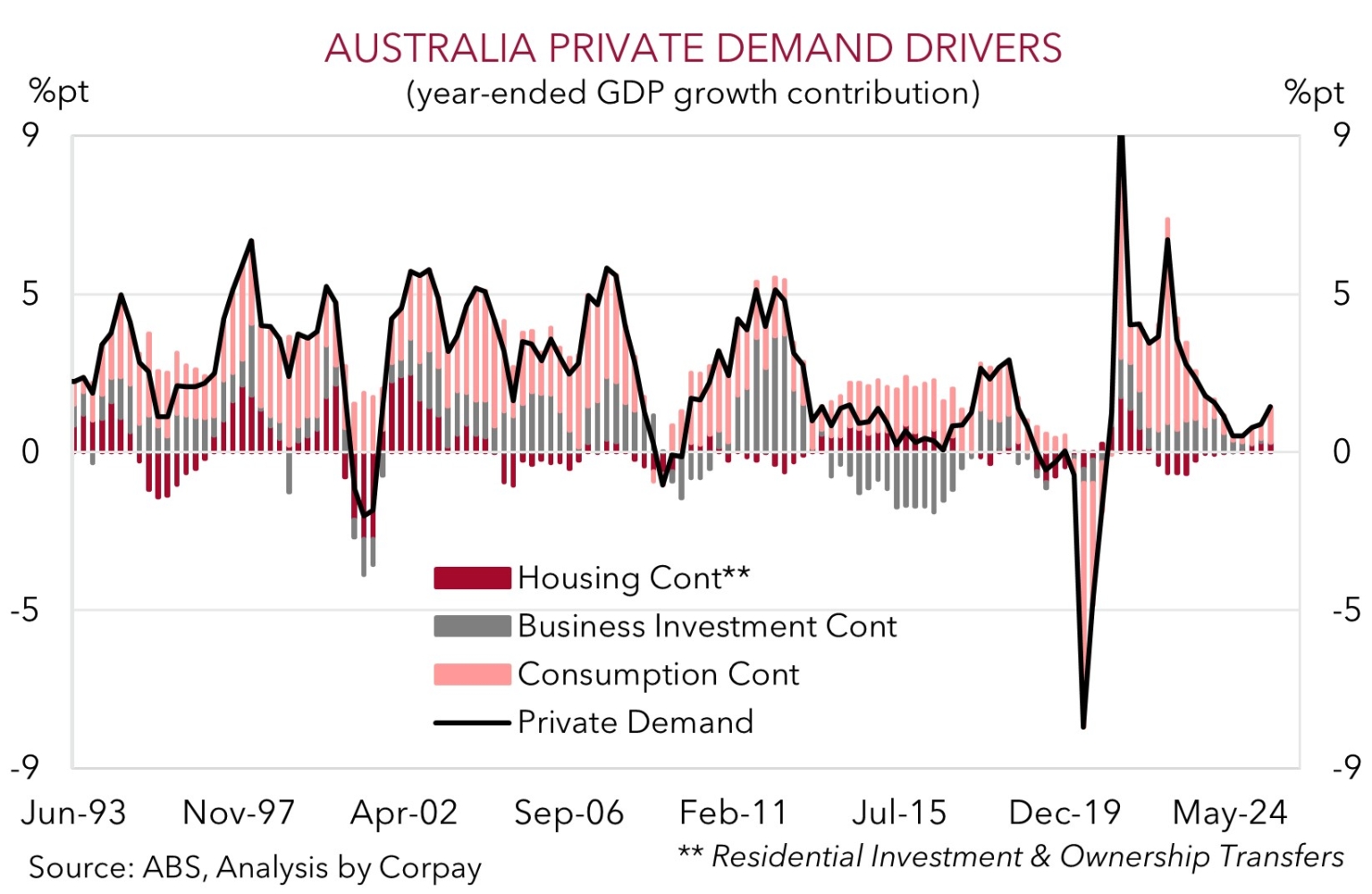

In terms of the AUD, Q3 Australian GDP is in focus today (11:30am AEDT). Based on the partial data released momentum, particularly across the private sector, looks to have been solid in Q3 with growth possibly coming in stronger than the RBA’s forecasts (mkt 0.7%qoq/2.2%pa). This run-rate is around ‘trend’ growth, and if realised would mean the economy continues to operate close to capacity. With the economy still butting up against capacity constraints broad-based inflation pressures could persist, which in our opinion, would reinforce views the RBA might not cut interest rates again this cycle and that the next move could be up not down. We think a positive Q3 GDP report may give the AUD more near-term support. More broadly, as outlined before, without a sharp deterioration in risk sentiment we believe the underlying improvement in US/China trade relations, more favourable yield spreads between Australia and other nations, and/or firmer domestic/Asian growth should help the AUD climb gradually higher into year-end and over coming months.