The dollar is edging higher after US president Donald Trump said he will nominate Kevin Warsh to lead the Federal Reserve, a move that would place a long-time critic of expansive monetary intervention at the helm of the world’s most powerful central bank. Short-term Treasury yields are declining while long-term rates climb, equity futures are moving lower, and most major currencies are retreating against a resurgent greenback.

Warsh served as a Fed governor from 2006 to 2011 and has deep ties to Wall Street, including a stint working with Stanley Druckenmiller. He is also married to the daughter of Ron Lauder, the Estée Lauder heir and long-time Trump confidant—connections that highlight both his establishment pedigree and the political context surrounding the potential appointment. “I have known Kevin for a long period of time, and have no doubt that he will go down as one of the GREAT Fed Chairmen, maybe the best,” Trump said. “On top of everything else, he is ‘central casting,’ and he will never let you down. Congratulations Kevin!”.

In recent months, Warsh has argued that rapid productivity gains are lifting the economy’s speed limit and easing inflation pressures, a view that aligns uncannily well with a White House pressing for lower rates. His record, however, is more hawkish. He backed higher rates on the eve of Lehman Brothers’ collapse and through much of the mid-2000s, has often argued that the Fed’s market interventions have gone too far, and has consistently called for a narrower, less activist and less communicative approach to setting monetary policy*.

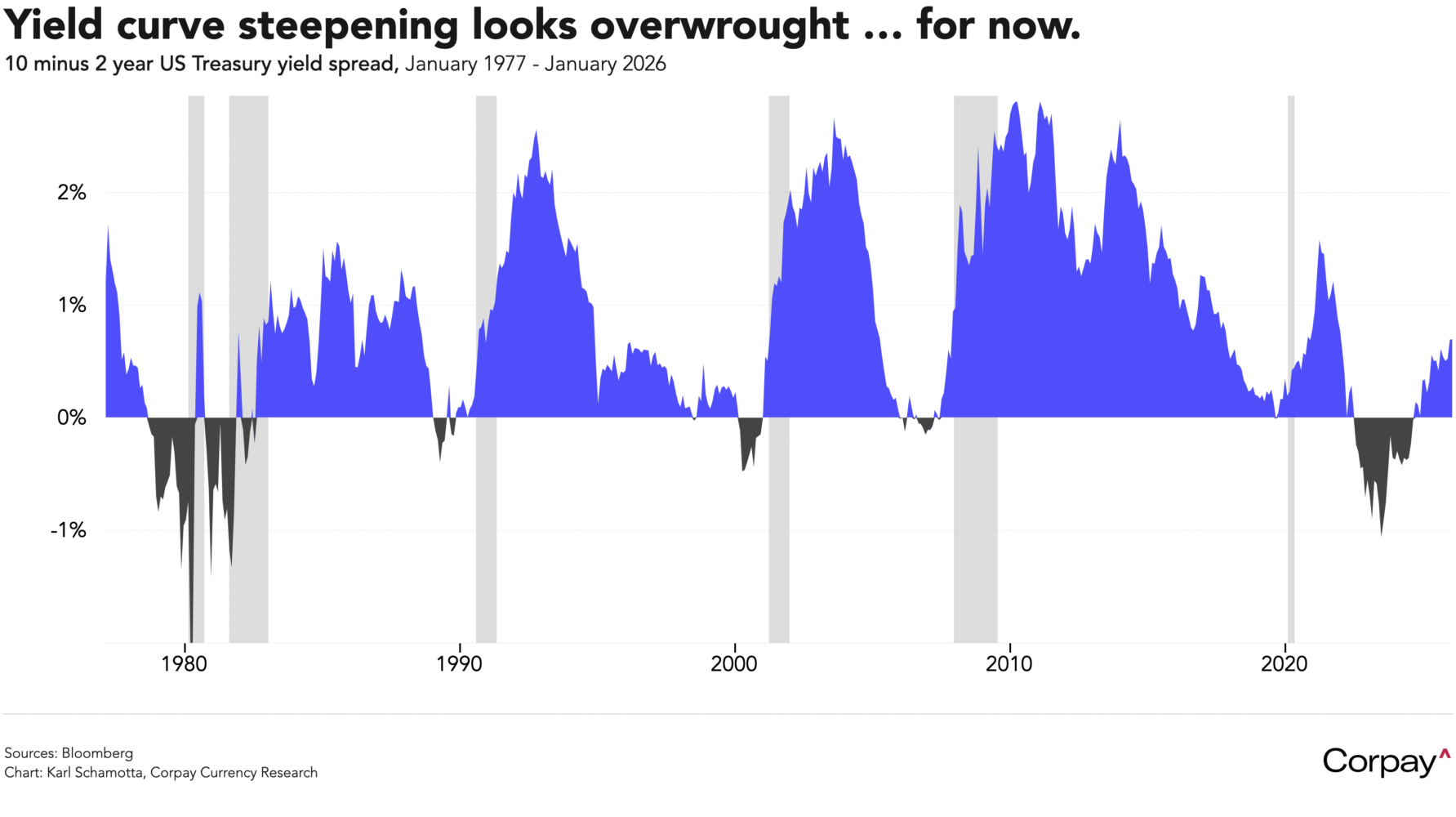

Many investors see the appointment as leading to a steepening in the yield curve, with near-term easing helping to depress short-end rates while a shrinking balance sheet drives long-term yields higher. This is likely overwrought—Warsh does not have a strong record of persuading his colleagues to follow his ideas, recent voting shows little appetite for aggressive easing into a still-hot economy, and balance-sheet operations are now geared to maintaining reserve liquidity, not managing broader financial conditions—and might ultimately unwind, reducing the dollar’s gains.

Warsh will struggle to demonstrate autonomy from the White House**, given that the president is widely seen as having prioritised those willing to deliver on his demands for lower rates. Unlike many of his predecessors—often flawed but broadly regarded as technocratic and politically detached—Warsh will take office under a cloud of scepticism, with market participants and colleagues likely to question his motives and scrutinise every decision for its political implications. For all practical purposes, the Fed’s independence—a fundamental anchor for the global monetary system—has already been compromised.

The Japanese yen is back to trading with a modest weakening bias after updated money market data showed no evidence of direct currency intervention last week, giving traders reason to think that authorities could limit themselves to jawboning efforts for now. According to numbers released this morning, the Ministry of Finance did not execute any meaningful buying activity when verbal “rate checks” were widely reported last Thursday and Friday, suggesting that finance minister Satsuki Katayama and her counterparts in Washington executed a highly-effective psychological warfare campaign to prevent further declines in the yen.

Canada’s dollar is lagging after the economy flatlined in November and likely expanded only slightly in December, putting the country on track for a weak handoff into 2026. According to numbers just published by Statistics Canada, growth slowed to zero in November, undershooting market expectations for a print closer to the 0.1-percent mark, while a preliminary estimate showed a 0.1-percent expansion in the final month of the year, implying a sub -0.5-percent contraction in the fourth quarter. Services-sector activity grew slightly, but was offset by continued weakness in manufacturing industries, with tariff frictions and a semiconductor shortage hitting output levels. Economists broadly expect growth to stabilise this year, but few foresee anything resembling a solid acceleration, given persistent weakness in domestic housing markets and continued headwinds from global trade.

Trade uncertainties clearly continue to roil Canada’s business landscape and hamper consumer confidence, but the impact on markets is wearing off. The Canadian dollar shrugged when Trump last night threatened to impose a 50 percent tariff on Canadian aircraft and to decertify all Canadian-made aircraft in the US, after apparently misunderstanding Ottawa’s certification process for Gulfstream jets. The president said he would impose 100-percent tariffs on Canada last week and hasn’t followed through as of yet, leaving the loonie to appreciate against the dollar this week.

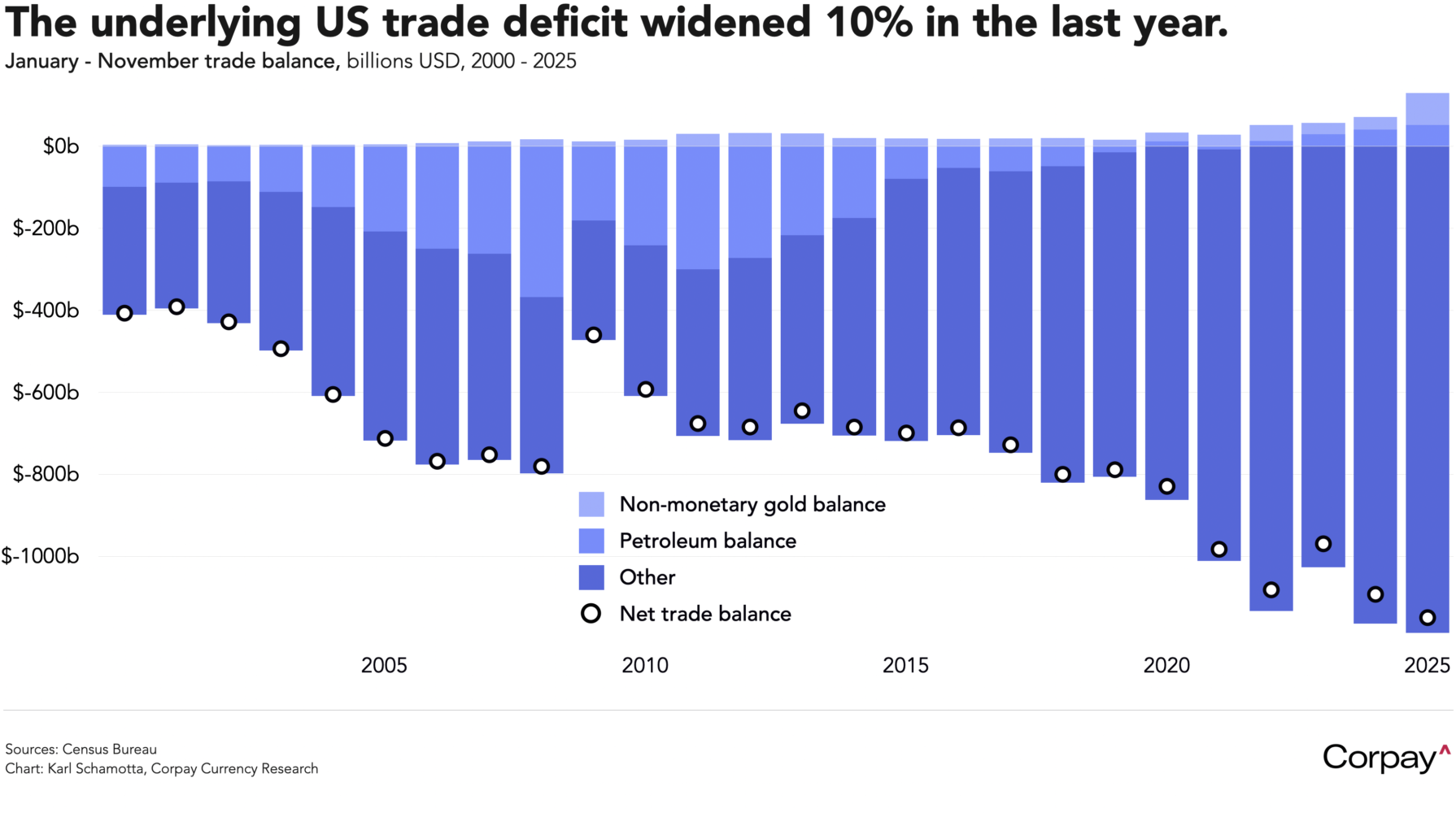

Data released yesterday showed that the US is importing more than ever. According to the Census Bureau, the difference between goods imports and exports blew out again in November, jumping 47.3 percent from the prior month on a rebound in purchases of electronics, pharmaceuticals, and other consumer goods while outbound shipments lagged. On a year-to-date basis, the deficit grew 10 percent from the same period a year earlier, underscoring the strength of domestic demand and offering support to export-oriented economies elsewhere—an impulse that could strengthen further in coming months as tax refunds lift US household purchasing power***.

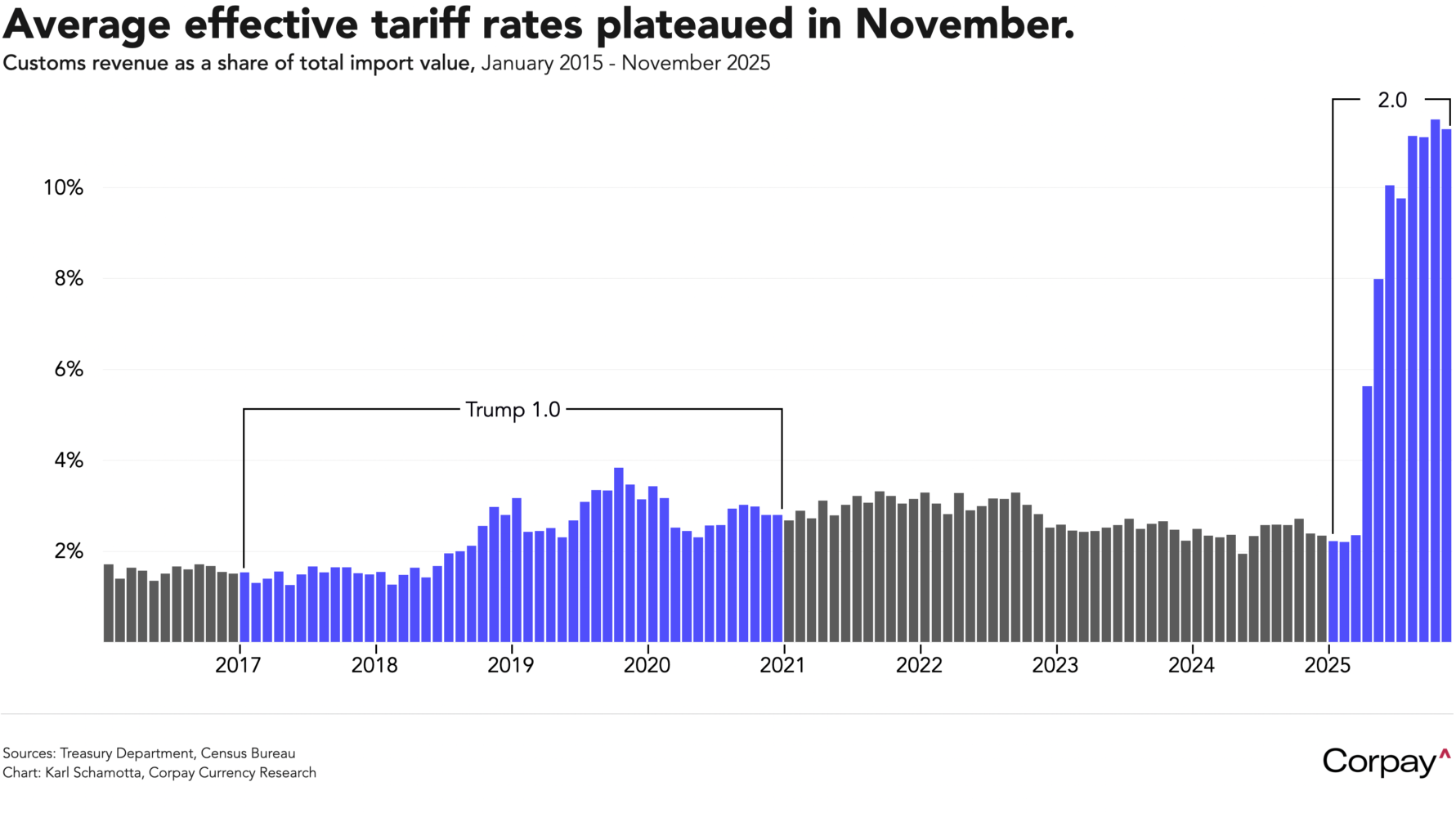

American companies are, however, paying more for the privilege. The average tariff rate on US goods imports held near 11.3 percent in November, slightly below the prior month, and is expected to remain around that level as new tariffs are imposed and others negotiated down. For manufacturers and retailers, the squeeze on margins is likely to persist, particularly if pricing power remains limited.

*Valid critiques, to be sure.

**I would like to trademark “Wishy Warshy” in advance, please.

***Just workshopping this, but thinking of titling my next round of presentations ‘Making the World Economy Great Again’.