• Reversal. Positive data & Trump’s Fed Chair announcement boosted the USD. Commodities fell. AUD also lost ground (now ~2% below Thursday’s peak).

• Macro risks. RBA expected to hike rates (Tues). But yield spreads & AUD already moved. US jobs data might rebound. This could be USD supportive.

Global Trends

There was a bit of a “reversal of fortune” across markets at the end of last week with US equities falling slightly (S&P500 -0.4%), short-end bond yields rising (US 2yr +4bps), commodities such as copper (-5.2%) and gold (-9.6%) tumbling, and the USD recouping lost ground. In FX, EUR declined ~1% on Friday (now ~$1.1849), as did the NZD (now ~$0.6013), while the interest rate sensitive USD/JPY rose ~1.2% (now ~154.92). The backdrop weighed on the AUD (-1.3% to ~$0.6954) with the AUD also underperforming on the cross-rates after its recent strong run ahead of tomorrow’s RBA decision.

A catalyst for the market swings was a little repricing in the US policy outlook following the announcement President Trump had picked Kevin Warsh as his nominee for the next Chair of the Federal Reserve. Warsh, who has been a Fed Governor previously, is viewed as more of a steady hand relative to some of the other more cavalier names in the frame given his markets/economics background and consensus voting record the last time he was on the FOMC. Compounding the news were a few solid upside US data surprises. US producer price inflation exceeded expectations (core PPI accelerated to 3.5%pa) suggesting price pressures remain in the pipeline. The Chicago PMI also increased more than anticipated with stronger production and new orders positive signs about manufacturing momentum.

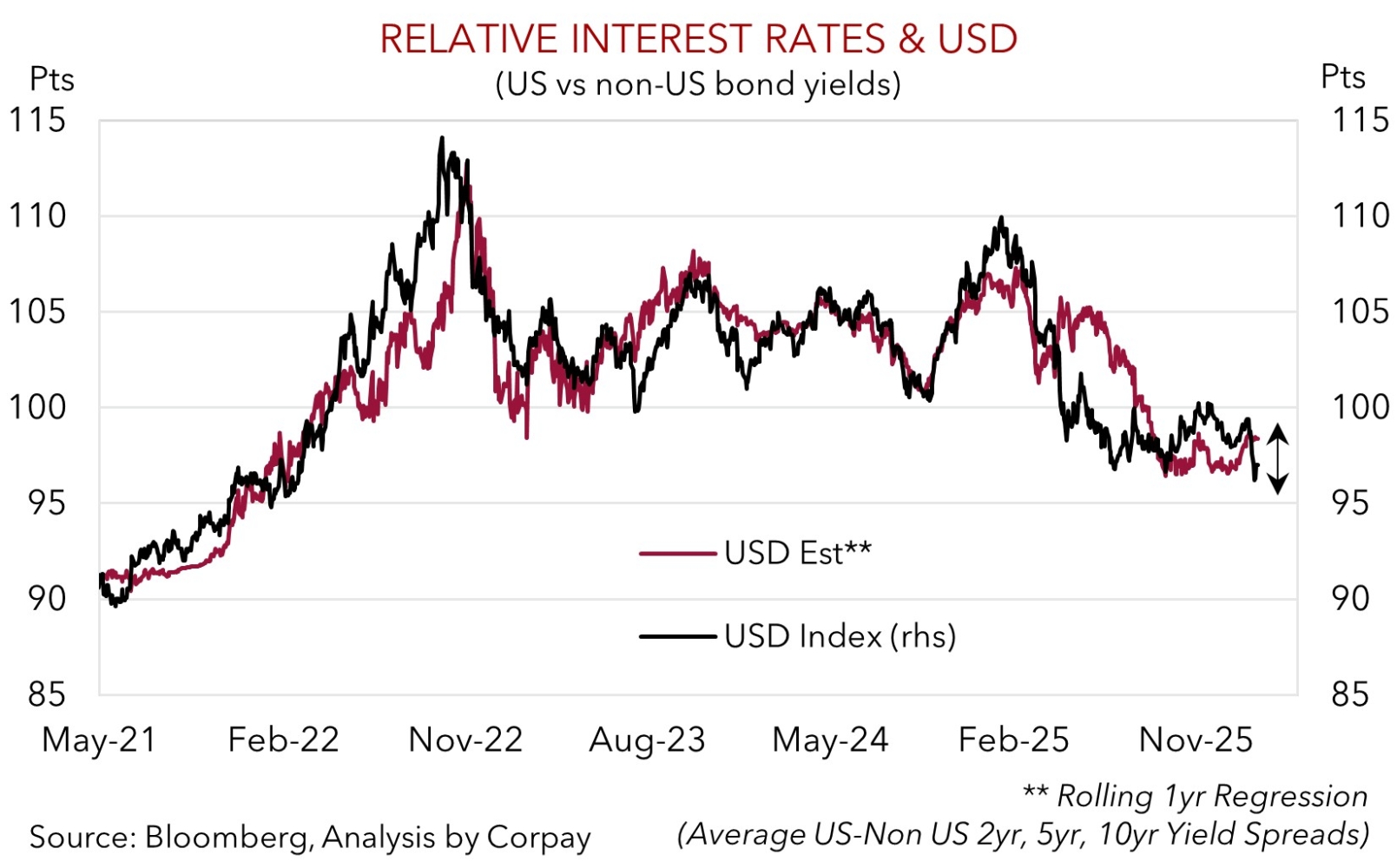

Last week we had warned about the prospect of a short-term reversal in the USD following its recent sizeable and rapid decline. We believe the rebound may have further to run given the USD is still tracking below our ‘fair value’ model estimate (see chart) and with the incoming US data potentially showing more of a post government shutdown recovery. The US ISM manufacturing index is due tonight (2am AEDT), while over the rest of the week several labour market indicators are due including JOLTS job openings (Tues night AEDT), ADP employment (Weds night AEDT), and the monthly non-farm payrolls report (Fri night AEDT). Signs of a turnaround in activity and/or improvement in labour market conditions could reinforce views that the Fed may not lower interest rates again until the new Chair takes the job in May. Indeed, the market is now not fully factoring in another US Fed rate reduction until July. Outside of the US the European Central Bank and Bank of England are expected to hold interest rates steady this week (both Thurs night AEDT).

Trans-Tasman Zone

The modest bout of risk aversion that washed through US markets on Friday, pull-back in commodities such as copper and gold, and rebound in the USD has exerted downward pressure on the NZD and AUD (see above). The NZD (now ~$0.6013) is ~1.3% below last week’s ~6-month peak, while the AUD (now ~$0.6954) is almost 2% from the multi-year high touched last Thursday. The AUD also lost ground on the crosses with falls of ~0.1-0.5% recorded against EUR, JPY, GBP, NZD, and CAD on Friday, while AUD/CNH declined by ~1.2%. That said, these moves come after a period of AUD outperformance. In level terms AUD/EUR (now ~0.5869) is still up near the top of its ~10-month range, AUD/CNH (now ~4.8394) remains towards the upper end of its 4-year range, and AUD/JPY (now ~107.74) is hovering at elevated levels.

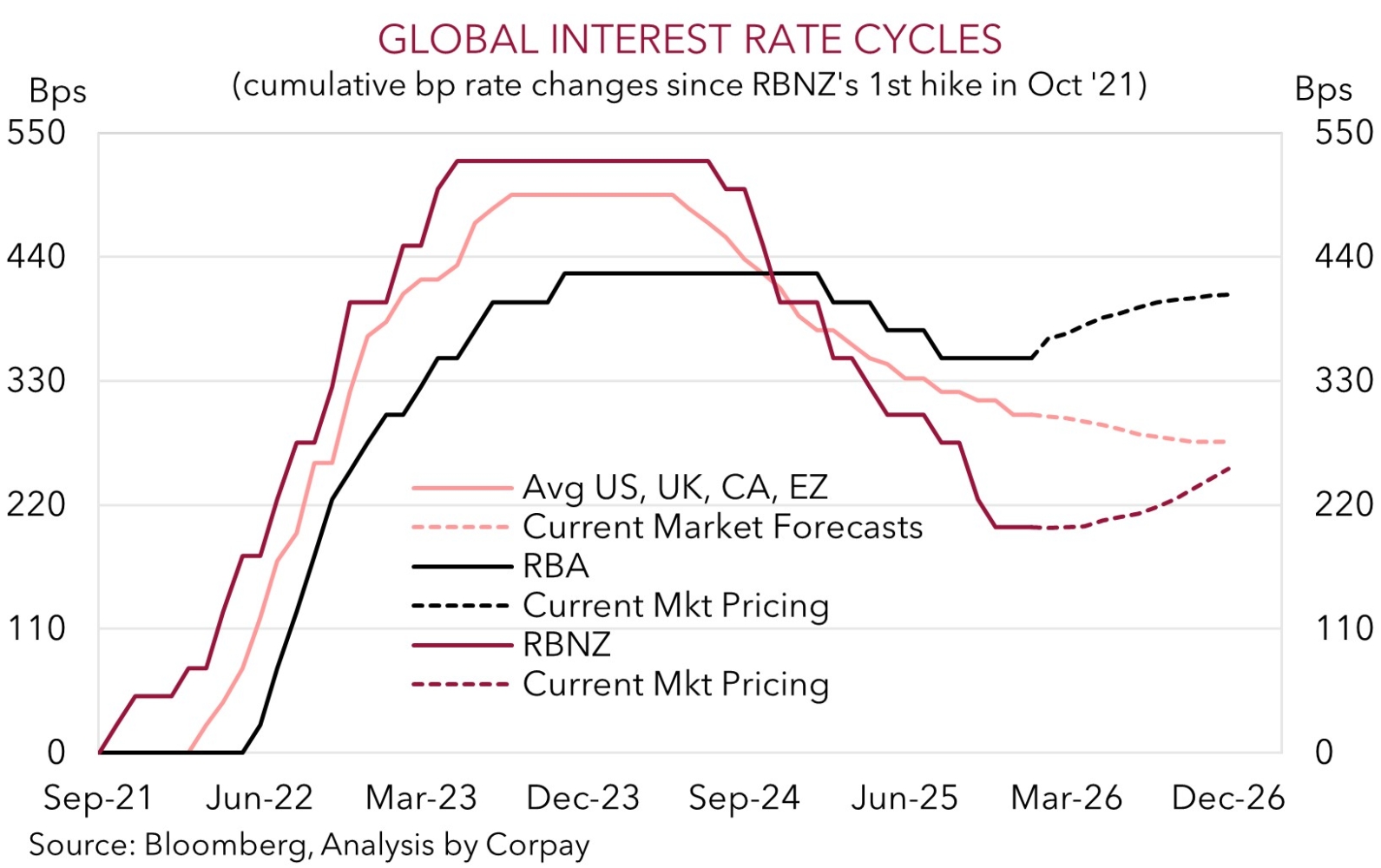

This week in Australia focus will be on the RBA decision (Tues 2:30pm AEDT) and press conference (Tues 3:30pm AEDT). Governor Bullock is also due to speak again later in the week (Fri morning AEDT). As mentioned previously, with the Australian economy operating at a high level (as illustrated by above average capacity utilization and low unemployment), private sector growth picking up, and inflation running above target we feel the current level of interest rates won’t get the job done and a RBA policy U-turn is on the cards. We expect the RBA to announce a 25bp interest rate hike as it ‘recalibrates’ its settings. This is now also the view of the bulk of surveyed economists (25 out of 32 are picking a rate rise this week), with the market assigning it a ~70% chance (note, a full rate rise is priced in by May, with 2 hikes baked in by November).

In markets outcomes relative to expectations matter. Based on this framework, given short-term technical/momentum indicators are still ‘overbought’, and with it tracking a bit above our ‘fair value’ models, we think there is a risk the AUD continues to slip back in the near-term. We had flagged the heightened chance of an AUD pull-back last week, and we believe there could be more room to run in the near-term, especially given our positive short-term USD bias (see above). Even if the RBA raises rates like we expect, we think its messaging about further moves may be ‘cautious’ and non-committal. This in turn could see medium-term interest rate expectations adjust slightly lower. By contrast, across the Tasman the quarterly NZ labour stats (Weds morning AEDT) might show the turnaround in the economy is starting to flow into the jobs market. A decline in NZ unemployment would reinforce views looking for the RBNZ to start to raise interest rates later this year. This can give the NZD a relative boost, particularly against the AUD, in our opinion.