• Weaker USD. US equities rose again while the USD remains under pressure. EUR at a multi-year high. AUD touched highest point since Q1 2023.

• Macro trends. Q4 Australian CPI out today. Will it help or hinder RBA rate hike expectations? US Fed meets tomorrow. No changes anticipated.

Global Trends

A few of the recent major market themes continued overnight with European/US equities rising and the USD remaining under downward pressure. More specifically, the US S&P500 (+0.5%) reached a record high while the tech-focused NASDAQ jumped up 0.9% to be within a whisker of its historic peak. US bond yields were little changed with the 10yr rate tracking near 4.23%, just below its 1-year average. Across commodities, gold is just shy of US$5200/ounce, and WTI crude oil gained ~2.8% (now ~US$62.30/brl, the top of the range it has occupied since October) with concerns about the US’ military presence in the Middle East and impact from the US winter factors impacting demand and supply thinking.

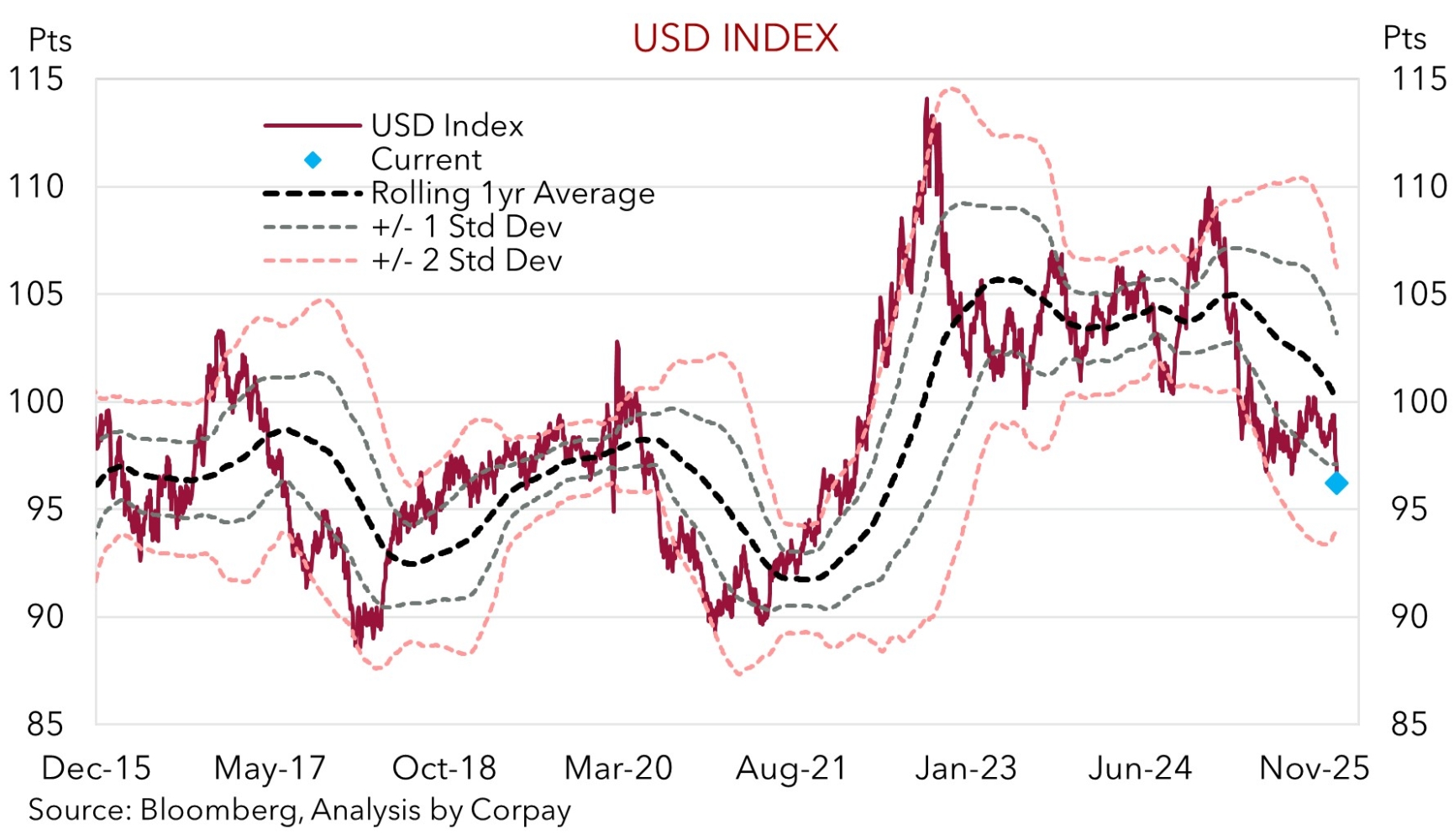

In FX, the USD index, which has undergone a sizeable adjustment over the past few sessions, touched its lowest point since February 2022 with President Trump indicating this morning that he “isn’t concerned” about its decline and that it is “doing great”. EUR (the major USD alternative) has risen to a multi-year high (now ~$1.2035), and USD/JPY (the second most traded currency pair) has extended its slide (now ~152.22, ~4.3% below Friday’s high) as the turn in sentiment on the back of the threat of potential currency intervention continues to see traders unwind overextended positions. We believe that over the medium-term USD/JPY may decline even further (down to ~145 by late-2026) as interest rate differentials between the US and Japan continue to narrow. Elsewhere, GBP has increased to levels last traded in Q3 2021 (now ~$1.3846), USD/SGD (now ~1.2606) has slumped to September 2014 rates, the NZD (now ~$0.6040) is around a 6-month high, and ahead of today’s Australian CPI inflation data (11:30am AEDT) the AUD (now ~$0.7005) touched its highest point since February 2023.

Diverging macro trends continue to dampen USD sentiment. In contrast to the historic trade deal finalized between the EU and India overnight, which will create a free-trade zone of ~2 billion people, US President Trump has threatened additional tariffs on Canada (100% if it signs a deal with China) and South Korea (25% given the failure to approve the framework reached last year). Data wise, due to lingering uncertainty, cost of living pressures, and job concerns US consumer confidence tumbled to its lowest since May 2014.

Looking ahead, the Bank of Canada looks set to hold interest rates steady tonight (1:45am AEDT), so should the US Federal Reserve (Thurs 6am AEDT). The Fed isn’t updating its economic forecasts this time around. With US unemployment still low, activity holding up, and fiscal settings more supportive through H1 2026, we believe Fed Chair Powell may reiterate policy is “well positioned”, suggesting there isn’t a great deal of urgency to cut interest rates again near-term. In our view, this might give the beleaguered USD a bit of temporary support.

Trans-Tasman Zone

The mix of upbeat risk sentiment, as illustrated by another positive session in US/European equities, and weaker USD has seen the NZD and AUD add to recent gains (see above). At ~$0.6040 the NZD is at levels traded last July, over 8% above its mid-November low. The underlying drivers continue to turn more NZD supportive. On the back of positive signs across the NZ economy and firmer inflation markets are pricing in ~2 RBNZ rate hikes by year-end. As discussed before, in previous cycles the NZD has tended to strengthen between the time of the last RBNZ cut and first rate rise.

The backdrop has helped the AUD extend its strong start to the year. AUD/USD is up around its highest level since February 2023 (now ~$0.7005). The AUD has also ticked up a bit on the major crosses with gains of ~0.1-0.3% recorded against the JPY, GBP, NZD, and CAD over the past 24hrs. And while AUD/EUR tread water (now ~0.5822, the upper end of its 9-month range), AUD/CNH (now ~4.8575) rose by 1% to be at levels last traded in October 2024.

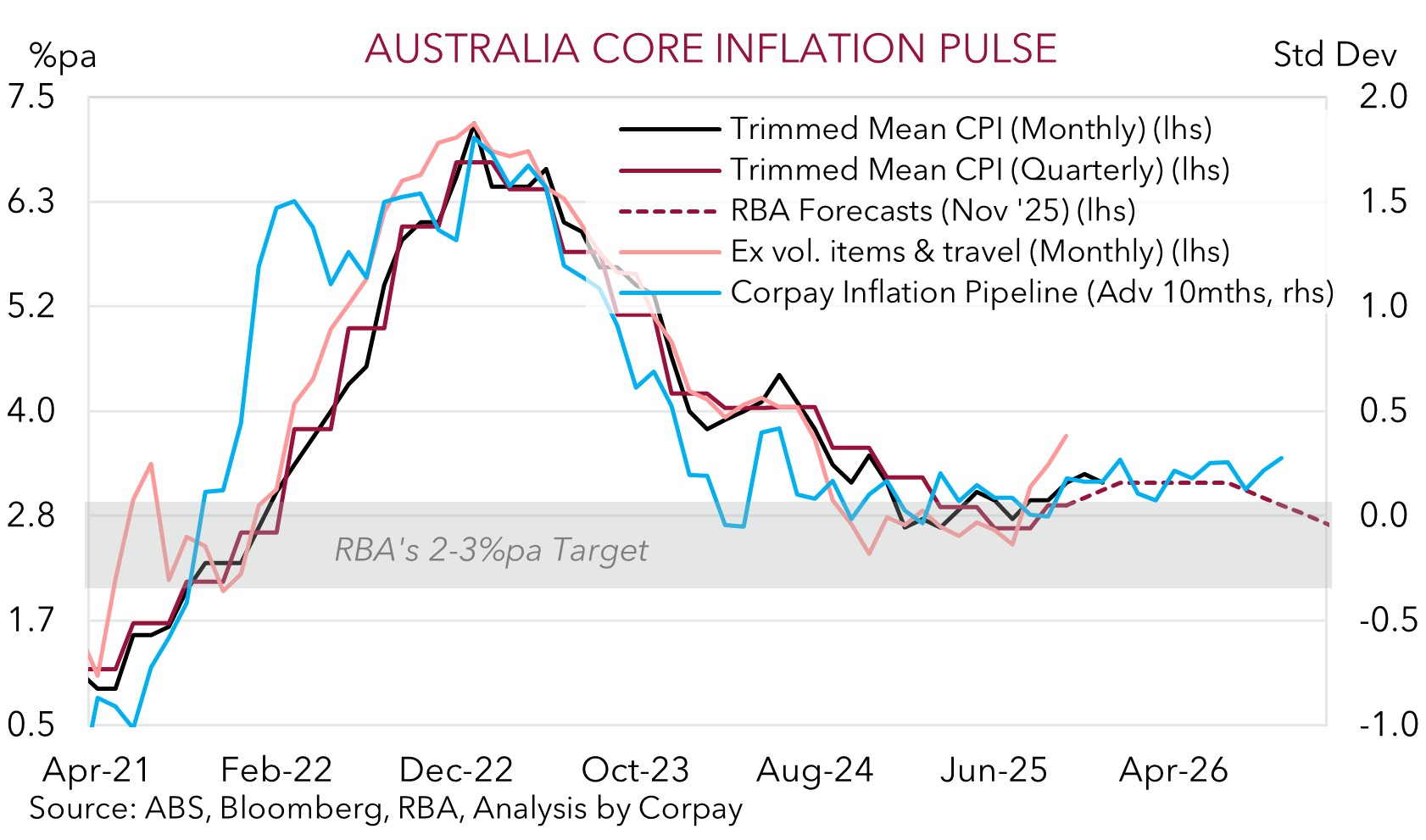

Today in Australia focus will be on Q4 CPI (11:30am AEDT). With the economy still operating at a high level (as shown by above average capacity utilization and low unemployment) inflation is proving to be a hard nut to crack. Indeed, base-effects related to the unwind of government electricity subsidies and other factors point to headline inflation accelerating (mkt 3.6%pa). For the RBA, more attention will be on the underlying/core inflation pulse. Markets are forecasting core inflation to be a little higher than the RBA is anticipating (trimmed mean: mkt 0.9%qoq/3.3%pa, RBA 0.8%qoq/3.2%pa). We would note that there has been a tendency for Q4 core inflation to slightly undershoot consensus predictions over the past few years. With this in mind, and based on the AUD’s rapid appreciation recently (the AUD has reached ‘overbought’ levels on short-term technical/momentum indicators) we feel the data might not be strong enough to see the AUD kick on even further near-term. Rather we see a risk the AUD dips a bit short-term in a “buy the rumor, sell the fact” type scenario, particularly as we also think the beaten-up USD may recoup some lost ground on the back of the US Fed meeting (Thurs 6am AEDT). That said, this should only be viewed as a “temporary reprieve” with underlying medium-term trends becoming more AUD supportive, in our opinion.