• Positive trends. A run of better than anticipated US data supported the USD. AUD drifted lower. NZD underperforms after yesterday’s RBNZ meeting.

• Macro news. RBNZ points to rate hikes later this year. But markets already factoring that in. Australian jobs report in focus today. Will unemployment lift?

Global Trends

It was a positive night for US markets with equities (S&P500 +0.6%), bond yields (+3bps across the curve), and the USD rising. EUR dipped towards ~$1.1780, USD/JPY tracked the lift in US bond yields (now ~154.80), and GBP remained on the backfoot (now ~$1.3499). The AUD drifted a bit lower (now ~$0.7040), while the NZD underperformed after the RBNZ failed to meet the markets ‘hawkish’ expectations at yesterday’s meeting (now ~$0.5965).

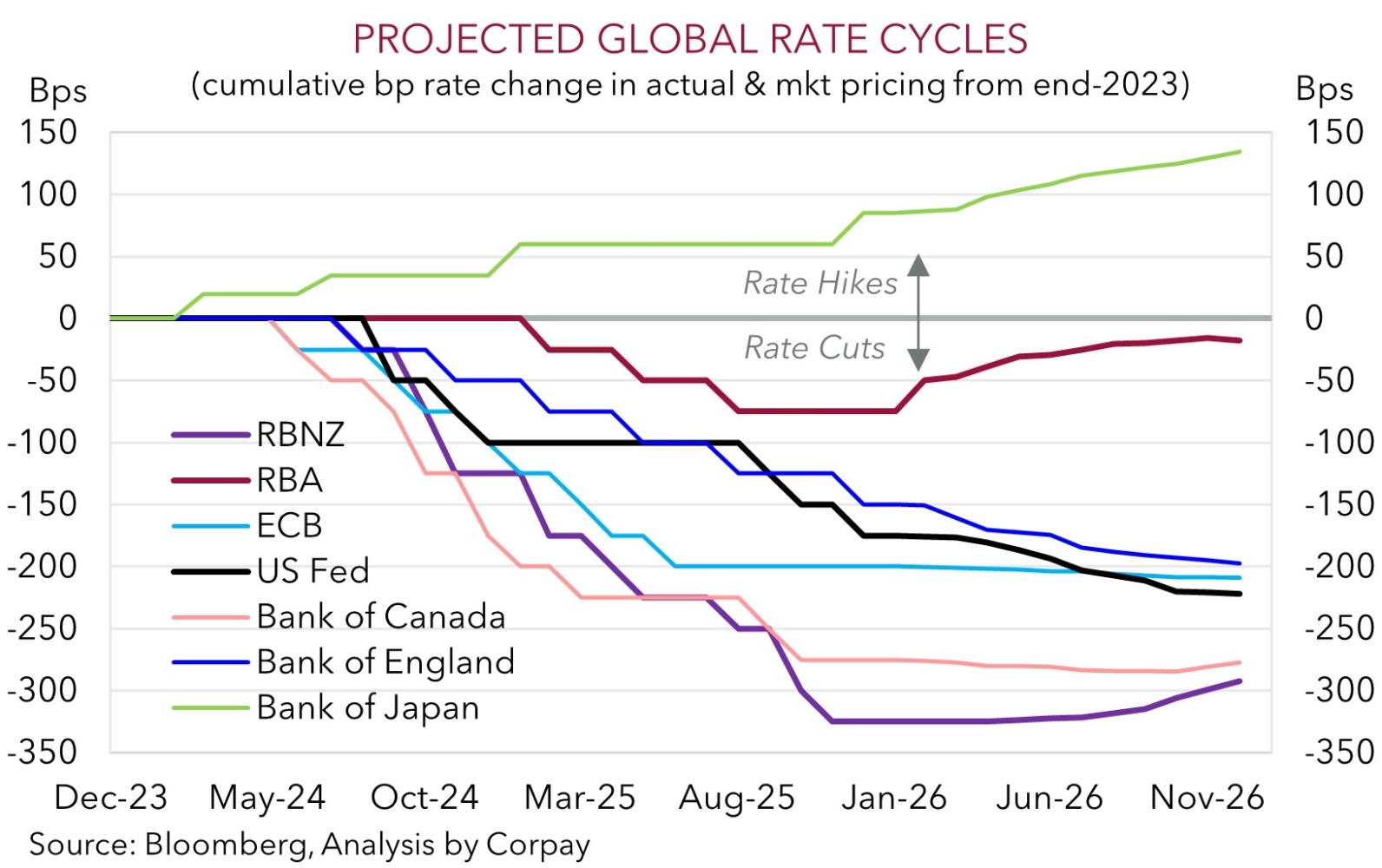

A run of better-than-anticipated US economic data was a factor at play behind the uptick in US yields and the USD, with a ‘hawkish’ tone in the minutes of the last US Fed meeting also catching the markets eye. Data wise, US housing starts and building permits rose in November/December, industrial production increased in January, and durable goods orders also improved with a proxy for business investment (i.e. capital goods orders excluding defence and aircraft) recording its 6th straight monthly gain. In terms of the US Fed minutes a “vast majority” of members noted downside labour market risks had moderated and they think inflation progress “might be slower and more uneven than generally expected”. This suggests there isn’t a great deal of urgency to cut rates again, at least not until after current Chair Powell’s term ends in May. Traders agree with another US Fed reduction not fully factored in until July.

Outside of the US, UK headline inflation eased with the annual rate slowing to 3%pa, its lowest level since March 2025. This, coupled with widening cracks in the UK jobs market, reinforced views looking for the Bank of England to lower rates again as soon as the 19 March meeting (markets are assigning a ~82% chance of a cut next month). Elsewhere, oil prices jumped with WTI crude rising ~5.2% (now US$65.45/brl). Doubts regarding the ‘general agreement’ that was supposedly reached by the US/Iran over the weekend have already crept in. US Vice President Vance stated there are certain US ‘red lines’ Iran is so far unwilling to address.

Looking ahead, there are several US Fed members speaking tonight, and on Friday the global business PMIs, Q4 US GDP, and the US PCE deflator (the Fed’s preferred inflation gauge) are due. We think the PMIs could indicate momentum in the US is perking up, and outside of a mechanical/temporary drag from the prolonged government shutdown, US GDP might hold up well. If realised, we believe this may give the USD (which is still tracking below our ‘fair value’ estimate) some more short-term support.

Trans-Tasman Zone

The firmer USD stemming from better than forecast US data has exerted a little downward pressure on the AUD over the past 24hrs (now ~$0.7040). That said, the AUD remains less than ~1.5% from its multi-year highs touched earlier this month. AUD/JPY remains at high levels (now ~109), AUD/EUR is tracking towards the upper end of its ~11-month range (now ~0.5976), and AUD/NZD is within a whisker of its highest point traded since June 2013 (now ~1.1804). This reflects the NZD’s knee-jerk underperformance in the wake of yesterday’s RBNZ meeting (now ~$0.5965).

In terms of the RBNZ, as anticipated, rates were kept steady at 2.25%. Attention was on the RBNZ’s updated thinking about the outlook given stronger NZ growth and inflation. The RBNZ noted the “economy is at an early stage in its recovery”, and if this takes hold as predicted policy settings are set to “gradually normalise” down the track. The RBNZ’s latest forecasts show rates might begin to rise from Q4 2026, with a move up to ‘neutral’ (i.e. ~3% interest rates) slightly quicker than previously thought. However, in markets outcomes compared to expectations are what matter, and a more ‘hawkish’ turn was already baked in. Failure to match lofty expectations has exerted pressure on the NZD, and this may have further to run in the near-term, in our view. But over the medium-term we expect the NZD to rebound towards ~$0.62 later this year, and as economic cycles converge AUD/NZD may ease down to ~1.13 by Q3 2026. For more see Market Musing: NZD – RBNZ (slowly) shifting course.

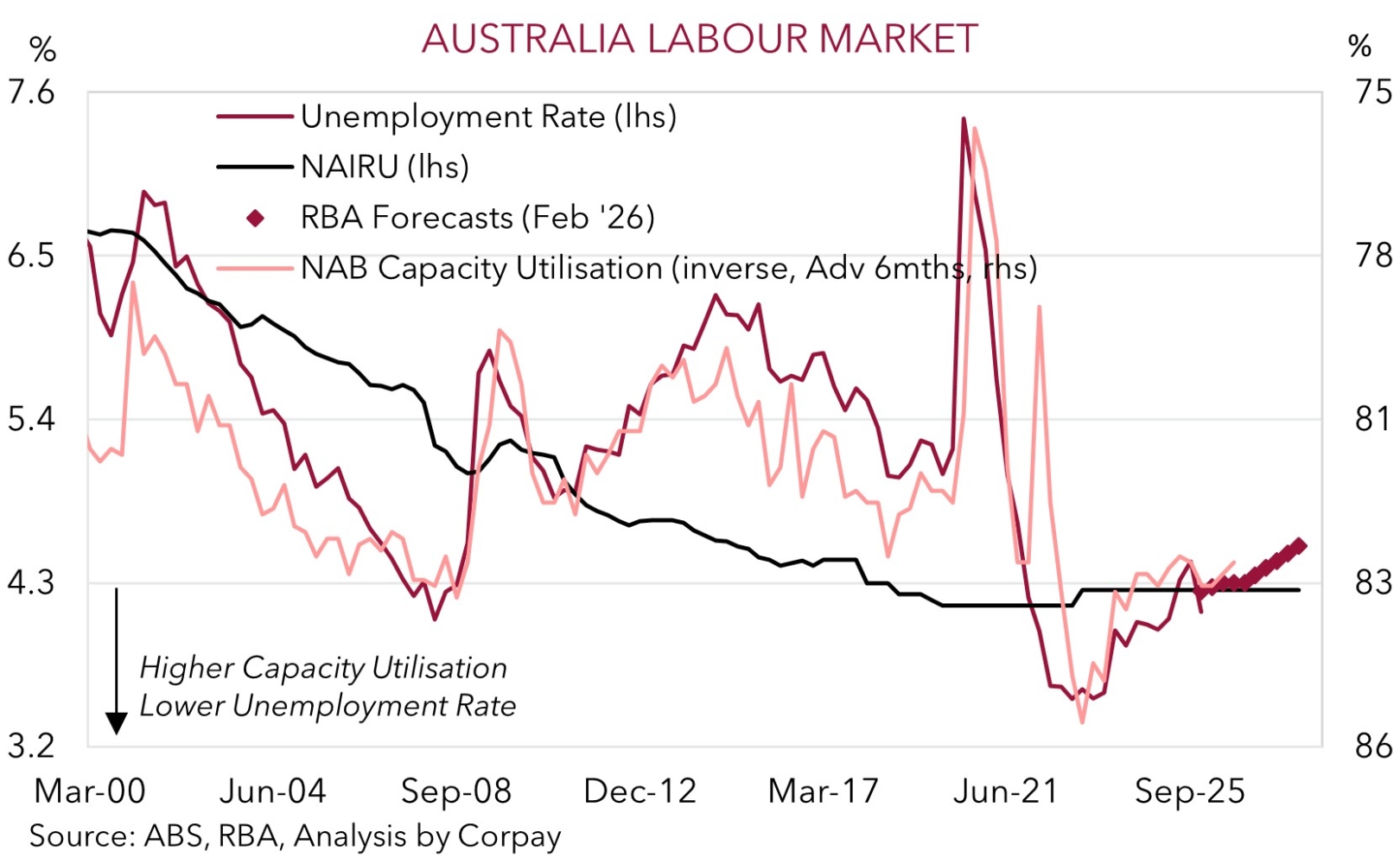

AUD wise focus today will be on the monthly Australian jobs data (11:30am AEDT). The labour market report is volatile, particularly at this time of year. We see a chance the January data shows a little loosening in conditions. Shifting seasonal job patterns after COVID have seen unemployment rise ~0.15%pts the past three Januarys. A repeat in 2026 might see traders pare back bets looking for another RBA rate hike over coming months (markets are assigning a ~75% chance the RBA hikes again by May). This, and a firmer USD, may exert a bit more pressure on the AUD over the next few days. However, the shift up in the level of Australian rates means that, on the assumption volatility remains low, the AUD should tracks in a higher average range than what has been seen the past few years.