• USD weaker. Falls in USD/JPY on back of intervention fears have weighed on USD. NZD also supported by NZ CPI. AUD near top of multi-year range.

• Data flow. Q4 AU CPI due tomorrow, US Fed also meets (Thurs AEDT). AUD has had a strong run, but starting to look ‘stretched’ on momentum gauges.

Global Trends

A few of the recent market themes have remained in place over the past couple of sessions. Risk sentiment has remained positive with the major European and US equity markets edging higher overnight (S&P500 +0.5%). Elsewhere, bond yields ticked down a bit with the US 10-year rate (now ~4.21%) slipping towards its year-to-date average, and in commodities gold’s uptrend extended (moving above US$5000/ounce for the first time) while WTI crude oil consolidated just north of US$60/brl.

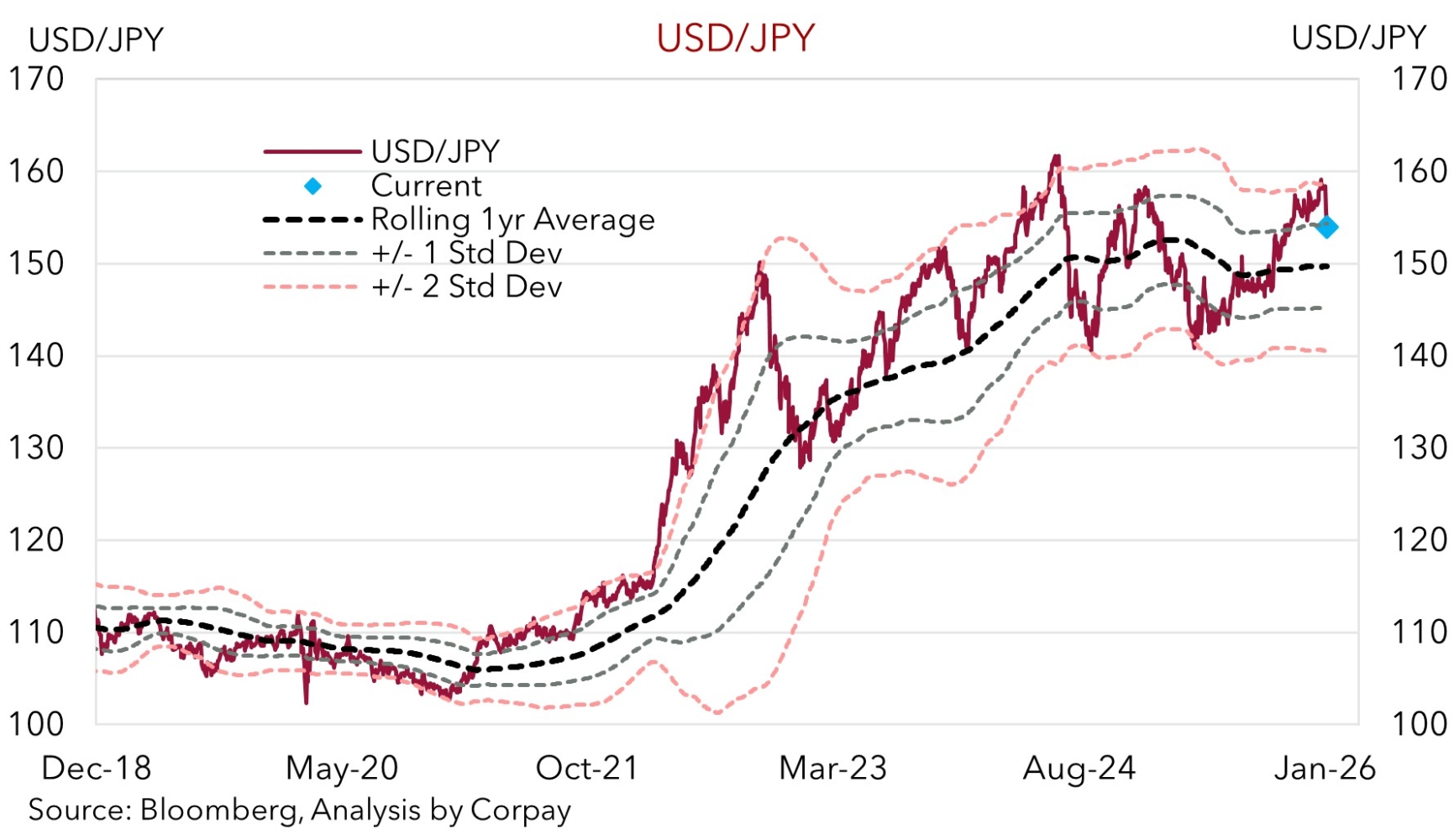

In FX, the USD has lost more ground. A catalyst for the latest bout of USD weakness has been the resurgent JPY. USD/JPY has fallen by ~3.2% from Friday’s peak (now ~154.11). USD/JPY is the second most traded currency pair and hence it is quite influential on overall USD trends. We have been noting that the undervalued JPY had diverged substantially from various drivers such as yield differentials. The abrupt reversal in the JPY was triggered by heightened odds of coordinated official intervention to prop up the currency after the Bank of Japan and New York Fed conducted “price checks” during Friday’s trade. The sizeable swing in the JPY on the back of the mere threat of intervention illustrates how one-sided the moves have been (indeed actual intervention doesn’t look to have occurred based on the timely BoJ reserves and cash balances data). We think that over the medium-term USD/JPY should decline further (down to ~145 by late-2026) as interest rate differentials between the US and Japan continue to narrow.

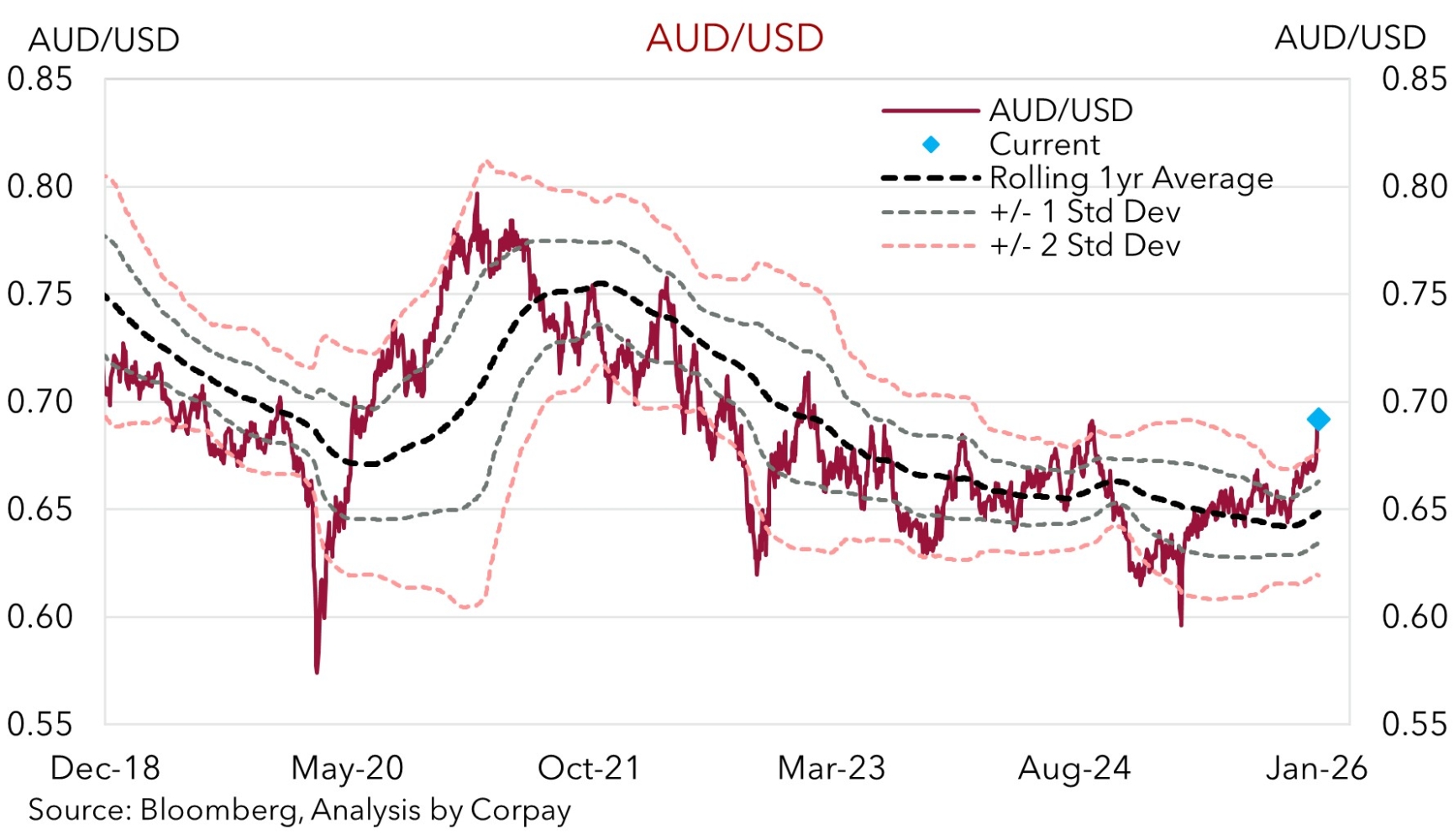

The weaker USD has washed through FX markets with EUR (now ~$1.1883) and GBP (now ~$1.3681) up near the top of their respective cyclical ranges. NZD has also added to its gains (now ~$0.5974) with stronger than predicted NZ CPI inflation, which bolstered the case for RBNZ rate hikes later this year, also helpful. Ahead of tomorrow’s Q4 Australian CPI data, the AUD (now ~$0.6919) has risen to the top of the range it has occupied since late-February 2023.

The weaker USD reverberations from the shot across the JPY’s bow by officials may have a little more to run. However, later this week we think the USD might find some support from the US Fed decision and press conference (Thurs morning AEDT). No change in policy is expected by the Fed this time out, and its economic forecasts aren’t updated. But with US unemployment still low, activity holding up, and fiscal settings more supportive through H1 2026, we believe Chair Powell could reiterate that policy is “well positioned”, suggesting there isn’t a great deal of urgency to cut rates again near-term. In our view, this might see the beaten-up USD rebound, albeit temporarily.

Trans-Tasman Zone

Domestic factors, such as last week’s stronger than anticipated Australian jobs report and higher than forecast NZ CPI inflation, coupled with a weaker USD on the back of the pull-back in USD/JPY (see above) has seen the AUD and NZD extend their respective upswings. The NZD (now ~$0.5974) has reached its highest point since mid-September with markets fully pricing in 2 RBNZ rate hikes by year-end. As outlined previously, in previous cycles the NZD has tended to strengthen between the last RBNZ cut and first rate rise, and we think this time shouldn’t be different.

The AUD (now ~$0.6919), which has enjoyed a strong start to the year (+3.6% so far in January), is hovering around the top of the range it has traded in since Q1 2023. The AUD paused for breath overnight on a few major crosses; however, this follows a strong run. More specifically, AUD/EUR (now ~0.5823) is tracking at levels it was last at ahead of last-April’s ‘Liberation Day’ tariff announcements. AUD/CNH (now ~4.8082) is up around the top of the range it has occupied since October 2024, and AUD/GBP (now ~0.5057) is closing in on its 1-year peak. AUD/JPY (now ~106.62) has fallen back over the past few days (-2.2% since Friday) due to the JPY’s broad-based recovery. We had been flagging that there were uneven risks for AUD/JPY at such elevated levels (i.e. a greater chance of a decline than further rise). We think AUD/JPY still looks stretched compared to underlying drivers and that over the medium-term it should fall further (to ~101 later this year).

This week in Australia attention will be on the Q4 CPI data (released Wednesday). After the strong jobs data markets now view a 3 February RBA rate rise as a ~55% chance with 2 increases baked in by November. We believe the Q4 CPI should show inflation pressures remain firm, reinforcing the view that the RBA could undertake a policy U-turn. However, as markets are driven by outcomes relative to expectations, and with the AUD enjoying a sizeable/rapid jump recently (the AUD has reached ‘overbought’ levels on short-term technical/momentum indicators) we feel the data may not be strong enough to see the AUD kick on even further near-term. Rather we see a risk the AUD dips a little in a “buy the rumor, sell the fact” type scenario, particularly as we also think the USD might recoup some lost ground on the back of the US Fed meeting later this week (Thurs morning AEDT). That said, this should only be viewed as a “healthy correction” with the underlying medium-term trends becoming more AUD supportive, in our opinion.