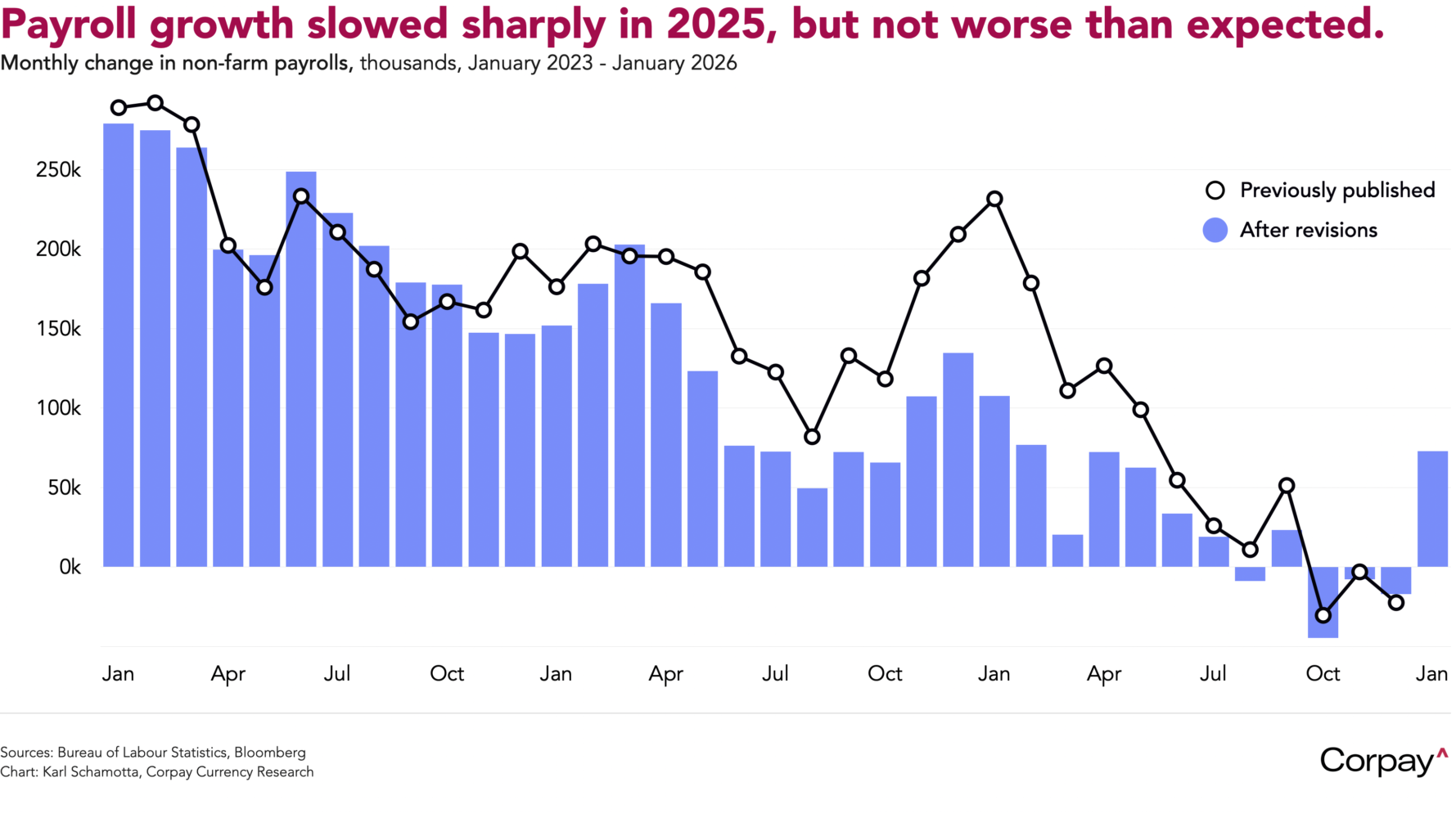

After slowing sharply over the last year, the US job creation engine showed signs of accelerating last month, frustrating market expectations for a rapid easing cycle from the Federal Reserve, and allaying fears of a dramatic slowdown in consumer spending. According to delayed data just released by the Bureau of Labor Statistics, 130,000 jobs were added in January—topping the 68,000-position consensus forecast—while the unemployment rate slid to a rounded 4.3 percent from 4.4 percent previously. Average hourly earnings climbed 0.4 percent month-over-month, jumping from the 0.1-percent pace set in the prior month, and rising 3.7percent in year-over-year terms.

Revisions muddied the picture somewhat. Updates made to the November and December prints showed 17,000 fewer jobs were added than initially estimated, and a number of technical adjustments subtracted 862,000 roles over the year, bringing 2025’s average monthly job creation rate down to 15,000 from 49,000 previously—and well below prior years.

Markets were prepared for something substantially worse. Administration officials flagged weakness in advance, with Kevin Hassett, director of the National Economic Council, telling CNBC viewers on Monday they “shouldn’t panic” if job numbers worsen, and Peter Navarro yesterday warning “We have to revise our expectations down significantly for what a monthly job number should look like”. The “whisper number”—Wall Street’s behind-the-scenes estimate of likely job growth—had likely fallen into the mid-30,000 range ahead of the print.

Traders are pulling back on monetary easing expectations once again, lifting yields across the policy-sensitive end of the curve, and bidding up the dollar against all its major rivals. A rate cut previously expected in June has moved to July, and there are 51 basis points in easing priced in by year-end, down from over 60 yesterday. Psychologically-important resistance levels in the euro, British pound and Canadian dollar look set to hold in the hours ahead as the dollar proves more resilient than expected.

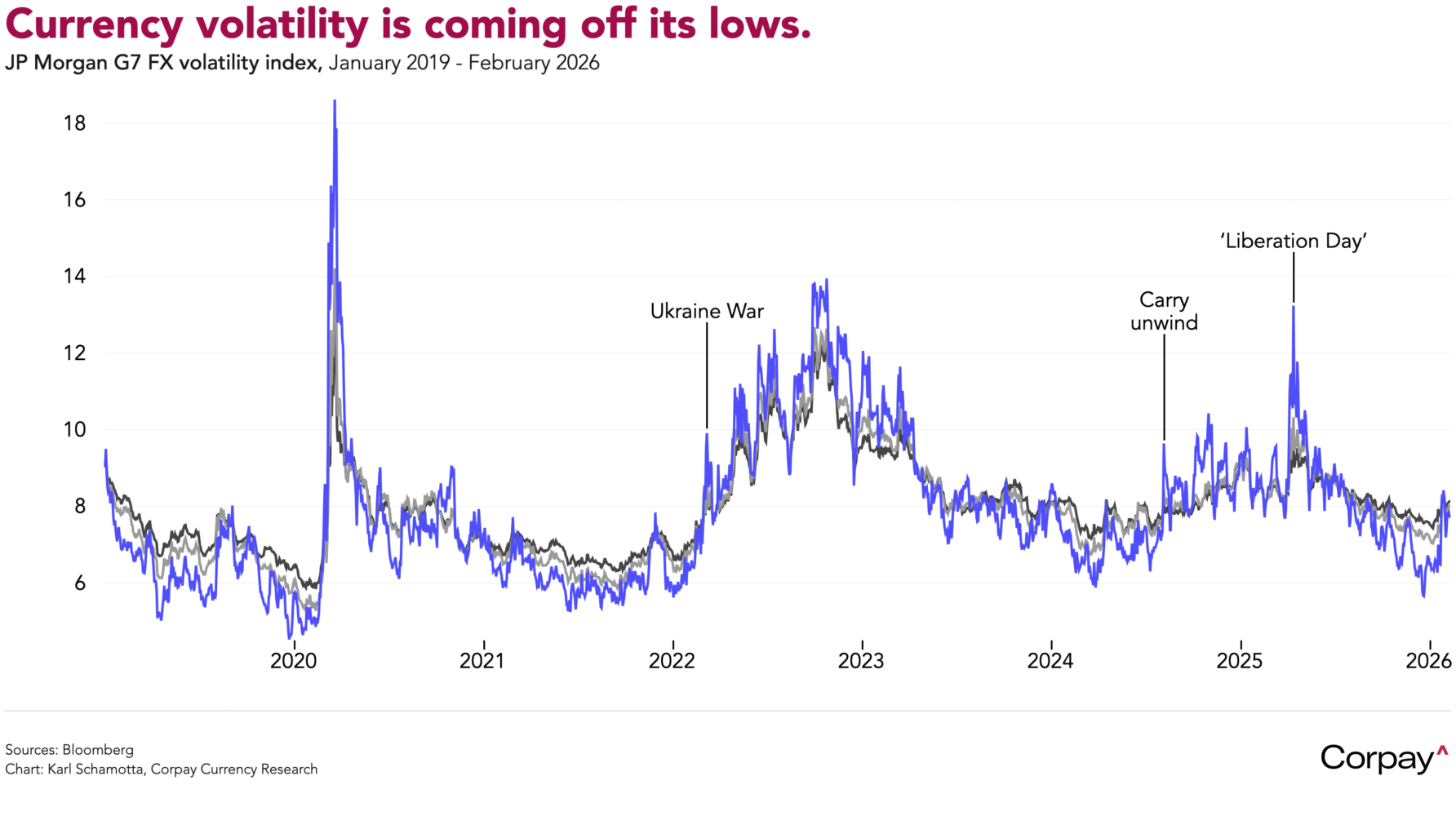

From a broader standpoint, numbers coming out of the US are consistent with a more hawkish policy path than is currently priced into currency markets. Volatility in major pairs could rise in the weeks ahead if investors reassess relative fundamentals and revive a more restrained version of the US exceptionalism trade.