The dollar is edging lower against a basket of its most-traded rivals as investors focus attention on this week’s Federal Reserve meeting—and on the implications for monetary policy in 2026. Benchmark ten-year Treasury yields are parked near the 4.15-percent mark, equity futures are holding steady ahead of the North American open, and the euro, pound, and Japanese yen are all firmly rangebound amid a lack of domestic catalysts.

Markets overwhelmingly expect a “hawkish cut” on Wednesday, with the statement language, dot plot projections, and Chair Powell’s words all pointing to a more gradual pace of easing in the coming months. Job growth in the American economy has gradually slowed this year, the unemployment rate has risen for three consecutive months, and private-sector indicators have highlighted a worrisome rise in corporate layoffs, raising the risk of a non-linear deterioration in labour markets. However, inflation remains stubbornly high, financial conditions are remarkably loose, and consumer spending is still going gangbusters, making it unlikely the entire rate-setting committee will vote to approve the move.

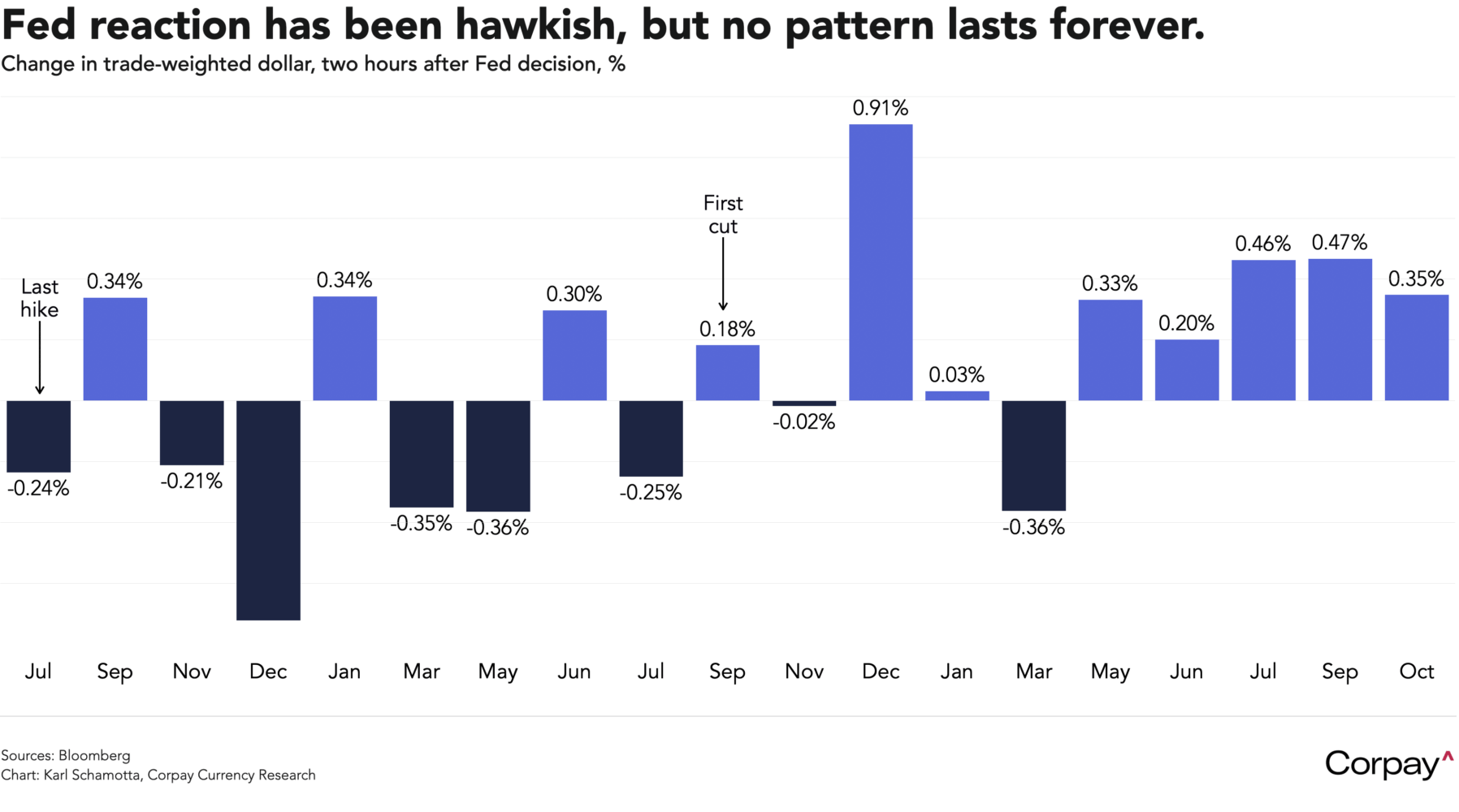

In theory, the dollar could catch a bid. Most observers believe at least two policymakers will dissent against a cut, the median forecast is still seen showing just a single move next year, and Powell himself is expected to warn markets against pricing in further easing in the early new year, arguing that policymakers will need to take time to assess the economy before adjusting rates again. A similar setup has produced an average 0.35-percent rise in the dollar in the two hours following each of the past five meetings. But he may struggle to out-hawk a market already inclined to look through tough talk, and ever-optimistic investors could latch onto even the faintest dovish nuance as evidence that the balance of risks is shifting toward a more aggressive cutting cycle in the new year.

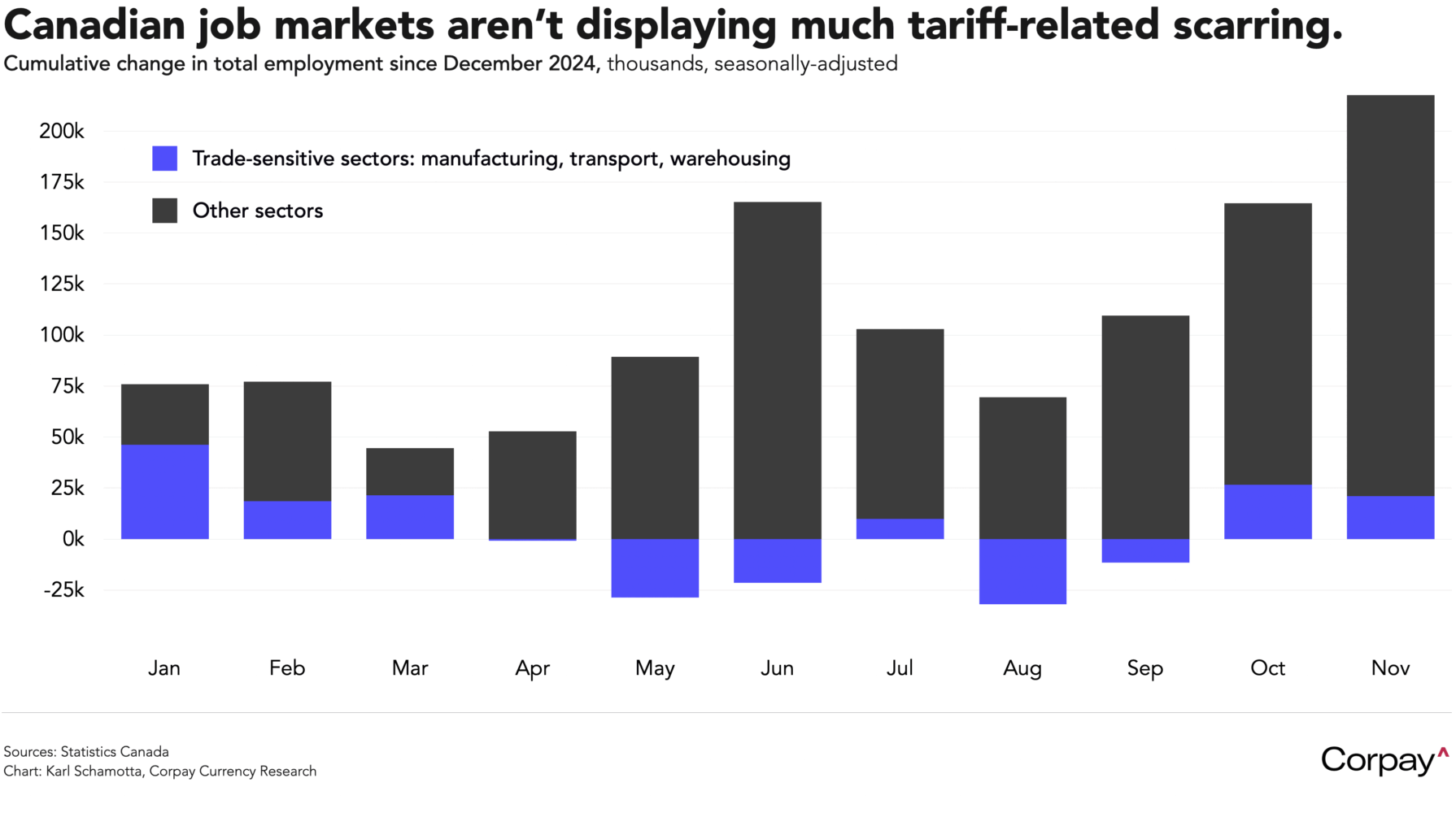

The Canadian dollar is holding territory gained on Friday morning, when a data update showed employment increasing at a faster-than-anticipated pace for a third month in November and the unemployment rate falling four ticks in line with a shrinking labour force, suggesting that other growth engines are helping insulate the economy against a trade-driven downturn. Taken cumulatively, export-exposed industries such as manufacturing, warehousing, and transportation have seen little evidence of job losses this year—despite the Trump administration’s volatile tariff regime—and momentum is emerging elsewhere as the effects of earlier monetary easing take hold and fiscal stimulus begins to gather pace.

No one expects this to translate into a policy change at this week’s meeting. Central bank officials deliberately handed the growth baton to the government and sidelined themselves at last month’s meeting, saying “If inflation and economic activity evolve broadly in line with the October projection, Governing Council sees the current policy rate at about the right level,” and communications since then have remained consistent with a prolonged period on hold.

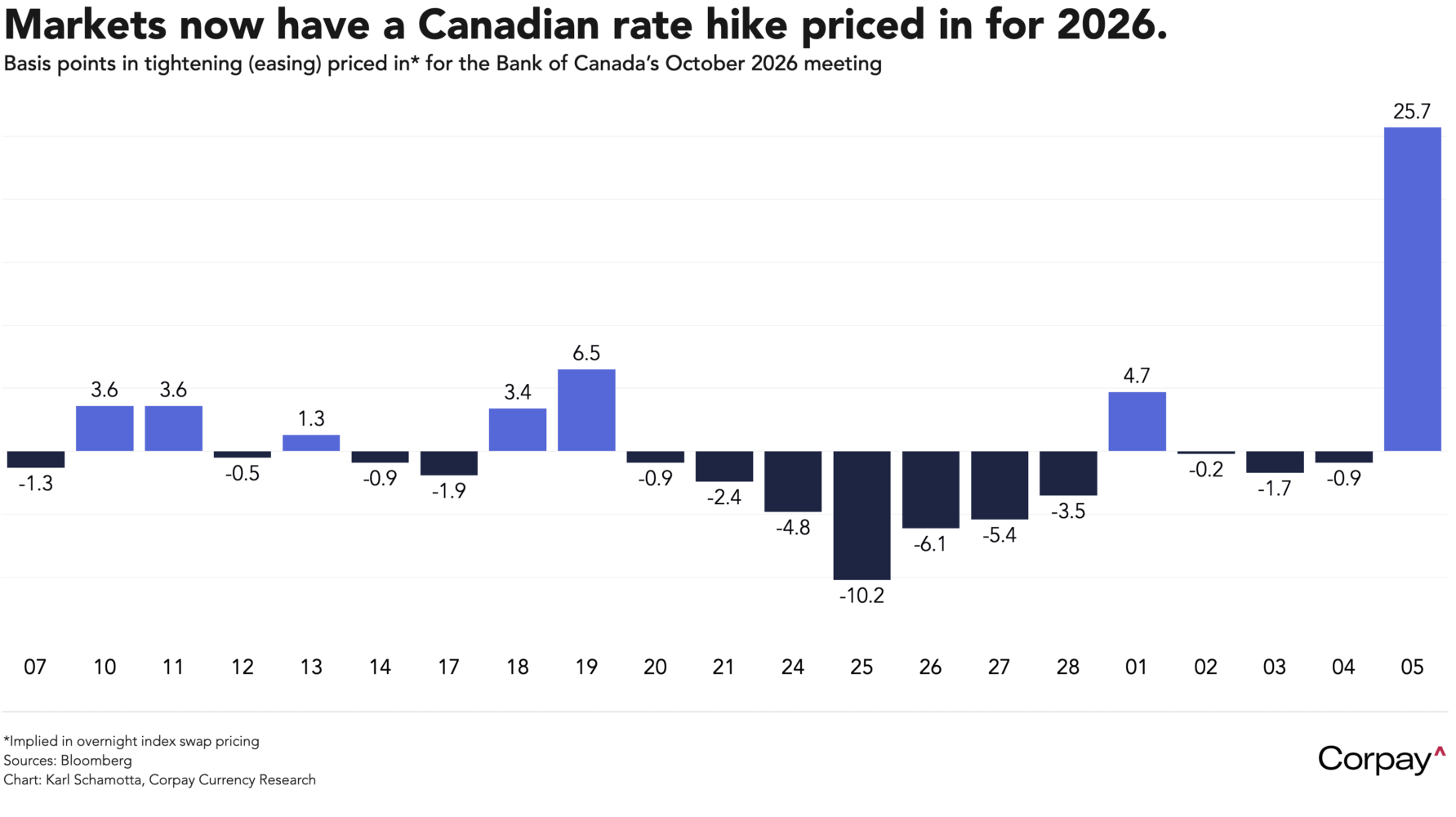

But swaps traders are suddenly pricing in a rate hike at the Bank of Canada’s October 2026 meeting. We think this should act as a warning to those expecting a smooth—and market-supportive—easing trajectory from the Fed over the year ahead, especially given that similar turning points have now been hit in Japan, Australia, and New Zealand. If a hawkish repricing in Fed expectations unfolds in the early new year, markets could perform in entirely unexpected ways.

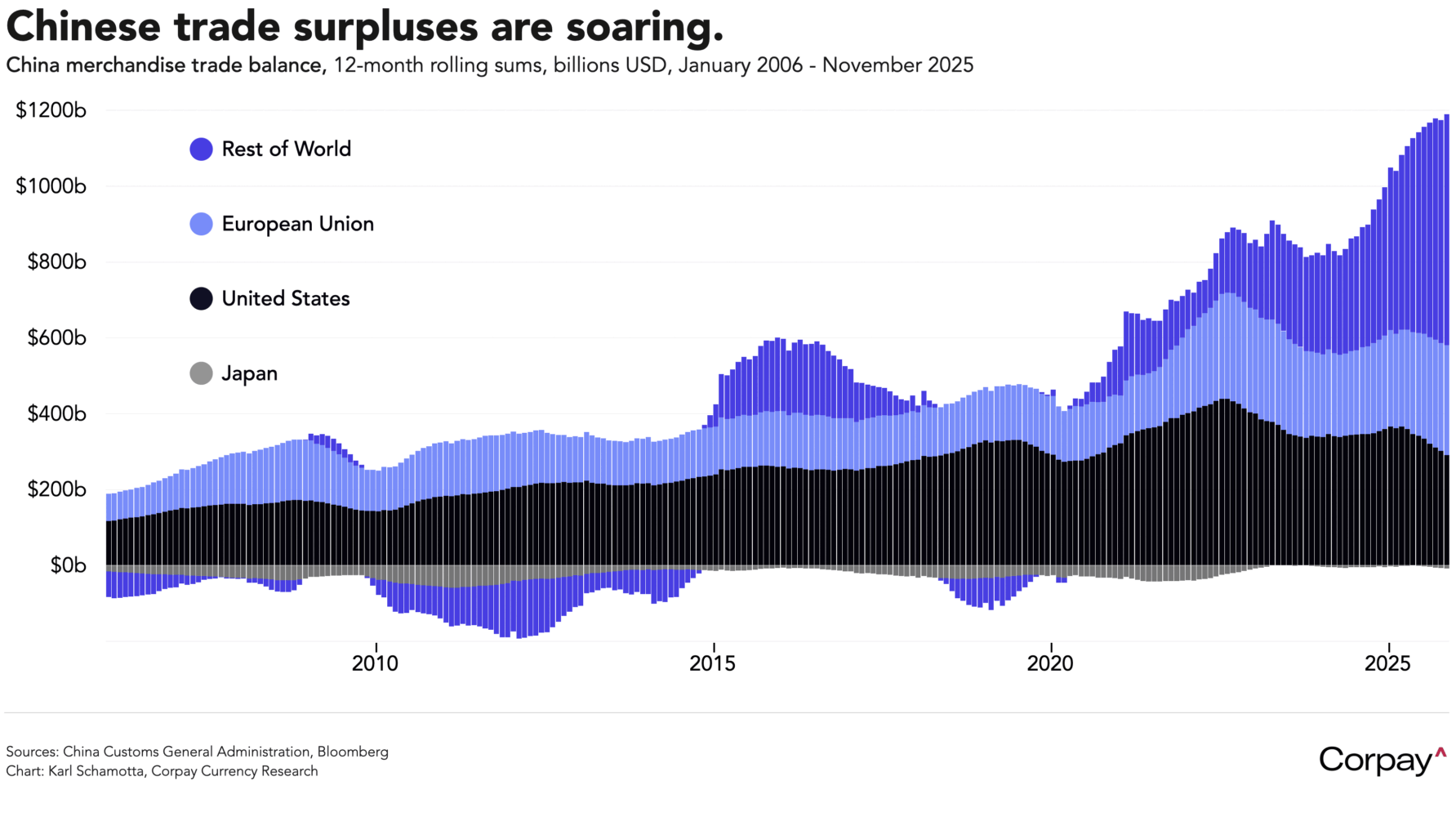

Lastly, we would highlight the fact that the biggest fault line in the global economy continues to widen, threatening to unleash another round of turbulence. According to data published last night, China’s global merchandise trade surplus exploded to almost $112 billion in November, bringing the 12-month rolling total to a record $1.18 trillion as falling direct exports to the US were offset by transshipments through third countries and to other major consumers, including the European Union. As economists have long warned, the patchwork of bilateral, product-specific tariffs implemented by the US this year has not succeeded in narrowing the country’s deficits—only moving them around geographically—and the supply-side growth regime favoured by Chinese policymakers is sending a wave of cheap exports crashing into other areas of the world. If not corrected, this could lead to an economic and political backlash, and to volatility in currency markets.