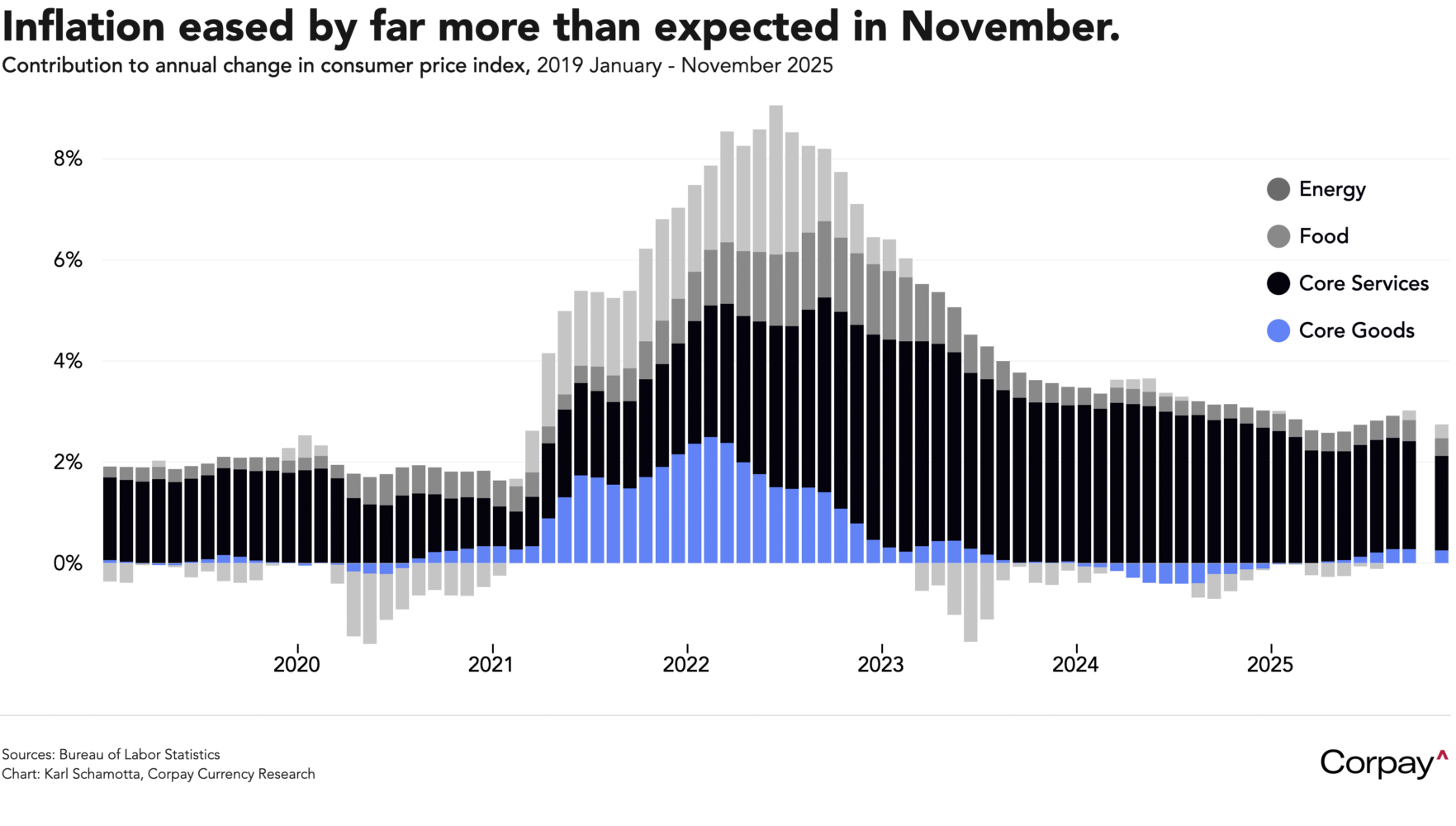

Underlying consumer price growth slowed dramatically in the US last month, helping support expectations for a more aggressive easing campaign from the Federal Reserve in the new year. According to data published by the Bureau of Labor Statistics this morning—data that skipped the month of October—the core consumer price index rose just 2.6 percent in November over the same period last year, decelerating sharply from September’s 3.0-percent increase. This undershot all estimates among economists polled by the major data providers ahead of the release. On a headline all-items basis, prices climbed 2.7 percent year-over-year, also slowing from the 3.0 percent pace set in September. Evidence of tariff-induced price pressures remained difficult to discern in the core goods category.

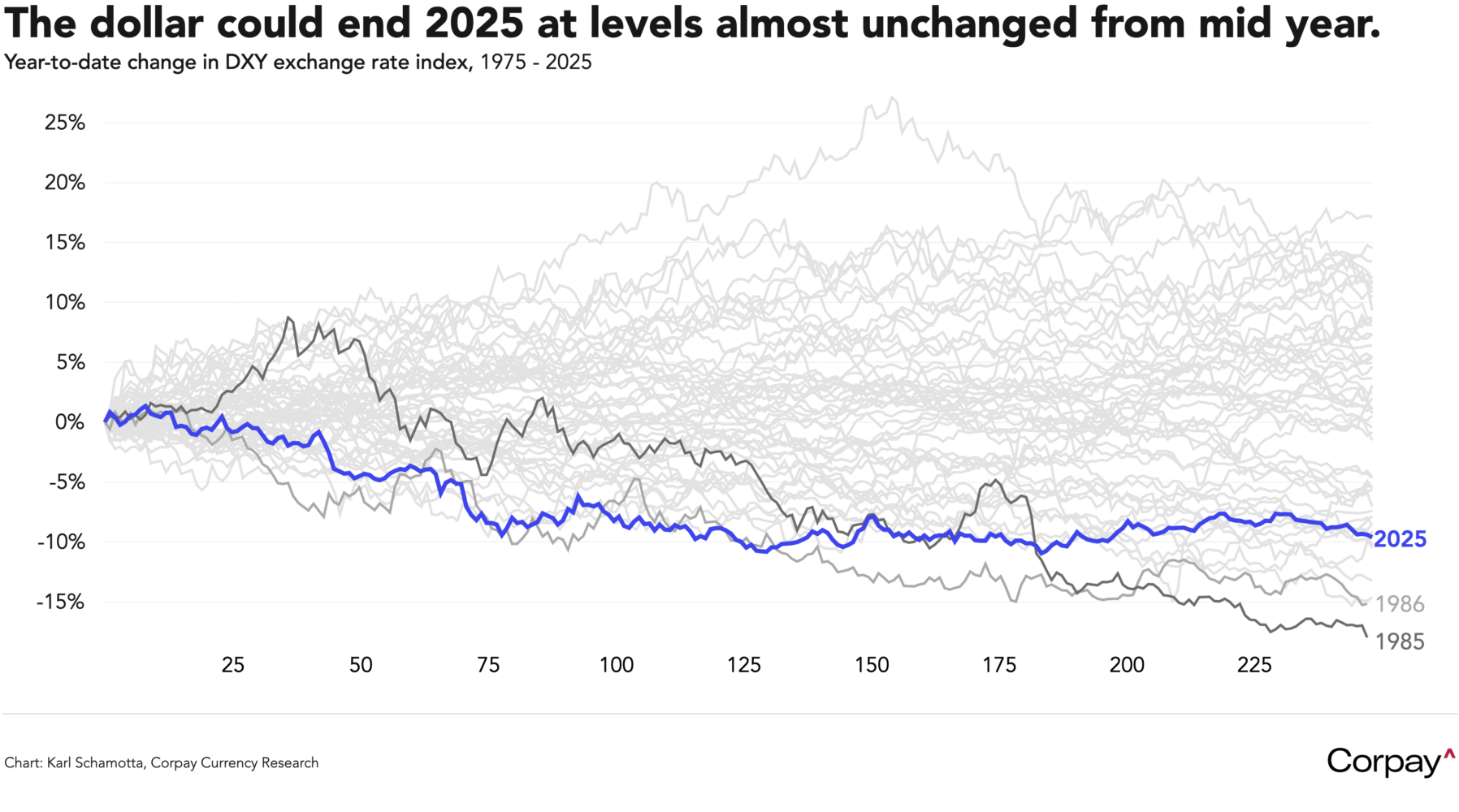

Treasury yields are coming down sharply on the policy-sensitive front end of the curve, equity futures are rebounding from yesterday’s selloff, and the dollar is retreating against its major rivals as traders move to price in a more decisive easing bias from the Fed in the early new year. There are major reasons to suspect that the disinflation narrative might prove short-lived—without October’s data to examine, today’s print could represent a seasonality-driven head-fake—but if this morning’s dynamic holds, the greenback could end the year on the defensive, essentially unchanged from levels reached in the months just after Donald Trump’s “Liberation Day” tariffs damaged the outlook for the world’s largest economy.

Earlier, both the Bank of England and European Central Bank delivered on market expectations with rate decisions and communications designed to keep their policy options open in the new year.

Policymakers in the UK opted to cut rates by a quarter point, but implied that their easing cycle could be nearing its terminus, briefly lending the pound support against both the euro and the dollar. After a series of disappointing economic data releases—and a largely unobjectionable government budget—the Monetary Policy Committee approved the move in a 5-to-4 split decision that saw Governor Andrew Bailey joining the doves after voting to stay on the sidelines in the previous two decisions. The minutes warned that further easing would “depend on the evolution of the outlook for inflation,” and Bailey guided markets to expect a deceleration from here, saying “We still think rates are on a gradual path downward, but with every cut we make, how much further we go becomes a closer call”. Traders had positioned for a slightly more-dovish stance, and ten-year gilt yields are up roughly 5 basis points, but we suspect this could unwind relatively quickly.

Across the Channel, European officials stayed sidelined—as markets had anticipated—and left their forward guidance unchanged, repeating previous language that emphasised a data-dependent, meeting-by-meeting approach to setting policy. Growth projections were revised higher as President Lagarde had teased last week, to 1.2 percent next year and 1.4 in the following year, up from 1.0 and 1.3, respectively. Headline inflation expectations climbed to 1.9 in 2026—up from 1.7—and 1.8 in 2027—down from 1.7. The euro is slipping ahead of the press conference—but this comes after it jumped last week when Executive Board member Isabel Schnabel told Bloomberg she was “rather comfortable” with market expectations for an eventual rate hike. Lagarde may warn investors against pricing a rate hike into the 2026 curve, but is otherwise likely to remain as neutral as possible in her comments on the outlook.

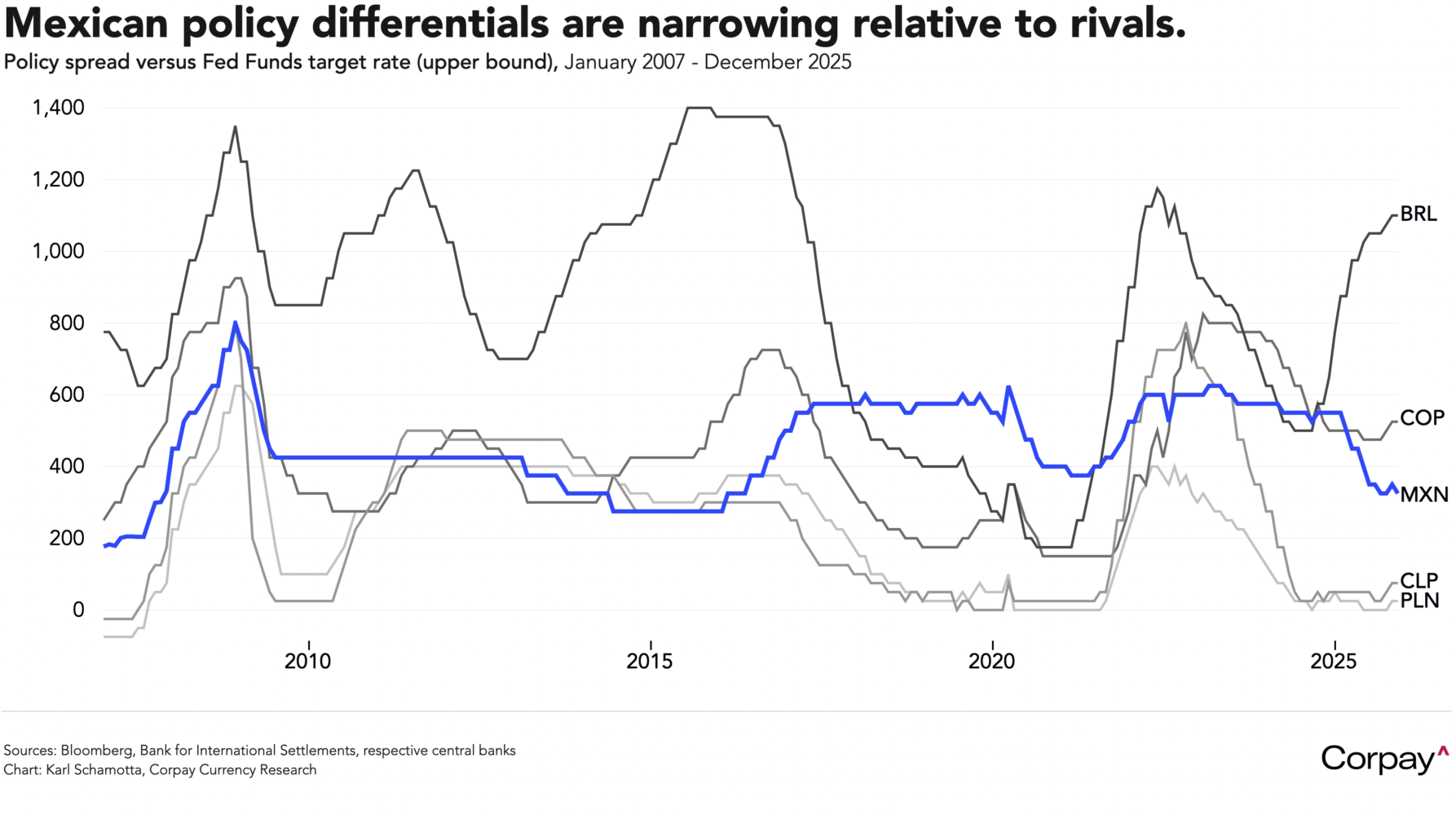

Later today, Mexico’s central bank is expected to pair its own rate cut with statement language that maintains a highly-conditional easing bias. Inflation and inflation expectations remain stubbornly above target and above Banco de México’s own projections, suggesting that officials could take a more hawkish view on the year ahead. But in our view, the case for further rate cuts has strengthened in recent months with net new foreign investment weakening, remittances tumbling, domestic demand slowing, and most measures of activity showing signs of slowing momentum. Disinflation seems likely to resume next year—helped by the peso’s appreciation in 2025, lower oil prices, and declining US rates—and we think the currency’s carry profile could deteriorate relative to some of its emerging-market counterparts, limiting scope for further gains.

The Bank of Japan is overwhelmingly likely to move in the opposite direction this evening when it hikes rates by a quarter-point, lifting front-end borrowing costs to a three-decade high. Officials led by Governor Kazuo Ueda are seen raising the overnight call rate to 0.75 percent and publishing commentary pointing to at least one additional move in the year ahead as they attempt to bring inflation down, reduce distortions in the economy, and stabilise the yen. We think currency market risks are slightly tilted toward the hawkish side of the equation—an explicit upward revision in the central bank’s estimate of the “neutral rate” could guide traders to expect more tightening than is currently priced in—but a deeply uncertain economic backdrop could prevent an outbreak of ebullience and keep the yen under pressure for now.