• Geopolitical vol. Weekend US tariff announcements initially rattled markets. But the USD lost ground as yesterday rolled on. AUD & NZD higher.

• US pressure points. US reliant on foreigners to fund its obligations. Reduced capital inflows could weigh on the USD over the medium-term.

Global Trends

There has been a modest market reaction to the weekend geopolitical news relating to Greenland. Indeed, for some the net swings may be somewhat surprising. For those catching up, over the weekend President Trump announced that eight countries (UK, Denmark, Germany, France, Sweden, Norway, Finland and The Netherlands) would be subject to a 10% tariff from 1 February (rising to 25% from 1 June) until they agree to support the US’ acquisition of Greenland. European leaders have called an emergency summit to discuss developments and possibly explore retaliatory measures on Thursday. President Trump will also remain in the spotlight as he is set to appear at the World Economic Forum in Switzerland in a few days’ time.

Notably, yesterday morning’s initial knee-jerk ‘risk off’ and firmer USD/softer EUR moves more than reversed course as the day rolled on, especially in the USD which has, on net, weakened over the past 24hrs. EUR is back up near its year-to-date average (now ~$1.1645), as is GBP (now ~$1.3428), while USD/JPY ticked up (now ~158.14) with the confirmation Japan will hold elections on 8 February (and prospect of more fiscal measures being unveiled) offsetting ‘safe-haven’ demand. The NZD outperformed (now ~$0.5795) and the AUD strengthened (now ~$0.6715).

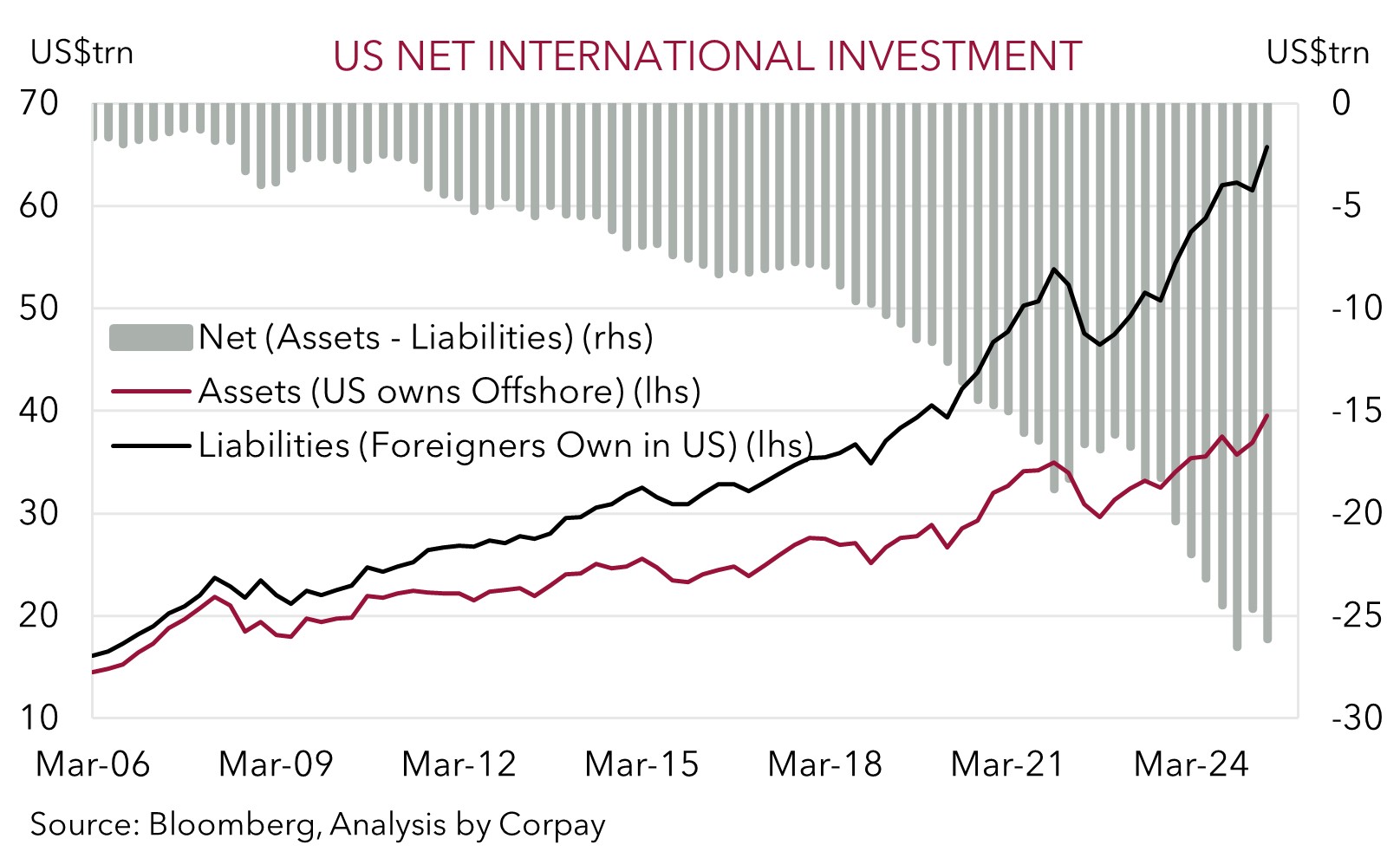

The dip in the USD may have reflected the fact market activity was lower due to the US observing its Martin Luther King Jr holiday. It could also be due to views that a rekindled tit-for-tat trade war between the US/Europe might not eventuate given last year’s TACO experience (i.e. Trump Always Chickens Out). Added to that, some renewed “sell America” pressure might have resurfaced. This was an underlying market trend in the wake of last year’s Liberation Day tariff announcements. As our chart shows, on the back of its large/persistent trade, budget, and capital flow deficits, the US has accumulated a sizeable net international investment position (i.e. foreigners own more US financial assets compared to what US residents own abroad). Overseas investors play a key role in funding the US’ obligations.

Fresh concerns about the US’ already fragile economic outlook, faith in US institutions, and/or its respect for national sovereignty could shake investor confidence with reduced capital inflows (or capital outflows) weighing on the USD. These are structural pressures we think should exert downward pressure on the USD over the medium-term. In the short-run, more Greenland/tariff-related headlines might generate a few bursts of volatility, particularly as the global data calendar is light until the end of the week.

Trans-Tasman Zone

After dipping slightly yesterday morning on the back of the weekend’s US/Greenland related geopolitical news, the pullback in the USD has helped the NZD and AUD edge higher (see above). The NZD (now ~$0.5795) is approaching its year-to-date peak while the AUD (now ~$0.6715) is hovering near the upper end of its 1-year range. Firmer commodity prices (gold +1.8% and copper +1.3%) were also helpful. Outside of a slight fall in AUD/NZD (now ~$1.1588) the AUD also outperformed on the other major cross-rates with gains of ~0.1-0.8% recorded against EUR, JPY, GBP, CAD, and CNH. We remain of the view that up around current levels there are uneven risks for AUD/JPY (now ~106.19). Since 1995 AUD/JPY has only been above where it now is in less than ~0.5% of trading days and it is appears stretched compared to underlying drivers such as yield spreads.

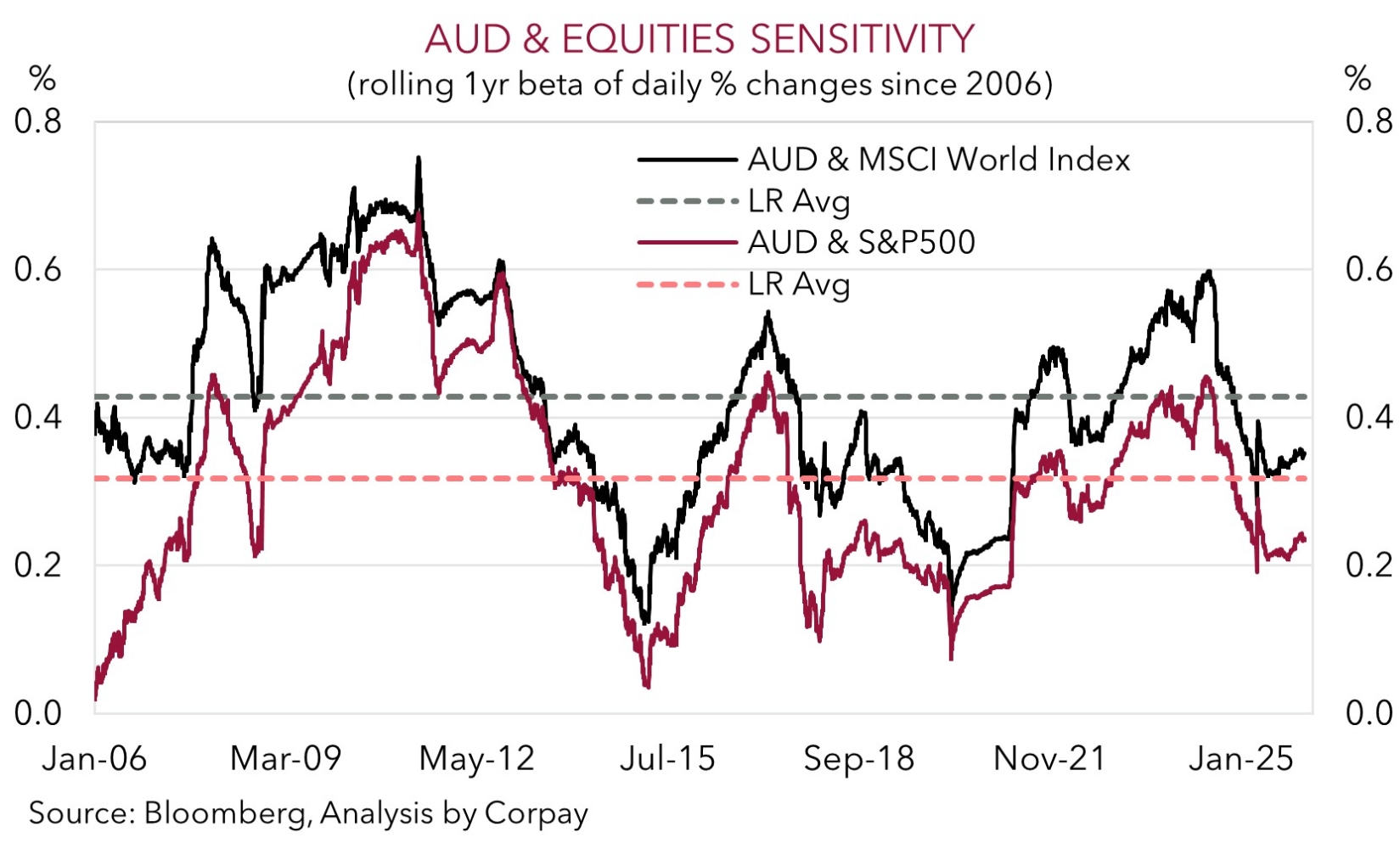

As discussed above, more bursts of US/European headline driven market volatility are possible over the short-term with President Trump appearing at the World Economic Forum and EU leaders holding an emergency summit over the next few days. However, we believe that barring a sharp/sustained bout of risk aversion the impact on the AUD should be minimal. As our chart shows, the AUD’s sensitivity/correlation to US and global equities has declined over recent years. This reflects the shift/improvement in Australia’s net international investment position and capital flow dynamics which means the AUD shouldn’t be as impacted by bouts of market turbulence like it was in the past.

Looking ahead, this week in Australian the monthly jobs data is released (Thursday). Volatility in the monthly labour force statistics should persist in December. We think that hiring was stronger after a weak November print. Signs Australia’s job market remains on firm footing could reinforce expectations that the RBA remains on a different path to its peers and/or boost odds a rate hike is announced in early-February. The market now views a February rate rise as a ~27% chance. The Q4 CPI inflation data is due next week (28 January). Over the medium-term, we continue to see the AUD grinding up into the high-$0.60s with more favourable yield spreads between Australia and others such as the US a factor, as is a weaker USD, and prospect of more stimulus out of China. Yesterday’s figures showed China’s economic growth moderated to ~5%pa in Q4 with investment dragging on activity. We expect China’s government to bolster its policy support to achieve its growth objectives.