Equity futures, Treasuries, and the dollar are down for a second day as investors shun US assets in the aftermath of the weekend’s Greenland-related tariff threats from Donald Trump, and selling in Japanese bond markets puts upward pressure on global yields. On Saturday, Trump threatened to impose import taxes on goods from European countries until they allow the US to buy the Danish territory, beginning with a 10-percent levy on February 1 and increasing to 25-percent on June 1. He then sent a message to Norway’s Prime Minister saying that he no longer feels obliged to “think purely of Peace” because he was not awarded the Nobel Peace Prize, later said there was “no going back,” and last night posted a picture of himself planting a flag on the island. The VIX index—Wall Street’s “fear gauge”—has risen almost 30 percent and is now flirting with the 20 threshold that typically signals extremes in sentiment levels.

European leaders have roundly condemned Trump’s bellicosity. European Commission president Ursula von der Leyen said Brussels would respond in an “unflinching, united and proportional” manner, prompting renewed focus on the EU’s so-called “bazooka”—the Anti-Coercion Instrument, which would allow the bloc to impose fees, penalties or bans on US companies and investors. But any such move would face steep procedural hurdles, including a lengthy investigation and approval from 55 percent of member states and US Treasury Secretary Scott Bessent dismissed its likelihood, saying “I imagine they will form the dreaded European working group first, which seems to be their most forceful weapon,” warning “The worst thing countries can do is escalate against the United States”.

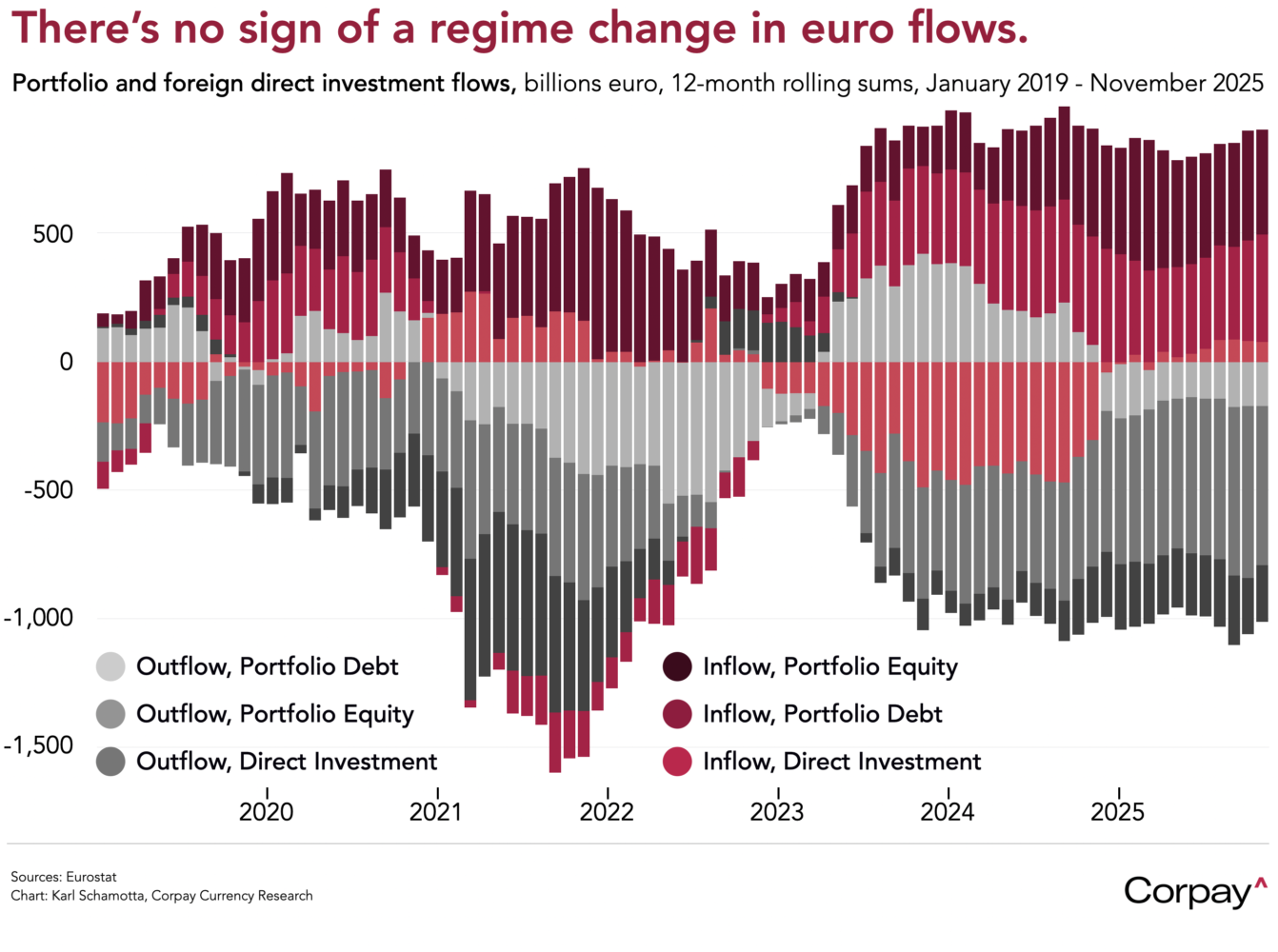

The euro is trading on a firmer footing as market participants anticipate a broader reallocation of capital flows toward the common-currency bloc and front-run an expected increase in defence spending among European members of the military alliance formerly known as the “North Atlantic Treaty Organization”. We don’t see this as a viable bull case in the long run, but merely a corrective move after an early-year shift in positioning toward the dollar. Despite endless newsprint devoted to the topic over the last year, there’s been no sign of a regime change in investment flows, and much of the economic area’s current account surplus continues to pour into US assets.

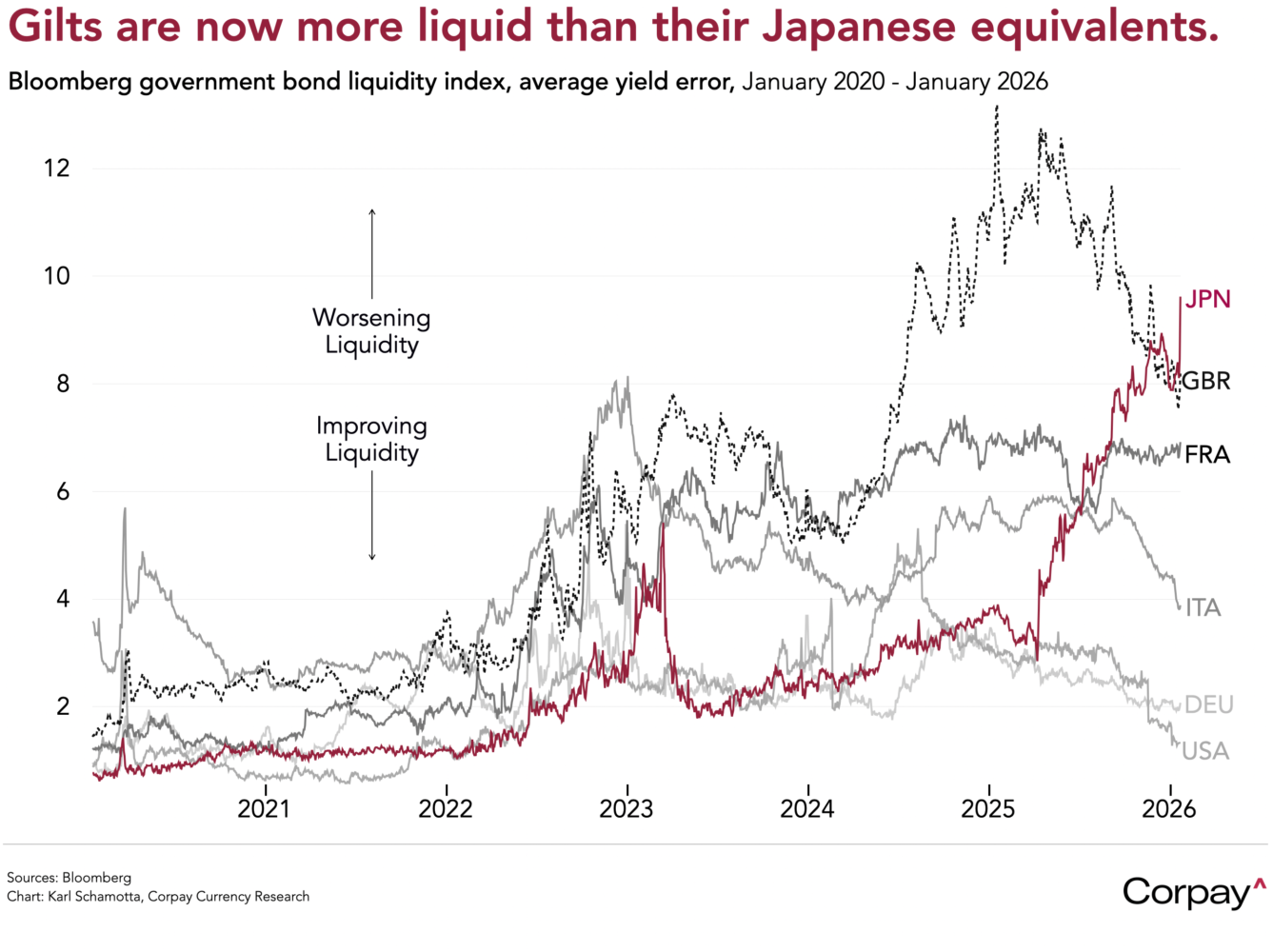

On the other side of the Pacific, interest rates are punching higher as Prime Minister Sanae Takaichi prepares Japan for a snap election. The yield on 10-year government bonds soared to three-decade highs and ultra-long-dated instruments jumped at least 27 points higher last night after Takaichi promised to cut sales taxes on food for at least two years, potentially widening an already-gaping budget deficit and increasing borrowing volumes. Government spokesperson Minoru Kihara tried to downplay the moves saying, “Long-term yields move on various factors,” and “We’ll make sure to gain market trust through a sustainable fiscal policy, making our economy strong and bringing down the debt-to-GDP ratio,” but liquidity conditions worsened beyond British levels, pointing to a lack of confidence among market participants and prompting calls for intervention from the Bank of Japan, which has been reducing its holdings.

The coming days are littered with political event risks. Investors will be on alert around 10:00 this morning, when the US Supreme Court may—or may not—rule on the administration’s tariff agenda. Markets could also react to a hearing on the attempted dismissal of Fed governor Lisa Cook, particularly if the justices endorse the government’s claim that the president can remove officials at will. Meetings in Davos between Trump and other leaders may add volatility, especially if his plans for a “Board of Peace” for Gaza falter and provoke renewed threats. Traders are also watching for developments on Iran. Against this backdrop, Thursday’s weekly jobless claims and stale November income and spending figures are likely to generate a fairly modest reaction.

Bottom line: as “Liberation Day 2.0” unfolds, waning confidence in American economic leadership is overshadowing fundamentals in currency markets. While there is no sign of a truly-destabilising repeat of last year’s unwind in Treasury basis trades, my conviction in an eventual hawkish repricing of US growth and monetary policy expectations has weakened, lowering the likelihood that the dollar outperforms its global rivals in the first quarter.