• Risk rebound. Strong recovery in US equities. USD lost ground. Backdrop pushed NZD & AUD higher. JPY still under pressure post weekend elections.

• Data flow. RBA Deputy Gov speaks (Weds). US retail sales (Tues night), jobs report (Weds night), & CPI (Fri night) due. Several Fed members also speak.

Global Trends

There was a turnaround in market sentiment at the end of last week with cyclical assets (i.e. equities and copper) and growth linked currencies such as the AUD and NZD posting solid gains on Friday. After a few soft sessions related to concerns about AI disruption and the scale of tech sector capex, bargain hunters emerged helping US equities rebound strongly with the benchmark indices rising ~2-2.5%, the best daily performance since last May. It also helped the S&P500 claw back lost ground and almost end the week unchanged. Elsewhere, US bond yields ticked up ~1-3bps, copper (+2.4%) and gold (+3.2%) rose, and in FX the USD weakened a little. EUR (the major USD alternative) ticked higher (now ~$1.1813), as did GBP (now ~$1.3591), while the NZD (now ~$0.6015) and AUD (now ~$0.7008) strengthened ~0.9%.

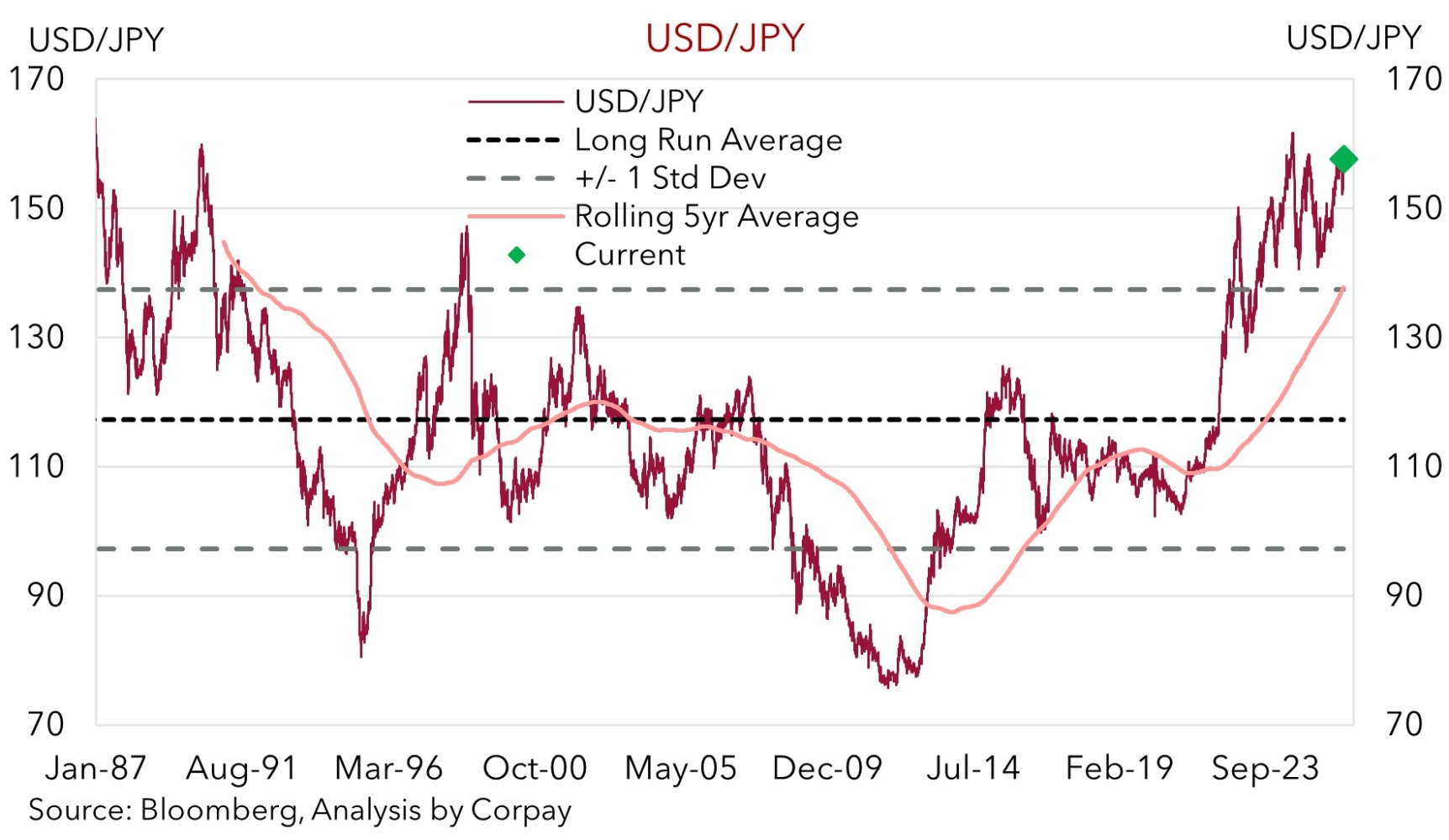

USD/JPY (the second most traded currency pair) also extended its uptrend. At ~157.62 USD/JPY is not that far from its cyclical peak, and as our chart shows, is in a region seldom traded over the past ~35 years. Over the weekend lower house elections were held in Japan. New Japanese PM Takaichi looks set to secure a landslide victory, reinforcing the high pre-election hype that the government will deliver cost-of-living fiscal relief measures. Ramped up expectations that the latest Japanese government will unleash large-scale fiscal spending and constrain the Bank of Japan’s ability to hike interest rates has weighed on the JPY (i.e. propelled USD/JPY and other crosses like AUD/JPY higher). In our opinion, the JPY looks undervalued (i.e. USD/JPY and AUD/JPY are too high) compared to underlying fundamentals such as yield spreads, with sentiment and momentum in the driver’s seat recently. We believe there are uneven risks and scope for the JPY to snap back sharply over the months ahead. Fiscal policy is unlikely to be more expansionary than anticipated before the election with the government facing pressure from financial markets. Equally, the Bank of Japan may raise interest rates sooner and/or by more than predicted because of the inflation impact of a weaker currency.

This week the economic focus should be in the US with several delayed pieces of data due to be released. The list includes US retail sales (Tues night AEDT), the quarterly employment cost index (Tues night AEDT), the January jobs report (Weds night AEDT), and the latest CPI reading (Fri night AEDT). Several US Fed members are also speaking this week. On net, we think the incoming data could show consumer spending and employment improved post the US government shutdown, while core inflation might remain a bit sticky. This mix may give the USD some short-run support, especially as it is still tracking below our ‘fair value’ estimate.

Trans-Tasman Zone

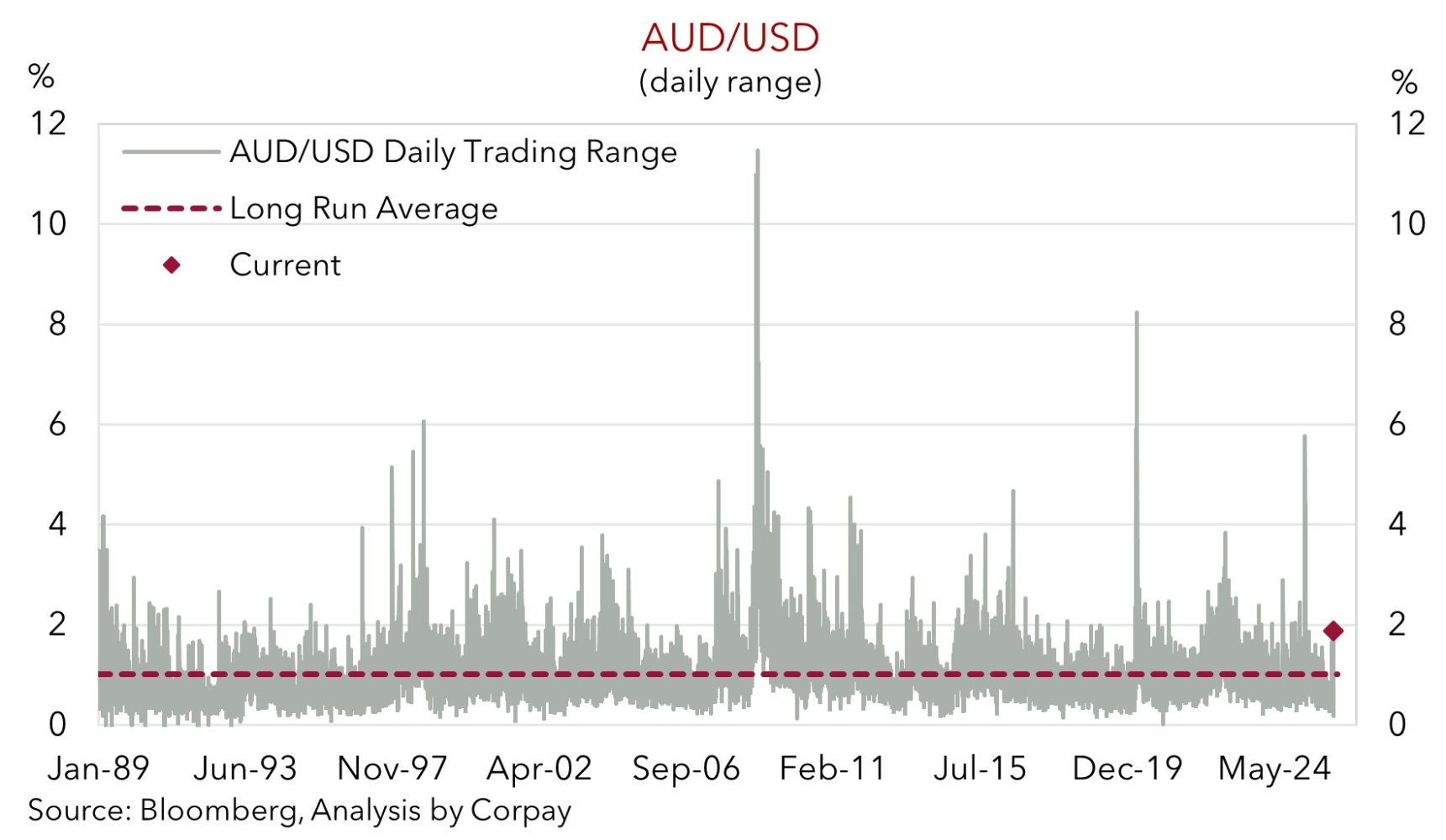

The improvement in risk sentiment, as illustrated by the rebound in US equities and firmer base metal prices, coupled with a softer USD boosted the NZD and AUD at the end of last week (see above). At ~$0.6015 the NZD is back inline with its 2-week average and is less than 2% from the top of its 1-year range. The AUD (now ~$0.7008) recouped lost ground, with the recent daily swings more reminiscent of the past. Over the past few weeks, the AUD’s daily trading range has generally been wider than its long-run average (see chart below). Some may have forgotten about the AUD’s inherent volatility given the extended period of below average daily volatility.

The AUD also perked up on the major crosses on Friday with gains of ~0.5-0.8% recorded versus the EUR, GBP, CAD, and CNH. AUD/JPY has jumped by more (+1.3%) and is now at levels last traded in H2 1990 (now ~110.46). As discussed above, the JPY has been weighed down by aggressive expectations the new Japanese government (and projected win at the weekend elections) would see a large-scale fiscal spending package unleashed. We feel markets may have run ahead of themselves with the JPY (and crosses like AUD/JPY and NZD/JPY) now very stretched compared to underlying drivers such as interest rate differentials. Indeed, since 1988 AUD/JPY has only closed above where it now is in ~3% of trading days. The risk of a sizeable pull-back in AUD/JPY over the period ahead, once Japanese fiscal reality hits and/or the Bank of Japan delivers more inflation fighting/currency stabilizing rate hikes, is a rising probability, in our view.

In terms of AUD/USD, Australian household spending is out today (11:30am AEDT), consumer and business confidence is due this week (Tues), and RBA Deputy Governor Hauser speaks (Weds). If policy is discussed we think Hauser should stick to the script and note the underlying inflation dynamics keep the door open for the RBA to raise interest rates again. But this is already priced with markets fully factoring in another RBA rate hike by August. Based on our thoughts the USD might tick up a little due to solid upcoming US data releases the AUD may drift back. However, the shift in relative interest rates in Australia’s favour should continue to generate solid support and limit AUD pull-backs. We expect the AUD to track in a higher average range compared to the past few years. But with the negative economic effects of higher interest rates also set to materialise over coming months we continue to think ~$0.71-0.72 may be a ceiling for the AUD.