Markets look set to extend gains for a second day after President Donald Trump ruled out the use of force and retreated from threats to seize Greenland through economic coercion. The dollar is firmer, yields are steadier, and stock futures are pointing to a stronger open as a relief rally plays out across asset classes. Measures of implied volatility in Treasury, equity, and foreign exchange markets are all coming down as investors reduce protection against tail exposures, and risk-sensitive currencies like the Australian and Canadian dollars are outperforming their safe-haven brethren.

Late yesterday, Trump said he would not proceed with his weekend tariff ultimatum against European allies, citing a “framework of a future deal” with NATO secretary-general Mark Rutte that would stop short of US ownership of Greenland—only hours after insisting he would accept nothing less. On Saturday, the president had threatened 10 percent tariffs on imports from eight European countries from February 1, rising to 25 percent by June if the US was not allowed to purchase the Danish territory. Details of the putative agreement remain sparse, but references to missile-defence staging—already covered by a 1951 accord—and mineral rights, which fall outside NATO’s remit, suggest the near-term macroeconomic consequences should be minimal, even as a fracturing in Western military alliances points to a less efficient global economy in the future.

Supreme Court justices appeared to take a dim view of the Trump administration’s attempt to fire a sitting Fed Governor in yesterday’s hearing, lowering the threat level for a central bank that has historically been insulated against political interference. Justice Brett Kavanaugh—a Trump appointee—noted that letting the president remove officials at will “would weaken or shatter the independence” of the Fed, and his conservative counterparts followed with hard-hitting questions on why the White House had chosen to file an emergency appeal rather than let the lower courts decide whether Lisa Cook’s “inadvertent mistake” in completing loan documents provided sufficient grounds for dismissal.

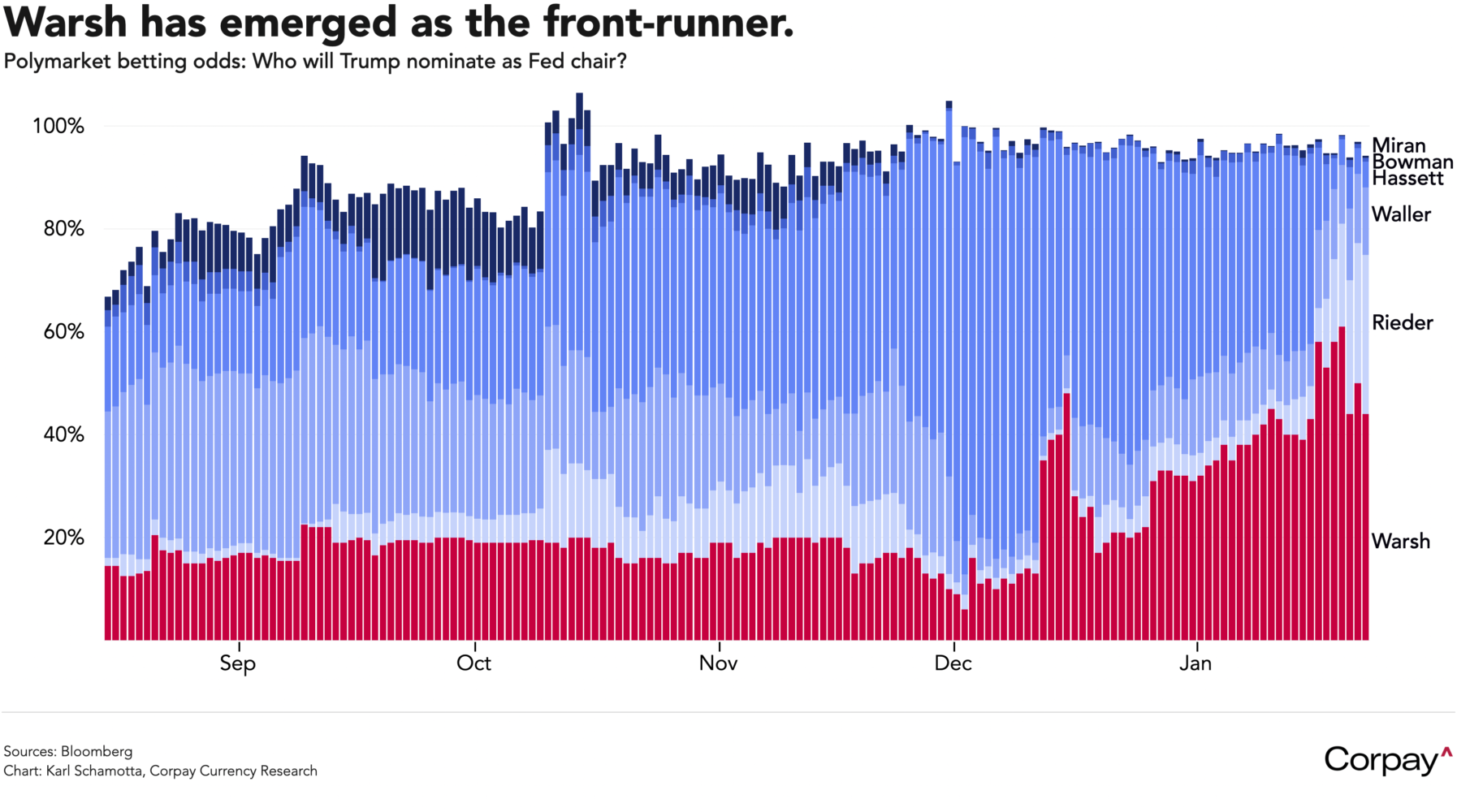

Fears of an erosion in the Fed’s independence are retreating along other vectors. Betting markets now point to Kevin Warsh as the leading contender to succeed Jerome Powell when his term ends in May, after President Trump appeared to play down Kevin Hassett’s chances in an interview last week. Warsh, who served as a Fed governor from 2006 to 2011, was often on the wrong side of inflation calls—including urging tighter policy as Lehman Brothers collapsed—but has since built a profile as a critic of the central bank’s governance, is politically well-connected, and looks the part—an important variable in the president’s estimation. Traders perceive him as someone likely to deliver modestly lower rates, but also as someone with the sound-money credentials needed to keep inflation expectations anchored over time.

Interestingly, the Mexican peso is sitting on another day of gains, and is now up roughly 3 percent on a year to date basis. The exchange rate has climbed through a series of exogenous shocks—including a sharp rise in long-term Japanese yields—with a still-wide rate premium to the US, continued low volatility, and ongoing evidence of a strong relationship between President Claudia Sheinbaum and Donald Trump providing insulation. Fundamentals have also played a relatively positive role, with domestic demand showing signs of improvement, activity levels holding up, and inflation running slightly warmer than economists had anticipated.

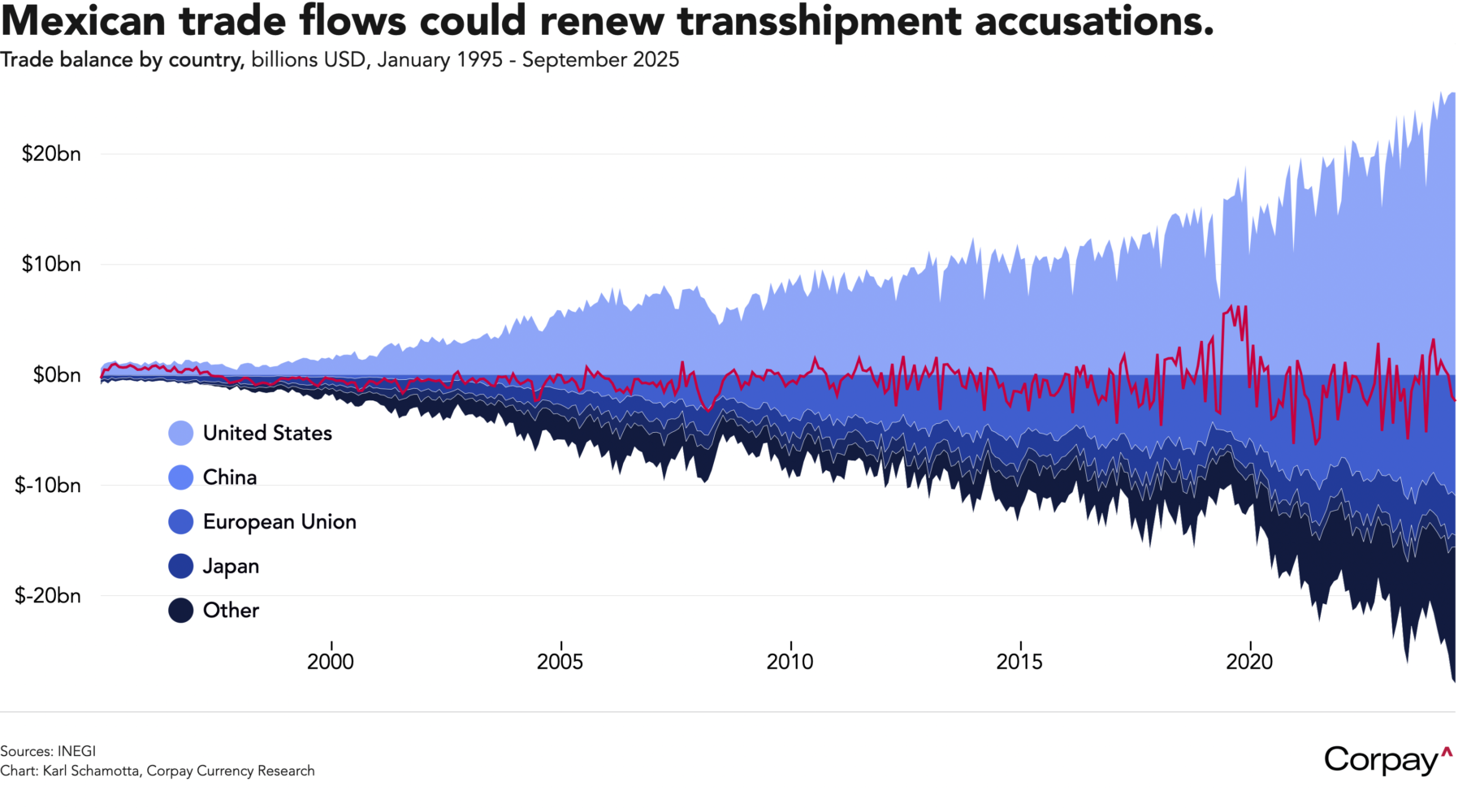

The currency has outperformed our expectations for the better part of two years, but we’re not sure how long its current strength can last. Although Mexico’s exports to the US have soared, imports from other countries have grown at a similar pace, suggesting that the economy is functioning less as a new manufacturing hub than as a logistical conduit through which products are routed into the United States. This pattern is consistent with firms exploiting trade agreements, geographical proximity, and final assembly capacity to sidestep the Trump administration’s tariff regime, leaving America’s dependence on imports effectively unchanged—and it raises the possibility that US officials take a harder line when it comes to the upcoming renegotiation of the US-Mexico-Canada trade agreement. Event risks seem underpriced, and the peso’s current valuations look stretched.