• Choppy markets. Intra-session swings overnight. Positive steps between US/Iran help sentiment. AUD & NZD tick a bit higher in quiet trading.

• Macro events. RBNZ today. No change in rates expected. New forecasts released. AU wages out today ahead of the monthly jobs report tomorrow.

Global Trends

Markets were choppy overnight with intra-session swings translating to only limited net changes. For example, after falling by nearly 1% at the open on the back of lingering AI uncertainty, the US S&P500 clawed its way back into positive territory (+0.1% over the day). In bonds, US yields edged a fraction higher (+1-3bps across the curve), while Eurozone and UK yields slipped back. A weaker than anticipated UK jobs report, which showed unemployment rose to a fresh five year high (now 5.2%), reinforced expectations looking for the Bank of England to cut interest rates again over the months ahead. Another BoE rate reduction is almost fully priced in by the late-April meeting. This also exerted some downward pressure on GBP (now ~$1.3562, the lower end of its one-month range).

Elsewhere, hopes of a de-escalation of Middle East tensions were triggered by news Iran and the US have reached a “general agreement” on a set of guiding principles for a potential nuclear deal. The positive steps supported sentiment, with oil prices shedding ~2% (WTI crude is at ~US$62.30/brl) and gold losing ground (-2.3% to US$4900/ounce). In FX, outside of GBP, movements were limited with the USD index consolidating. EUR is hovering near ~$1.1852 and USD/JPY is tracking at ~153.27 (around the bottom of its four-month range). The AUD is within ~1% of its cyclical peak (now ~$0.7083), and ahead of today’s RBNZ meeting (12pm AEDT) where no change in interest rates is predicted the NZD is trading towards the upper end of its multi-month range (now ~$0.6049).

Today, in addition to the RBNZ, Australian Q4 wages data is due (11:30am AEDT), while later UK CPI inflation (6pm AEDT) and US durable goods orders (12:30am AEDT) are out. Further ahead, the global business PMIs are due (Friday), as is Q4 US GDP and the PCE deflator (the Fed’s preferred inflation gauge) (Fri night AEDT). On balance, the PMIs may show momentum in the US has picked up, and although US GDP growth might have slowed from its robust Q3 pace, some of that will be mechanical because of the extended government shutdown. US consumer spending (the engine room of the economy) looks like it was solid in Q4. If realised, we think this could give the USD some short-run support later this week given it is below our ‘fair value’ estimate.

Trans-Tasman Zone

The improvement in sentiment, as illustrated by the intra-session rebound in US equities and reduced risk premium attached to oil and gold, has helped the NZD and AUD nudge up (see above). At ~$0.6049 the NZD is less than 1% from its multi-month peak, while the AUD (now ~$0.7083) remains within striking distance of its multi-year high. The AUD has also edged up against the CAD (+0.2%), CNH (+0.1%), and EUR (+0.1%), while the dip in GBP on the back of the weaker UK jobs report and rising odds of another BoE rate cut over the next few months has pushed AUD/GBP towards its recent peak (now ~0.5223).

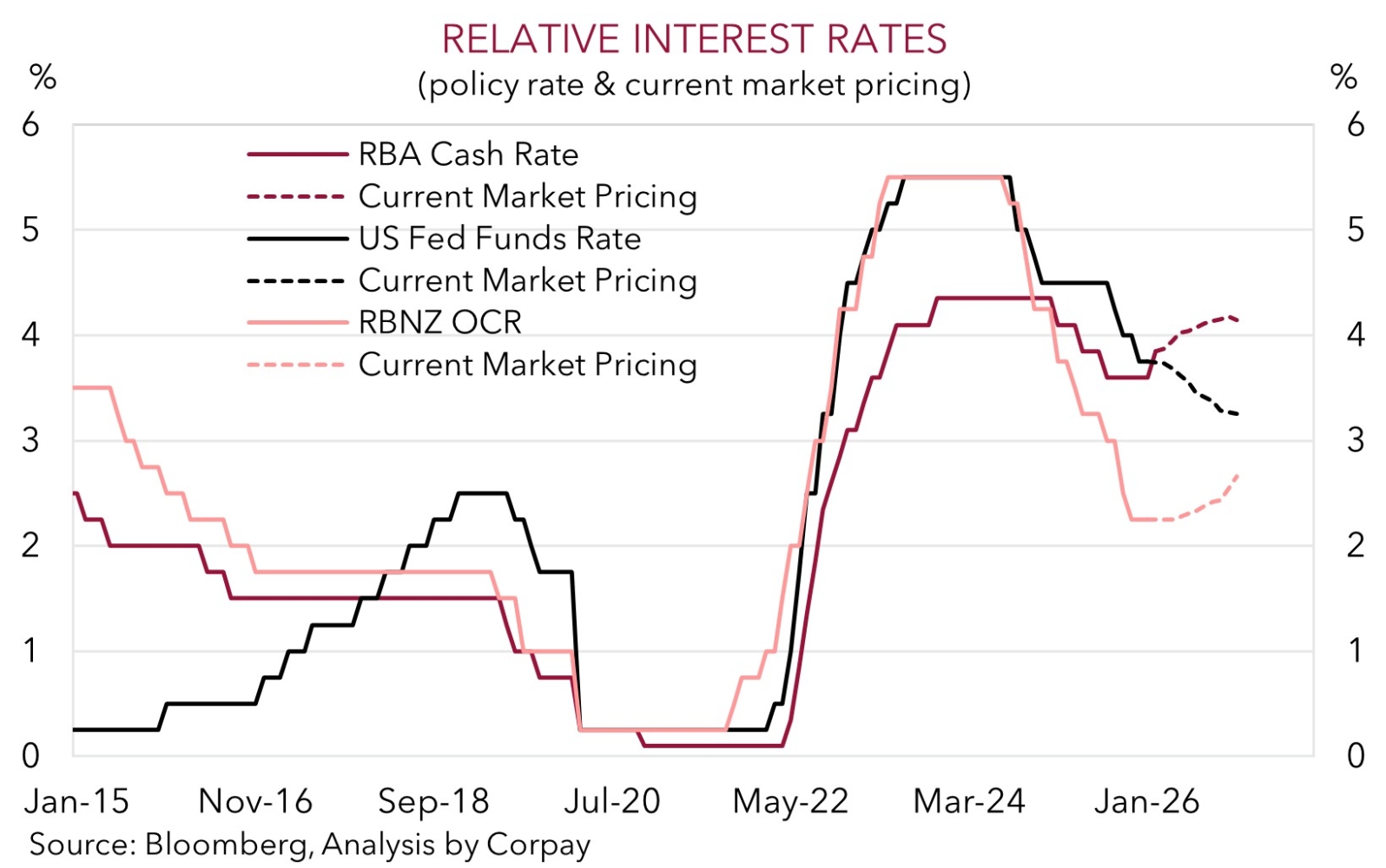

Today, the RBNZ meeting (12pm AEDT) and press conference (1pm AEDT) are in focus. Not only is this the first RBNZ gathering of the year, but it is also the first under the leadership of new Governor Breman. No change in interest rates is anticipated by traders or economists today, with views about the future the point of interest given new forecasts will be released. Recent NZ growth and inflation outcomes have been stronger than predicted. As such, we believe the evolving trends should see the RBNZ remove the small chance of more policy easing implied within its last interest rate track and sound more ‘neutral’ in its stance. However, we doubt things have progressed enough to see the RBNZ confidently flag the start of an eventual rate hiking cycle. This might disappoint ‘hawkish’ markets given a rate rise is already factored in for later this year. If realised, we think this may see the NZD give back a little ground in the near-term.

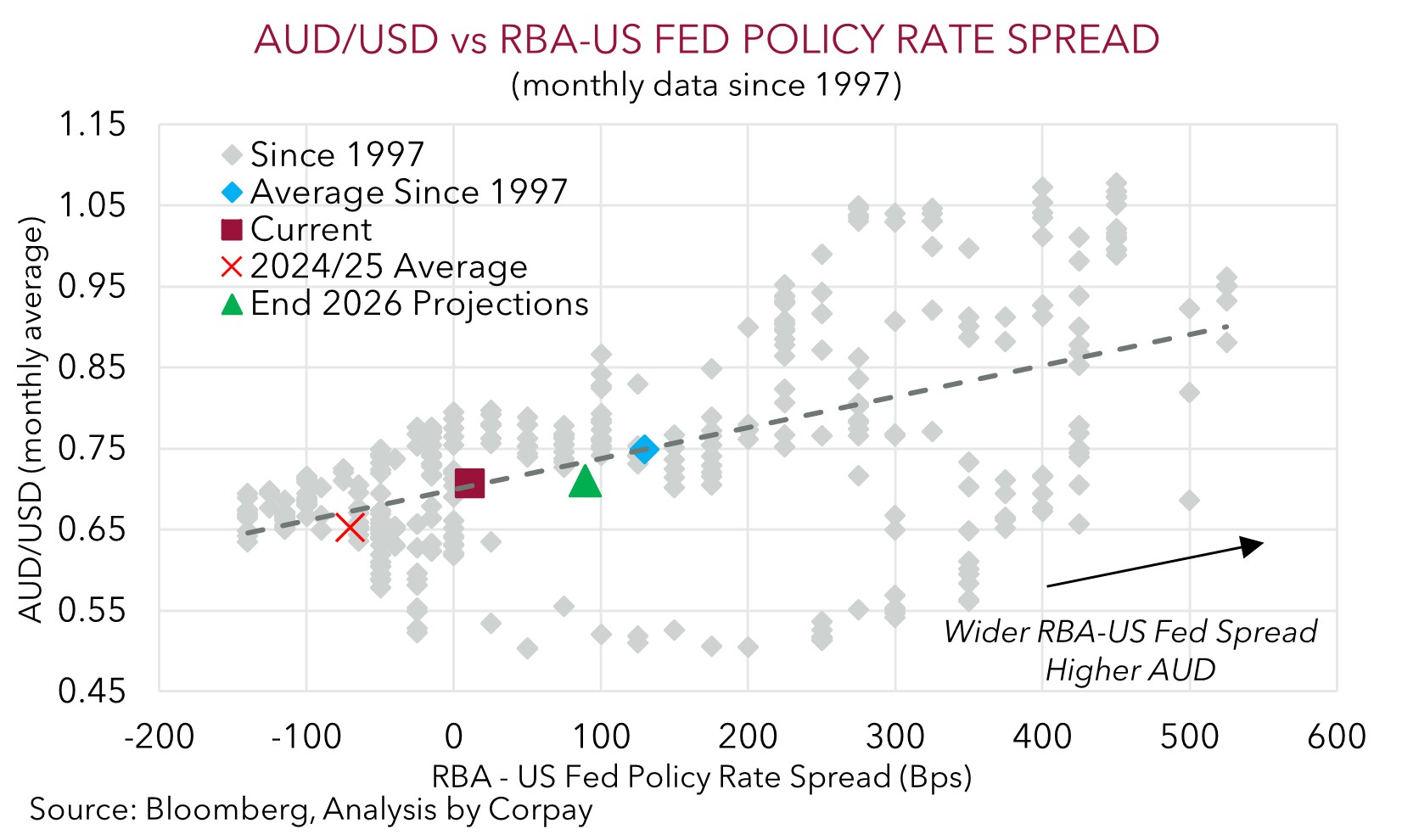

For the AUD, quarterly wages data is released today (11:30am AEDT), ahead of the monthly jobs data tomorrow. Consensus is looking for wages growth of 0.8% in Q4, inline with the RBA’s forecasts. There is a risk of slightly firmer wages given the data will include a solid pay increase for ~400,000 care workers. That said, we also see a chance tomorrow’s January employment report shows some loosening in conditions. Shifting seasonal job patterns after COVID have seen unemployment rise by ~0.1-0.15%pts the past three Januarys. A repeat in 2026 might see traders temper bets looking for another RBA rate rise over the next few months (markets are assigning a ~75% chance the RBA hikes again by May). This in turn may exert some downward pressure on the AUD over the next few days after its strong start to the year. From our perspective the upward repricing in RBA interest rate expectations may have largely run its course as an AUD tailwind. However, the shift up in the level of rates and swing in interest rate differentials in Australia’s favour could mean the AUD tracks in a higher average range than what has been seen the past few years (i.e. oscillating around ~$0.69-0.70 rather than ~$0.6520 which was the average over 2024/25).